In the current market environment it has become popular to debate the outlook for “Growth vs. Value”. While we believe broadly splitting the market into these two categories is an unhelpful oversimplification, there are some interesting observations that can be made. At 6 Meridian, our portfolios tend to have a modest tilt towards value, which is evident from recent performance. During the 12 months through October 2020, the Russell 1000 Growth Index returned 29.2% while the Russell 1000 Value Index declined by 7.6% resulting in nearly 40% of outperformance for the growth index over the value index. Clients rightly want to understand – Are we missing something? Do we need to shift our investing style?

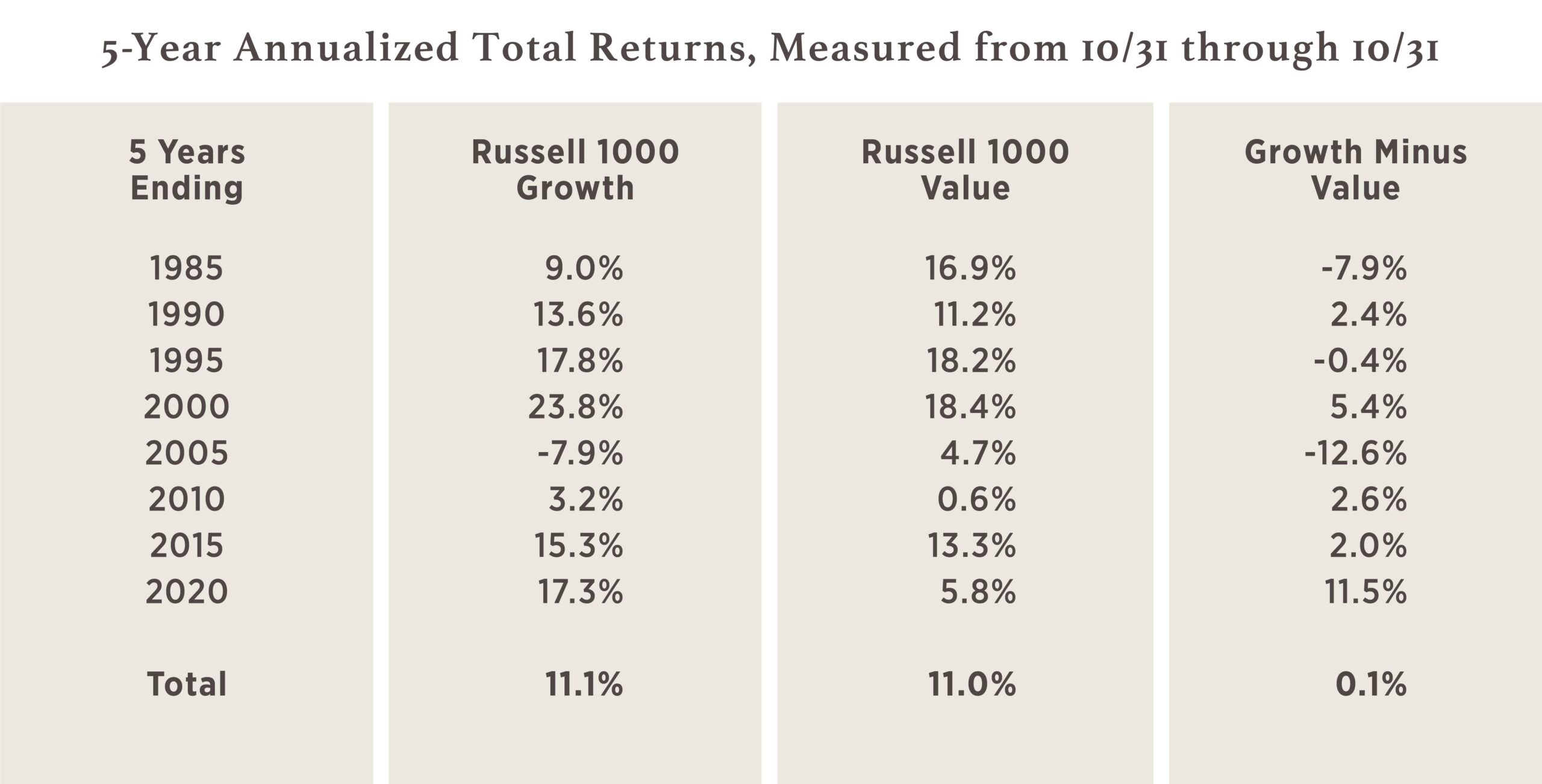

The popularity of growth and value as investing styles ebbs and flows, and historically has resulted in the two delivering nearly the same return over longer time horizons. The table below shows the returns for the Russell 1000 Growth and Russell 1000 Value indices in 5-year increments. As one can see from the chart, there are times when growth shines and times when value outperforms. Importantly, over the full 40-year timeline the returns are almost identical. Investors have not earned any excess returns over the long run from owning an index of high growth companies.

Source: Bloomberg 2020, Analysis by 6 Meridian

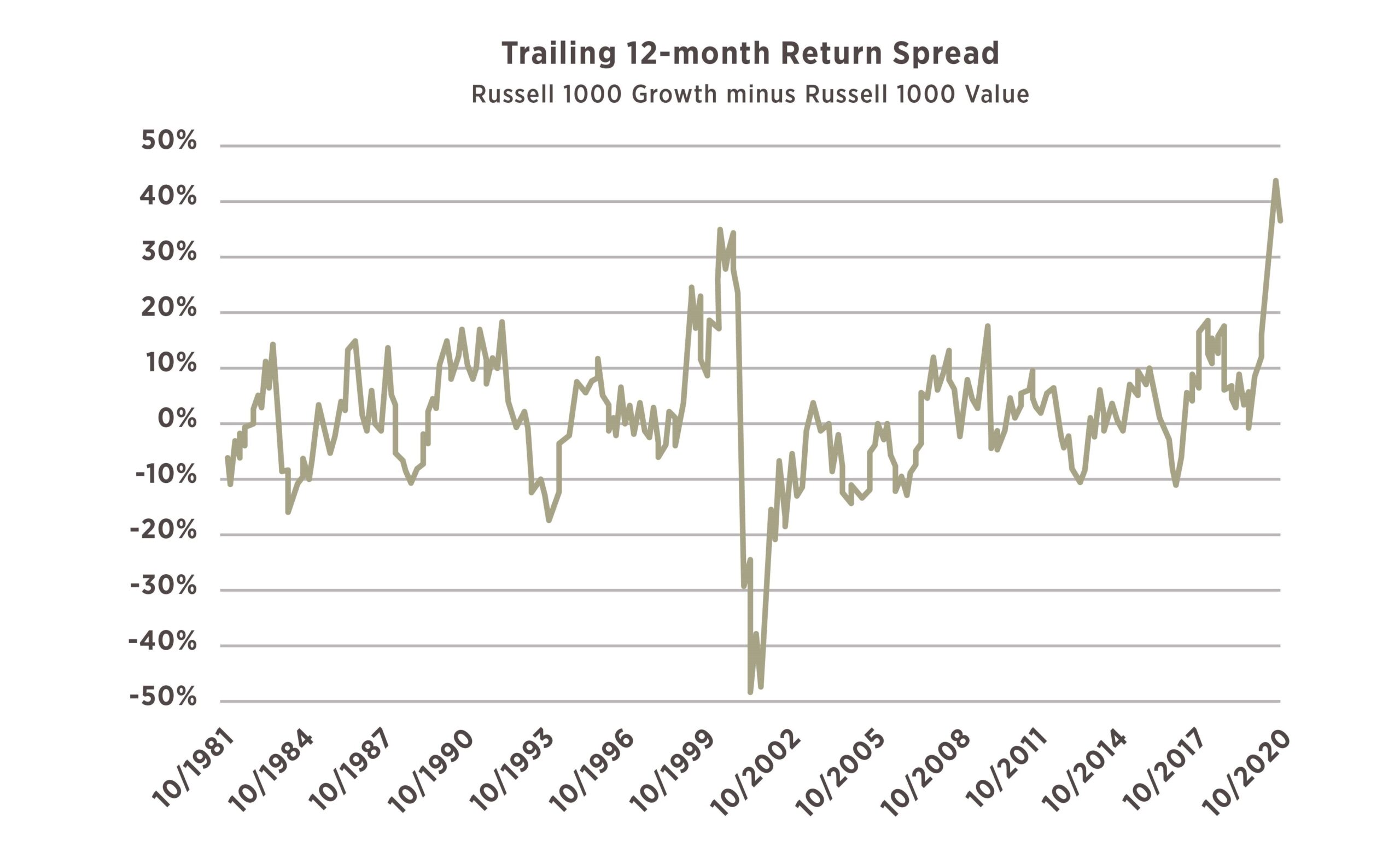

Does this seem surprising? If so, it may be because of the experience of the past year. The 12 months through September 30, 2020 saw the most dramatic outperformance of growth over value ever, including during the height of the dotcom craze in 1999-2000. The chart below shows this to be an extreme, even among long periods of growth outperformance.

Source: Bloomberg 2020, Analysis by 6 Meridian

If we expected this to continue indefinitely, it would obviously make sense to avoid stocks that fit into the value index. Needless to say, we do not expect that to happen. Based on the past 40 years of data, extreme outperformance by either style is unlikely to continue over long time frames.