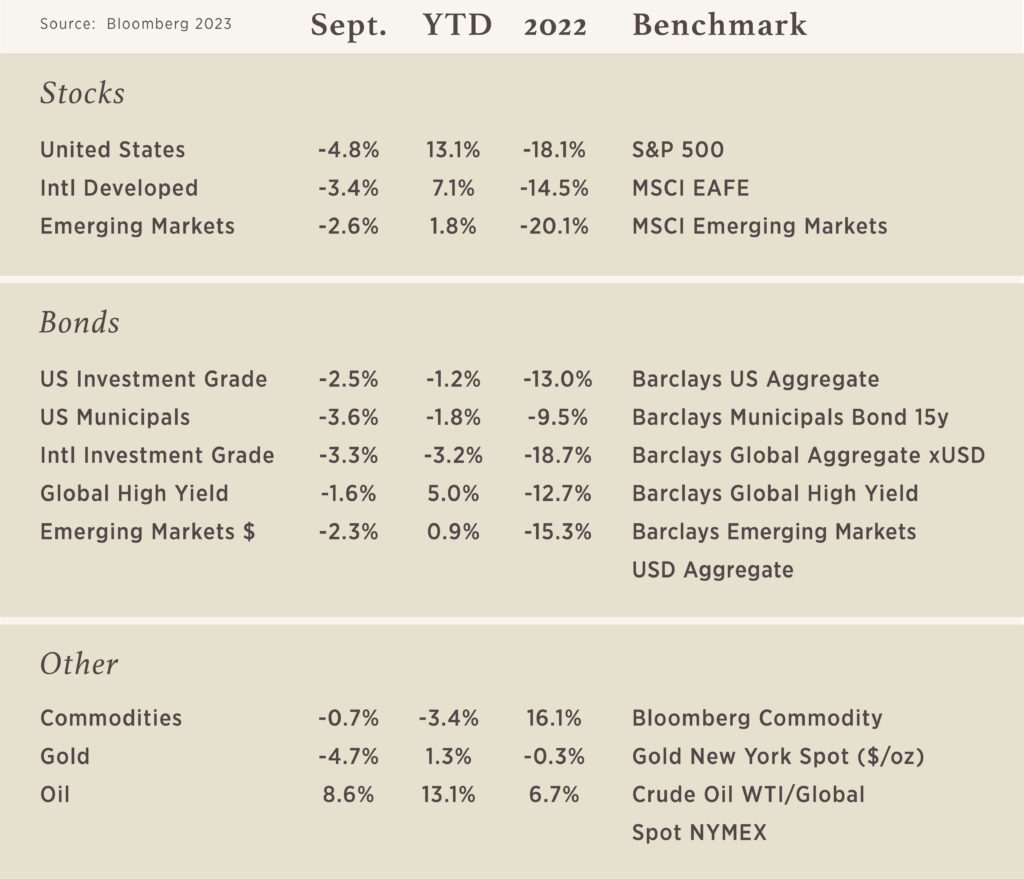

Chart of the Month

In November 2022, we wrote about the anticipation for interest expense in the US to rise as debt matured and needed to be refinanced at higher rates. In February 2023, we discussed the U.S. Government debt ceiling and the need to issue more debt in order to cover the projected shortfalls from revenue.

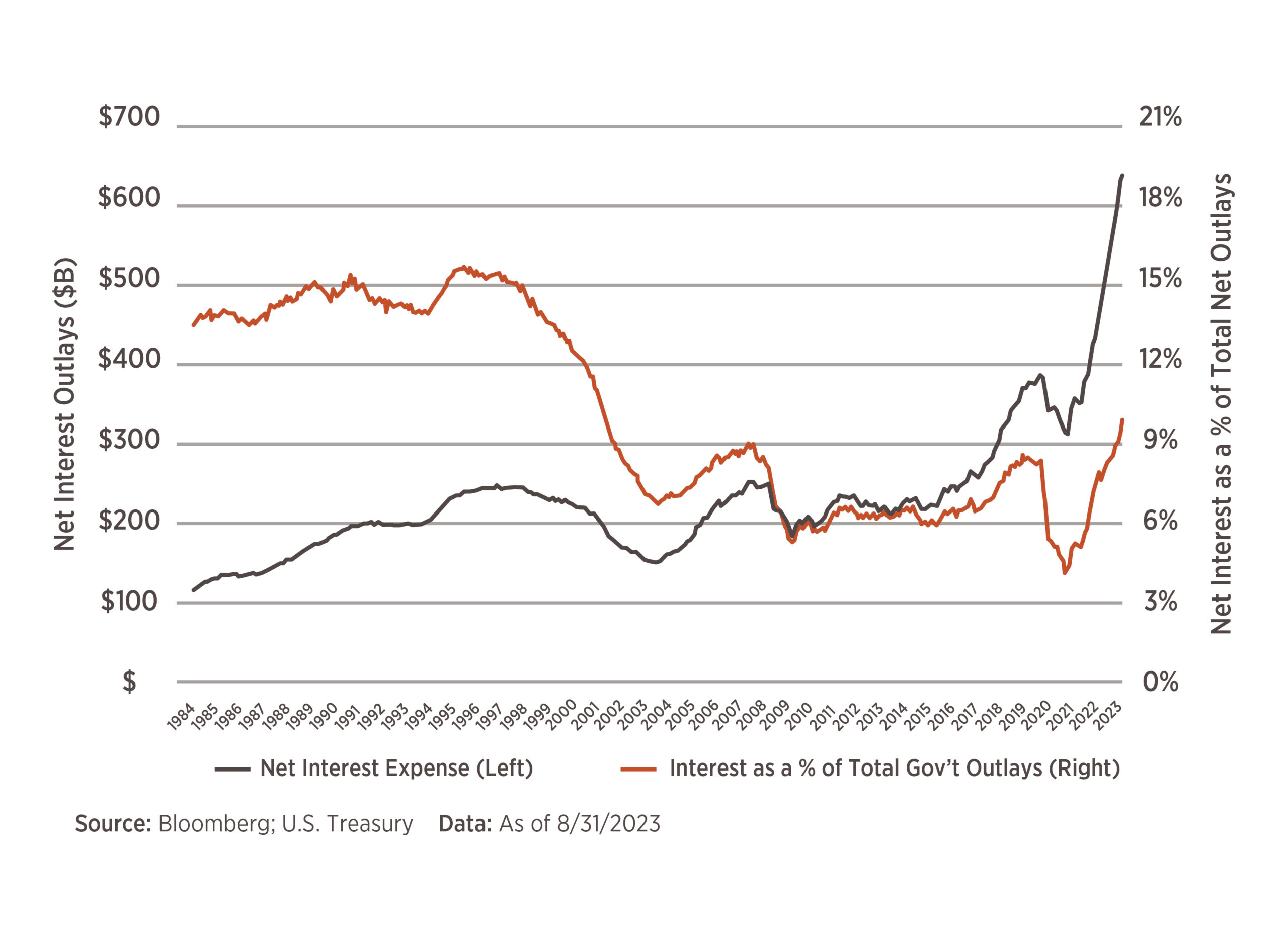

As you might have guessed, interest expense has exploded, reaching $850 Billion for the 12-months ending 8/31/2023 or 19% higher than the year prior. This graphic shows net interest outlays, which is approaching $650B, as well as how much of total U.S. Government Outlays are going towards that expense. It is approaching 10% of total net outlays, eating up a growing chunk of the budget.

To put some additional perspective around what lies ahead:

- Nearly 1/3 of the US Marketable Debt outstanding matures in the next 12-months

- The average interest rate on this debt is nearly 3%, and rising! It has not been this high since 2009, when the total debt outstanding was significantly lower.

What we find interesting about this entire setup is that all of this is occurring while unemployment remains near record low! In any sense, the continuation of the Government to continue bleeding red ink, meaning they spend more than they bring in, is going to continue being a challenge that needs some sort of resolution. It is hard to get ahead, however, when you continue to take on more debt while the rate you pay also continues to climb.

When it comes to retirement, some women face obstacles that can make saving for retirement a challenge. Women typically earn less than their male counterparts and often take time out of the workforce to care for children or other family members. Added to the fact that women typically live longer than men, retirement money for women may need to stretch even further.1

Despite these challenges, there are a lot of reasons to be hopeful.2

REVIEW YOUR SITUATION

Do you want to spend your years traveling together, or do you envision staying closer to home? Are you seeing yourself moving to a retirement community, or do you want to live as independently as you can? Sit down with your spouse, if you’re married, to discuss your visions for retirement.

You can’t see if you’re on track for your goals if you haven’t defined them. And if you find you’re falling short of where you want to be, you can work together to strategize about how you can either get to where you want to go or to adjust your strategy so that it fits your existing situation.1

GET CREATIVE

These challenges don’t have to stop you from saving for retirement if you’re willing to get creative. If you plan to or have taken off time from the workforce, try and increase your contributions to your retirement accounts while you are working. If you’re staying home while your spouse works, you may be able to contribute to an individual retirement account. A spousal IRA may be an option for you. If you file a joint return, you may be able to contribute to an IRA even if you didn’t have taxable compensation as long as your spouse did. Each spouse can make a contribution up to the current limit; however, the total of your combined contributions can’t be more than the taxable compensation reported on your joint return.3

Beginning in 2023, the SECURE 2.0 Act raised the age that you must begin taking RMDs to age 73. If you reach age 72 in 2023, the required beginning date for your first RMD is April 1, 2025, for 2024.

YOU MAY BE ABLE TO BE PAID FOR CAREGIVING

Many adult children wonder if they can be compensated for the countless hours that they spend caregiving for their aging parents. This is especially true with those family members who are caring for a loved one with Alzheimer’s or another form of dementia. The short answer to this question is yes, it is possible. Unfortunately, the short answer is insufficient, as the subject is complex. Many variables impact whether a loved one who requires care is eligible for such assistance, and what many people fail to ask, is if they, themselves as caregivers, are eligible.4 Do your research and speak to a trusted advisor about your options.

GET INVOLVED

One of the best things you can do is to get involved in conversations about finances. Many women undervalue their knowledge in this area and having regular conversations with your spouse, family, and financial professional can help ensure that you always know where things stand. If you’re facing discomfort with speaking to your family about finances, financial writer, Rachel Cruz offers these 5 steps to try.5

1. Share your money story.

Start by saying, “In my house growing up, money was . . .”

Discovering how money was handled in the household your husband or wife grew up in will help you understand the foundation for their beliefs about money. It will probably help you get to the root of money fights you guys have too. Their experience was probably totally different than yours, which means you guys are coming at this big (and sometimes emotional) topic of money from two different perspectives.

2. Share your fears.

Bring up the subject by saying, “My biggest financial fear is . . .”

Fear is a terrible financial advisor. But believe it or not, every single one of us either has or has had fears about money.

While women may face additional challenges, careful preparation with your financial professional may help you to live a fulfilling retirement.

3. Share your dreams.

Begin with, “My big dream for both of us is . . .”

Knowing your dreams will keep you connected to a shared goal and motivate you to save for the future. In fact, if you guys haven’t discussed your dreams together, you’re probably not seeing much progress financially. You might be saving a little here and a little there, but you’re going to have to tap into your dreams if you want to start making real progress.

4. Share your attitude about giving.

Say, “When it comes to giving, I . . .”

One of you probably has a soft spot for any and every cause out there, while the other isn’t so easily moved. Neither of you is right or wrong—it just means one of you is a spontaneous giver and the other is a planned giver.

Simply learning which kind of giving you and your spouse lean toward is eye-opening. Planned givers can help spontaneous givers make more of an impact with their giving, and spontaneous givers can help planned givers experience the joy of surprise generosity.

5. Share your appreciation for grace.

Start with, “When I make a money mistake, I love it when you . . .”

We all want to be a safe place for our spouse to land, but some of us don’t naturally extend grace. If you tend toward withholding grace, you care deeply about integrity and doing things right. This is admirable and important, but you don’t want to sacrifice the relationship in your pursuit of being right.

Tell each other about a time when you felt the other show compassion for a mistake or misunderstanding. Then, the next time someone slips up, remember how you can handle it with grace. Money mistakes will happen, but as long as you learn from them, they can actually make you a stronger couple.5

We have highlighted women’s unique retirement challenges, such as lower earnings, career interruptions for caregiving, and longer life expectancy. Despite these obstacles, women can secure their financial future in retirement with the right planning. For more information on these topics or to start the conversation, please reach out to one of our advisors.

1. CNBC.com, March 6, 2020

2. Entrepreneur.com, August 13, 2020

3. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits

4. https://www.payingforseniorcare.com/paid-caregiver/elderly-parents

5.https://www.ramseysolutions.com/relationships/3-ways-to-get-spouse-on-board-financially