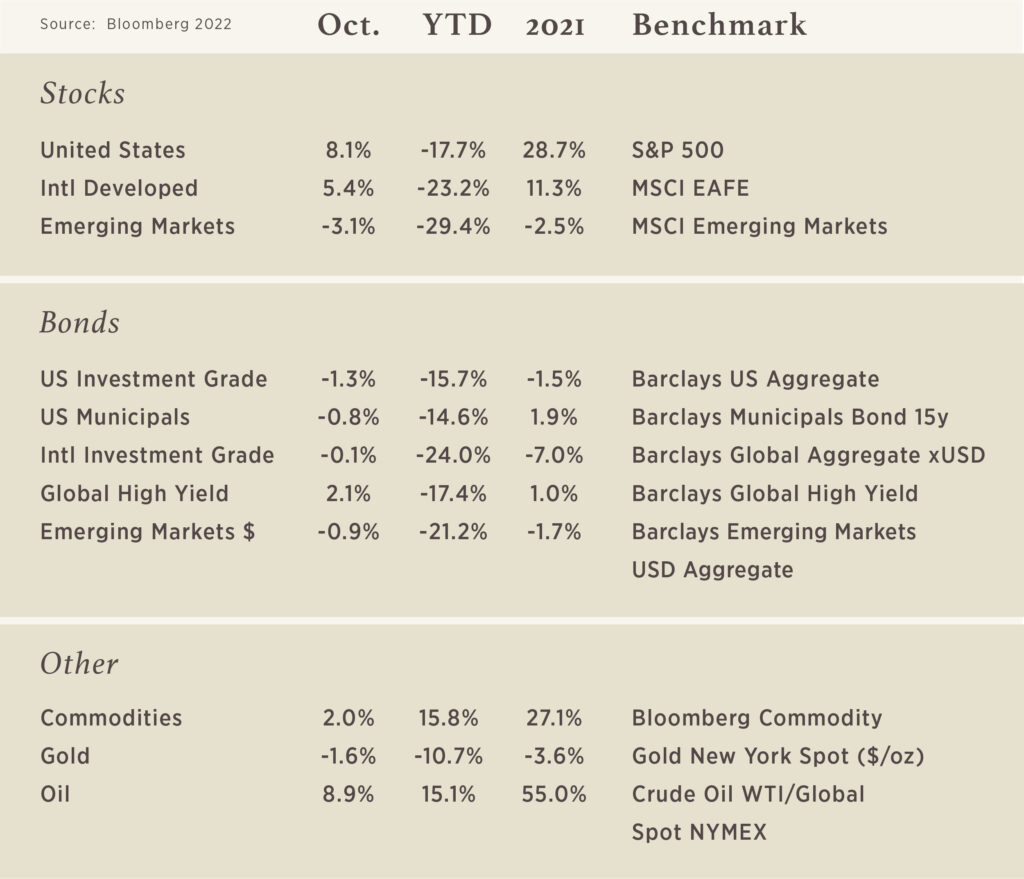

Chart of the Month

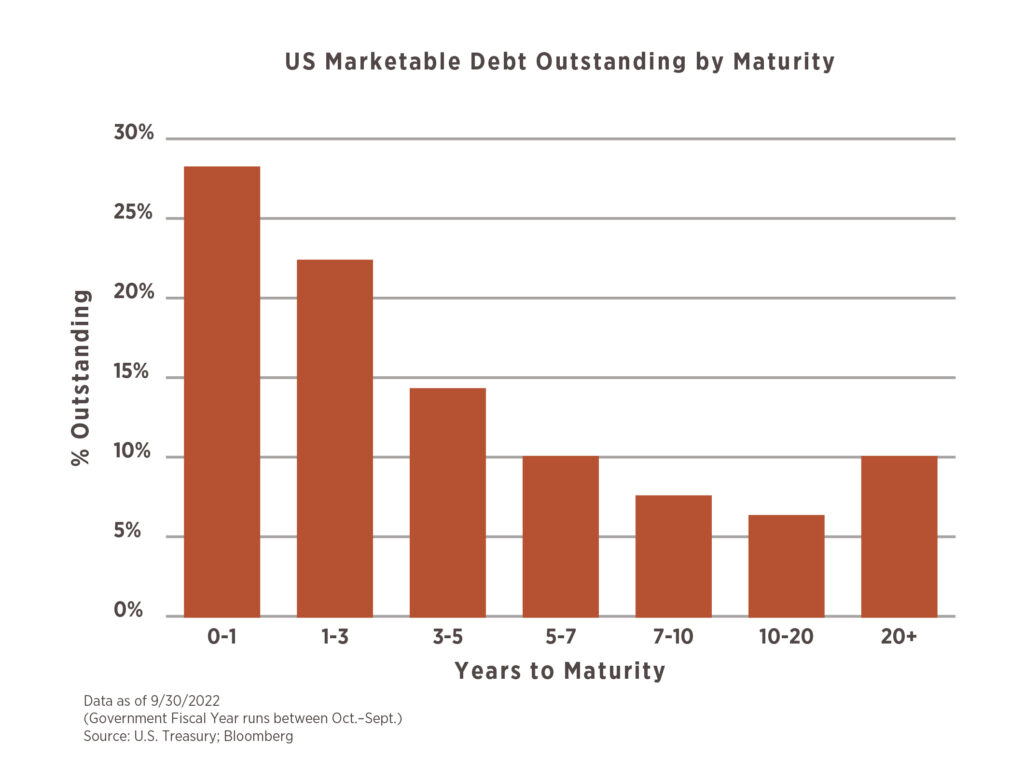

It is no secret that the US has a continuously growing debt balance – increasing at an annualized rate of 8.5% the last 15-years and even faster over the last 3-years at 11%. In response to high inflation readings, the Fed has been hiking interest rates rapidly and the yield on Treasury securities are at levels not seen since 2007. Approximately 50% of all marketable US debt ($23 trillion) will mature in the next three years and will have to refinanced at higher rates than what the US had been paying on the debt that matures. The US has an additional $7 trillion in non-marketable debt (non-transferable), creating a total debt balance of $30 trillion.

The interest expense on US debt outstanding was $719B for the fiscal year ending September 2022. This is the highest amount of annual interest expense ever (2nd highest was $575B in 2019). As debt matures and is refinanced and the current deficits are financed with new borrowings, the US will see its annual interest expense go up significantly. On the positive side, this will result in higher earnings for US households and institutions that are owners of Treasury debt.