Chart of the Month

Sunny side up, hard boiled, scrambled? If any of those are part of your daily routine, you’ve surely noticed that the trip to the grocery store has become a little more expensive. You may have even encountered restrictions on the number of eggs you can buy, but why? The Avian Flu.

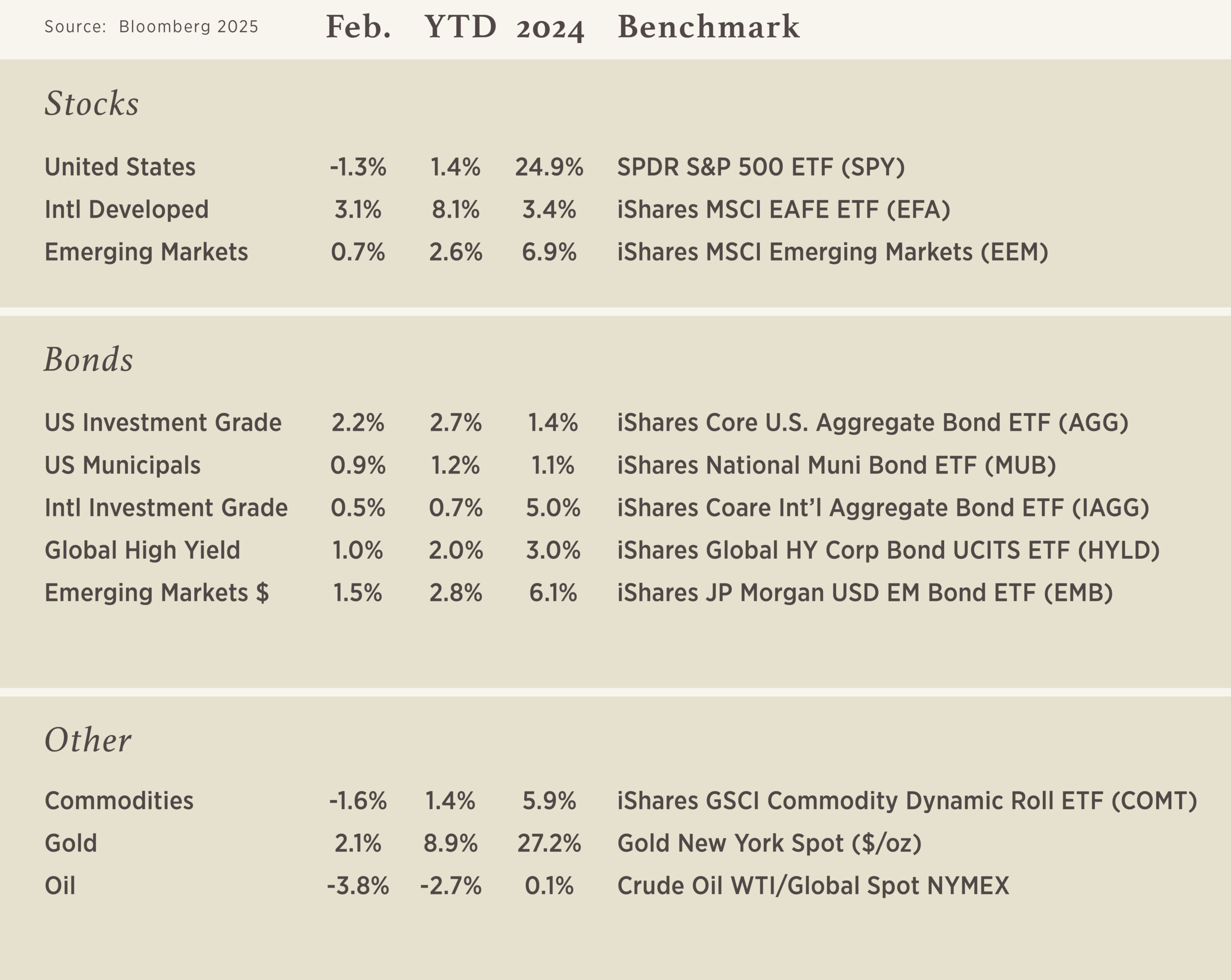

Our chart this month illustrates the recent surge in the price of a dozen eggs alongside the summation of affected poultry over the prior 6-month periods. The first detection of this current strain in a commercial flock was February 2022, and there is some seasonality to it as the virus spreads most heavily during wild bird migration periods (spring and fall).1 To understand the scope at which this has impacted the poultry population, consider that there are 357 million egg-laying chickens in the U.S. and 292 million of them produce eggs for eating.2 Over the last 12 months, of the 84 million total poultry that have been affected, 67.6 million have been “table” egg-layers. That is 23% of the egg-for-eating population!

Egg buyers have never encountered such a surge in price – all have been accustomed to seeing the price of a dozen fluctuate between $1–2. In fact, the average price for a dozen large eggs at wholesale in the Midwest averaged $1.15 between 2012–2021, prior to the recent Avian Flu outbreak. The impact of this is personal to each individual, family, or restaurant based on their egg-buying habits.

But, as a fun exercise, we consider that there are roughly 350 million people living in the U.S., and the number of eggs produced over the last 12 months is 107.8 billion.2 The math then leads you to see, on average, each person eats 308 eggs per year (or ~26 eggs per month). From this lens, if you usually buy 2 dozen eggs per month, and were used to paying $1.15 but now pay $8, that is an extra $14/month outlay (less than a month of Netflix). However, perhaps more realistic is that someone eats 3 eggs per day, 7 days per week (84 eggs or 7 dozen). To which, they’ve seen their monthly bill climb from $8 to $56, an extra $48/month outlay.

Ultimately, the price of eggs has little bearing on broader inflation. In fact, the latest data from the Bureau of Labor Statistics (BLS) gives it a weight of 0.17% (Dec. 2024). It may inflate consumer expectations for inflation, given the frequency in which you see the price of eggs change – as in every trip to the grocery store – but is your nest egg going to “crack” because of this? No. Is it going to change your cooking and eating habits? Perhaps. Is it an interesting story to follow? Absolutely.

1 Confirmations of Highly Pathogenic Avian Influenza in Commercial and Backyard Flocks | Animal and Plant Health Inspection Service

2 Chickens and Eggs 02/24/2025

How to Teach Your Children About Taxes

Many parents start teaching their children about money at a young age. Topics like budgeting, learning how to save, investing, and establishing good spending habits are all common conversations that parents have with their children. However, understanding what taxes are and how they are paid is often a topic that is left out of the conversation.

While taxes can often be intimidating and confusing to even adults, it is important that your child has a basic understanding of them to help encourage financial literacy. Once you start teaching the basics of taxes young, they will likely have a strong understanding of taxes and how they will be taken out when they start their first job. To help guide you in starting these conversations with your children, we share common questions that they may have about taxes and how to answer them. We also provide a fun game to help teach your child how taxes work.

Family Conversations: The Who, What, When, Where, and How of Taxes

Q. What are taxes?

A. Taxes are mandatory financial charges that individuals and businesses must pay to our local, state, and federal governments to help cover the costs of governmental services, benefits, goods, and services.

Q. How many types of taxes are there?

A. There are several types of taxes that we must pay, including but not limited to income tax, sales tax, payroll tax, property tax, estate tax, gift tax, and travel tax. The taxes that you will most likely be charged the most as a young adult are payroll and sales tax.

Q. When are taxes paid?

A. The frequency of when payment is due for taxes depends on the type of tax. For example, sales tax, the tax you pay when you purchase something from a store, is paid immediately upon purchase. So, when you pick up a $1.99 bag of chips and give it to the cashier and the cashier says your total is $2.13, that means you paid 14 cents in sales tax for that item. Income tax is a bit different. When you pay income tax, you are charged taxes for the income you made throughout the entire tax year (between January 1st and December 31st of that calendar year). The deadline for payment for those taxes typically is April 15th each year, unless you are granted an extension or are self-employed.

Q. How can I see how much tax is taken out of my paycheck?

A. Every time you get paid, you will receive a pay stub which is essentially your receipt of how much money you made before taxes were taken out (gross income) and how much money you will actually receive in your bank account after taxes have been taken out (net income). Within that pay stub, you will see a breakdown including how much federal and state income tax was taken out for the pay period along with Social Security and Medicare.

Q. Is the amount of taxes taken out the same for each pay period?

A. No, the money you pay in taxes varies depending on how much you earn during the pay period. So, for example, if for the first two weeks of the month, you worked 10 hours and the last two weeks of the month you worked 20 hours, you will pay more for the latter half of the month since you worked more and therefore made more income.

Q. Are taxes taken out of my tips?

A. Yes, if you have a tipped job such as a waitress or barista you must report your tip income.

Q. Where do my taxes go?

A. Your taxes go toward a multitude of public services such as schools, road repairs, parks, and our various government budgets. Taxes enable Americans to collectively contribute to all of the everyday resources that we benefit from.

Q. Do college students have to pay taxes if they work part-time?

A. If you make less than $14,600 in 2024 and are a single filer, you may not be required to file. However, they may decide that they want to file, especially if they are making student loan payments while in school or paying for their own education out of pocket. If they pay out of pocket, they can file a 1098-T and potentially receive a refund.

Candy Tax Game to Learn About Taxes

Step 1: Go to the store and purchase a large bag of candy.

Step 2: Spread all of the candy on the table.

Step 3: Remove a little less than a quarter of the candy off the table. This simulates the roughly 14.5% tax that single individuals pay in the U.S.1 It will show your child that even though initially they received a larger amount of candy, a certain chunk will be removed so they can “pay” their fair share as a working citizen.

Step 4: Check in with your child to make sure they understand that their earnings and the goods they purchase will be taxed.

[1] York, E. (2025, January 6). Who pays federal income taxes? Latest federal income tax data. Tax Foundation. https://taxfoundation.org/data/all/federal/latest-federal-income-tax-data-2025/