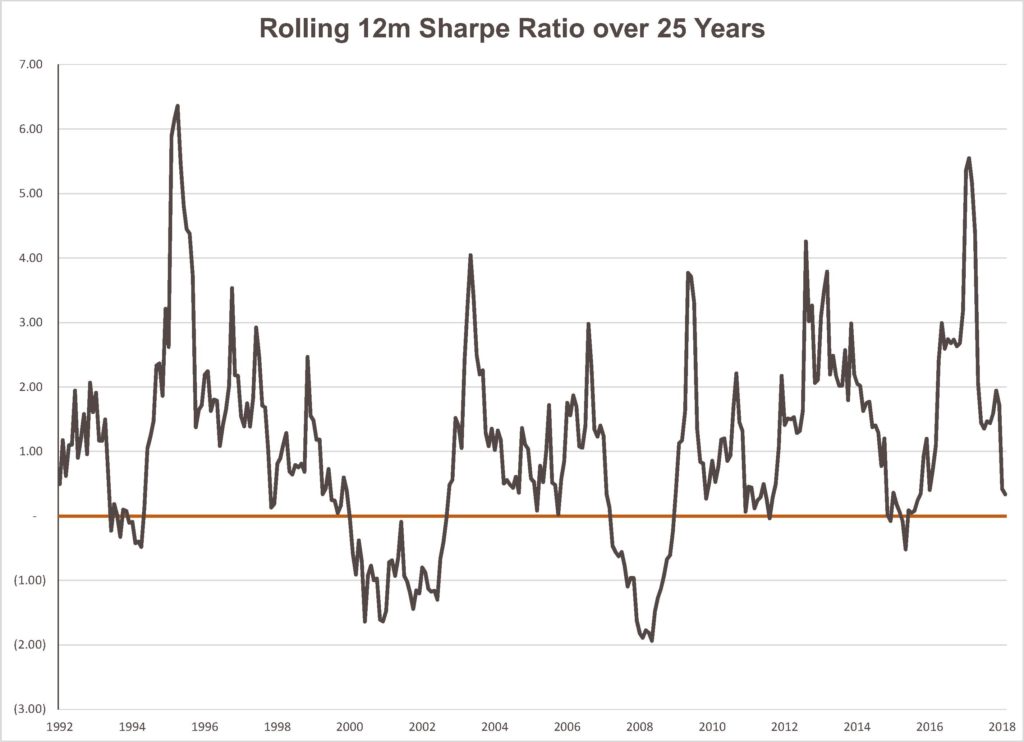

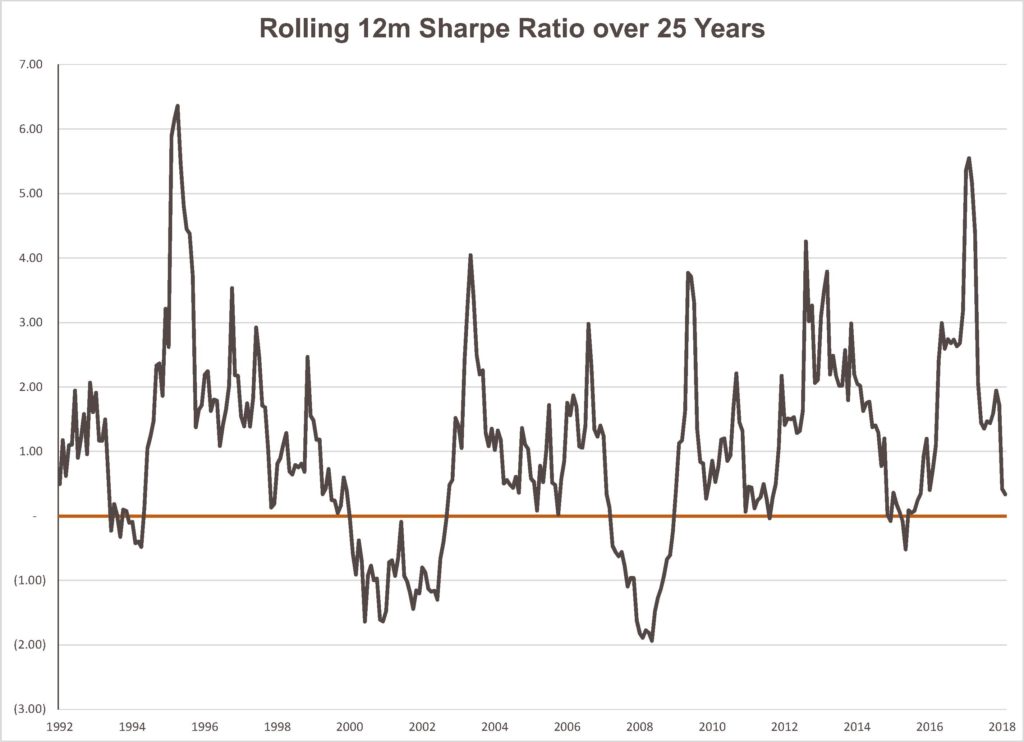

A little over a year ago we published a blog post noting that risk-adjusted return for US stocks had been unusually high. Specifically the Sharpe ratio – return in excess of the return on cash divided by volatility – was at a historically high level. The conclusion was that it had been nice for investors but was unlikely to be sustainable. Since then, every piece of the equation has moved to lower the Sharpe ratio. Cash interest rates have risen, volatility has increased, and stocks have posted lower returns.

Source: Bloomberg 2018

While not as nice for investors, this is more in line with what we would expect from equity markets. We’ll be releasing a webinar in January with our outlook going forward, but to sum up: expectations for positive return should go hand in hand with expectations for volatility.

This commentary in this presentation reflects the personal opinions, viewpoints and analyses of the 6 Meridian employees providing such comments, and should not be regarded as a description of advisory services provided by 6 Meridian or performance returns of any 6 Meridian client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this presentation constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. 6 Meridian manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.