Chart of the Month

Deglobalization is a buzz word that has been making rounds for the past several years due to:

- The US starting a trade war with China during President Donald Trump’s stint in the Oval Office

- COVID and the ensuing inflationary pressures heightening focus on supply chain risks

- An increasingly polarized world running on high tensions everywhere (Russia/Ukraine, Red Sea, China/Taiwan, etc.)

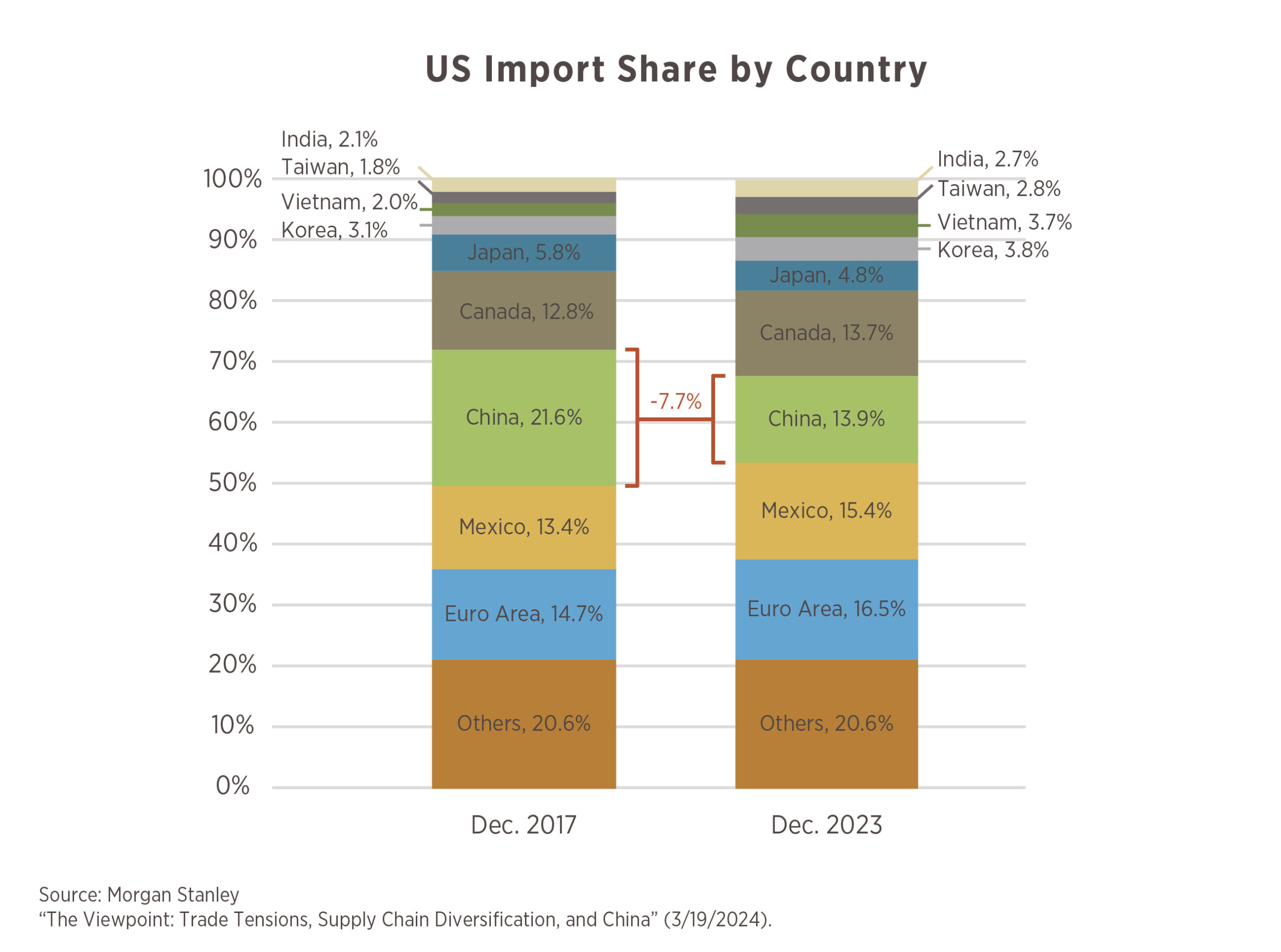

Has the flow of trade really been impacted? Is “deglobalization” walking the walk or just talking the talk? This month’s chart illustrates what has transpired since the end of 2017 from the perspective of US Imports, showing from which countries the US imports most of its goods. The results from this chart and other data (not shown) offer a mixed bag of outcomes, but for the US, one thing is evident: it has become more diversified amongst the countries it does import. This is clearly highlighted, probably unsurprisingly, in the reduction in reliance on China (-7.7%).

To answer the questions above: Yes, trade flows have been impacted as the US has become less reliant on China. And yes, deglobalization appears to be in the works, but it looks to be more aligned with “friend-shoring” or “near-shoring” as opposed to true onshoring.

What doesn’t show up in the chart is the US share of global imports has remained relatively flat while its trade deficit has widened, effectively pointing towards the lack of “onshoring.” And, even despite the US reducing their Chinese exposure, China remains the world’s largest exporter and has seen its share of the global export market grow since President Trump initiated the trade war in early 2018.

The concept of “deglobalization” is likely here to stay for the foreseeable future, but we don’t see that as necessarily a bad thing. Much like we advocate for a diversified portfolio of investments, the concept of diversifying suppliers could be viewed as a risk reducer for the country and the companies that make it run.

High net worth investors face investment challenges that some would consider distinctive to their financial status. The fundamental tenets of investing apply equally to them as with any other investor, but the affluent investor needs to be mindful of issues that typically arise only from substantial wealth. Let’s examine a few of these.

Being Too Conservative – When an individual has more assets than they think they’ll ever spend, there can be a tendency toward conservative investment. This may result in lower long- term returns that may shortchange the impact of bequests to charities or the wealth that will transfer to the next generation.

Collectibles – The affluent have a tendency to invest in their passions, and many collectibles have performed well over the years. However, one common mistake is not keeping up-to-date appraisals on record, which may have adverse consequences with regard to estate liquidity and taxes.1

Concentrated Equity – Some senior executives accumulate large stock positions in the company that employs them. This creates a possible risk and potentially can be managed in several ways.2

DIY Mentality – Some wealthy investors have achieved a high level of success in their careers, in large measure due to their intelligence, hard work, and self-confidence. This very success often carries over to the belief that building or managing successful enterprises is not dissimilar to managing great wealth. But it can be quite different, requiring a whole different body of knowledge and experience.

Too Many Professionals – Affluent investors often place their investment assets with multiple professionals, thinking that better results will arise from that. However, many of the key needs for larger portfolios, such as risk management and tax efficiency, will suffer since there is no overarching view into the larger picture of an individual’s entire portfolio. The independent actions by separate professionals, all with the best of intentions, may actually work to suboptimal outcomes.

With increasing wealth come even more complex challenges beyond those covered by this discussion. Consequently, affluent investors are encouraged to seek professional guidance that may be best suited for their particular needs and circumstances.

1The value of collectibles can be significantly affected by a variety of factors, including economic downturns or markets that have little or no liquidity. There is no guarantee that collectibles will maintain their value or purchasing power in the future.

2Keep in mind that the return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost.