Chart of the Month

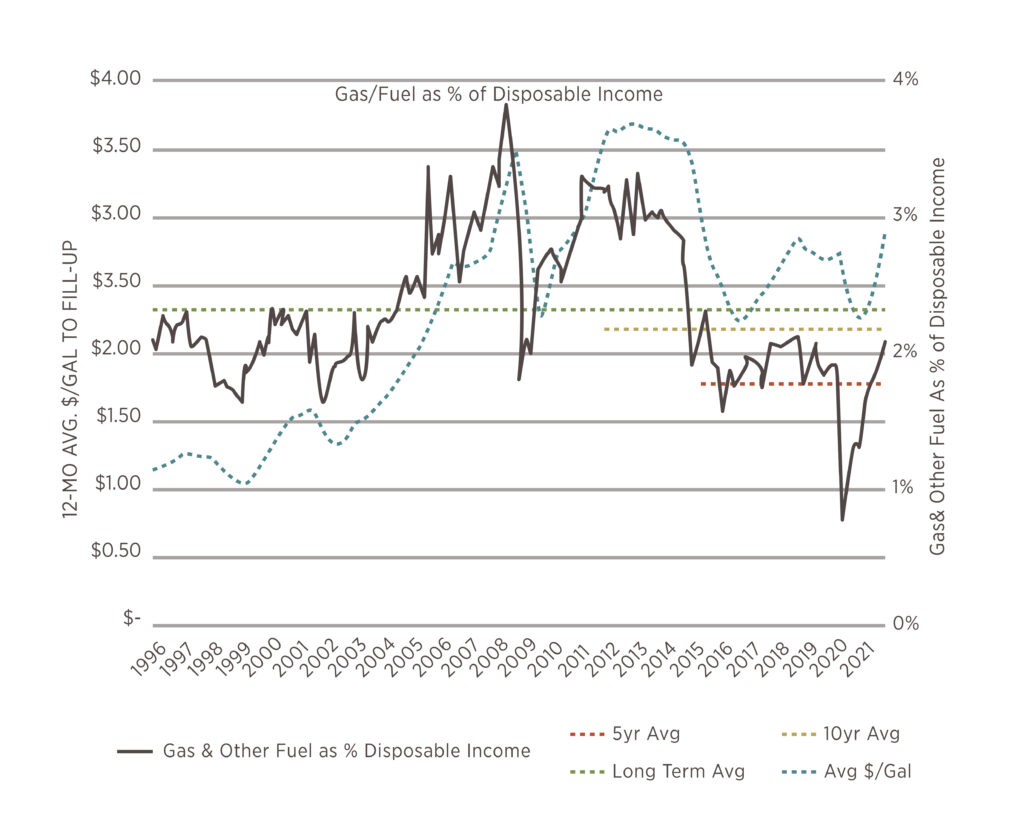

It is tough to gain consensus in today’s world, but one thing that seems to strike at the heart of all Americans is the distaste for paying higher prices at the gas pump. As inflation continues to steal headlines, we wanted to paint a different perspective on the impact fuel prices have on the consumer’s wallet. There is no question that inflation has been hot, and diving into the details shows motor fuel as a key culprit. Even though it averages a relative weight to the index of 3-4%, the volatility presented by the underlying commodity can create large swings and cause gas prices to “punch above their own weight” when it comes to headline numbers. The gyrations in food and energy prices are often cited as the rationale for looking at the more stabilized core inflation measure that excludes those two items.

Despite this, data from the Bureau of Economic Analysis (BEA) shows that the amount consumers are spending at the pump relative to their disposable income remains low relative to the 10-year and 25-year averages (Chart). We have technological ingenuity to thank for this as our vehicles have continually become more efficient over time, even with trucks growing in their share and accounting for the majority of vehicle production. So, despite the increasing miles driven each year, gallons consumed continues to decline and it is resulting in lower expenses at the pump relative to income.

Data Source: US Bureau of Economic Analysis (BEA); US Energy Information Administration (EIA)

What financial, business, or life priorities do you need to address for the coming year? Now is an excellent time to think about the investing, saving, or budgeting methods you could employ toward specific objectives, from building your retirement fund to managing your taxes. You have plenty of choices. Here are a few ideas to consider:

Can you contribute more to your retirement plans this year? In 2022, the contribution limit for a Roth or traditional individual retirement account (IRA) is expected to remain at $6,000 ($7,000 for those making “catch-up” contributions). Your modified adjusted gross income (MAGI) may affect how much you can put into a Roth IRA. With a traditional IRA, you can contribute if you (or your spouse if filing jointly) have taxable compensation, but income limits are one factor in determining whether the contribution is tax-deductible.1

Keep in mind, this article is for informational purposes only and not a replacement for real-life advice. Also, tax rules are constantly changing, and there is no guarantee that the tax landscape will remain the same in years ahead.

Once you reach age 72, you must begin taking required minimum distributions from a traditional Individual Retirement Account in most circumstances. Withdrawals from Traditional IRAs are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty.

To qualify for the tax-free and penalty-free withdrawal of earnings, Roth 401(k) distributions must meet a five-year holding requirement and occur after age 59½. Tax-free and penalty-free withdrawal can also be taken under certain other circumstances, such as the owner’s death. Employer match is pretax and not distributed tax-free during retirement.

Make a charitable gift. You can claim the deduction on your tax return, provided you follow the Internal Review Service guidelines and itemize your deductions with Schedule A. The paper trail can be important here. If you give cash, you should consider documenting it. Some contributions can be demonstrated by a bank record, payroll deduction record, credit card statement, or written communication from the charity with the date and amount. Incidentally, the IRS does not equate a pledge with a donation. If you pledge $2,000 to a charity this year but only end up gifting $500, you can only deduct $500.2

Make certain to consult your tax, legal, or accounting professional before modifying your record-keeping approach or your strategy for making charitable gifts.

Open an HSA. A Health Savings Account (HSA) works a bit like your workplace retirement account with the funds being used to pay for qualified healthcare expenses. There are also some HSA rules and limitations to consider. You are limited to a $3,650 contribution for 2022 if you are single; $7,300 if you have a spouse or family. Those limits jump by a $1,000 “catch-up” limit for each person in the household over age 55.4

If you spend your HSA funds for non-medical expenses before age 65, you may be required to pay ordinary income tax as well as a 20% penalty. After age 65, you may be required to pay ordinary income taxes on HSA funds used for nonmedical expenses. HSA contributions are exempt from federal income tax; however, they are not exempt from state taxes in certain states.

Pay attention to asset location. Tax-efficient asset location is one factor that can be considered when creating an investment strategy.

Review your withholding status. Should it be adjusted due to any of the following factors?

* You tend to pay the federal or state government at the end of each year.

* You tend to get a federal tax refund each year.

* You recently married or divorced.

* You have a new job, and your earnings have been adjusted.

Consider consulting your tax, human resources, or accounting professional before modifying your withholding status.

Consider the tax impact of any upcoming transactions. Are you preparing to sell any real estate this year? Are you starting a business? Might any commissions or bonuses come your way in 2022? Do you anticipate selling an investment that is held outside of a tax-deferred account?

If you are retired and in your seventies, remember your RMDs. In other words, Required Minimum Distributions (RMDs) from retirement accounts. In most circumstances, once you reach age 72, you must begin taking RMDs from most types of these accounts.5

Vow to focus on your overall health and practice sound financial habits in 2022. And don’t be afraid to ask for help from professionals who understand your individual situation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment.

Citations

1. thefinancebuff.com, August 11, 2021

2. irs.gov, January 22, 2021

3. nerdwallet.com, July 31, 2020

4. irs.gov, September 8, 2021 5. irs.gov, May 3, 2021