Chart of the Month

Summer is here! The kids are out of school, pools are open, grills are smoking, and the S&P 500 is at or near all-time highs. These are all great happenings, but if we had to choose a favorite, all-time highs would be it! As is common when markets are setting new records, investor anxiety can begin to creep in, wondering if maybe the market is at the top. As our team has reiterated time and time again, we don’t have a crystal ball – we can’t tell you what the next week, month, year, or decade holds for markets – there is always a degree of uncertainty present. However, what we do know is that making any attempt to try and time the market’s tops and bottoms is not time well spent.

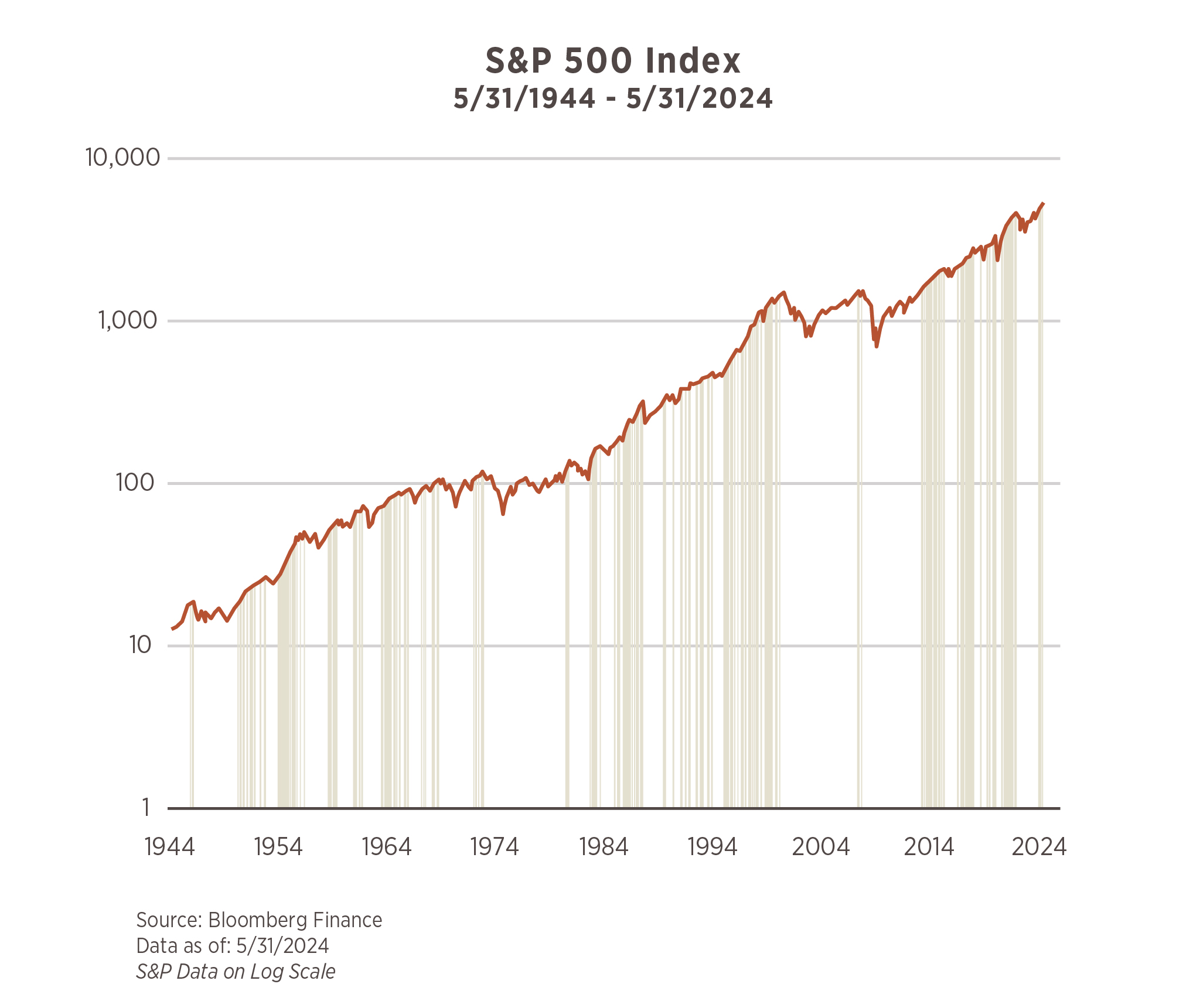

Our chart this month illustrates why we are always stressing the importance of sticking to the plan that was created to provide the greatest likelihood of your own defined success. Each bar shows a new “All Time High” set by the S&P 500, and as you can see, it happens more frequently than you might have guessed. Over the past 80 years, a new high has been set on 7.1% of all trading days (20,119 of them).

Even more interesting is that if you were to look at the price returns after the S&P 500 achieved a new all-time high, the average over the following 1-, 3-, 5-, and 10-years are all positive, ranging from 6.5% to 9% annually. That is not to suggest there are not instances in which future returns were negative, because those exist, too. The chart shows these as the big gaps between new highs – 7.5 years in the 1970s; 7 years post-Tech Bubble; 5.5 years after the Great Financial Crisis. But the general expectation of equity markets to go up in the long run, plus the historical evidence of it actually doing so, continues to point us towards expecting equities to play an important role in portfolios.

Despite knowing the history, we are proponents of continuing to revisit your plans in place with your advisor and having a conversation about where you stand relative to the goals you have created.

Here we’ll bust some of the myths surrounding retirement so we can get on with planning how you will spend your time and make these your best years. Have you ever had these thoughts?

“I’ll Start Saving For Retirement After I Pay Off My Big Expenses”

It may seem easier to hold off saving for retirement after you pay off your mortgage, college debt, kids’ college bills, and any other large expenses that come up in life. But this procrastination can harm what is supposed to be your “golden years.” People are living longer, which often means more years spent in retirement, and this all adds up to needing more money. Therefore, what seemed easier, will actually cause more hardships in the future.

Think about it this way, the sooner you start, the less you will have to save each month to reach your goal.

“Medicare Will Cover All Health Care Costs In Retirement”

It’s estimated that 15% to 20% of your annual expenses during retirement will need to go towards health care costs.1 Medicare, while it has a significant number of programs to help pay for many of these expenses, won’t cover all that you’re going to need. For instance, dental, hearing and vision care are not seen as medically necessary in Original Medicare. I’m sure you already know about the price of drugs, so you’ll want prescription coverage, too. All these additional coverages will require one or more Medicare Advantage plan, and the cost of these supplemental plans can be surprising.

“When I Retire My Taxes Will Be Lower”

When you retire you may assume your income will be less and thus your taxes will be reduced. But since you also will likely qualify for fewer tax breaks (mortgage, college savings) and have fewer dependents to claim, you may see more of your money than you expected going to the government.

Or, you may find yourself with the same amount of income in retirement, and thus not actually landing in the lower tax bracket like you expected.

“I Can Always Get A Part-Time Job In Retirement If I Need More Money”

Although many retirees do get part-time jobs during retirement, relying on this income can be problematic. There are external factors outside of your control, such as changes to your health (or that of your spouse), that can impact this plan. Also, getting a well-paid, part-time job that you enjoy can be harder to find than some envision.

“I Will Spend Less In Retirement”

Another myth is that during retirement you only need 70% to 80% of your pre-retirement income. In fact, during retirement you may be traveling, visiting family and starting new hobbies much more than you did while you were clocking 40 to 60 hours a week at work. Travel, and all those additional activities, requires spending power.

If you want to do all these things while maintaining your standard of living, you’ll need a dedication to saving.

“I Will Live In The Same Place All Throughout Retirement”

By the time you retire, your mortgage may be paid off and housing costs settled. Therefore, it may seem quite appealing to sit back and relax in your paid-off, perfectly decorated home. But moving during your retirement years is often a reality.

For instance, you may realize you want to be closer to the grandkids, live in an urban area with access to more amenities, or for health reasons need to move to a residence all on one level or one with more services available.

“I Will Only Invest Conservatively In Retirement”

In the past, when inflation was predictable and people were not living as long, investing your money in certificates of deposit and safe bonds was an easy choice. Today, a no-risk portfolio may not be the best choice for you. It may end up eating at your purchasing power, and you will see your hard-earned savings slowly disappear.

Investments of your savings will need to be highly personalized, and it won’t just be as simple as fixed income vehicles and as CDs. Having a conversation with your financial advisor is a must.

“If My Money Is In Order, Retirement Will Be a Breeze”

Just like any new stage in our life, retirement takes adjustment. Think about your first day at work or your first day away from home – was your financial situation your only concern? Developing relationships, connections and purpose are the things that will bring you happiness in retirement. Taking time to envision your new lifestyle, and what each day will look like, can help this adjustment period.