Chart of the Month

Wall Street has a new mnemonic, enter BAATMMAN1 (POW! BANG! ZWAP!)! For many years, Wall Street has come up with various naming conventions to define parts of the market. We’ve seen the FAANG stocks, Meme stocks, and most recently the Magnificent 7. BAATMMAN is simply the Magnificent 7 + 1, each letter representative of the company name it represents: Broadcom, Apple, Amazon, Tesla, Microsoft, Meta, Alphabet, and Nvidia. The most recent addition, Broadcom, is a result of its recent rise above the $1 Trillion Market Cap threshold on 12/13/2024, joining the rest of the previously named “Mag 7”.

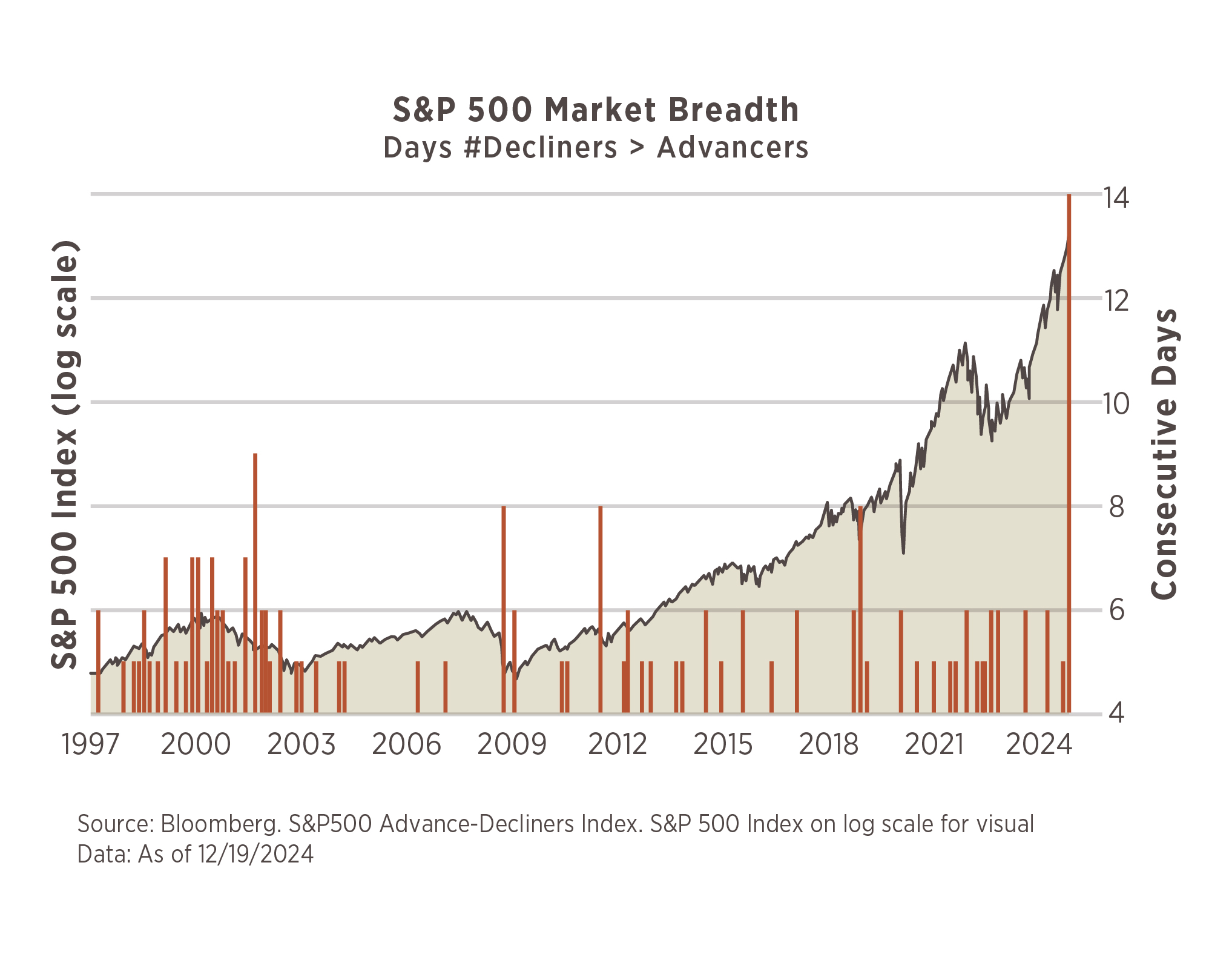

This is important context to our chart of the month, in which we highlight the extreme concentration within the broader market during the first half of December. Put another way, our chart is an illustration of market “breadth,” or lack thereof, midway through December. It shows every period since February 1997 in which the number of stocks declining on a given day exceeded those advancing for at least five consecutive days.

Between 12/2/24 and 12/19/24, the market saw 14 straight days of this, yet, the S&P 500 was only down 2.7% in that window. This is a record feat for the time period shown, the next closest instance being centered around the 9/11 attacks in 2001 when this measure was at nine consecutive days, but, the S&P 500 was down 14.7% (9/5/01 – 9/21/01).

Ultimately, it is rare for more declining stocks than advancing over a five-day consecutive period, occurring only 1% of the time over the past 28 years. And this specific instance we just encountered held up well when viewed in the broader market context, thanks in large part to the performance from the BAATMMAN stocks. All except NVDA were positive in the 14-day window, and they combine for an index weight of 36% (at 12/19/2024).

CITATION

1 https://sherwood.news/markets/the-magnificent-7-is-dead-long-live-the-batmmaan-stocks/

Understanding the Role of Emotions and Biases in Investing

During the COVID-19 pandemic and the subsequent years, the global economy experienced significant volatility. Supply chains were disrupted due to labor shortages, factory closures, transportation bottlenecks, and geopolitical conflicts. While industries such as healthcare, pharmaceuticals, and technology thrived, others—like restaurants, leisure, automotive, and airlines—faced considerable challenges. Additionally, borrowing costs rose as interest rates and inflation increased, with the Federal Reserve recently lowering rates by 0.25 percentage points in November 2024, marking the second cut of the year.1

This level of uncertainty can lead many investors to panic and make hasty decisions, often resulting in skewed logic and poor outcomes. Although it’s nearly impossible to eliminate emotions from our actions, investors must strive for balance by adopting strategies that help mitigate emotional responses. To assist you in making more informed investment choices, we present four strategies designed to help you pause and think critically before acting.

Understand Your Past Behaviors

The way investors make decisions is significantly influenced by behavioral finance, an economic theory that links irrational behaviors to psychological factors such as fear, anxiety, and eagerness. These emotions can manifest both consciously and unconsciously, leading to mistakes in the stock market.

To navigate these challenges, investors must recognize common cognitive biases and learn to identify them in their own decision-making processes. Here are five prevalent biases that can impact investment choices:

1. Herd Behavior

This occurs when individuals follow the actions of a large group of investors without conducting their own research. A notable example is the GameStop phenomenon in 2021, where retail investors rallied on platforms like Reddit and X (formerly Twitter), driving the stock price up. While some profited, many others faced significant losses. This event even prompted the SEC to propose new regulations addressing conflicts of interest in financial firms’ use of predictive data analytics.2

2. Mental Accounting

Mental accounting refers to the tendency to assign specific values to different types of money and investments, treating them unequally despite their equivalence. For instance, investors might categorize losses as “affordable” without acknowledging that any loss still impacts their overall financial health.

3. Anchoring Bias

This bias occurs when investors give disproportionate weight to the first piece of information they encounter, often ignoring subsequent data that could provide a fuller context. Frequently, this initial information is anecdotal rather than factual, leading to assumptions made without thorough research.

4. Overconfidence

Overconfident investors often credit their skills for successful investments while attributing poor performance to external factors. This mindset can lead to impulsive decisions, as they fail to learn from past mistakes.

Avoid Consuming Too Much Financial Media

There are numerous sources of financial information, including television, print media, YouTube, and social media. Many investors rely on these channels to stay updated on market developments. However, with so many voices sharing opinions on various stocks and market movements, it can be challenging to cut through the noise and find reliable information.

To focus on what truly matters, investors need to be discerning in how they consume financial media. This involves applying fundamental investing principles, such as analyzing a company’s financials, historical trends, corporate governance, and growth potential, rather than being swayed by sensational headlines.

If you’re active on social media, it’s crucial to follow reputable news sources like Bloomberg, Forbes, or Nasdaq. This approach helps mitigate the risk of being influenced by viral trends or falling victim to misinformation.

Take a Breather

When markets indicate a potential economic downturn, it’s common for investors to feel anxious and make hasty decisions to safeguard their investments. However, before taking action, it’s crucial to pause and consider how a short-term choice might impact your portfolio in the long run. For instance, research indicates that investors under 45 were more likely to withdraw funds from their retirement accounts in response to rising living costs after the pandemic.3 While this may alleviate immediate financial pressure, it can significantly harm your retirement savings, especially if you’re young and missing out on the benefits of compound interest.

Before reacting, reflect on your biases and how they have influenced your past decisions during major economic events. Taking this extra time to think can help you identify the best course of action.

Talk with Your Advisor

To help ensure your financial strategy aligns with both your short- and long-term goals, it’s wise to consult with your financial advisor. Their experience allows them to see the bigger picture and provide sound advice, helping you avoid risky decisions. If you have any questions or concerns about your portfolio, please don’t hesitate to reach out to us.

Citations

1. Picchi, A. (2024, November 7). Federal Reserve lowers interest rates by 0.25 percentage points in second cut of 2024. CBS News. https://www.cbsnews.com/news/fed-rate-cut-today-november-meeting-federal-reserve-announcement/

2. Broughel, J. (2023, October 19). GameStopped: How a meme stock controversy led the SEC astray. Forbes. https://www.forbes.com/sites/jamesbroughel/2023/10/19/gamestopped-how-a-meme-stock-controversy-led-the-sec-astray/

3. CFP Board survey reveals cost of living is a worry for 9 in 10 Americans polled. (n.d.). CFP Board. https://www.cfp.net/news/2023/04/cfp-board-survey-reveals-cost-of-living-is-a-worry–for-9-in-10-americans-polled