What Happened to Defensive Equity Investing?

We have long been advocates of defensive equity investing. Several of the portfolios we manage incorporate some element of defensive positioning which has historically helped to protect investors during market declines and allowed them to participate on the way up. One of these strategies is the Low Beta Equity portfolio which buys stocks that exhibit low volatility relative to the index. So far this year, that strategy has struggled relative to our expectations and to the broader market. This is not unique to 6 Meridian – many defensive equity strategies have performed worse than simply holding the S&P 500. In fact, the S&P 500 Low Volatility Index, which is a good proxy for this type of defensive equity strategy, is down 7.1% year to date through July 31, 2020.

To make matters worse, the drawdown came during a time of extreme price swings in the broader market – when defensive strategies are most relied upon to perform. This has understandably caused some investors to question whether defensive strategies are worthwhile parts of a portfolio. Given the disappointing run for defensive equity strategies year to date, we look at the history of the low volatility investing style, as represented by the S&P 500 Low Volatility Index, to attempt to put 2020 in context.

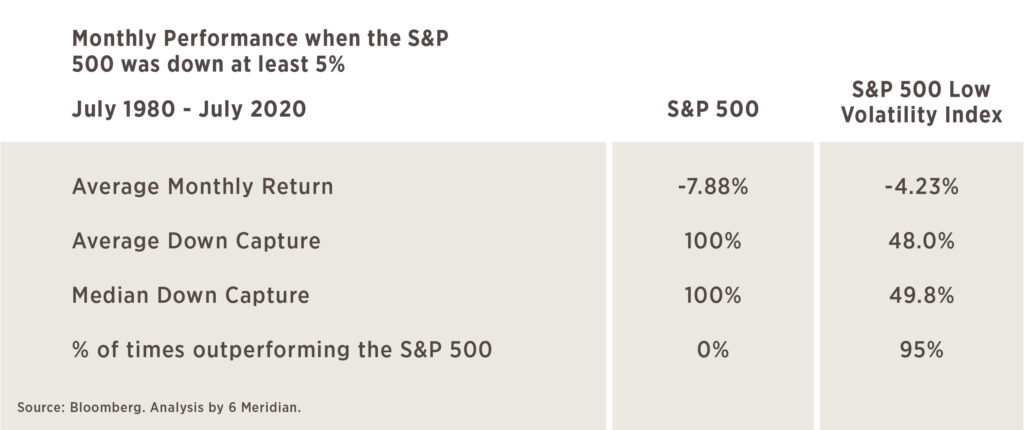

We generally expect defensive equity strategies to participate in rising markets but lag the broader index. It may seem odd, then, that over the long term the S&P 500 Low Volatility Index has actually outperformed the S&P 500. The low volatility index returned 13.0% annualized from July 1980 through July 2020 compared to 11.5% for the broader market index. Much of the outperformance can be attributed to relative stability during times when the broader market is falling. To highlight this effect, we analyze the returns of the S&P 500 Low Volatility index over the past 40 years during months where the broad S&P 500 index dropped by at least 5%. On average the performance of the low volatility index was more than 3 percentage points better than the S&P 500 during those months, as shown in the table below.

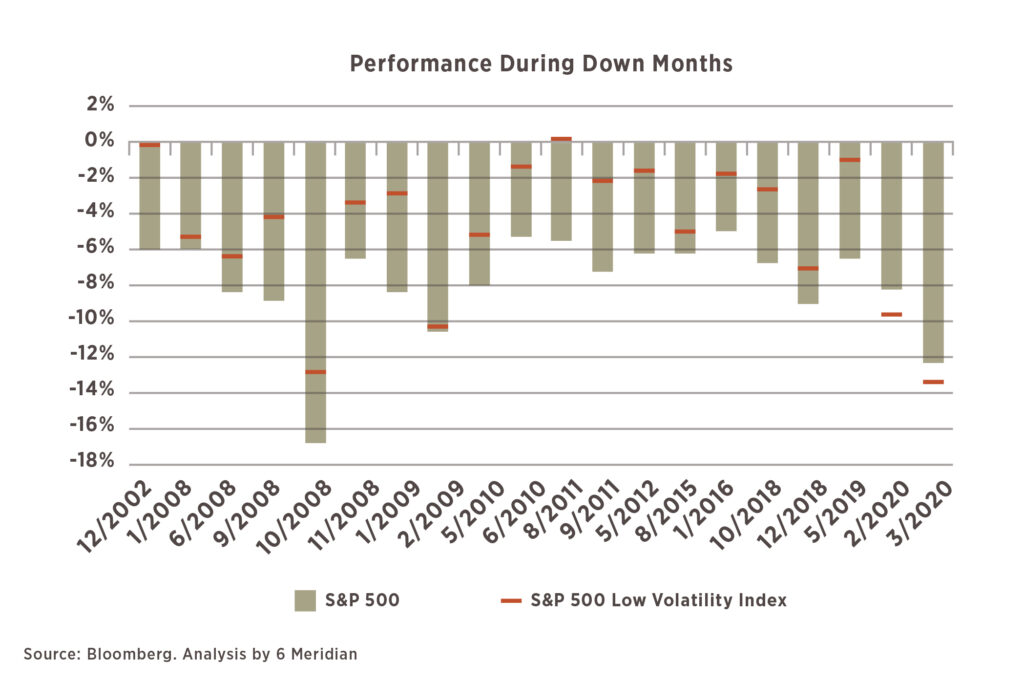

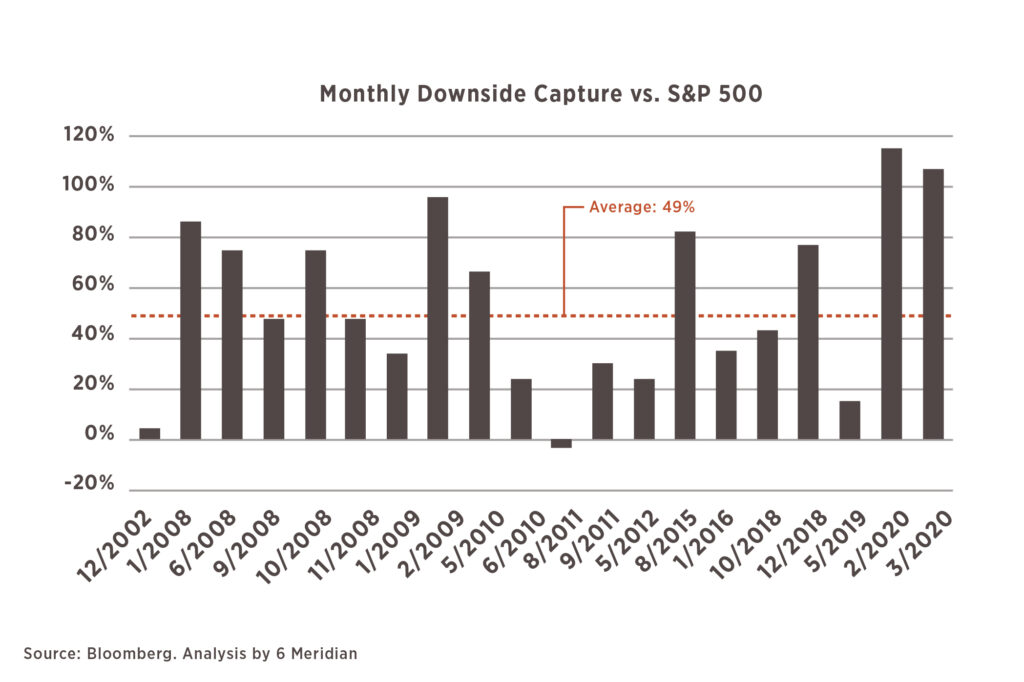

Of the 43 monthly declines since 1980 that we analyzed, two have taken place this year. In February, the S&P 500 fell by 8.2% and in March it dropped another 12.4%. This year, however, was strikingly different from the other months we examined. During these two months the low volatility index declined by more than the benchmark instead of less. The first graph below shows the performance of the S&P 500 Low Volatility Index compared with the S&P 500 during the recent subset of monthly declines. The second graph reframes the same performance in terms of the proportion of the S&P 500’s return that the Low Volatility index achieved, also known as monthly downside capture. The readings for both February and March 2020 are over 100%.

The February and March 2020 drawdowns are jointly the worst we have seen for the low volatility index in terms of performance relative to the market. This proved particularly painful as we were living through it. However, it is important to note that the range of outcomes over short time frames is wide even as the average downside capture has historically remained very attractive during deep drawdowns. As shown in the graph, the investor experience over any one of these months would have ranged from capturing none of the downside to capturing more than all of it. Taken in aggregate however, the investor in the low volatility index would have realized slightly less than half of the downside of the S&P 500 during deep drawdown months.

While the 2020 performance for defensive equity strategies, including those at 6 Meridian, has been disappointing, it does not reduce our confidence in their ability to add value for long term investors. The historical track record remains compelling despite recent underperformance. Furthermore, considering the lack of opportunities for yield today in fixed income markets and a high degree of economic uncertainty facing equity markets that are already richly valued, equity strategies designed to reduce volatility could remain an attractive choice.

Andrew Mies, CFA® Chief Investment Officer