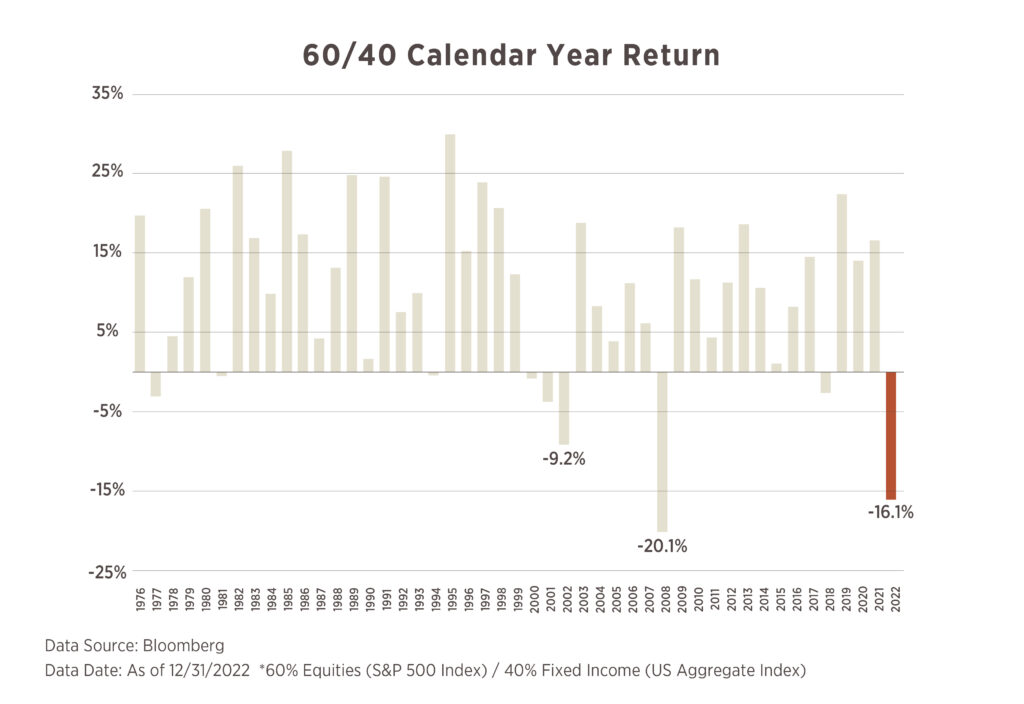

Chart of the Month

The markets had a lot to digest in 2022, making you wonder how this period will be taught in retrospect 20-30 years from now. Will it be remembered the most for the bond market’s record-breaking poor performance? That the inflationary environment was predicated by record-breaking fiscal and monetary stimulus? That the Federal Reserve undertook the fastest tightening cycle in its history? Will it mark the beginning of the end of the globalization movement? Check back with us in 20-30 years to find out!

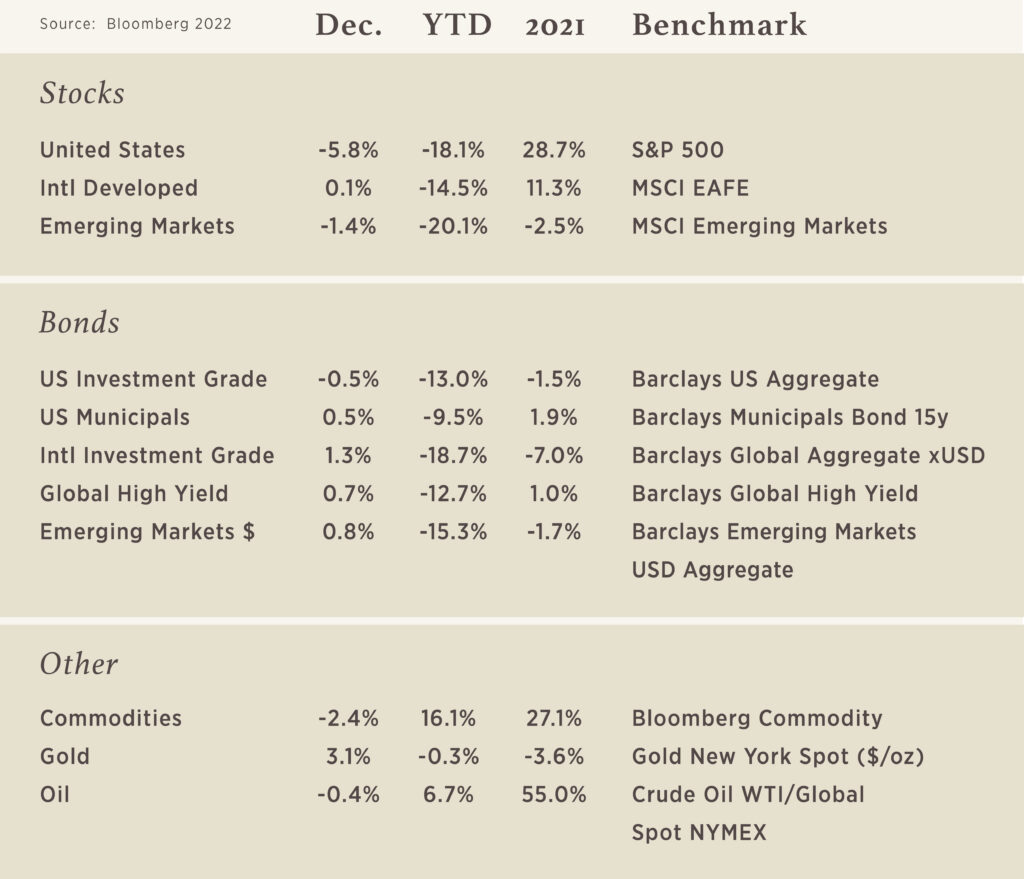

Nevertheless, 2022 was memorable. As the chart shows, investing in a traditional 60/40 portfolio would have made any diversified investor cringe. Equities (-18.1%) were not down as much as they were in 2008; the record poor performance from US bonds (-13%) resulted in the 60/40 portfolio being down a similar amount as in 2008. While it is rare to have consecutive years of negative performance for a diversified investor, it did occur in the early 2000s, a period known for having a significantly overvalued market. As we recently detailed in our Market Insights, we may not be out of the woods yet as the odds of a recession increase, and the market has yet to reflect such an event appropriately.

Bad Money Habits to Break in the New Year

Five behaviors worth changing.

Do bad money habits constrain your financial progress? Many people fall into the same financial behavior patterns year after year. If you sometimes succumb to these financial tendencies, now is as good a time as any to alter your behavior.

#1: Living without a budget.

You may earn enough money that you don’t feel you need to budget. “No matter your financial status, not knowing how much you spend and where it all goes is the most fundamental bad habit, and we are all probably guilty of it to a point,” says Wealth Advisor Tim Rozzell. In calculating a budget, you may find opportunities for savings and detect wasteful spending. Margaret Dechant, CEO, agrees, “Most would be shocked at where the money goes if they tracked spending. Even for those who have ‘enough,’ it is still an enlightening exercise.”

#2: Emotional investing.

During market volatility, it’s common for investors to become nervous, and without a solid financial plan, many make investment decisions based on fear rather than sound advice. Wealth Advisor, Bryan Green, suggests, “Some investors too often think of a portfolio as a whole. They should instead think of it in different ‘buckets,’ i.e., short-term, medium-term, and long-term buckets. Reviewing each ‘bucket’ based on purpose can reduce anxiety during down markets.” Dechant adds, “Build a long-term plan with your advisor based on facts, not emotions.” Wealth Advisor, Sarah Hampton, recommends having an appropriate perspective of acceptable risk and reward when reviewing investment opportunities. Visit 6meridian.com/compass to learn more about our interactive financial planning tool that encompasses your entire financial picture.

#3: Saving too little too late.

Good savers build emergency funds, have money to invest and compound, and leave the stress of living paycheck to paycheck behind. Wealth Advisor, Tim Lynch, shares, “The importance of saving, even if incremental, and the understanding of compound interest is key to creating a lasting savings fund. A local business owner shared with me that his former employees are retiring with $5M+ in their 401Ks after 30+ years of service because he encouraged them to save and educated them on the benefits of a company match. His employees were paid competitive salaries, but these results show the long-term benefits of following a process and staying committed.”

Calvin Pearson, Wealth Advisor, adds, “Saving does not always require a goal of purchasing something. Savings that aren’t attached to a spending goal gives you options and flexibility, like the ability to take advantage of market opportunities or having the freedom to live your life on your terms.”

#4: Inadequate financial literacy.

Is the financial world boring? To many people, it can seem that way. The Wall Street Journal is not exactly Rolling Stone, and The Economist is hardly light reading. You don’t have to start there, however. There are excellent, readable, and entertaining websites with valuable financial information. Visit the Resources section of our website for timely financial planning articles with clear takeaways. Reading articles daily from reputable resources could help you significantly increase your financial understanding.

#5: DIY retirement strategy.

Those who save for retirement without the help of professionals may leave themselves open to abrupt, emotional investing mistakes and other oversights. Another common tendency is to underestimate the amount of money needed for the future vastly. Sarah Hampton, Wealth Advisor, cautions, “Having an appropriate perspective of acceptable risk/reward when reviewing investment opportunities is often overlooked. Many fall into the trap of investing in opportunities that don’t fit into their long-term planning.” Few people have the time to amass the knowledge and skill set possessed by a financial services professional with years of experience. Instead of flirting with trial and error, see a professional for insight.