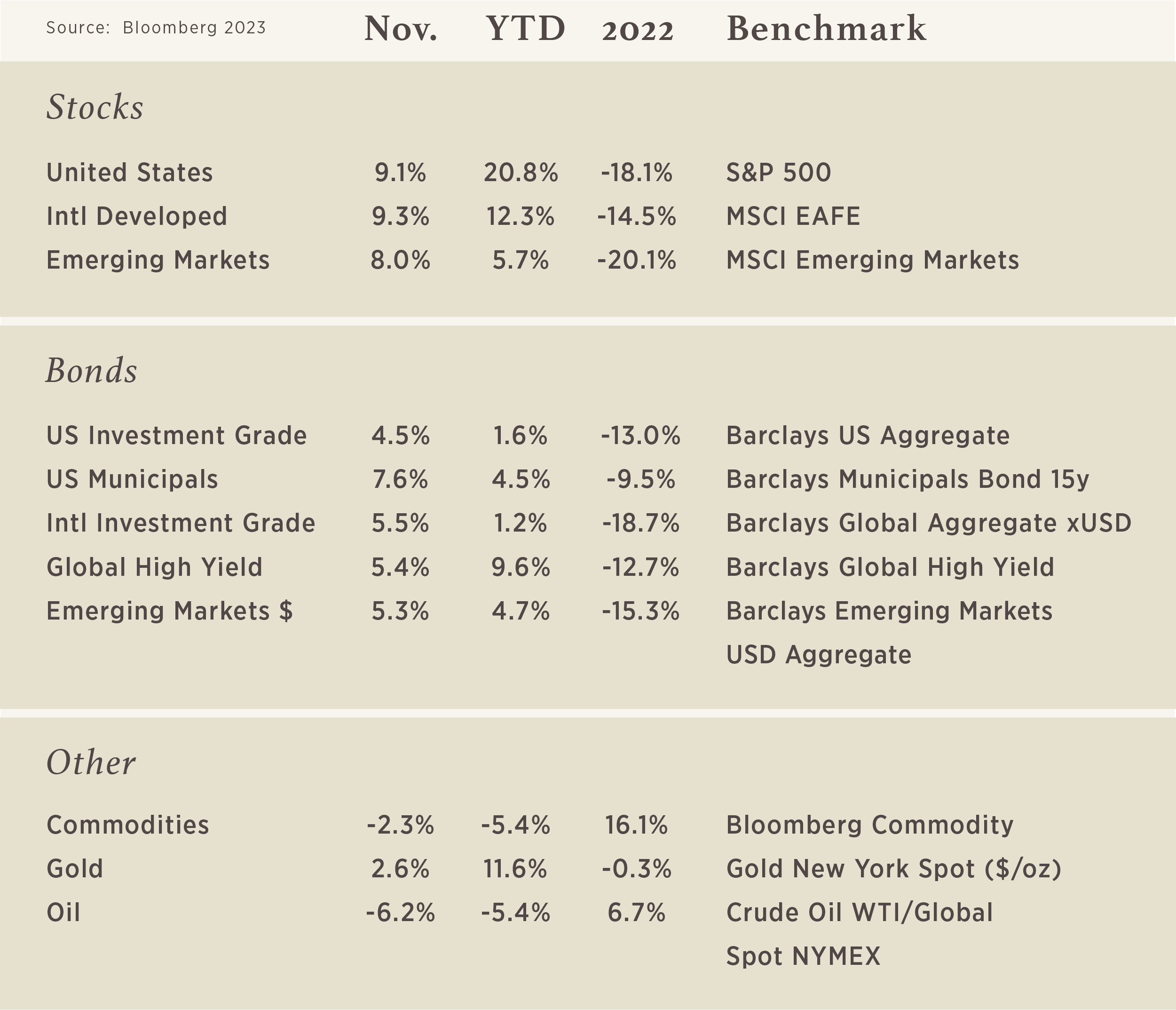

Chart of the Month

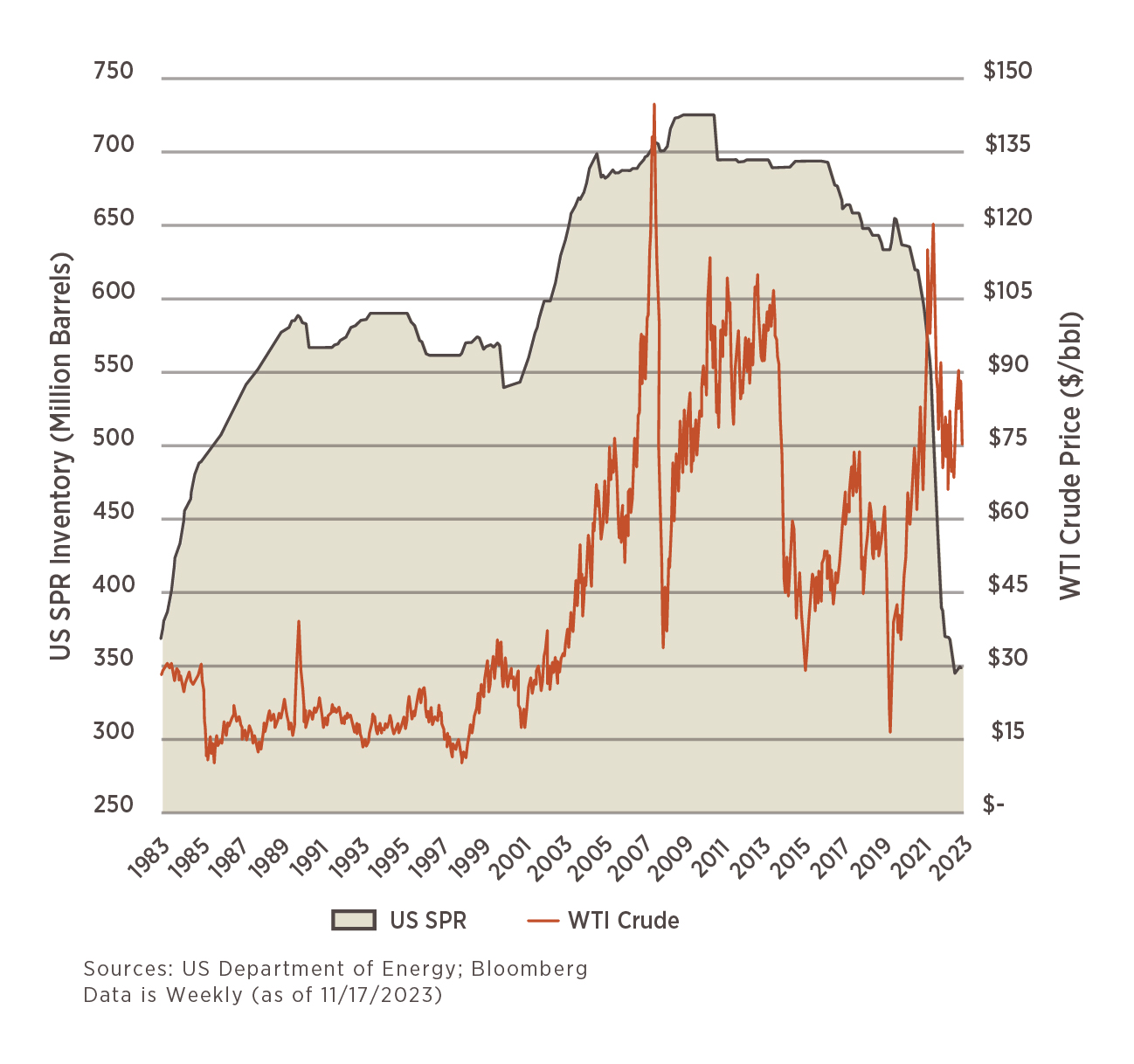

An interesting dynamic playing out in global markets is that centered around energy, and more specifically, oil. As the most traded commodity in the world (either through Brent Crude or WTI Crude), there never seems to be a shortage of price fluctuations. It is also the commodity most of us are well-tuned into understanding in our day-to-day because we use fuel to get from point A to point B. As a commodity, the price is largely influenced by supply and demand dynamics and the past 3-4 years have brought about a multitude of shocks to the system: (1) COVID (negative demand shock), (2) Russia invading Ukraine (negative supply shock), (3) US drawing down reserves (positive supply shock), (4) Saudi Arabia (OPEC+) production cuts (negative supply shock), and (5) Israel/Hamas conflict (unknown/TBD).

What we focus on in the chart this month is the US drawdown of the Strategic Petroleum Reserves (SPR), potentially guiding us to a reasonable expectation of where oil prices can move from today.

The SPR was created as a result of the Arab Oil Embargo in 1973 in order to mitigate damage from future oil shortages. The capacity today, per the DOE, is 713.5 million barrels (mmb). However, as the chart shows, the inventory is down to 351mmb. The Biden Administration started pulling oil out of the SPR in large quantities following the oil price spike on the heels of Russia invading Ukraine in March 2022. This was done in an effort to reduce what Americans were paying at the pump as the national average hit $5/gallon (per AAA).

Today, the price pressures from Russia/Ukraine have abated to some degree, yet, the SPR remains at levels not seen since they started filling it up in the first place. So where can oil go next? From the perspective of a price floor, a good place to consider starting is the White House’s stated intention to begin replenishing the SPR at $79/bbl or less. We use the term “floor” loosely, however, because WTI Crude ended the month of November priced at $76/bbl and the White House is not required to purchase at $79/bbl.

It’s not too late to take action.

The end of the year is a joyous time, marked by family reunions, plate-laden feasts and the exchanging of gifts. It’s also an important time to review your tax planning strategy to ensure that you are on track to meet deadlines, maximize deductions and minimize payments. With all of the hustle that surrounds the season, however, last minute tax planning can add stress to this hectic time.

If you’ve delayed tax planning until now, don’t despair—there are still some strategies that you can put into practice. Brian Pugliese of accounting and advisory firm, GMS Surgent, a Hightower affiliate, has some tips.

Tip: Maximize your match.

Many companies offer a 401(k) matching program and although it may seem obvious, Pugliese says, “It’s a big one that gets missed a lot.” Likening the employer match program to “free money,” this tax-deferred income is paid by the employer directly into your account. To the extent that you can, maximizing your 401(k) contributions is one of the simplest, smartest moves you can make. Employees can put up to $22.5k into 401(k)s on an annual basis before year-end.

Tip: Make the most of Flexible Spending Accounts (FSA) and Health Savings Accounts (HSA).

FSAs and HSAs allow you to set aside pre-tax dollars for specific expenses. “There are different ways of doing this,” Pugliese says, “but these tax free accounts allow you to reserve funds for upcoming expenses such as contact lenses, orthodontist bills and other medical purposes.” Check with your employer and insurance company to confirm eligibility and make sure you reserve money by the deadline.

Tip: Consider tax loss harvesting strategies.

Year-end is an ideal time to consider tax loss harvesting strategies to offset gains in your portfolio. This strategy involves selling an investment at a loss and purchasing a similar investment to reduce tax liability without changing the overall focus of your portfolio. Pugliese likens this to selling shares of Coca-Cola at a loss and then investing in Pepsi. “Tax loss harvesting can be a good response to changing market conditions, but do not attempt to time the market—it’s a dangerous practice” he says, adding, “It’s important to integrate your financial advisor when considering such investment strategies.”

Tip: Stay abreast of upcoming tax legislation.

Congress regularly passes legislation that may impact your tax strategy. Though Pugliese says “no major changes appear to be on the immediate horizon,” there are potential updates to be aware of as you consider your long-term personal and business planning approaches. As one example, he references the Tax Cuts and Jobs Act, which is set to sunset after 2025. “The current estate or gift exclusion is almost $13m per person, and that number is projected to be cut almost in half if this act expires without intervening legislation.” High net worth taxpayers with estates in excess of $13m should seriously consider gifting or incorporating the use of trusts now to prepare for what could be a significant tax increase in 2026.

Tip: Consider how you give to philanthropies.

The holiday season puts many in giving moods. Lean into that generosity, but be savvy about how you do so. When making larger donations, for example, Pugliese suggests considering stock donations instead of cash. When making a $5k cash donation, you receive a deduction of an equal amount. If, however, you donate stock valued at $5k and if, for example, the purchase price on the stock was $1k, “two good things happen”:

- You receive a $5k deduction.

- You avoid gains that would have been incurred if you sold the stock for $5k and paid tax on $4k.

Another strategy Pugliese recommends is for those over 70 ½ who are taking IRA distributions. This group can make donations through qualified charitable distributions (QCDs). These non-taxable donations are made directly from the IRA, while counting toward the minimum distribution requirement. This is especially beneficial to taxpayers who do not itemize their deductions but claim the standard deduction.

Tip: This holiday season, give the gift of education.

Aligning holiday gifting with estate reduction strategies is common practice. Many, however, are not aware that the $17k gift tax exclusion limit is not applicable to payments made directly to an educational institution or towards medical bills. “That means,” according to Pugliese that “grandparents or parents can pay tuition directly to any school, as well as pay medical bills, and it does not count towards the $17k annual gift exemption.” Therefore, high net worth clients seeking to reduce the value of their estates should consider giving the gift of education this holiday season by making direct tuition payments.

Tip: Make 529 plan contributions before year-end.

This is yet another strategy for parents or grandparents to build savings for future generations, while achieving tax benefits as many states offer deductions for 529 plan contributions. Pugliese says, “This is an example of a step that may not result in a lot of savings, but it’s the little increments that add up over time that help.” 529 plan contributions can be made at any time for future education payments for schools that go through grades K-12 as well as for secondary schooling.

Tip: Integrate your team of advisors.

When it comes to successfully coordinating your tax strategy with your holistic financial plan, communication is key. Maintain an open line between your tax and wealth advisors—and, not just in April. This coordination is critical for alignment on any changes that impact your overall financial strategy. Pugliese recommends a cadence of quarterly and, depending on the circumstances, even monthly.

Tip: Set your New Year’s resolution.

In a perfect world, Pugliese recommends beginning to think about your tax planning strategy as early as spring or summer. Practically, however, tax planning ideally happens before Thanksgiving, since the holidays are a busy time of year. But, if you did wait until the last two weeks of the year, make the moves that are available to you now and get the New Year started off right with a resolution to start earlier in the coming year.

Overwhelmed?

If these tax planning opportunities have you overwhelmed, you are not alone. Take the steps you can and remember that incremental changes can add up to make an impact.

Have questions? Our advisors are here to assist you. Contact us here.