Chart of the Month

American citizens are four months away from casting their ballots for the next president of the United States. As it relates to the investment landscape, major events such as the U.S. election can stoke anxiety and uncertainty about the future of the market, but is it warranted?

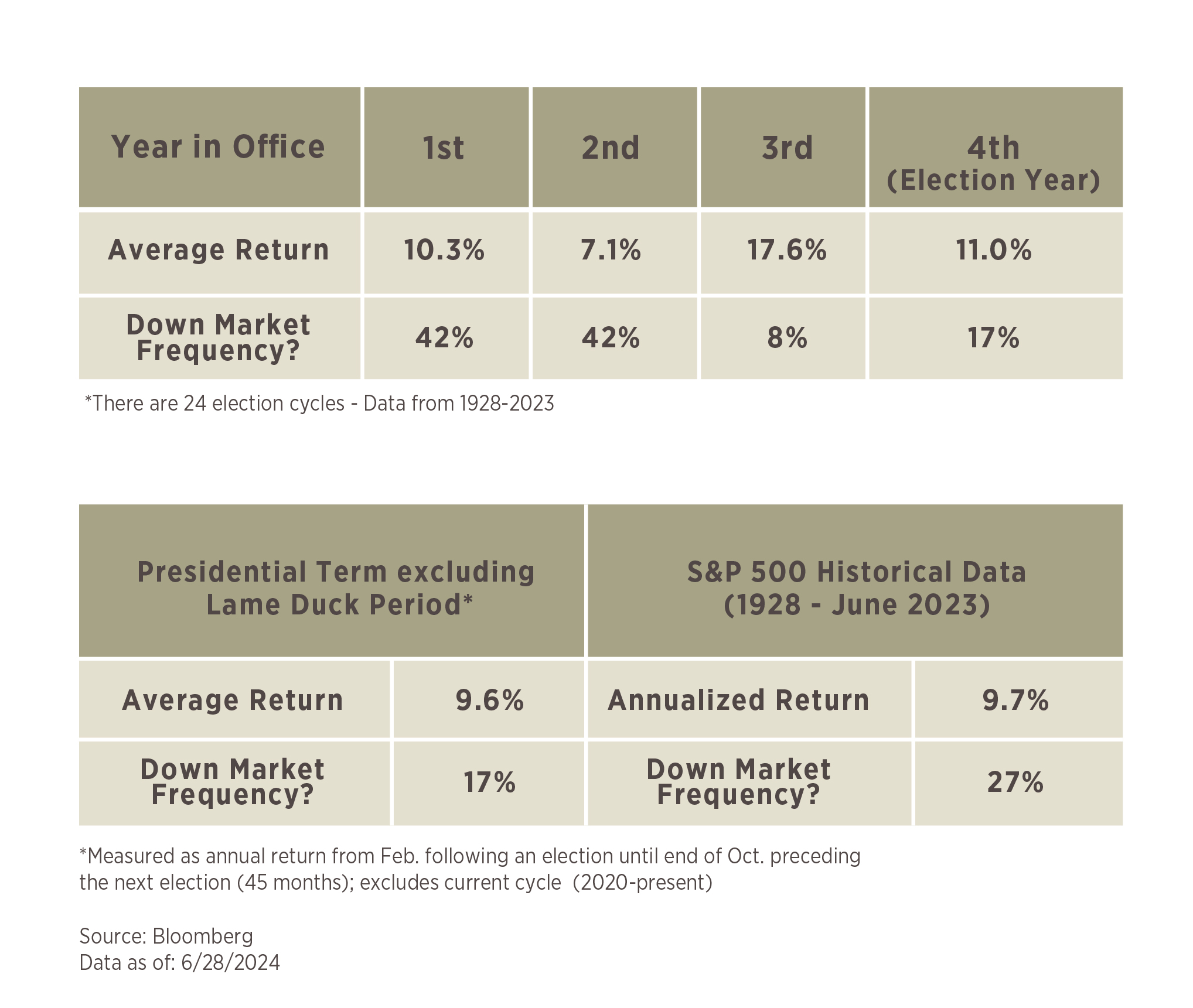

In this month’s chart, we dig into the numbers of the past, seeking to understand how the market has fared over prior presidential cycles. In reviewing the past 24 presidential elections, we found that returns, on average, are strongest and more frequently positive in the 3rd and 4th (final) years of a term compared to the 1st and 2nd. This is not that surprising given that the 3rd and 4th years are often most associated with the incumbent government doing all in their power to get re-elected, effectively stimulating the economy.

We also look at a full presidential term but exclude the three-month “lame duck” window for another perspective. This tells us that, on average, a president has overseen an annualized return of 9.6% while in office, and there are only four terms (17%) in which the S&P 500 has been lower during a term. Those four instances were a result of the Great Depression (two from 1930s), post-Dot Com Bubble, and the Great Financial Crisis.

Neither data point is suggestive that the U.S. presidential election really matters to the market. The S&P 500 has an annualized return of 9.7% since 1928 and is positive in nearly 75% of all calendar years. While the results may come as a surprise to some, to us, it reiterates our philosophy on creating a plan and sticking to it, no matter the noise coming from the outside.

For most of us, the point of making money is doing what we want with it, as far as possible.

That could mean building a business, giving to a special cause, supporting a family, and indulging in a hobby. Although it can be a difficult conversation, working with a financial advisor on an inheritance plan is an important part of planning for the future. Your main goal could be providing for the well-being of loved ones, or making a charitable gift. But without a plan, there is no guarantee that your final wishes will come to be.

One place to start the conversation could be with the question of whether to create a plan that distributes assets on an equal basis, or one that seeks to create equitable outcomes.

01 | Making a Plan

As anthropologist Ashley Montagu noted, “The goal of life is to die young — as late as possible!”

While enjoying your money during your life can bring happiness, it’s also important to ensure that you have a plan in place for the future. The money we make during our lives becomes an important part of what we call our legacy. In concrete terms, our legacy is partially made up of the assets we leave behind to a surviving spouse, or other family members, when we pass.

Being prepared for that day should include developing a formal plan for what happens to those assets and why. You may have already created a living trust, designated your beneficiaries, and assigned a power of attorney. But circumstances may have changed, and there’s no time like the present for making sure that, whatever happens to you, your legacy reflects your wishes.

For someone with a surviving spouse, the first consideration is usually maintaining the spouse’s lifestyle during their remaining years, as well as anticipating living and health care costs. Providing for surviving children, family members such as a sibling, or other extended family, may also be part of one’s plan.

Preparing an estate plan, or last will and testament, with the help of an attorney is one part. But having a conversation with a financial advisor can shed light on how best to create a lasting legacy. With any estate plan, the goal is to provide clarity and eliminate ambiguity. Avoiding the probate process will save money and headaches for survivors.

Even with a document in place, litigation between family members could arise when the intent of a will is not clear, or in the absence of a formal estate plan. To avoid that situation, experts recommend making end-of-life arrangements early and in consultation with licensed professionals.

02 | Equal and Equitable Inheritances

The most common form of estate plan simply leaves assets to one’s surviving family members in equal shares: one third of the total estate to each of three children, for example. While that may be the right approach for many, another way to allocate one’s legacy is equitably. That could mean taking into account the needs of your survivors and adjusting gifts accordingly.

One surviving child may struggle with finances due to a physically-limiting condition. One may have a well-paying job, another may be struggling due to a broken marriage. In such a case, talking with your children about your plans may pave the way for cooperation among family members later, in the event that one resents receiving a smaller amount.

You might also choose to make an equitable gift as a form of reward. For example, one child may have worked as a handy-person, performing maintenance work at the family home. Another child may have spent countless hours acting as a caregiver.

Weighing past financial gifts might be another consideration. One child may have already received your financial aid for college tuition or a home purchase, while another has never asked for money. In other words, you may wish to design an estate plan that specifically addresses a surviving child’s situation, rather than one that divides assets mathematically.

While everyone’s circumstances will vary, fairness could involve a specifically-tailored plan.

03 | Possible Issues

Although the goal of equal treatment may seem easily accomplished, problems could arise. In considering an equitable allocation, one should consider the likelihood of resentment from the survivors, including someone contesting the will.

Even in an equal inheritance, one’s heirs may have very different ideas about how much a house, a piece of jewelry or a parcel of land is worth. While one can hire professionals to assess market values, emotions obviously can also play a role. One child may want to sell a family vacation home, another may wish to rent it out during the summer, while a third wants to make it home.

Having conversations with family members can help address those kinds of disagreements before they happen and give you the opportunity to express your wishes. Discussing these situations with your financial advisor can help you understand the role that such assets play in one’s portfolio, and help you explore other options for achieving your goals.

04 | Tax Implications

Taxes are another important consideration for your estate plan. A well-designed estate plan can help mitigate tax concerns while ensuring the financial security of the family.

As of February 2024, twelve states, as well as the District of Columbia, levy an estate tax on qualifying estates. Other jurisdiction may assess a tax on those that inherit estates above a given value. The federal government’s estate tax applied to estates worth more than about $14 million in 2024.

While such taxes may affect only very high net-worth estates, it’s worth discussing with a financial advisor whether there are steps you could take to avoid a future tax liability that falls on a surviving spouse or other family members. After all, you work hard throughout your life to create wealth for yourself and your loved ones.

It’s just as important to have a say in what happens to that wealth after your life ends. Please reach out to one of our advisors if you have questions about creating an equal versus an equitable inheritance.