Chart of the Month

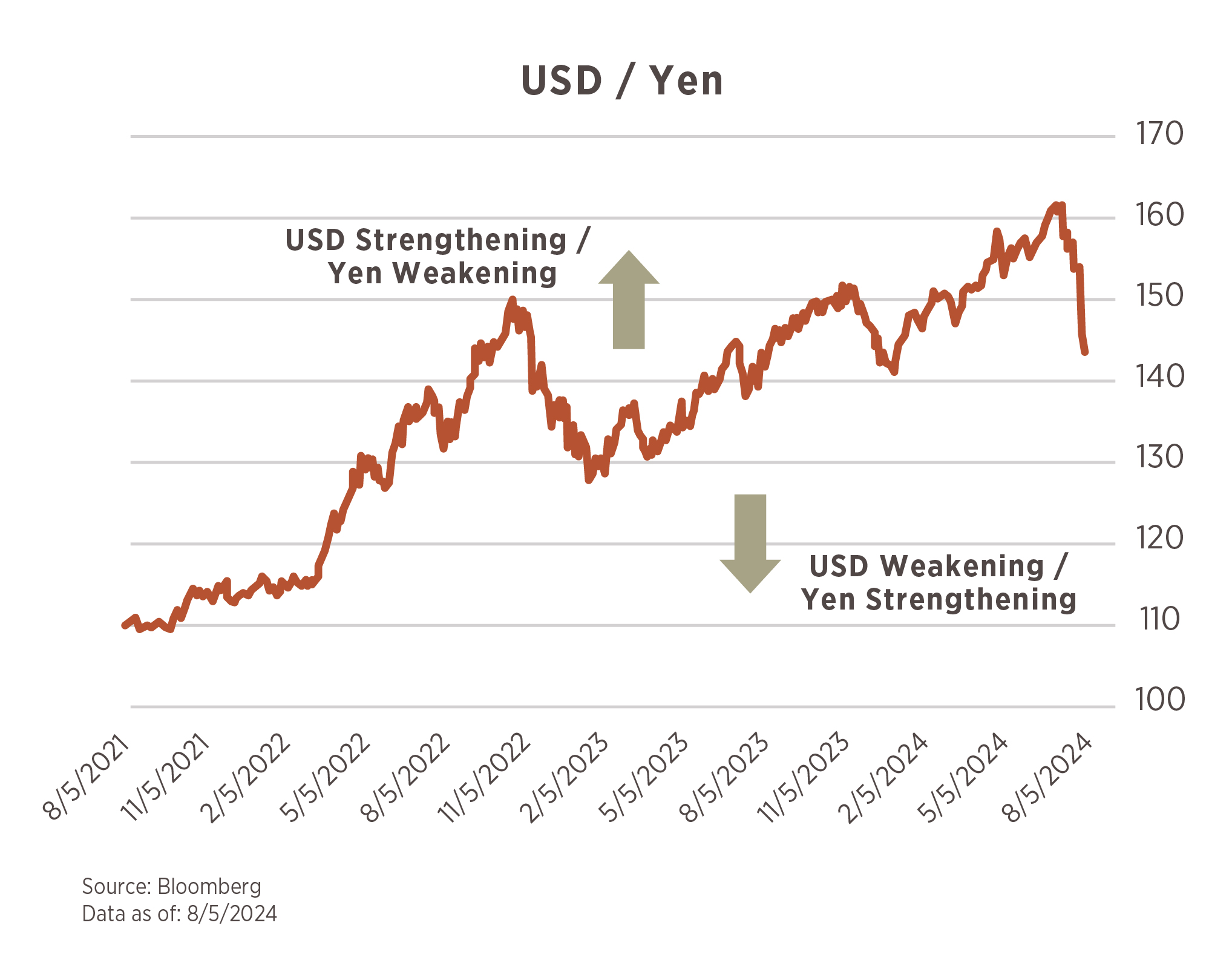

It was a mere five months ago we were celebrating the Japanese equity market finally getting back to a new all-time high after 34 years had passed. That celebration has quickly soured. The Nikkei 225 Index dropped 25.5% from its July 11 all-time high through August 5, the time of this writing.

What changed?

In reviewing our March Viewpoint, we noted three factors at the forefront of the Japanese rally: (1) Corporate Reform, (2) Valuations, and (3) Weak Yen.

The one that sticks out is the yen. It had been weakening against the U.S. Dollar for the better part of the past three years, at least until a sharp reversal that began on July 10.

Why is this important?

A prominent strategy exists called the Yen Carry Trade – this means you borrow in Yen (very cheap) and use those funds to go buy other assets (like Japanese or U.S. equities). As inflation raged across the world, Japan was the outlier, their Central Bank holding rates near zero until this year. In their latest meeting, however, they initiated a rate hike to 0.25% and suggested more could follow. This, paired with expectations the U.S. is going to cut rates, narrows the return one could get on the “carry.”

You can think of the Yen Carry Trade as leverage, and as the leverage “unwinds,” it creates a self-fulfilling cycle of turmoil across assets. For Japanese equities, a strengthening yen could prove to be punitive to their profitability as it makes their exported goods less competitive.

“May you live as long as you want, and never want as long as you live,” goes a traditional Irish saying.

With average life expectancy trending up, many more people are enjoying the first part of that blessing. Others find themselves happily retired but going through savings faster than anticipated as they age.

With living a longer life being a possibility, it’s worth considering how your current home, career, social interests and portfolio are structured to meet your needs at every stage of your life. Whether you’re retired, contemplating retirement, or at an earlier career stage, being prepared to live a long and comfortable life includes taking a serious look at how your career, savings, and investment choices will affect your retirement lifestyle.

The overreaching goal is to have as much money as you need throughout your life. While unforeseen factors can put stress on even the best-designed growth strategies, a proactive financial plan can help you to meet your goals, however you define them.

When Will You Retire?

For many, retiring early has become an option. For others, it may not be a matter of choice. Even those who retire with a comfortable nest egg may find themselves budgeting as they age.

Federally-mandated required minimum distributions from retirement accounts start at age 73. These withdrawals are becoming a challenge for many, since a timeline that anticipated a somewhat shorter period between retirement and death may be outdated for many investors.

Rising costs for essentials such as housing, food and health care are making it tough on seniors and others out of the workforce. Avoiding financial stress during a time in life when one should be enjoying the fruits of one’s labor means adjusting accordingly.

However, possible challenges can appear: such as an early retirement, expensive health challenges, or unexpected costs. A financial plan can provide a roadmap toward retirement. That can start with a close look at one’s current monthly or yearly annual budget.

Where Will You Be Living?

Many people count on the sale of a home to provide a needed inflow of cash. However competitive rental markets nationwide may mean that you could expect higher costs for a rental than you paid in home costs. Yet not every home is practical for someone in their later years.

For some people a retirement community will hold great appeal, but with greater competition for space comes higher prices.

Towns that support a college or university may also be a draw for people in their later years. A mix of restaurants, cultural opportunities such as theatre, museums and musical performance; learning opportunities such as public lectures; and the chance to see live sports at affordable prices bring many to such towns or smaller cities.

Examining local and state taxes is one place to start as you are deciding where to live. A growing community may introduce new levies to fund schools or other services, putting an unwelcome burden on personal finances. Yet a community with little access to medical services or cultural amenities could pose its own drawbacks.

Who Will You Have Around You?

Connecting with a community is likely to lead to a happier and longer life. Whether married, widowed, single or divorced, companionship is an important part of living a long, happy life.

Having friends and colleagues in the community, or family nearby, can mean staying socially active all throughout one’s life.

However, having to travel can be expensive, demanding or impossible. Putting money aside for cross-country trips to see family or friends is one possible consideration.

What Do You Want To Do?

Along with living longer lives, many people are also leading more active lives.

Without the daily demands of office visits or business travel, newfound leisure time can become too much “free time,” which isn’t always free of cost. For some retirees, leading a more active lifestyle can put unexpected pressure on savings.

One question might be whether fees for a country club or gym membership are still worthwhile. For many people, the cost of such memberships offers good returns in the form of friendships, recreational opportunities, and volunteer engagement.

Some look at retirement as a chance to spend more time enjoying sports, such as golf, tennis and pickleball. Others want to spend more time outdoors, swimming, hiking or bicycling. Equipment costs may be substantial, but activity comes with peripheral benefits, including better health.

Others will take the opportunity to travel. While luxury travel may not be necessary, cutting corners on meals, transportation, lodging or amenities can lead to an unpleasant overall experience. For some, the cost of upgrading to a more comfortable seat, or selecting a more convenient flight, simply is worth the extra money and comfort.

Whatever new hobbies one may pursue, looking at investment strategies that match up with your personal preferences should be a part of a conversation with your financial advisor.

Live Long and Prosper: Looking At the Future

For younger people, a job that pays well, rewards loyalty, and features a generous pension or retirement package is no longer a given. With technology changing society on a daily basis, getting ready for the future is no easy task.

Younger investors, as well as their elders, ought to consider taking the long view when designing an investment portfolio. Take into account possible changes to federal entitlement programs. Give weight to your own ideas as to where you want to be when you retire.

That means getting started early on a savings and retirement plan. At minimum, a dedicated retirement account, such as an IRA, helps prepare young workers for later years in which a job may not be the primary source of income.

Whatever stage you are at in your career, it’s never too soon to be thinking about ways in which to maximize earnings and savings. While a job with a high salary may mean stress, it is worthwhile to remember that one’s peak earning years are relatively short. Saving more today could mean less worry down the road, and more flexibility to meet future goals.

Whether those future goals include supporting a family or providing for subsequent generations, examining your options as an investor prepares you for a more financially-stable future.

What lies ahead is a future that you may be part of for longer than you expect, so adjusting your finances to meet that reality is logical.

Conclusion

The bottom line is that a long, happy, and yes, prosperous life is within reach for most of us. By balancing our present wants with our future needs, investors at all stages of their journey can incorporate a portfolio that best matches up with their future needs and wants.

Surprises in life happen to everyone, but being prepared for the future calls for starting on a plan today.

A financial advisor is ready to help with any questions or concerns you might have.