Chart of the Month

Being in the dog days of summer, and particularly having to endure this recent wave of hot temperatures that have been magnified by the heat dome, it can be nice to visualize something cool and refreshing – like a watermelon! While this is not meant to be a lesson in physics or meteorology, we can use the science experiment of wrapping a watermelon with rubber bands, as an illustration, to understand what is taking place in lending markets. If you have not seen this experiment, we recommend you look it up! But what effectively happens is that as you continue to add rubber bands around the watermelon, they will eventually squeeze it tight enough to the point where the watermelon explodes!

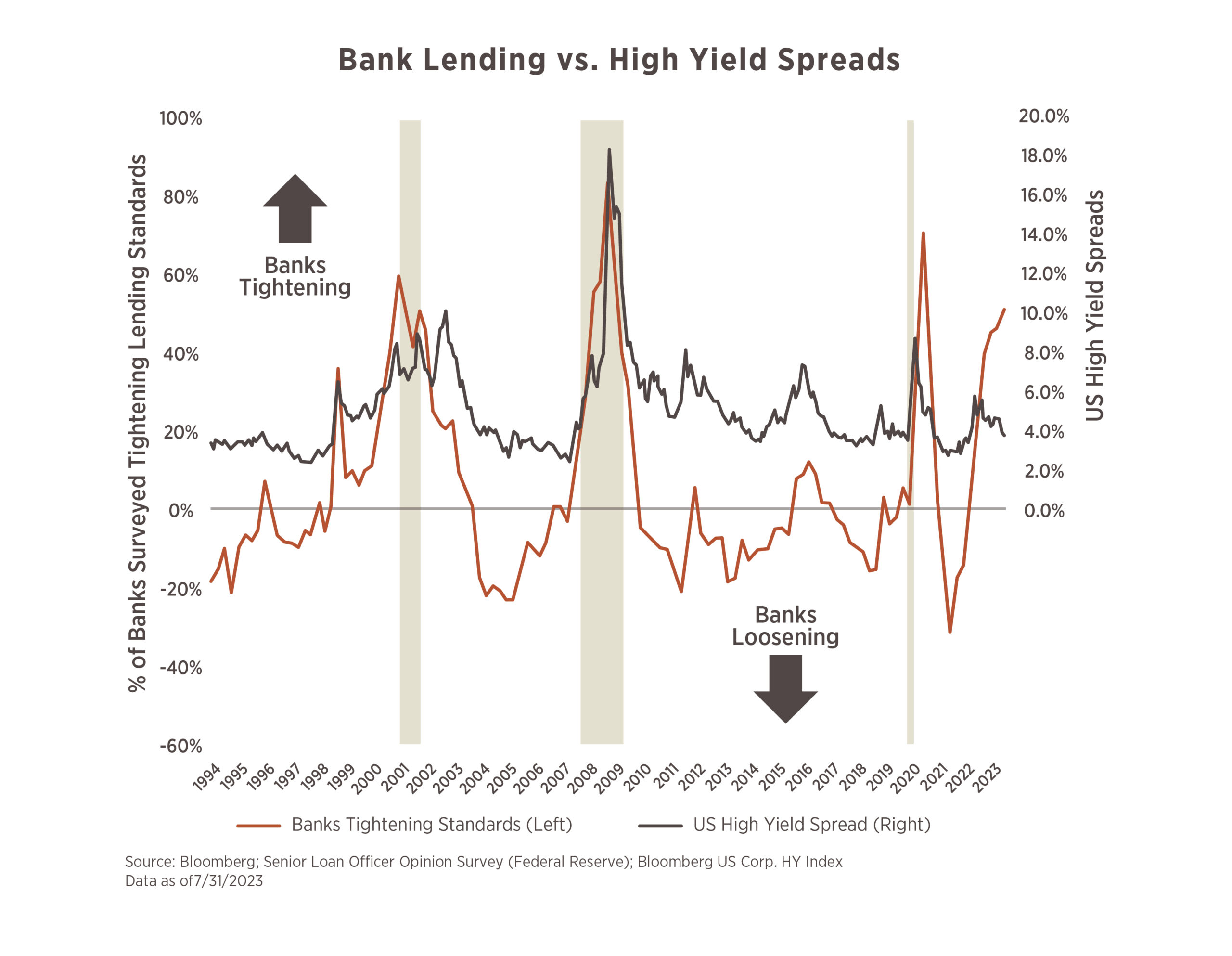

In the chart above, the watermelon is represented by US High Yield Spreads, which is how much investors are being paid above a risk-free asset (Treasuries) to accept the risks that come with owning lower quality debt. The rubber bands are represented by bank lending standards. Shown here graphically as the percentage of surveyed banks that are tightening their standards, or put another way, putting more guardrails around who they lend to and on what terms given the uncertainty in the macroeconomic environment. Historically, as banks have been less willing to lend, investors also demanded a higher risk premium to own lower quality (junk) debt. However, despite the continued addition of “rubber bands” (banks tightening their lending), the squeeze has not yet been felt by the “watermelon” (HY Spreads) in 2023. Some technical support is keeping the HY Spread low for now, but we continue to watch it closely as the effects of the Federal Reserve’s rapid increase in rates will continue to trickle through different parts of the market.

As a business owner, you will likely face a difficult decision: whether to keep or sell your company. This may happen over time as you set your sights on retirement. Or it may happen more suddenly, for example, when confronted with an unsolicited offer, favorable market conditions or the need for capital.

Regardless of the trigger, having a plan ahead of time can help you maximize the value of your business, whether through a sale or as a continued source of income for you and your family. But easier said than done. We know from serving other business owners that this decision often involves answering complex questions and dealing with strong emotions.

To simplify the process, here are some questions to consider and discuss with your family and advisors.

Is your business a financial asset, or more, to you and your family?

Most business owners care deeply about their company and employees. But for some, the value of their business runs even deeper than taking care of their company’s stakeholders financially. It is part of their family’s history and identity, something they would like to pass down to their children or other beneficiaries. If that is the case, you should adopt strategies for being able to keep your business in the family. If not, you will want to adopt a different set of strategies for readying your company for a sale.

Is someone willing and able to inherit your business?

If you determine that you would rather pass your business down to your children or other beneficiaries, you should carefully consider whether suitable successors exist. Is the next generation interested in running your business? Have you talked to them overtly about this possibility? Are they capable? Do you believe they will have the right motivations and skills to continue your hard work and vision? This is often one of the most difficult pieces of succession planning for business owners to address. But not proactively doing so can create much more difficult situations — such as family conflict and declining business value, down the road.

Can you afford to sell (or keep) your business?

Answering this question can be broken down into a three-part exercise:

PART ONE | Valuing your business

Among privately held companies, 98% haven’t been valued(i). But this number is arguably the most important input needed to determine if you should sell your business, not to mention knowing if it is properly insured and funded.If, like many business owners, what’s stopping you is a lack of time and/or concerns about the expense, know that you have options. While a certified business valuation, one that adheres to the Uniform Standards for Professional Appraisal Practice (USPAP) guidelines,is needed in certain situations, simpler options exist. For example, our firm partners with BizEquity, a patented, online service that makes business valuation easier and more affordable.

PART TWO | Quantifying your personal goals

The other necessary side of the equation is, of course, how much money do you need? What are your plans for retirement? What large purchases (e.g., a second home) do you plan to make? How much money would you like to leave to family or charity? Identifying and quantifying the cash outlays associated with these goals will then allow you to reconcile them with the cash inflows (net of taxes) associated with keeping or selling your company. The numbers may surprise you, possibly making the decision much easier.

PART THREE | Understanding what it would take to sell your business

It is also possible that, through the first two parts of this exercise, you determine that you would need to invest significant time, money and effort into increasing the value of your company in order to sell it. If that is the case, you need to ask yourself: Am I willing to put in the effort to make my business more attractive to potential buyers? This often includes initiatives such as further developing your leadership team, investing in operating systems and diversifying your customer base. Confronting this reality helps some business owners decide their company is more of a lifestyle business than a growth-oriented business, worth sustaining for as long as possible for the income rather than preparing for a future sale with the hopes of a financial windfall.

While these questions can serve as a guide, they likely won’t make the decisions easy. For help, including valuing your business and quantifying your future personal cashflow needs, please reach out to us. We can help you model your options and learn from the experiences of other business owners who have also faced this difficult crossroads.