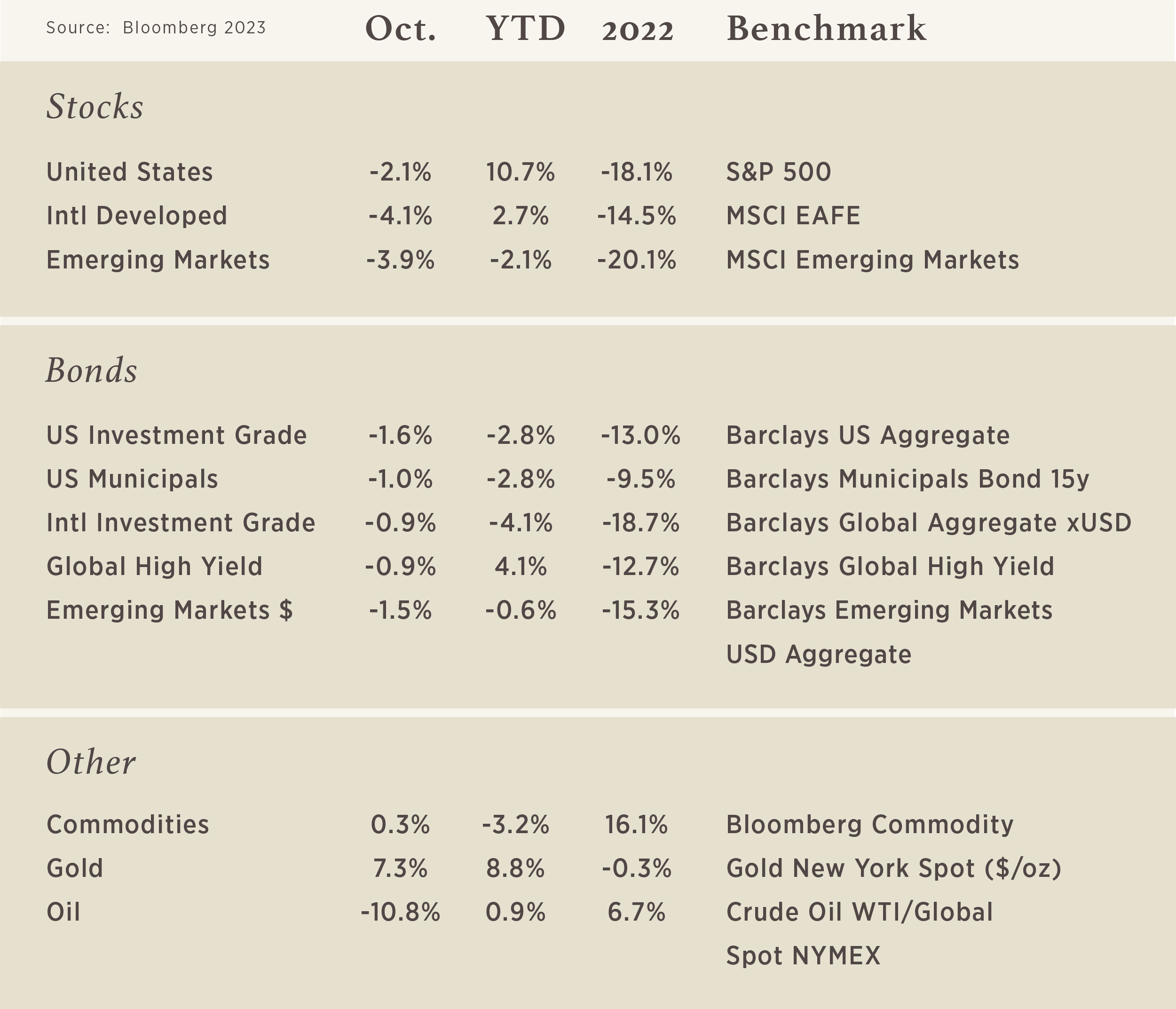

Chart of the Month

Bonds, boring bonds.

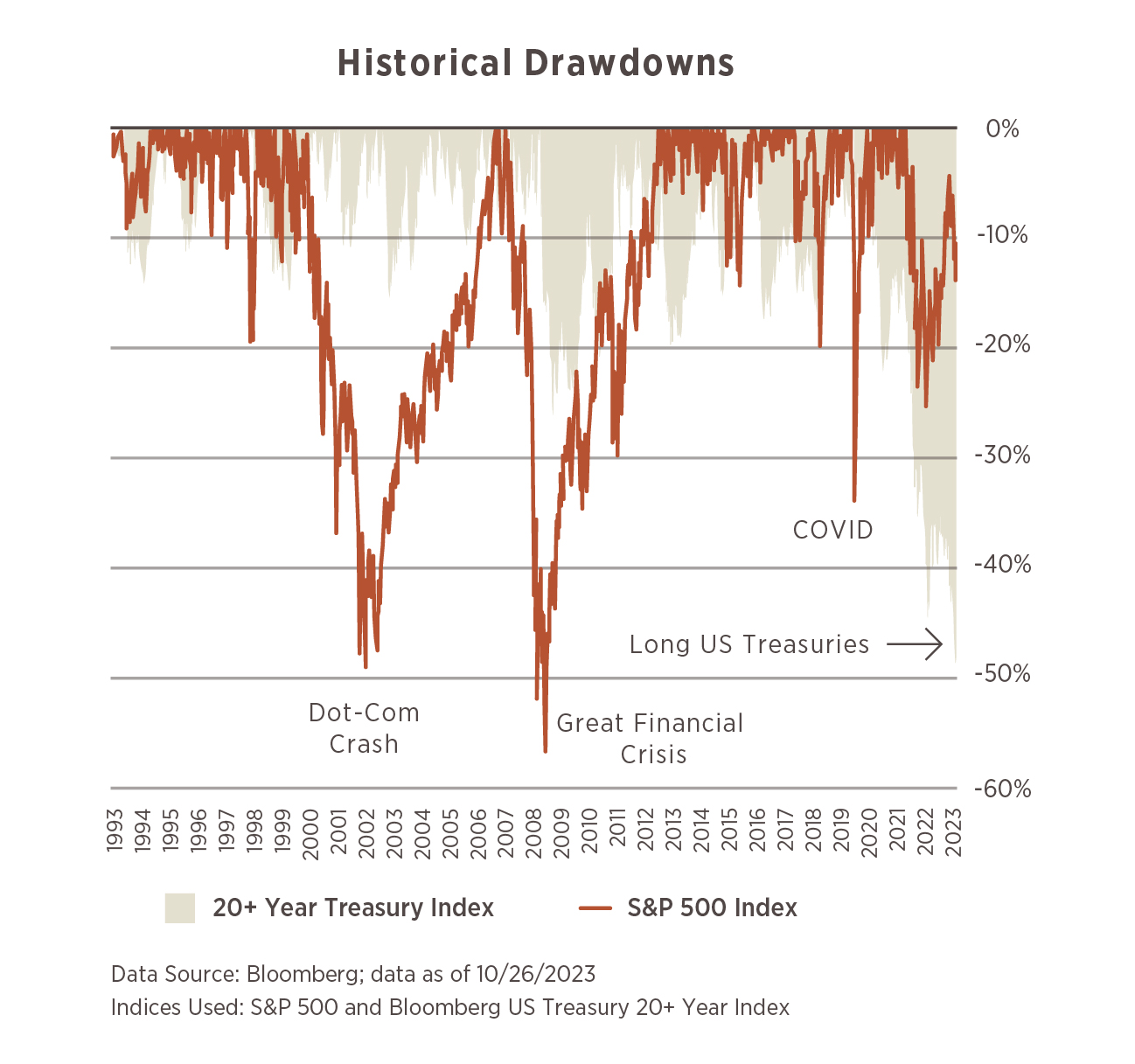

Well, they are not so boring anymore! What if we told you that the value lost in a risk-free asset was just as bad as some of the major drops in equities in history? We’re talking the Dot-Com Burst, Great Financial Crisis, and COVID, would you believe us? Probably not! But the truth of the matter is that is exactly what has occurred for long US Treasury bonds over the past ~3.5 years! These are debt obligations backed fully by the US Government, they are labeled as “risk-free” because the US has never defaulted on its debt, it simply just prints more money. So how in the world are these down ~50% since March 2020 if there is no risk?

Bond values are just math, the price is determined by the present value of future cash flows (we’ll spare you the formulas!). In this case, during March 2020 a 30-year US Treasury had a rate of 1%. Debt issued at that time was making the promise to pay 1% in income distributions (known as coupons) each year. Today, a 30-year US Treasury has a rate of 5%, meaning, the US Government is promising to pay 5% in coupons each year! Because of the math, and fact that US Treasuries are very liquid (they trade a lot and often), if you wanted to buy the 30-year bond issued in March 2020 you would need to be compensated to the point where you can earn today’s rate (5%). The only way to get that compensation is to price the bond at a discount to its par value because the coupon component will never change, it will still be 1% per year.

All this is to say that if you bought a long US Treasury in March 2020 and were looking to sell it today, the buyer would require a very steep discount to compensate for the fact he/she is only going to receive 1% annual income distributions when the going rate is 5%. The increase in the current market rate from 1% to 5% has been a result of monetary policy to fight inflation and a growing supply and demand imbalance from the US Government running large deficits while buyers of Treasuries take a step back.

“What do I need to do now?” That is a question you might ask yourself after the death of a loved one, and for good reason. There are often a lot of issues to consider and steps to take.

The following list may help you and/or others during this difficult and stressful time. Not all of the points will apply in all cases, but many may.

Download the full checklist here.

Requirements

In order to gain access to a deceased safe deposit box, you will need to present a death certificate and an executor’s letters testamentary. These forms are required to prove legal rights to the box. Also, be prepared to provide a copy of the rental agreement and photo identification. An employee of the facility will then take the necessary steps to grant you access to the box.

Spousal Rule

If the spouse of the deceased is alive, he or she may visit the facility and get unrestricted access to the box, provided he or she is able to present a death certificate. A marriage certificate may also be required. In states that recognize common-law marriage, proof that the relationship was valid during the entire time that the state recognized common-law marriage may suffice for access.

Important Considerations

Check with the state’s unclaimed property office to ensure proper compliance with all rules and regulations. Some states allow box renters to designate specific people who may access the box and its contents in the event of their death.

States without safe deposit laws generally rely on the facilities’ rental contracts to cover the specifics of what happens to boxes and their contents when renters die. Simply having a power of attorney will not be enough to designate and earn access to a safe deposit box.

Planning Ahead

To avoid any issues with access to the safe deposit box after a loved one dies, make sure he or she has information about where the safe deposit box is located, how to access it, and who can access it in a will. Without this information, ensuring the items in the box get to where they should be may present a hassle for the family members. If there is no will, make sure another trusted individual has the appropriate information to access the box in the event of death. The easiest way to handle accessing a deceased person’s safe deposit box is to ensure the appropriate information is available to the beneficiary.

Have questions? Our advisors are here to assist you through this time. Contact us here.