Chart of the Month

Source: Bloomberg. Developed (Non-U.S.) = MSCI World Ex-U.S. Index; Emerging = MSCI EM Index; USA = Russell 3000 Index.

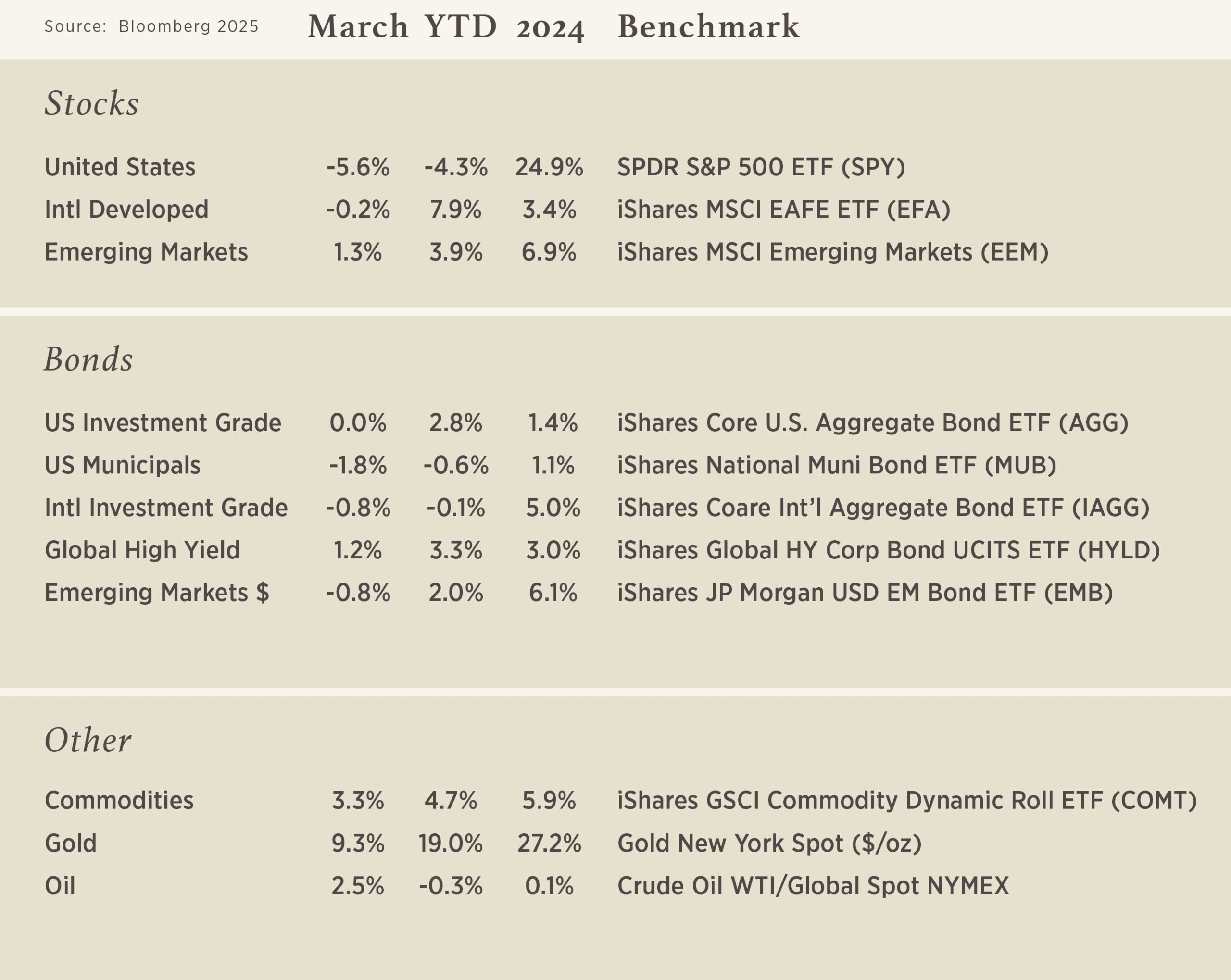

Date: As of 03/31/2025

Weather changes, time changes, spring break, allergies, and occasionally Easter find their way into our already busy schedule and daily lives during the month of March, making it literally a month of madness (the basketball tournament included!). As our local City of Wichita recently played host to the early rounds of the 2025 NCAA Basketball Tournament, we thought it fitting to illustrate in this month’s chart what has felt a bit like a Cinderella story to start the year!

It is no secret that if we had created an “asset class” bracket, that the #1 seed would have been U.S. Equities. Using the broadest measure available for the U.S., the Russell 3000 Index, it has annualized performance of +10% over the last 30 years (March 1995 – March 2025). Further down the rankings you would find Developed Non-U.S. and Emerging Market equities – both of which delivered +6%/yr. over the same time frame. If you’ve been investing that long, those are all good returns, but it required that you never touched it, even amidst the chaos!

In the first 3 months of 2025, Developed (Non-U.S.) and Emerging Market equities have trounced the U.S.. Where we really want to focus in on in this graphic is the disparity between Developed (Non-U.S.) and the U.S. To understand how big of an upset this is, we ranked 3-month returns for the past 30-years, and the current outperformance of Developed (Non-U.S.) over U.S. of +11.1% is the 2nd best in the time frame!

Given the brevity of this monthly view, it is challenging to delve too deep into the reasons driving this gap, but at a high level, it boils down to these items: (1) Valuation disparity between the geographies; U.S. = Expensive; Non-U.S. = Less Expensive, (2) Uncertainty on global/domestic policy; tariffs; Ukraine/Russia, and (3) that uncertainty prompting European Governments (Germany is at the forefront) to open up their fiscal coffers.

As we often articulate, we do not know where markets will be 3 months, 12 months, or even 3 years from now. Making attempts to time entry and exit points tends to be counterproductive to achieving one’s ultimate wealth building goals. We do continue to advocate for diversification in portfolios, and, as the last 3 months have shown, having diversification across geographies can make for a smoother ride in meeting one’s wealth objectives.

What to Do After Identity Theft Occurs

Identity theft can be a distressing and overwhelming experience, leaving individuals feeling vulnerable and uncertain about how to protect themselves. When personal information is stolen, it is crucial to take immediate and effective actions to mitigate the damage and safeguard your financial and personal data. The following steps provide a comprehensive guide on what to do after identity theft occurs, helping you navigate the process of securing your accounts, monitoring your credit, and preventing further unauthorized access. By following these steps, you can take control of the situation and protect yourself from the potential fallout of identity theft.

Steps to Take to Protect Yourself

- File a police report.

2. Notify banks/credit card companies/custodian.

3. Add a freeze and/or alert with the Credit agencies. For alerts, you only need to do this for one agency, and you’ll be covered by all three.

- Equifax: call 1-888-378-4329 or visit https://www.equifax.com/personal/credit-report-services/credit-freeze/

- Experian: call 1-888-391-3742 or visit https://www.experian.com/help/credit-freeze/

- TransUnion: call 1-800-916-8800 or visit https://www.transunion.com/credit-freeze?atvy=%7B%22258139%22%3A%22Experience+A%22%7D

4. Change your username and passwords (social media, email, banks, custodians, etc.).

- Remember to also set up two-factor identification, if applicable.

5. If you have clicked on a website that is malicious, the scammers may gain your future keystrokes for the next few sites which will include all your accounts and new passwords – make sure to delete all browsing history.

6. Contact phone provider to secure your phone number (set up two-factor ID).

7. Remove personal information on social media/email and check your privacy settings.

8. Consider a credit monitoring/protection service such as Lifelock or AllClear.

9. Add alerts to your credit cards/bank checking accounts so that you will receive notification if there are any changes to your accounts and/or new activity.

10. Add two-factor ID to your bank accounts, streaming services, student loan servicer accounts, etc.

Where to Report Identity Theft

- To report identity theft, please visit the Federal Trade Commission’s Identity Theft portal at https://www.identitytheft.gov/

Best Practices

- Remember to sign out of each website once you are done browsing and turn off your computer.

- Don’t click on unsolicited email attachments or a legitimate-looking download.

- Let unknown callers go to voicemail.

- Use strong passwords.

- Avoid using unsecure Wi-Fi networks in public places.

- When in doubt about a link, email etc., call your advisor.