Chart of the Month

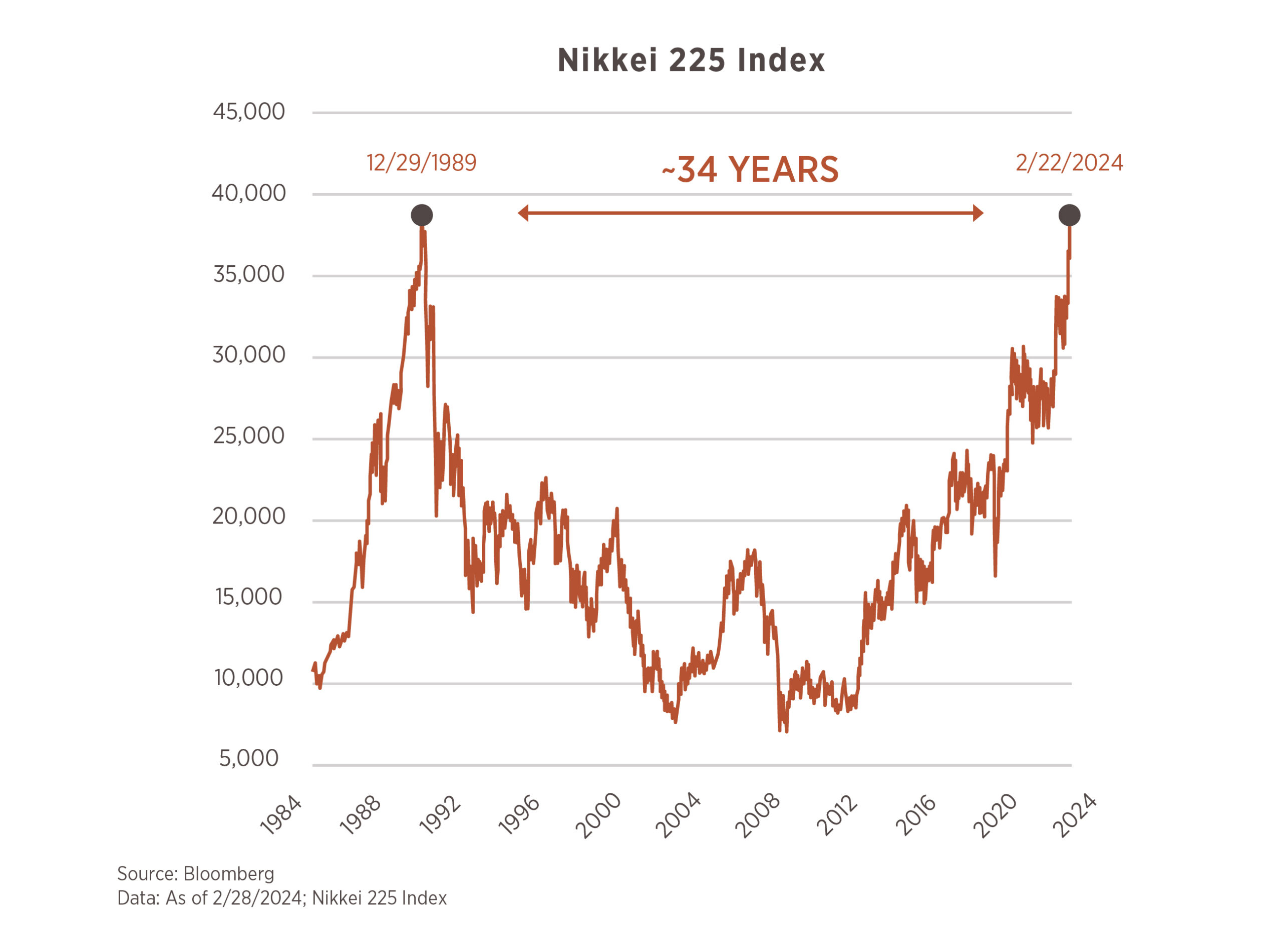

The year is 1989. You are getting prepared to ring in a new decade, and you are thrilled! Why? Because you have been invested in Japan for the past 10 years, reaping an incredible +19.5% annualized return. Unfortunately, that was the last time you were probably excited about Japan for a long time. As soon as the calendar turned to 1990, the Japanese stock bubble began to burst, eventually bottoming out in March 2009 – returning a negative 7.8% annualized from peak-to-trough for nearly 20 years. Fast forward 34 years to February 2024 and Japan, by way of the Nikkei 225 Index, has finally eclipsed that all- time high, as this month’s chart illustrates. There has been a recent uptick in intrigue around Japan in the past few years, but why?

1) Corporate Reform: Japanese companies have increased returns to shareholders via buybacks and reduced corporate cross holdings (which have historically protected management teams from investors).

2) Valuations: a large portion of Japanese companies trade below their book value (37% of Nikkei members per Bloomberg).1 Going hand-in-hand with Corporate Reforms and why there are a number of firms doing buybacks.

3) The Yen: Japan’s currency has been weak. As an exporting country, this benefits many of the Japanese companies, as their products are cheaper for foreign buyers, increasing profits.

Given the fall from grace 30+ years ago, Japan remains the world’s 3rd largest economy, has produced annualized returns (measured in USD) of +8.1%,2 and has grown earnings at an annualized rate of +7.5% (in Yen), which is slightly higher than the US at +7% (in USD) over the past decade.3 We like to remind clients that, no matter how hard you look, it is impossible to see the future. It is inevitable that something will change – like a sweeping overhaul of Corporate Governance – that can alter the path of performance. This is why we are advocates of a globally diversified portfolio.

1Bloomberg – Japan Shares Open New Chapter as Nikkei Reclaims Its 1989 Peak (Sano, Hideyuki) – 2/22/2024

2Total Return (USD) of Nikkei 225 Index 2/28/2014 – 2/28/2024 (Bloomberg)TTM EPS (Yen) of TOPIX Index and TTM EPS (USD) of 3MSCI USA Index annualized over 10-years between 12/31/2013 – 12/31/2023 (Bloomberg).

When it comes to the discussion on financial planning, words like “growth,” “build” and “maximize” are often heard. While it’s certainly important to ensure that your wealth appreciates, it’s equally critical to implement strategies to help protect those assets.

Stick To Your Plan, But Revisit It With Regularity.

Whether you are preparing for the sale of a business, saving for upcoming education costs or approaching retirement, a holistic financial plan is essential. As interest rates rise, market volatility increases and the future of the global economy continues to evolve, your financial strategies might need to shift. It’s important to regularly monitor your portfolio and investments to ensure that you are on pace to meet your goals. Consider reviewing your portfolio or consulting with your financial advisor with a regular cadence—at minimum, on an annual basis.

Establish An Emergency Account.

Though it’s hard to plan for the unpredictable, a general rule of thumb is to have a savings of approximately three to six months of expenses in liquid financial vehicles. When the unexpected inevitably happens, you can access these funds and avoid incurring penalties by prematurely withdrawing money from retirement accounts, CDs, etc.

Consider Alternative Investments.

Incorporating alternative investments can help diversify your portfolio with products that may offset market downturns and help mitigate risk. Private equity investments, real estate, collectibles, etc. are just some examples of investments to explore.

Have A Back-up Plan.

Long-term care insurance (LTC) may be a worthwhile investment to cover any costly personal care needs that may arise in the future. Though LTC insurance is often expensive and confusing, it can be instrumental in protecting your family and legacy. Bob Oros, Chairman and CEO of Hightower notes, “It is always best to be bought when in great health,” cautioning, “not every policy offers equal benefits, so be sure to comparison shop.”

Maximize Retirement Savings.

There are a range of approaches to make the most of your retirement savings. For example, individuals aged 50 and older are eligible to make catch-up contributions to 401(k)s and IRAs, boosting the impact of these accounts as they approach retirement age. It’s also typically prudent to avoid making withdrawals for as long as possible until you are required to (for traditional IRAs, the year in which you turn age 72, or 73 if you reach age 72 after December 31, 2022) to benefit from the tax-deferred growth of assets.

Optimize Your Tax Strategy.

Approach tax time strategically, incorporating techniques to reduce your obligation so that you are required to pay Uncle Sam the least amount permitted by law. Strategies such as tax-loss harvesting and strategic gifting can be meaningful in helping to reduce your burden.

Make A Legacy Plan.

Estate planning is a standard part of any savvy wealth management strategy. At a basic level, it’s critical to craft trust documents, designate beneficiaries and assign a power of attorney. Ensure, however, that you dig deeper into your estate plan so that it is written in a manner that’s closely aligned with your true intentions. Thoughtful planning can make all the difference in promoting the efficient distribution of your assets with the least amount of taxes, while preserving your legacy.

Instill A Sense of Responsibility In Future Generations.

According to author Peter J. Klein, CFA, “Future generations are less likely to squander wealth when they see themselves as stewards of their family legacy with a greater purpose.” Establish a sense of purpose for your wealth by incorporating a philanthropic component within your wealth management plan.

Partner With The Right Team.

A complex portfolio that involves a diverse group of multi-generational stakeholders typically requires a team of professionals to manage that wealth. Do research, gather referrals and conduct interviews to find the right team. Some professionals that may comprise your team include a Certified Public Accountant, estate planning attorney and financial advisor.