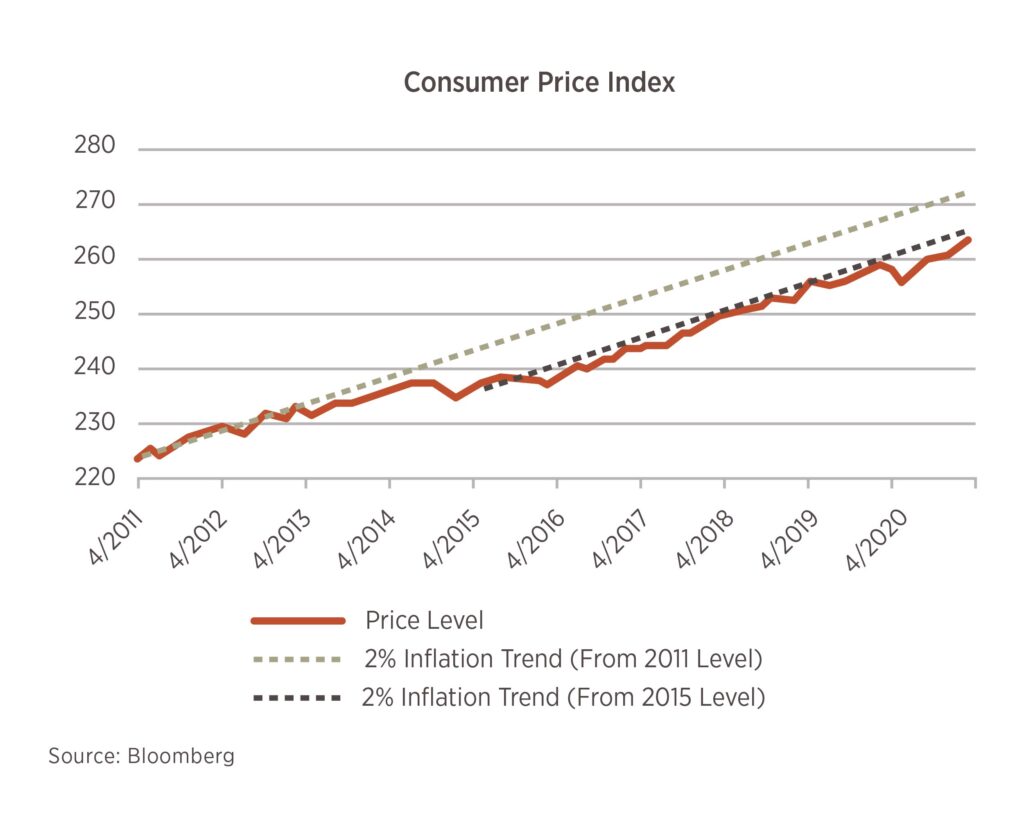

Chart of the Month

Recent headlines, or trips to the gas pump, might lead one to believe that inflation is running rampant. However, the data show that a good portion of recent price increases are the result of a recovery from last year’s depressed levels. As this month’s chart shows, price levels as measured by the consumer price index have not yet recovered to the trend of 2% annual inflation that had been in place since 2015. While prices are likely to continue rising in the coming months as economic activity fully resumes and supply disruptions from the pandemic are worked out, the current level does not justify fears of a sustained push higher in inflation.

Advisor Q&A- Bryan Green, Partner

The Future of Capital Gains Tax Rates

The debate on capital gains tax rates has started again in Washington D.C. It’s critical to remember that any capital gains tax proposal will likely face a long, uphill battle before becoming law. One prominent investment bank already has said it projects a more modest increase in the rate, which may land at around 28%.1 During this time, our clients have been asking how they can prepare. Bryan Green, Partner, answers the most common questions advisors have been hearing from clients.

If I am currently in retirement, how can I prepare for a possible increase to the capital gains tax rate?

Retirement accts would not be subject to the proposed capital gains tax increase, however, a retiree who has taxable (non-IRA ) investment account would be subject to a higher capital gains tax if they have taxable income of $1mm+.

Who will be most affected by a tax rate change?

The most affected will be investors who have more than $1mm in income in a given year and who sell long-term (held more than 1 year) investments in a taxable account. This would include publicly traded securities as well as privately owned companies. Instead of paying the current federal long-term capital gains tax rate of 20%2, investors would be paying a possibly higher rate in the near future.

Could this possible tax rate change affect my overall portfolio allocation?

Based on your goals and timeframe it could have an impact on your allocation in taxable accounts. Due to the difference in how ETFs (exchange-traded-funds) are taxed, it may be more tax-efficient to invest a greater part of the overall allocation in ETFs, as opposed to managed portfolios or mutual funds.

Is it best to act now or wait for new laws to pass?

Portfolio allocation decisions should be made based on multiple criteria such as risk tolerance, timeframe for the investment and need for income or growth. At this point, it is uncertain what type of legislation will be taken up by Congress. Although it is difficult to be patient during a time of uncertainty, it would be best to consult your financial or tax advisor before selling any investment for the sole reason of a possible tax law change.

1. Markets.BusinessInsider.com, April 23, 2021

2. The most common federal tax rates (exclusive of the Medicare Contribution Tax on net investment income) are 20% for net long-term capital gains and qualified dividends.