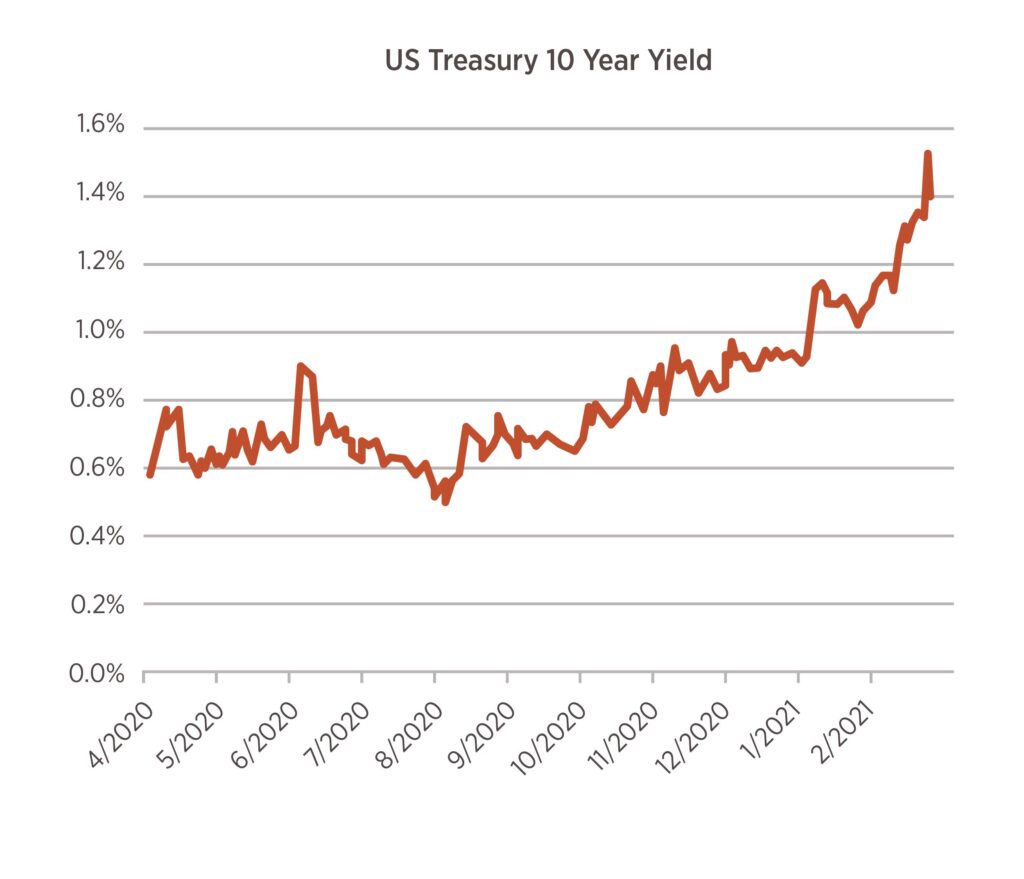

Chart of the Month

In the past month the yield on the 10-year US Treasury note rose from 1.07% to 1.41%. This sharp climb continues the trend of rising rates that began in late 2020. The yield has now reached the same level as last February before the COVID-19 pandemic had heavily affected the US. Higher rates generally reflect expectations for higher growth as well as potential inflation as vaccines are distributed and activity picks up.

Prices of stocks and commodities have also risen, largely due to these same expectations for improved growth. However, rising rates do pose a potential risk – if borrowing costs rise too quickly, they could work to slow economic growth, which would likely be bad news for stock prices as well.

Saving Your Elderly Parents from Financial Fraud

According to AARP*, the FTC saw an astonishing 2,920 percent annual hike in the number of identity theft cases in which victims said their information was used to apply for or receive government benefits, such as unemployment compensation. The disturbing trend likely stems from the trillions of federal dollars unleashed in COVID-19 relief.

In addition to these increases associated with the pandemic, there are other ways the elderly in particular are being affected by fraud. These include elder abuse by friends, family and caretakers and phone and email scams that use threatening emotional tactics.

What can you do to help avoid these situations?

First, start the conversation. Part of this conversation will be about the elder in your life taking you on as a sort of second line of defense, someone to help them watch over things. They may be resistant, at first, but advise them that this is a precaution not necessarily for today, but for a time when they may not be able to make decisions. From there, have a conversation about setting up powers of attorney and other legacy paperwork (will, living will, health care directives) in coordination with legal and financial professionals.

Maintain good communication with outside professionals – not just the aforementioned legal and financial professionals, but caregivers, health care professionals, and anyone else who works with them on a regular basis. Maintaining these conversations with seniors and the people who work with them, asking questions, and being present can go a long way to deterring financial fraud.

For more information on this topic, click here for the full article or contact your financial advisor.

* Katherine Skiba, AARP, “Pandemic Proves to Be Fertile Ground for Identity Thieves”, February 5, 2021, https://www.aarp.org/money/scams-fraud/info-2021/ftc-fraud-report-identity-theft-pandemic.html