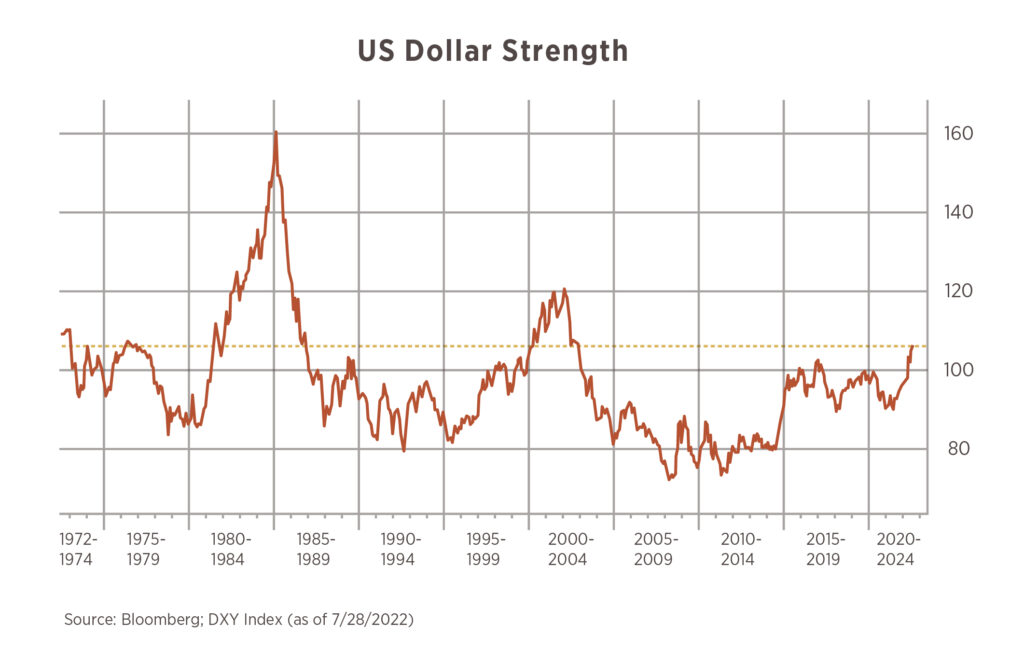

Chart of the Month

If you had been planning a trip overseas, now may be a good time to go from a money standpoint. The U.S. Dollar is trading at levels we have rarely seen throughout history and the chart this month shows its current strength. The U.S. Dollar is a global powerhouse, on one side of 88% of all trades in 20191, and often sought around the world for its safety and stability. There are only two instances in which its current level of 106 or higher has been sustained for a period of time – the 1980s and early 2000s.

What does this mean? Your dollars are worth more abroad!

If you had dreams of buying a new €84,000 Mercedes-Benz, you would have needed $100,000 a year ago ($1 = €0.84), but today, that new car would only be $84,000 ($1 = €1). The same is true for other major global currencies too, not just the Euro.

From a market perspective, the strong dollar can:

- Benefit countries with a large export focus. Their goods are now more competitive, increasing demand.

- For U.S. businesses with operations abroad the strong dollar can act as a headwind when they translate their earnings from overseas back into the U.S. Dollar.

- Emerging economies that have borrowed in U.S. Dollars can have more difficulty making payments as they need to translate their local currency into Dollars.

1BIS Triennial Central Bank Survey (2019)

Chart: Bloomberg; DXY Index (as of 7/28/2022)

Ways To Guide Your College-Age Kid Toward the Right Career Path

Sending your children off to college is an exciting and emotional milestone for your family. You’ve done the work to plan out your finances, taken them on campus tours, and waited with bated breath as they open their notification letters, but what role should you play once their education is underway?

To help parents facing this challenge, Mark Presnell, executive director of Career Advancement at Northwestern University, offers suggestions on how to support your college-age student as they seek to make the right decisions.

Students — and parents — should engage with their career services office by the fall of the second year.

Most students don’t visit their school’s career counselor until their third or fourth year, Presnell says, but it should be a priority during year one and the beginning of year two, especially if they have no idea what they want to do yet.

Encourage exploration — and be patient if they don’t choose a major right away.

Some majors — education, nursing or accounting, for example — are best declared early as specific courses may begin in the first or second year of college, but Presnell says most majors and career paths don’t have to be identified right away. “Sometimes students are following their peers and feeling the pressure to choose certain career outcomes. We’d love for them to say, ‘I’m going to take my first year to take a bunch of different classes, get involved in some different clubs, talk to people, do my research, and explore and grow so that in my second year I can make a more focused decision,” he shares. “Sometimes it’s hard for parents to be patient with them, but it’s a process — it takes some time and experiences.”

Students should complete at least one internship during college.

Take the long view and suggest your child take a part-time internship during the school year over an unrelated part-time job. While many students don’t start looking at internships until after their junior year or even after graduation, Presnell recommends students start their first internship or career-related experience (research, shadowing, etc.) after their sophomore summer.

Help them talk to somebody in the field they’re interested in.

Is your student considering a career in public relations? Ask if they can shadow your company’s PR director for a day. Are they interested in fine art? Arrange a lunch with the head of your favorite gallery. Presnell says the most important thing for your child to do when considering a career path is to talk to someone who already has that career — not to ask them for a job, but to have a candid conversation about what they like and don’t like about it, how they got their start, and whether the real-world salary in that field will afford the lifestyle your child may want to have.

Having a kid in college is about more than keeping the tuition bills paid. We are always here for you, including for conversations about your kid’s education — beyond just funding it. Visit 6meridian.com/category/resources for more ways to aid your children on their career path and please reach out to your advisor with any questions.