Chart of the Month

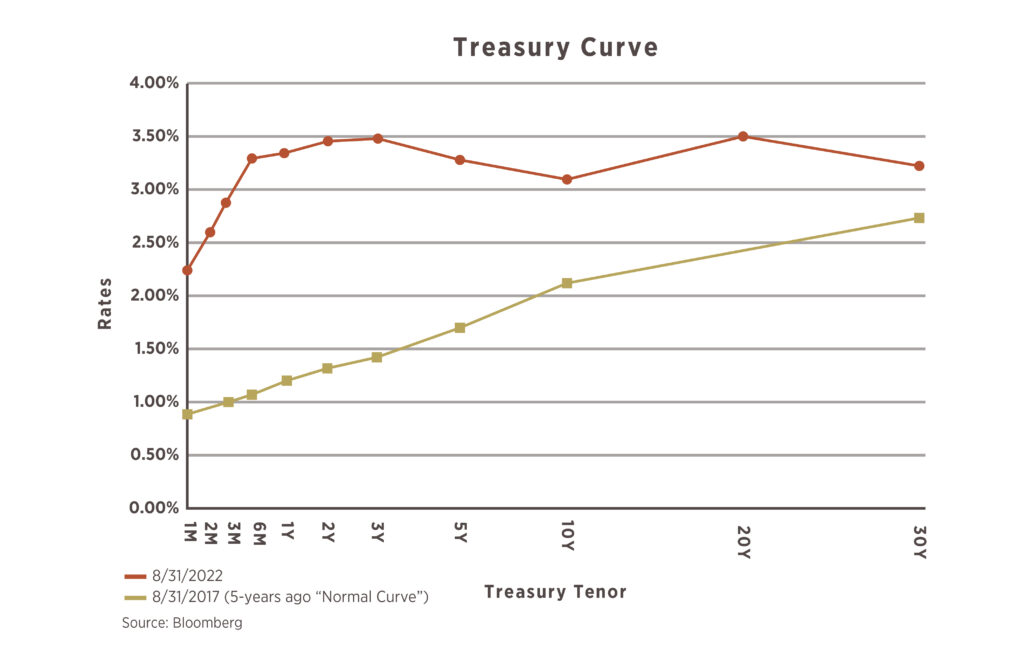

The Treasury Curve can take many shapes, but in a normal period, the curve is upward sloping. This makes sense since an investor should be compensated for the unforeseen risks that can occur over a longer time period. As the chart shows, 5-years ago was what we would consider “normal”.

Today’s market tells a different story in which the curve is relatively flat, if not inverted. The reason behind this shift is a result of Federal Reserve policy that is being implemented to slow inflation. The Fed can manipulate the short-end, or short maturity part of the Treasury Curve by hiking rates – the main storyline for 2022. A common reference point is looking at the 2-year vs. 10-year rates, which are currently inverted (shorter rate above the longer rate). Some consider this to be a recession sign while others are uncertain of its accuracy given how much the Fed has done over the past decade to influence the treasury market via quantitative easing. From a practical standpoint, an inversion in the 2-year and 10-year may cause banks to tighten their purse strings and slow lending practices as they typically borrow via short rates and lend at longer rates. This can lead to an economic slowdown as credit becomes more difficult to obtain.

What Happens When There Are No Beneficiaries

Where do those accounts and policies end up?

Some accounts have no designated beneficiary. Rarely, the same thing occurs with insurance policies. This is usually an oversight. In exceptional circumstances, it is a choice. What happens to these accounts and policies when the original owner dies?

The investment or insurance firm gets the first chance to determine what happens. On many retirement plans, for example, a spouse is often the default beneficiary, even if not named on a beneficiary form. If the deceased has no spouse, then the plan assets may just become part of that person’s estate. Brokerage accounts without any designated beneficiaries are also poised to become part of the estate of the decedent. The next stop for these assets could be probate.1

The state may end up deciding where the assets go when beneficiary forms are blank. If the deceased failed to name account or policy beneficiaries but had a valid will or other valid estate documents, this will influence the path from here – but it may not exempt the assets from probate court.

If no legally valid estate documents exist, then the deceased party dies intestate, and the state determines the destiny for the assets. Most states go by the same ladder of potential inheritors – surviving spouse at the top, then kids, then grandkids, then parents, grandparents, siblings, nephews or nieces. If absolutely no legitimate heir can be found, then the assets become property of the deceased’s state of residence.2

What about life insurance policies? A life insurance policy usually has at least two levels of designated beneficiaries, and it is rare when a policyholder outlives them and even rarer when a policy has none. In such a circumstance, the proceeds of the life insurance policy become part of the estate of the policyholder upon the policyholder’s death.3

Several factors will affect the cost and availability of life insurance, including age, health, and the type and amount of insurance purchased. Life insurance policies have expenses, including mortality and other charges. If a policy is surrendered prematurely, the policyholder also may pay surrender charges and have income tax implications. You should consider determining whether you are insurable before implementing a strategy involving life insurance. Any guarantees associated with a policy are dependent on the ability of the issuing insurance company to continue making claim payments.

What if a person simply lacks possible heirs, or sees no worthy heirs? Occasionally, this happens. Some people remain single for life, and others are estranged from relatives or heirs who would otherwise be beneficiaries.

A person in this situation has a choice: charity. Perhaps a charitable or non-profit organization deserves the assets. Perhaps a college or university would be a worthwhile destination for them. Choices exist, and those who are single can explore them as they consider their estate. Visit with your advisor on steps you can take to ensure your beneficiary designations are current.

1. Kiplinger, June 6, 202

2. Schwab.com, September 24, 2021

3. SmartAsset, April 28, 2022