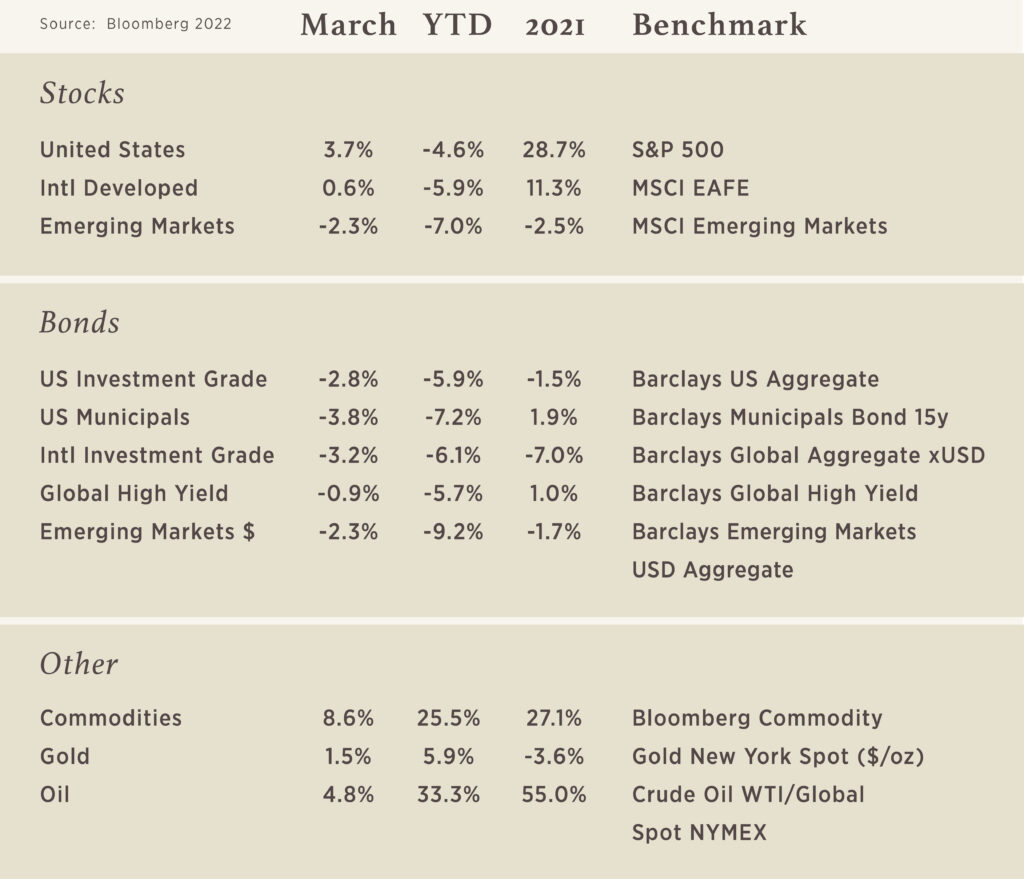

Chart of the Month

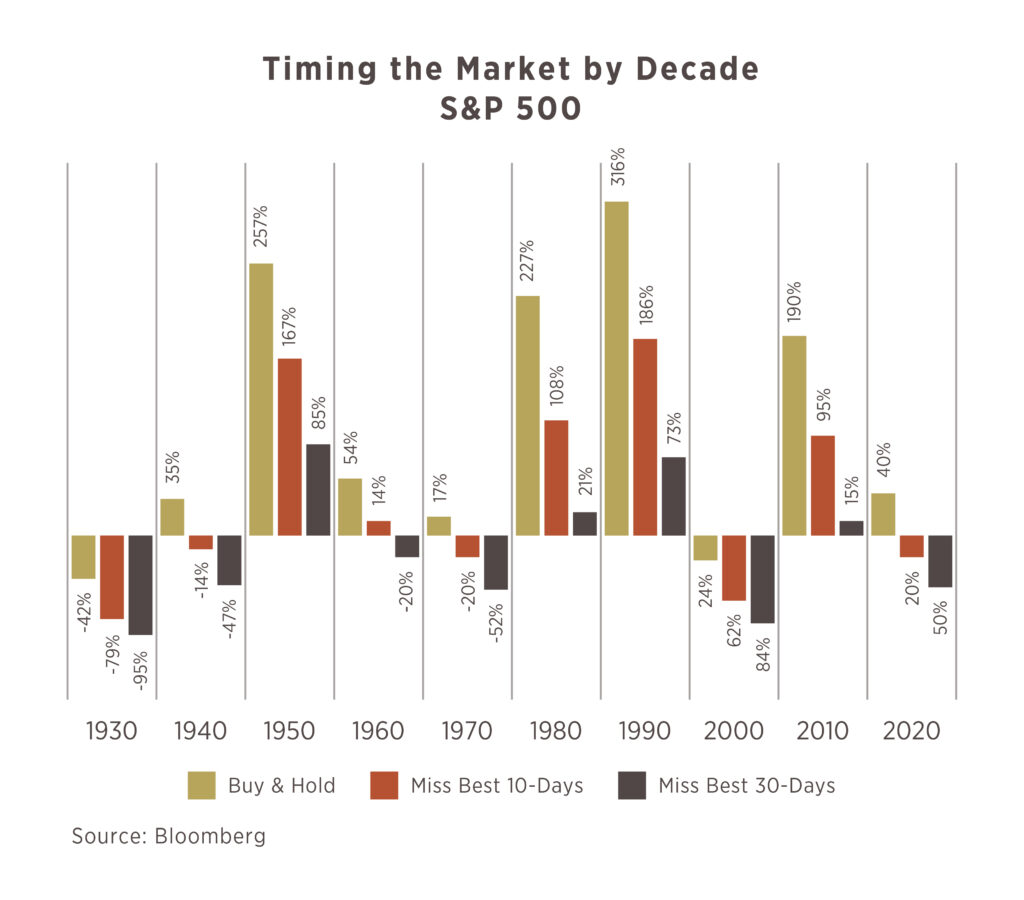

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Peter Lynch

Periods of market turmoil often result in near-sightedness, something we touched on in last month’s Viewpoint as we suggested taking a step back to view things with a wider lens. A multitude of events can rattle markets in the near-term – we have seen it happen the past 3-months – yet, despite the anxiety the fluctuations may present, we want to support investors in making rational decisions. A crystal ball does not exist and as such, attempting to time exiting at the highs and buying at the lows is an irrational move. Sure, if we could go back in time and place it would be easy, but such technology does not yet exist! The chart shows how an investor would have fared if they had missed the best 10- or 30-days in a particular decade – and to put that into even greater perspective – there are roughly 250 trading days a year making 10-days the equivalent of 0.40% and 30-days 1.20% of all trading opportunities in a given decade. In short, missing even the 10-best days leads to very low returns relative to the simple tactic of holding steady.

Emergence of ESG Investing

How generational and societal change is influencing companies and the markets.

ESG: what does that acronym stand for? Those three letters stand for “Environmental, Social, and Governance” and signify an investment that has

particular merit to investors of all ages. A recent Morgan Stanley Bank survey found that almost 90% of millennials would prefer to have investments that suit their values. With young adults, ESG investing could become more and more of an element in investing strategies. 1 You may recall how the phrase “socially responsible investing” became part of the stock market vocabulary a generation ago. Socially responsible investing (SRI) was often about not investing in certain companies – businesses whose products or services seemed distasteful to this or that investor. ESG investing focuses more on corporate behavior. Is a corporation managing natural resources sustainably? Does it treat workers well? Is its culture inclusive and diverse?

Corporate values count, perhaps now more than ever. Today, you have companies pledging to commit to environmentally sustainable practices and leadership initiatives designed to include women and members of minority groups in the C-Suite.

Some corporations now include ESG metrics in financial and annual reports. This is more than a nod to investors; it represents a trend in corporate communication and behavior. One notable ESG metric is CEO pay. Some S&P 500 firms have received bad publicity over the last decade for the degree of executive compensation their leaders receive, and investors are watching.

Philosophically, ESG investing asks two questions. An ESG investing proponent’s answers may difer significantly from those of an investor uncom-

pelled by the ESG approach. One, should social responsibility matter more than a company’s financials when you are considering an investment? Two, can positive environmental and social news about a corporation influence its stock’s value more than its earnings and guidance?

If you want to explore the world of ESG investing, consult your financial professional for insight and information that can help you identify your choices.