Chart of the Month

EUREKA! Likely a common cry in the West during the Gold Rush, as prospectors sifted for the precious metal. While you are unlikely to hear anyone make that exclamation today, gold has been having a shining moment to start 2024, with prices having increased +10.8% YTD. In mid-April, the metal even touched a new all-time high at $2,392/oz. What is behind the recent rally, and what makes it different from historical patterns?

For starters, gold is a commodity, and as such, is driven by supply and demand. Historically, gold prices have reacted negatively to higher interest rates and a stronger U.S. Dollar. The reason being that gold does not provide any yield to an investor, and higher rates present competition for demand. With U.S. interest rates +0.70% to +0.85% higher, plus the U.S. Dollar getting stronger, it would have been rational to expect gold prices to have fallen so far this year.

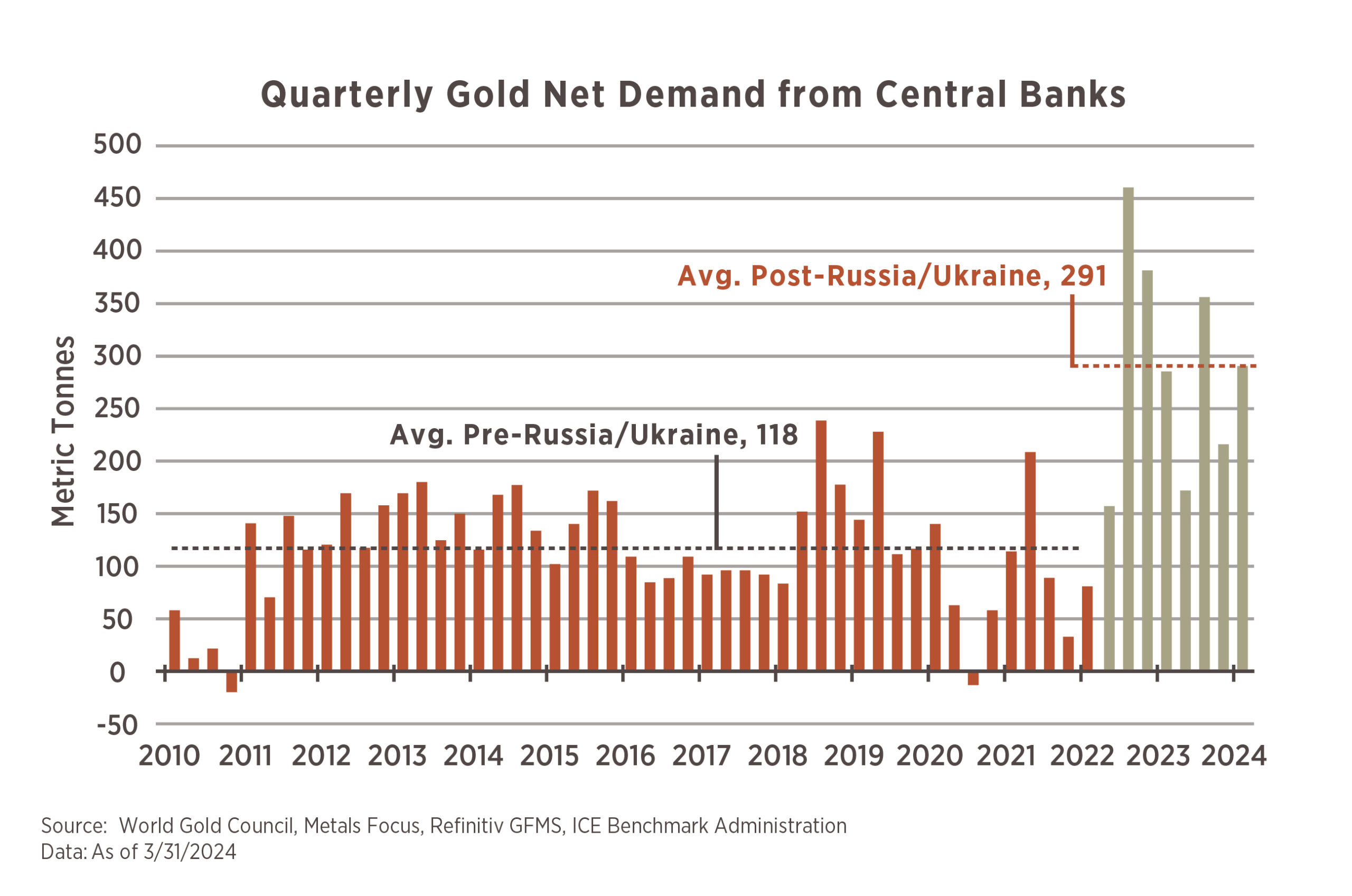

Our graphic this month shows something has changed. It is demand from Global Central Banks having picked up substantially since Russia’s invasion of Ukraine. As punishment for that action, the U.S. and others placed sanctions on Russia, effectively “weaponizing” the U.S. Dollar. Other Global Central Banks that may have concerns with U.S. policy in the future took notice and started buying gold in large quantities. Prior to Russia’s invasion, Central Banks only accounted for ~10% of gold demand, but in the last two years, they have doubled that to ~20%.

So, while the rally in gold this year has gone against conventional wisdom, it appears as though Central Banks diversifying away from the U.S. Dollar are driving demand, and thus prices, higher in gold.

Who among us wants to pay the IRS more taxes than we have to?

While few may raise their hands, Americans regularly overpay because they fail to take tax deductions for which they are eligible. Let’s take a quick look at the five most overlooked opportunities to manage your tax bill.

- Reinvested Dividends: When your mutual fund pays you a dividend or capital gains distribution, that income is a taxable event (unless the fund is held in a tax-deferred account, like an IRA). If you’re like most fund owners, you reinvest these payments in additional shares of the fund. The tax trap lurks when you sell your mutual fund. If you fail to add the reinvested amounts back into the investment’s cost basis, it can result in double taxation of those dividends.1 Mutual funds are sold only by prospectus. Please consider the charges, risks, expenses, and investment objectives carefully before investing. A prospectus containing this and other information about the investment company can be obtained from your financial professional. Read it carefully before you invest or send money.

- Out-of-Pocket Charity: It’s not just cash donations that are deductible. If you donate goods or use your personal car for charitable work, these are potential tax deductions. Just be sure to get a receipt for any amount over $250.2

- State Taxes: Did you owe state taxes when you filed your previous year’s tax returns? If you did, don’t forget to include this payment as a tax deduction on your current year’s tax return. There is currently a $10,000 cap on the state and local tax deduction.3

- Medicare Premiums: You may be able to deduct unreimbursed medical and dental premiums, co-payments, deductibles, and other medical expenses to the extent that the costs exceed 7.5% of your adjusted gross income. This includes most Medicare premiums.4

- Income in Respect of a Decedent: If you’ve inherited an IRA or pension, you may be able to deduct any estate tax paid by the IRA owner from the taxes due on the withdrawals you take from the inherited account.5

1 Investopedia.com, January 11, 2024

2 IRS.gov, 2024

3 IRS.gov, 2024

4 IRS.gov, 2024

5 IRS.gov, 2024. In most circumstances, once you reach age 73, you must begin taking required minimum distributions from a Traditional Individual Retirement Account (IRA). Withdrawals from Traditional IRAs are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty. You may continue to contribute to a Traditional IRA past age 70½ as long as you meet the earned-income requirement.