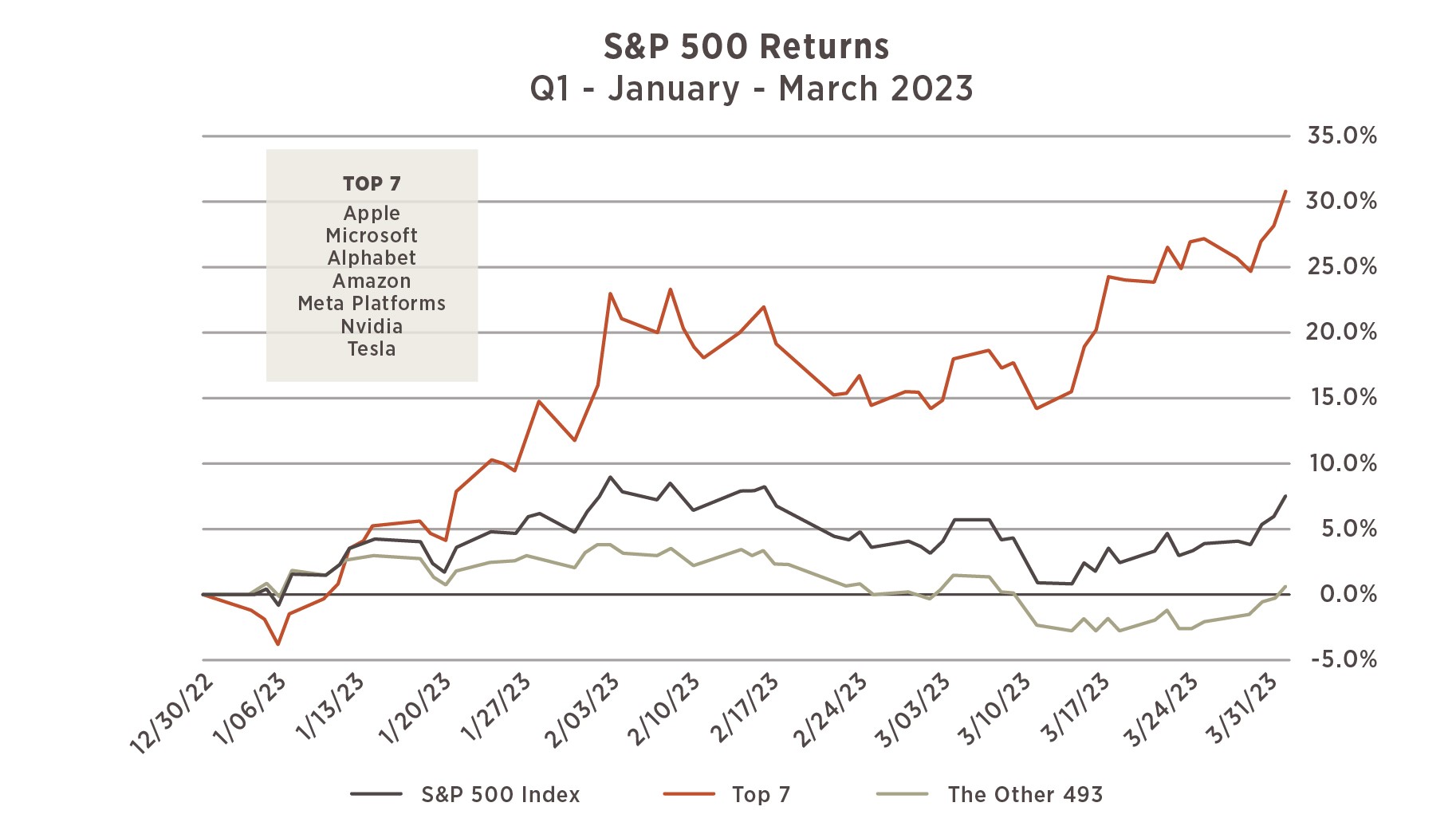

Through the 1st Quarter of 2023 the S&P 500 Index returned 7.5%, however, a deeper look finds that almost the entirety of that gain is a result of strong performance from a few companies that are heavily tied to technology. In our March Viewpoint we discussed the heavy concentration of stocks that sit atop the S&P 500 and carry an outsized weight for the index. This concentrated cohort has led the way for US equities through the end of March. Seven of the eight largest companies in the S&P 500 – Apple, Microsoft, Alphabet (Google), Amazon, Nvidia, Tesla, and Meta (formerly Facebook) – account for 25.4% of the index. The chart shows that this group of seven companies had a cumulative return of nearly 31% in the first 3-months of 2023. The remaining 493 companies in the S&P were collectively up only 0.6%.

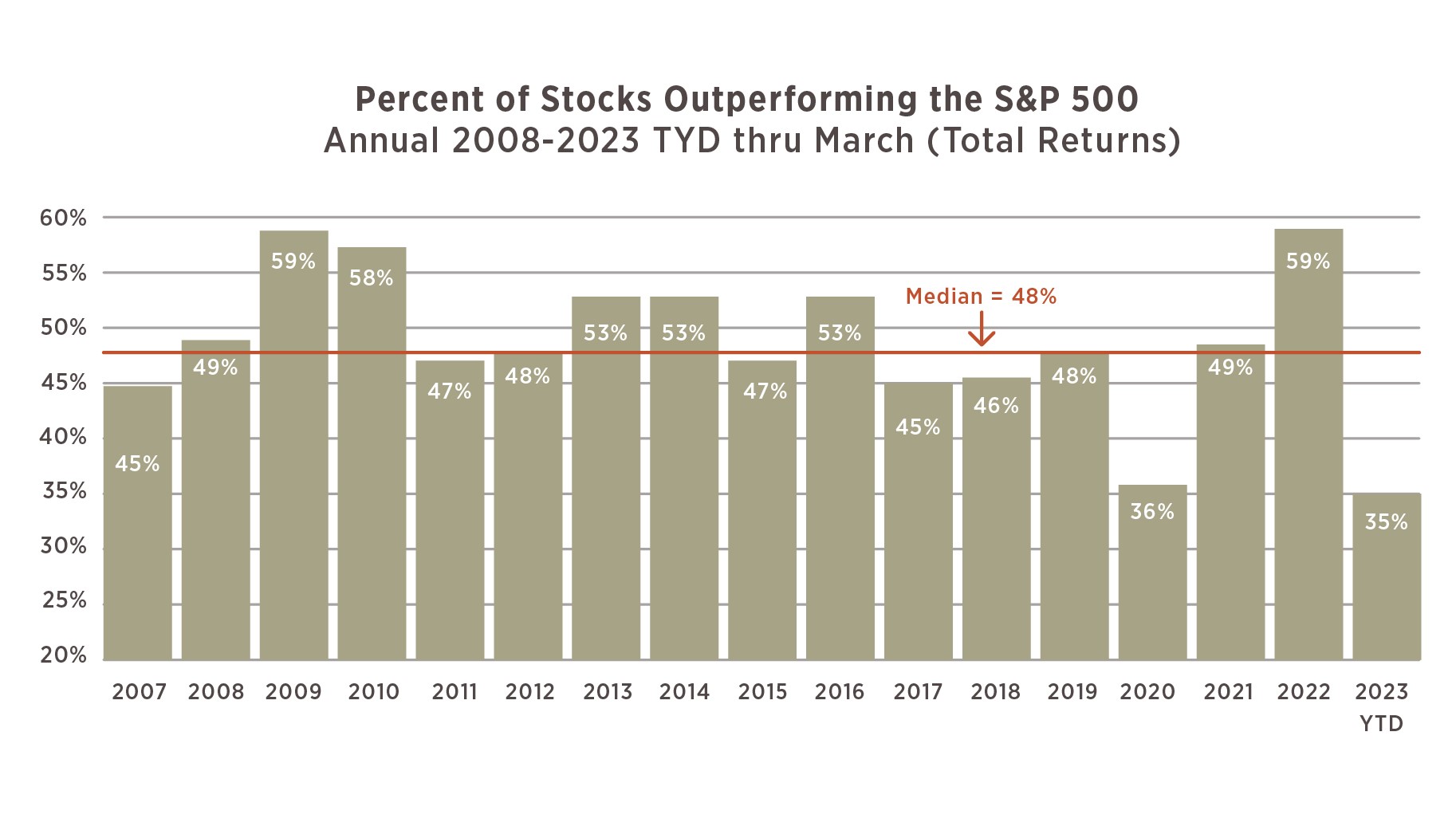

Another way to illustrate how narrowly concentrated performance has been in 2023 is by looking at how many stocks are outperforming the S&P 500. As this next graphic shows, historically you have nearly 50% of the stocks performing better than the market, but so far this year we have only seen 35%. Put another way, only 176 stocks out of 500 have outperformed to start this year and as a result, this is the narrowest S&P rally in the past 17 years.

These charts show that this is the narrowest rally we have seen in the S&P 500 in over a decade, and it has been dependent on an extremely small cohort of stocks performing well. For questions or comments, please contact your financial advisor.