Chart of the Month

The U.S. Government hit the debt ceiling in mid-January, again. Betting odds would say that the debt limit gets increased, like the prior 22 ceiling increases since 1997 (Source: Government Accountability Office), but not without some tug-of-war and public shaming from both sides of the aisle in Washington.

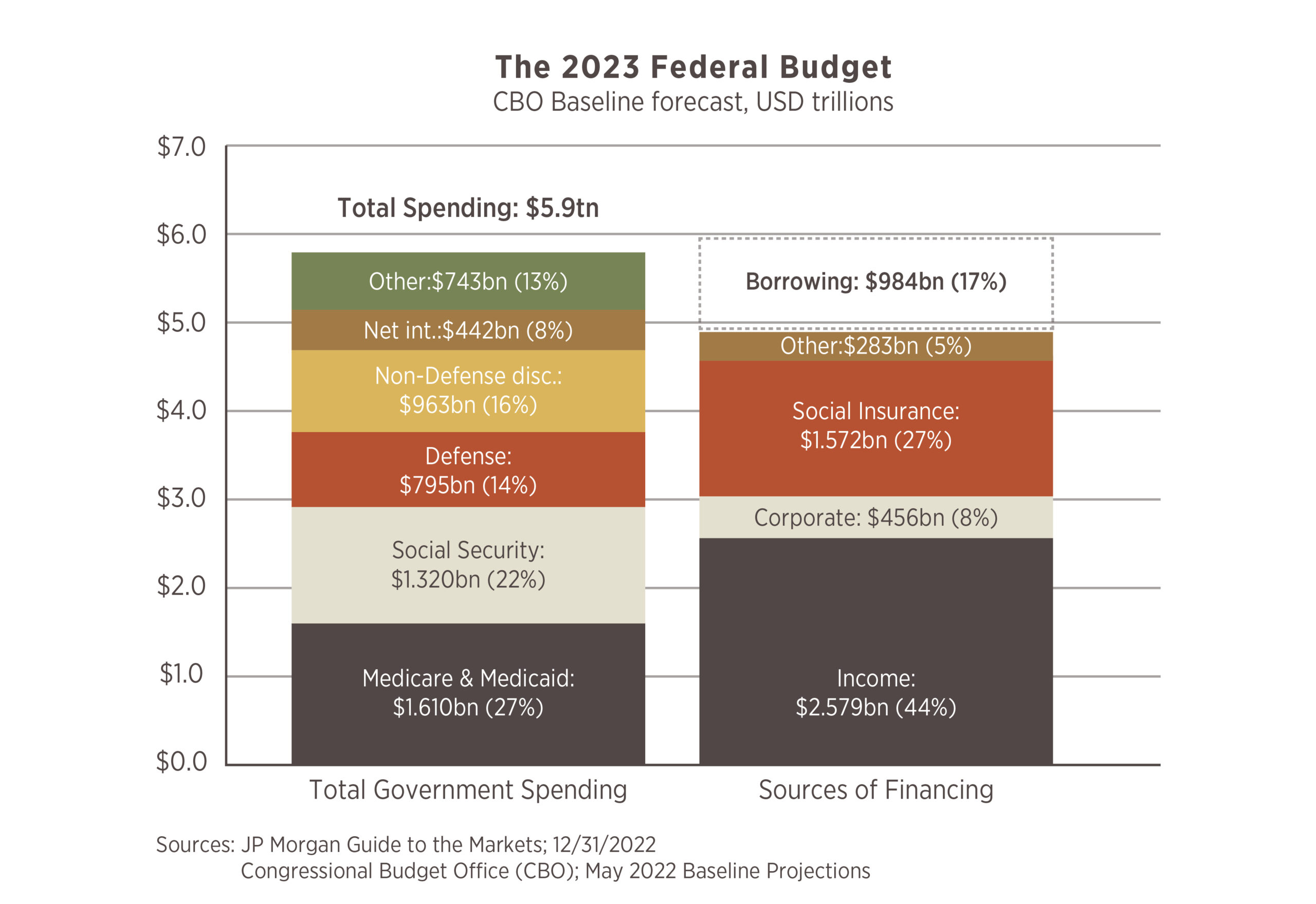

So, why does the US continue to hit the debt ceiling? In short, the Government spends more than it brings in and the gap to cover that excess is filled by borrowing. As the graphic below shows, the CBO expects a shortfall of $984bn for Fiscal Year 2023 (Oct. 2022 – Sept. 2023). The majority (70%) of government expenditures are considered mandatory (Social Security, Medicare & Medicaid, interest expense, and other). Discretionary expenditures, a nearly equal split between defense and non-defense, account for the other 30% of the total expenditures of the Government. Despite all the noise, Congress has very little opportunity to cut spending. All things considered, the prospects of an increase to the debt ceiling are strong as it is almost implausible to find a quick solution to a nearly $1 Trillion problem.

2022 Tax Guide

Form 1099 Tax Information Mailing Schedule

By January 31, 2023, Pershing will begin mailing Form 1099 tax statements. When you receive your Form 1099 depends on the holdings in your account.

Phase One: January 31, 2023

Phase Two: February 15, 2023

Phase Three: February 28, 2023

Phase Four: March 15, 2023

For more detailed information regarding the timing, click here for the 2022 Tax Guide from BNY Mellon | Pershing and scroll to page 3 of the guide.

Corrected 1099 Form will be mailed as needed.

You may receive a corrected Form 1099. There are several reasons for this- for example, issuers of securities held in your account may provide updated or additional information after your Form 1099 is mailed to you. The IRS requires financial organizations to send corrected forms with revised information as it becomes available.

Want quicker access to your Form 1099? Enroll in electronic delivery (eDelivery). Log-in to your account to sign up for access or contact Lynne Davidson for assistance at 316-776-4633.