Chart of the Month

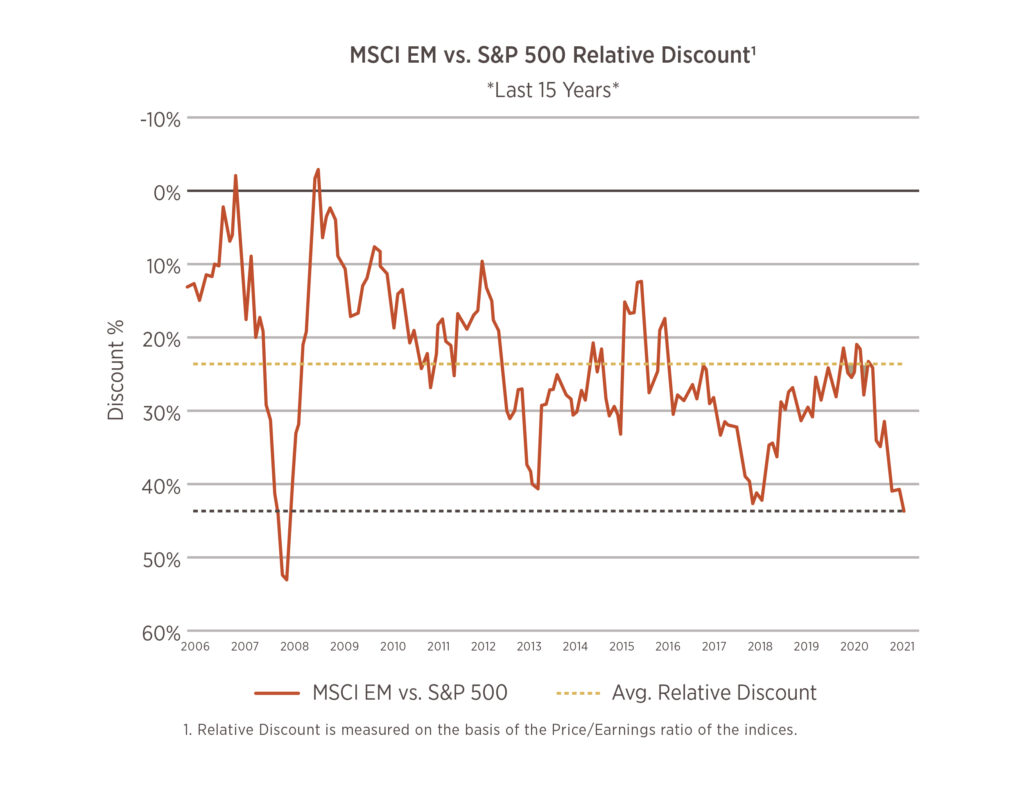

The underperformance of emerging market equities vs. the United States has continued in 2021. This continues a 10-year underperformance that is causing investors to question the wisdom of investing anywhere other than the U.S. Over the last decade, the S&P 500 has generated an annualized return of 16.2% while the MSCI Emerging Market Index has returned 5.3%. For an investor, this means the difference between having $1 grow to $4.48 vs. $1 growing to $1.67.

As detailed in the chart, this underperformance has created a large gap in valuation multiples. Over the past 15 years, the average relative discount of EM to the S&P 500 is 24%, but currently, it is 44%, the largest discount since the Great Financial Crisis. Despite what seems to be the never-ending Covid variant headlines, vaccination rates in the countries making up the EM Index continue to improve and many of the countries (ex-China) have moved away from their zero-tolerance approach as a result. This, along with continued clarity around new regulations in China (who accounts for 1/3 of the EM Index and has vastly underperformed in 2021), should be supportive of EM going forward.

Advisor Survey

6 Meridian

2021 Recap from the CEO

After facing the challenges brought on in 2020, we eagerly turned the page into a new year with great hope for our lives to return to normal. Well, not quite. In times when so much seems out of our control, we turn our focus to that which we can control and the team at 6 Meridian did indeed spend our energy moving a number of initiatives forward in 2021.

The investment team continued to bring outstanding research and solutions to our clients. On the heels of our very successful launch of the 6 Meridian ETFs in 2020, in May of 2021 we launched another, our Quality Growth ETF, (SXQG) offering clients another innovative and tax efficient investment solution.

One of our biggest initiatives for the year was focused around Compass, the dynamic wealth planning tool that includes sophisticated resources customized to your family’s situation. Our advisor team used this resource to dive deeply into our clients’ financial lives, managing both their wealth and well-being.

After a long hiatus from in office work, our team fully returned to the office on June 1, 2021. We have, in an effort to preserve the best of both worlds continued to give our team the ability to have flexibility in their work logistics. A priority of 6 Meridian has always been to support work/life balance and the ability to continue to work at home at times is an added benefit to many.

Although we can’t declare the world back to ‘normal’, we have seen progress on many levels. Grandparents are able to hug their grandchildren again. Families are reunited around the holiday dinner table. At 6 Meridian, we were able to join together again and meet with clients in person. Many things we had taken for granted are now cherished.

None of what we do could be accomplished without the support and loyalty of our clients. It is absolutely our pleasure and privilege to work with you. On behalf of the team at 6 Meridian, we wish you a blessed and joyful holiday season!