Chart of the Month

As we head into Christmas, it is a time of year people can get caught up in “excesses.” Whether it be just one more slice of pie or one more giant water carrying vessel, having “excess” is something we all indulge. How does excess translate into financial markets?

One area we see the potential for “excess” is the rapid growth of single-stock leveraged ETFs. Leveraged products can be a dangerous game. At the most basic and generalized level, a leveraged product is going to provide an investor either 2x or 3x the daily return of the underlying security. The products tend to reset each day, thus, owning one of these is a poor long-term decision due to the compounding effects – leverage works on both the way up and the way down.

As a brief example: You invest $10,000 in a 2x leveraged ETF. Day 1, the underlying is +5%, but the 2x leverage makes your product +10%, turning $10k into $10.1k. On Day 2, the $10.1k is your new starting point and the underlying falls -5%. The 2x means you lose -10%… $10.1k turns to $9.9k. Had you just owned the underlying (which also carries no expense ratio), you would only be down $25 instead of $100.

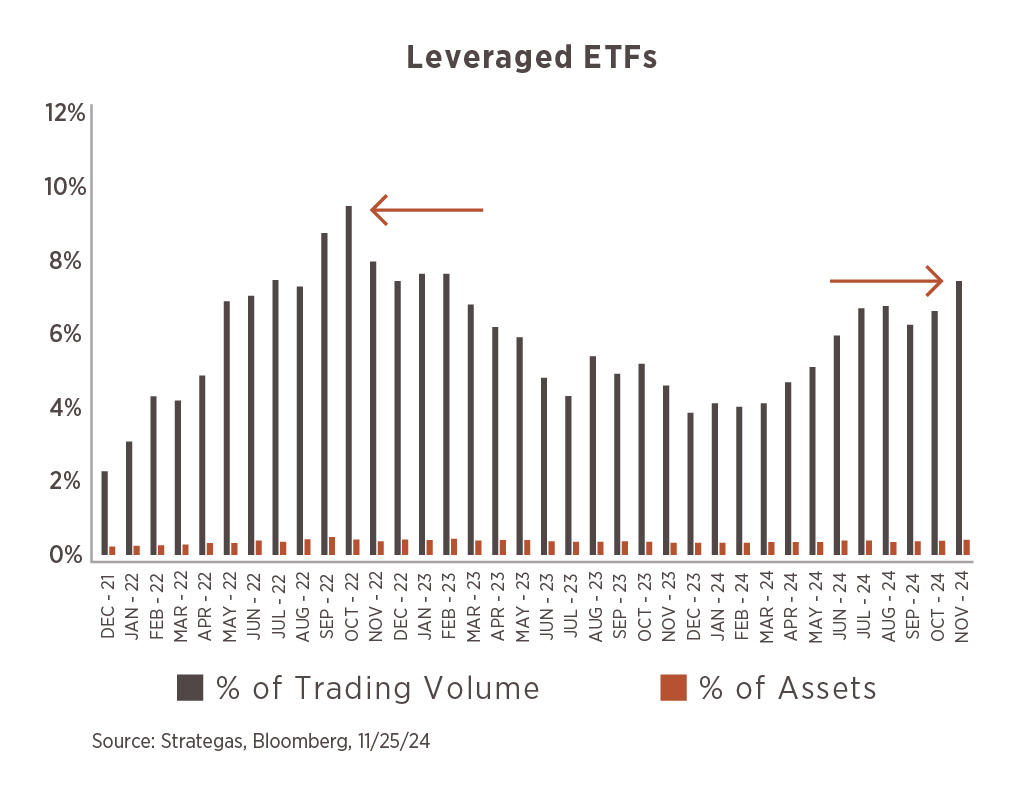

According to research firm Strategas1, leveraged ETFs account for a very small portion of U.S. ETF Assets (0.4%), yet, the dollars traded have suddenly spiked to account for nearly 9% of all ETF volume in recent weeks. Our chart this month highlights the usage of these products over the past few years, but there is one major difference between the current spike and the prior spike in late 2022.

The S&P 500 was hitting its bottom during the 2022 bear market in Sep/Oct that year, whereas today, the S&P 500 is hitting new all-time highs. This activity certainly impresses the vibe of potential excess and exuberance! Someone just paid $6.24mm for a banana duct-taped to a wall at a Sotheby’s auction! If anyone is in the market for such a thing, we would be happy to gather up the appropriate supplies and send someone your way!

1. Strategas: What to Make of Strong Equity Flows and Elevated Leveraged Volume (Todd Sohn); 11/26/2024

Performing An Insurance Checkup

It makes sense that as your income and assets increase, you grow more financially comfortable. That’s a good thing. The more wealth you build, the more freedom you can attain from the day-to-day stress of meeting your expenses and worrying about your financial future.

However, greater financial success also comes with greater risk. You have bigger bills to pay. More loved ones rely on you for financial support. The value of your property, and therefore the cost to repair it, increases. You become a more attractive target for lawsuits. The list goes on.

Yet, many people underestimate or overlook these risks as they focus on the more pressing, easily quantifiable parts of their financial lives. That is, until the unexpected happens ― illness, disaster, an accident or even death ― and the financial consequences become clear and possibly unmanageable.

A proactive review of your insurance coverage surfaces these risks and can make the difference between manageable and insurmountable loss when something goes wrong. To help, here is a summary of insurance categories and considerations to review regularly with your financial advisor.

1. Life Insurance

Why:

Life Insurance can protect your loved ones from multiple financial hardships, including by:

- Replacing your income

- Paying off your debt

- Paying estate/inheritance tax

What To Review:

All policies are not created equally. You need to consider the following:

- Timeframe: How many years would you like your policy to cover? Is there a specific goal you are striving to achieve through your life insurance policy?

- Price: Policies fluctuate widely in price. Some include specific provisions as standard features, while others may require you to pay extra to add these features as “riders” to your policy.

- Accelerated death benefits: This feature allows a terminally ill person to collect a significant portion of their policy’s death benefit while still alive.

- Disability waiver of premium: This provision waives premiums when a policy owner suffers a long-term disability, typically lasting more than six months.

- Accidental death benefits: This clause doubles or triples the benefit in the case of death by accident.

- Convertibility: When purchasing a term policy, consider what kind of permanent policies are offered by the insurance company you are considering in the event you seek to convert.

- Beneficiaries: Make sure you regularly review and update your beneficiaries as needed.

2. Disability Insurance

Why:

The risk of becoming disabled and not being able to work at the same pay level or at all is probably more than you think. For example, a 2020 analysis by the Social Security Administration estimated that for an insured worker born in 2000, the probability of becoming disabled between age 20 and normal retirement age is 25 percent.1

What To Review:

To understand whether you have enough protection for you and your family, consider the following:

- Do you have workplace disability insurance, and will it be enough? Your employer-based policy may have a cap and likely only replaces a certain percentage of your income.

- What types of coverage do you need? Do you need both short- and long-term coverage, or do you have enough liquid assets to possibly forgo short-term coverage? If you have worked long enough and paid Social Security taxes, you also may qualify for Social Security disability insurance, but it only applies to situations where you can’t work at all and involves a relatively lengthy and cumbersome approval process.

3. Property And Casualty Insurance

Why:

From 1980–2022 there was an average of 8.1 annual weather/climate disaster events in the U.S. with losses exceeding $1 billion; the annual average for the most recent five years (2018–2022) rose to 18.0 events.2 The rate of deaths related to preventable injury occurring in or around the home has increased 320% since 1999.3 Property and casualty insurance helps protect you against these rising risks.

What To Review:

- Understand what your policy covers. Although typically bundled into one “umbrella” policy, P&C insurance can include homeowner’s insurance, automobile insurance and power sports insurance, among other types. You also often have the option to include liability coverage in your policy. This protects you financially should you be found responsible for someone else’s injury or damage to their property.

- Understand how much your policy covers. Some policies only cover the cash value (i.e., the amount to replace an item less depreciation) of property rather than its replacement value (i.e., the amount to replace an item without depreciation).

- Update your coverage to reflect changes in your net worth. . Not doing so is a common mistake.

4. Health Insurance

Why:

Already high national health expenditures are projected to continue growing ― by 5.4 percent annually, on average, from 2022–2031.4 Picking the right coverage matters.

What To Review:

- If applicable, carefully consider your employers’ insurance plan options (i.e., HMO, PPO, HDHP), and make sure you know when open enrollment is for the following year. Keep in mind that even if you are young and healthy, selecting a lower premium option can prove much more costly if the coverage ends up being insufficient or your preferred doctors are out of network.To help evaluate your options, take advantage of expense calculators. Also, if you are married to someone who works at another company, consider your spouse’s insurance options in the comparison.

- Take full advantage of Health Savings Accounts (HSA). If you choose a high-deductible health insurance plan, you will be eligible for an HSA to help offset out-of-pocket medical expenses. HSAs offer triple-tax benefits: Contributions are tax-deductible, grow tax-deferred and are not taxed when withdrawn to cover eligible health care expenses.

- Prepare for Medicare. Well before you reach age 65, the age of eligibility to enroll in Medicare, you should begin to educate yourself on your options so that you can more accurately factor health care cost estimates into your retirement plan. This includes understanding the different parts and coverage of Medicare (e.g., Part A, Part B, Medicare Advantage) and considering whether you may need supplemental insurance to address the risk of unexpected out-of-pocket expenses.

5. Long-Term Care Insurance

Why:

Long-term care insurance provides protection for prolonged illness, accident and disability. It usually covers the following:

- Skilled care, such as licensed therapists, nursing homes and rehabilitation services

- Custodial care – home health aides, companion services

- Assisted living and sheltered care

- Adult day care and hospice care

- Care coordination services

What To Reivew:

- Act while you are still healthy. You should begin considering long-term care coverage around age 50 and definitely no later than age 70.

- Understand the options and their coverage; not all policies offer the same benefits.

- Brace for long-term premium costs. Premium payment amounts are not guaranteed and may increase significantly after you purchase your policy.

- Take advantage of tax benefits, if applicable. Your premium counts toward your overall medical expenses, which may be deductible if they exceed 7.5% of your gross adjusted income (AGI).

We Are Here To Help

While managing risk is critical to long-term financial health, so too is ensuring insurance costs are justified by their coverage. Yet, the terminology, volume of choices and lack of a crystal ball can make navigating the landscape challenging. Please reach out to us for help and to make sure your coverage aligns with your broader long-term financial goals.

- Social Security Administration, “Disability and Death Probability Tables for Insured Workers Born in 2000,” Actuarial Notes, Number 2020.6, June 2020.

- National Centers for Environmental Information, “Billion-Dollar Weather and Climate Disasters,” https://www.ncei.noaa.gov/access/billions/. Accessed August 24, 2023.

- National Safety Council, “Deaths in the Home,” as of year end 2021, https://injuryfacts.nsc.org/home-and-community/deaths-in-the-home/introduction/. Accessed August 24, 2023.

- Keehan, Sean P., Jacqueline A. Fiore, John A. Poisal, Gigi A. Cuckler, Andrea M. Sisko, Sheila D. Smith, Andrew J. Madison and Kathryn E. Rennie, “National Health Expenditure Projections, 2022–31: Growth To Stabilize Once the COVID-19 Public Health Emergency Ends,” Health Affairs, Vol. 42, No. 7, June 14, 2023, https://www.healthaffairs.org/doi/10.1377/hlthaff.2023.00403. Accessed August 24, 2023.