Another year-end, another opportunity to reduce taxes while making a positive impact. According to a 2024-2025 report from the Lilly Family School of Philanthropy, charitable giving is expected to increase by 4.2% by the end of 2024 and 3.9% by the end of 2025 due to individual’s stock market gains and growth in their income and net worth.1 And with the 2017 Tax Cuts and Jobs Act slated to expire at the end of 2025, it may be worth reconsidering your approach to charitable giving over the next year to minimize tax burden and maximize tax benefits.

Gifting Appreciated Stock Or Other Non-Cash Assets To Charity

This strategy is worth considering in any tax year, as it allows you to eliminate the capital gains tax you would need to pay when you eventually sell the appreciated asset, in addition to providing a deduction (if you itemize) equal to the fair market value of the asset when you donate it. You may decide to employ this strategy after selling your nonprofitable investments at a loss (tax-loss harvesting).

Note that a deduction limit of 30% of your adjusted gross income (AGI) applies to these types of donations, whereas most cash donations have a higher 60% limit. However, you can carry over the deduction for five tax years, should it exceed the limit.

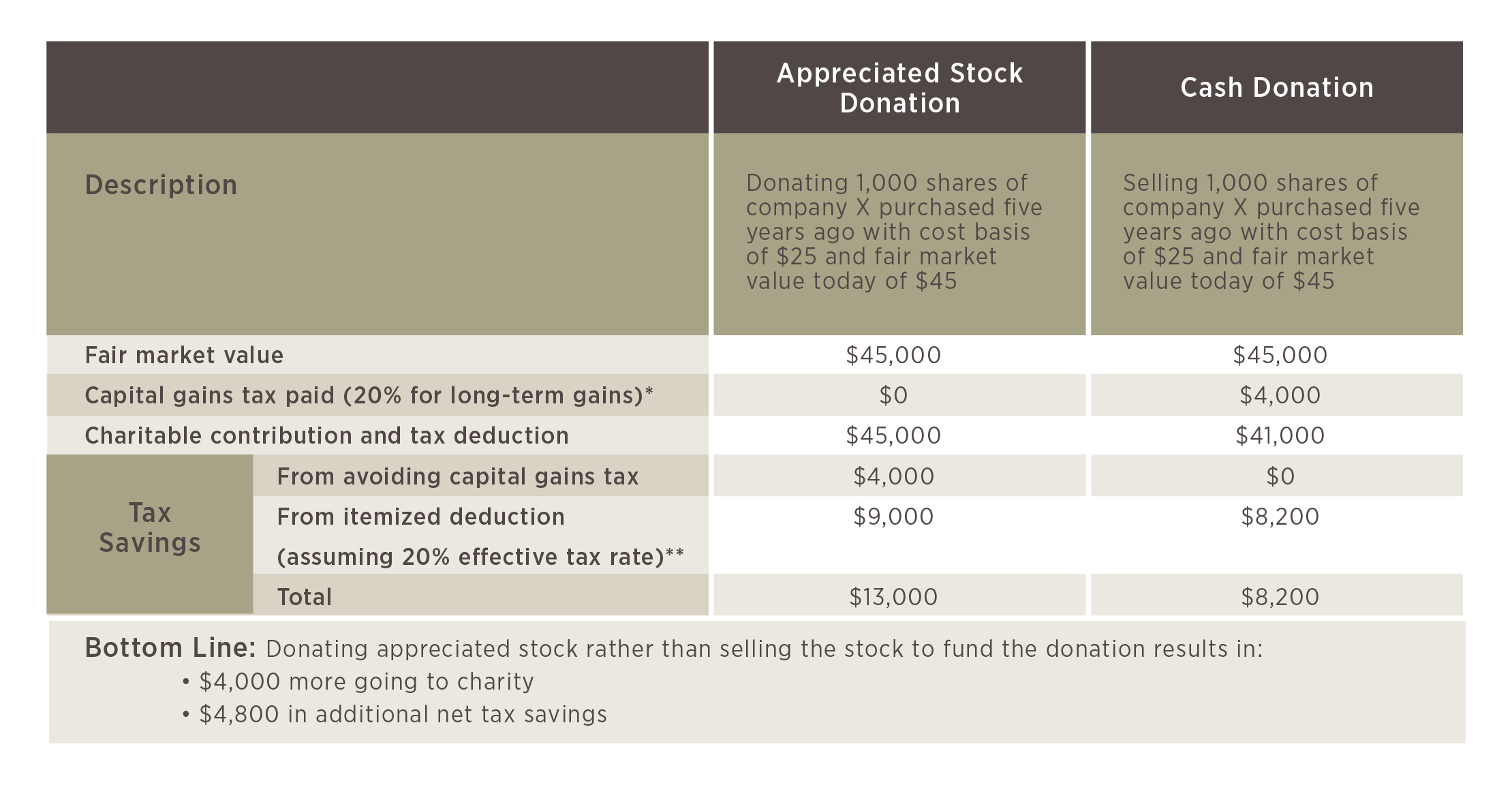

Example – Donating Stock vs. Selling Stock to Fund a Cash Donation

Important note: The above example is for illustration purposes only. Please consult a tax advisor to understand the implications of this strategy based on your particular situation.

*Assumes donor earns $533,400 or more. Donor will pay a 15% rate if they earn less than $533,400.

**Assumes donor’s AGI exceeds $150,000 and therefore that the charitable deduction for the donation does not exceed 0.3% of the donor’s AGI.

Source: Donating IPO stock. (n.d.). Schwab Brokerage. Retrieved October 23, 2024, from https://www.schwabcharitable.org/non-cash-assets/ipo-stock

If You Are 70 1/2 Or Older, Making A Qualified Charitable Distribution (QCD) From Your IRA:

A QCD is an otherwise taxable distribution of up to $105,000 from an IRA to a qualified charity.2 This distribution counts toward your required minimum distribution (RMD) and is excluded from your taxable income, even if it exceeds your RMD. Depending on your unique situation, making a QCD may even allow you to remain in a lower tax bracket and avoid the 3.8% net investment income tax on capital gains, interest and other investment income, applicable to taxpayers above certain modified gross adjusted income thresholds (e.g., $250,000 for married couples in 2024).

It is also important to note the following:

- Using required minimum distributions (RMDs), which begin at age 73, for QCDs is often advantageous.

- QCDs cannot be made from employer-sponsored retirement plans such as 401(k)s and 403(b)s.

- QCDs cannot be made to private foundations, supporting organizations or donor-advised funds.

- The timing of QCDs is important so as not to inadvertently generate taxable income. For example, if you were to take a $15,000 RMD early in the year and then toward year-end make a $15,000 QCD, the $15,000 QCD will not offset the RMD you made earlier in the year; the IRS would treat the first $15,000 as taxable income.

- You must inform your tax advisor when you make a QCD, as the standard 1099-R tax document provided by IRA administrators does not distinguish between the types of withdrawals made.

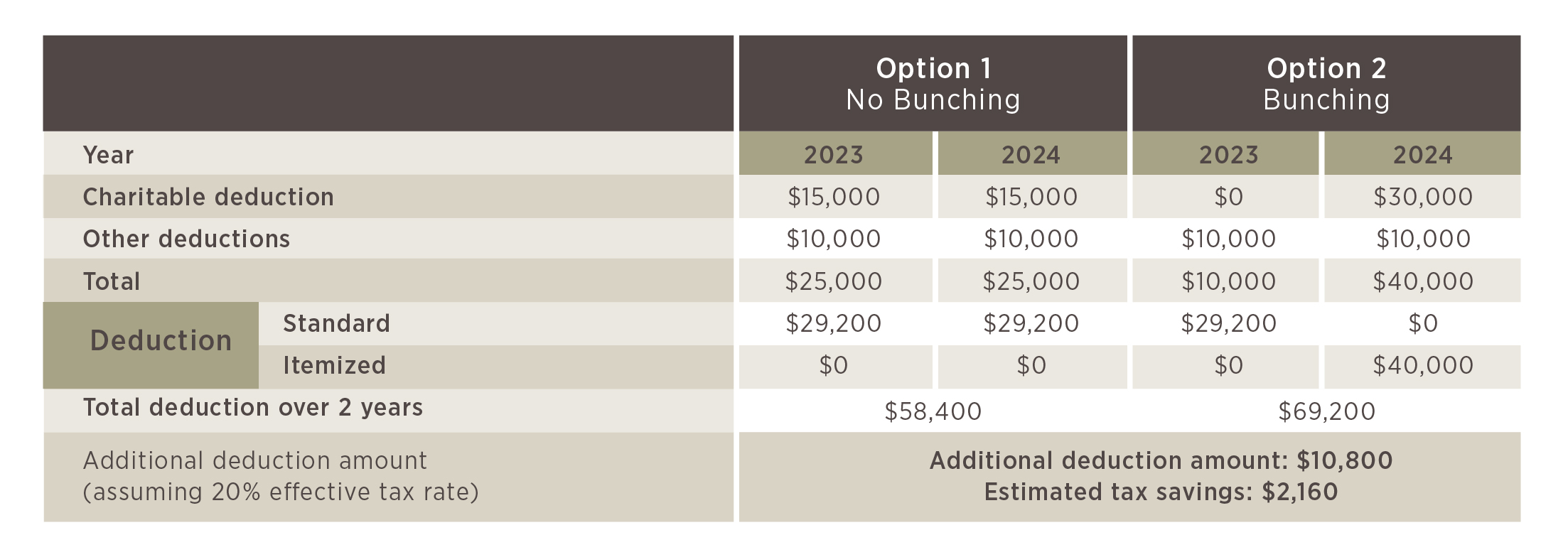

Bunching Charitable Gifts

Bunching charitable gifts (combining multiple years’ donations into one year) — perhaps through a donor-advised fund, itemizing deductions the year you bunch, and taking the standard deduction in years you don’t bunch — could make sense. This is particularly the case in situations where there is a relatively small tax liability difference between taking the standard deduction and itemizing your deductions.

Example of Bunching – Married, Filing Jointly – for Illustrative Purposes Only3

Important note: The above example is for illustration purposes only. Please consult a tax advisor to understand the implications of this strategy based on your particular situation.

*Please note that limits on itemized deductions exist for high-income taxpayers. Please consult your tax advisor for more detail.

Funding A Charitable Trust:

Establishing a charitable trust may help you achieve multiple goals, including balancing your charitable goals with your income needs and/or providing potential tax deductions. There are two main types of charitable trusts that you can consider with your advisors — charitable remainder trusts (CRTs) and charitable lead trusts (CLTs). Both types of trusts involve gifting assets to a trust after which regular payments from the trust are either made to a noncharitable beneficiary (CRT) or charitable beneficiary (CLT) until the end of the trust’s term, at which point remaining assets are paid to a charitable beneficiary (CRT) or noncharitable beneficiary (CLT). Both vehicles can benefit individuals and families who have significant charitable intentions. They can be beneficial for those looking to preserve the value of highly appreciated assets while also receiving tax deductions and exemptions.

The above techniques, and other tax planning strategies, require careful, skilled consideration. Please reach out to us, and we can coordinate a custom, year-end plan with your accountant, tax attorney and any other advisors.

1 School of Philanthropy, Indiana University Lilly Family. (2024, March 1). The Philanthropy Outlook 2024-2025 Report. https://scholarworks.indianapolis.iu.edu/items/499ae1f5-c885-4aa3-aa49-1f27534dd096

2 IRS provides tax inflation adjustments for tax year 2024 | Internal Revenue Service. (n.d.). https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2024