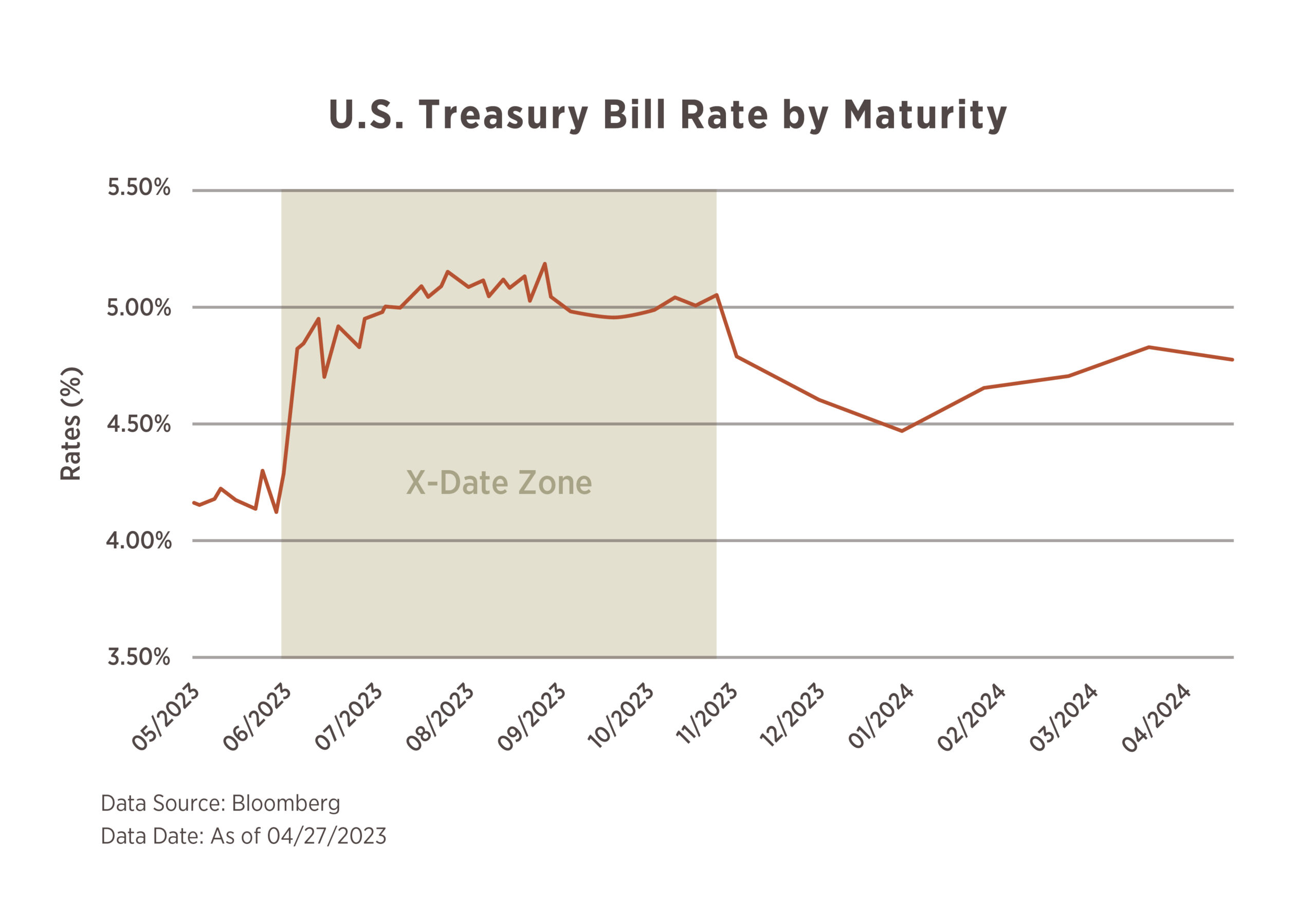

Chart of the Month

At some point in our lives, we all probably imagined going on a treasure hunt where “X” marked the spot of the chest of gold coins. The “X” we highlight in this chart is no treasure but instead refers to a date, the one in which the US could breach the debt ceiling and be incapable of paying some of the Government’s bills. This chart highlights the expected zone in which the “X-Date” is anticipated to occur, and it is noticeable to see the dramatic change in Treasury Bill rates as that timeframe approaches.

This has created an anomaly where T-Bills maturing prior to the expected “X-Date” are seeing outsized demand, driving prices up and pushing rates lower relative to later maturing T-Bills within the highlighted zone.

While our politicians begin to battle things out in regards to raising the debt ceiling and/or trimming expenses in order to avoid the consequences of default, the Treasury Department is probably wishing they could stumble across the other “X”, the one that marks buried treasure, saving all of us from needing to hear bickering back and forth across the political aisle.

Being a parent means being responsible to a degree you never have been before. That elevated responsibility also impacts your financial decisions. You are now a provider and a protector, and that reality may make the following financial moves necessary.

Think about a budget.

As a couple, you may have lived for years without budgeting. As parents, this may change. You will face new recurring costs: clothes, toys, diapers, food. Keeping track of weekly or monthly expenses will be handy. (The Department of Agriculture has an online calculator where you can estimate the total cost of raising a child to adulthood. The math may surprise you: the U.S.D.A. puts the average cost at $233,610 for a middle-income family.)¹˒²

Take care of health and life insurance.

Your child should be added to your health insurance plan quickly. Most insurance providers require you to notify them of a child’s birth within 30 days. You can get started before then; be aware that a Social Security number and birth certificate can take weeks to arrive in the mail. If you are in a group health plan, talk with the human resources officer or benefits administrator at work, and let them know that you want to add a dependent to your health care plan. (If you have coverage through a private plan, your premiums may go up after you notify the carrier.) Under the Affordable Care Act, a parent or legal guardian who has health coverage arranged through the federal or state Marketplace has 60 days from the date of birth or adoption to enroll a child as a dependent on their plan; once that is done, health care coverage for the child will apply, retroactively.³

Term life insurance provides an affordable way for new parents to have some financial insulation against a worst-case scenario, and disability insurance (which may be available where you work) provides coverage in the event of an extended illness or injury that stops you from doing your job. If you have a Health Savings Account (HSA), you can contribute more per year when you have a child. The maximum annual contribution for a family is currently set at $7,300.

Draft a will and review beneficiary designations.

A will can do more than declare who receives your assets when you die. It can also name a legal guardian for your child in the event both parents pass away. Additionally, you can specify a guardian of your estate in your will, to manage the assets left to a minor child. While you may have named your spouse or partner as the primary beneficiary of your IRA or investment account, you may decide to change that or at least add your child as a contingent beneficiary.⁵

Save a little for college.

The estimated cost of four years at a public university starting in 2036? $184,000, CNBC reports. That may convince you to open a 529 plan or have some other kind of dedicated college savings account with investment options. Most 529 plans require a Social Security number for a beneficiary, so they are commonly started after a child is born, rather than before.²˒⁶

Review your withholding status and tax forms.

An addition to your family means changes. You may also become eligible for some federal tax breaks, like the Earned Income Tax Credit, the Adoption Tax Credit, the Child Tax Credit, and the Child & Dependent Care Credit.⁷

After reading all this, you may feel like you need to be a millionaire to raise a child. The fact is, most parents are not millionaires, and they manage. Whether you are wealthy or not, you will want to take care of many or all of these financial and insurance essentials before or after you bring your newborn home.

Citations:

1 – cnpp.usda.gov/tools/CRC_Calculator/default.aspx [9/20/18] 2 – tinyurl.com/y8rlmm7w [2/26/18] 3 – healthcare.com/info/health-insurance/baby-health-insurance-newborn [10/18/17] 5 – everplans.com/articles/what-does-a-guardian-of-the-estate-do [9/20/18] 6 – cnbc.com/2018/05/07/this-is-how-much-parents-need-to-save-to-cover-college-bills-in-2036.html [5/7/18] 7 – efile.com/tax-deductions-credits-for-parents-with-children-dependents/ [9/20/18]