As working adults, many of us look forward to the freedom that retirement will bring. This freedom will give us the chance to focus on the things that matter most, like spending time with family, traveling, or picking up new hobbies. But have you considered what your lifestyle in retirement will look like and how much your necessary and discretionary expenses will be each year?

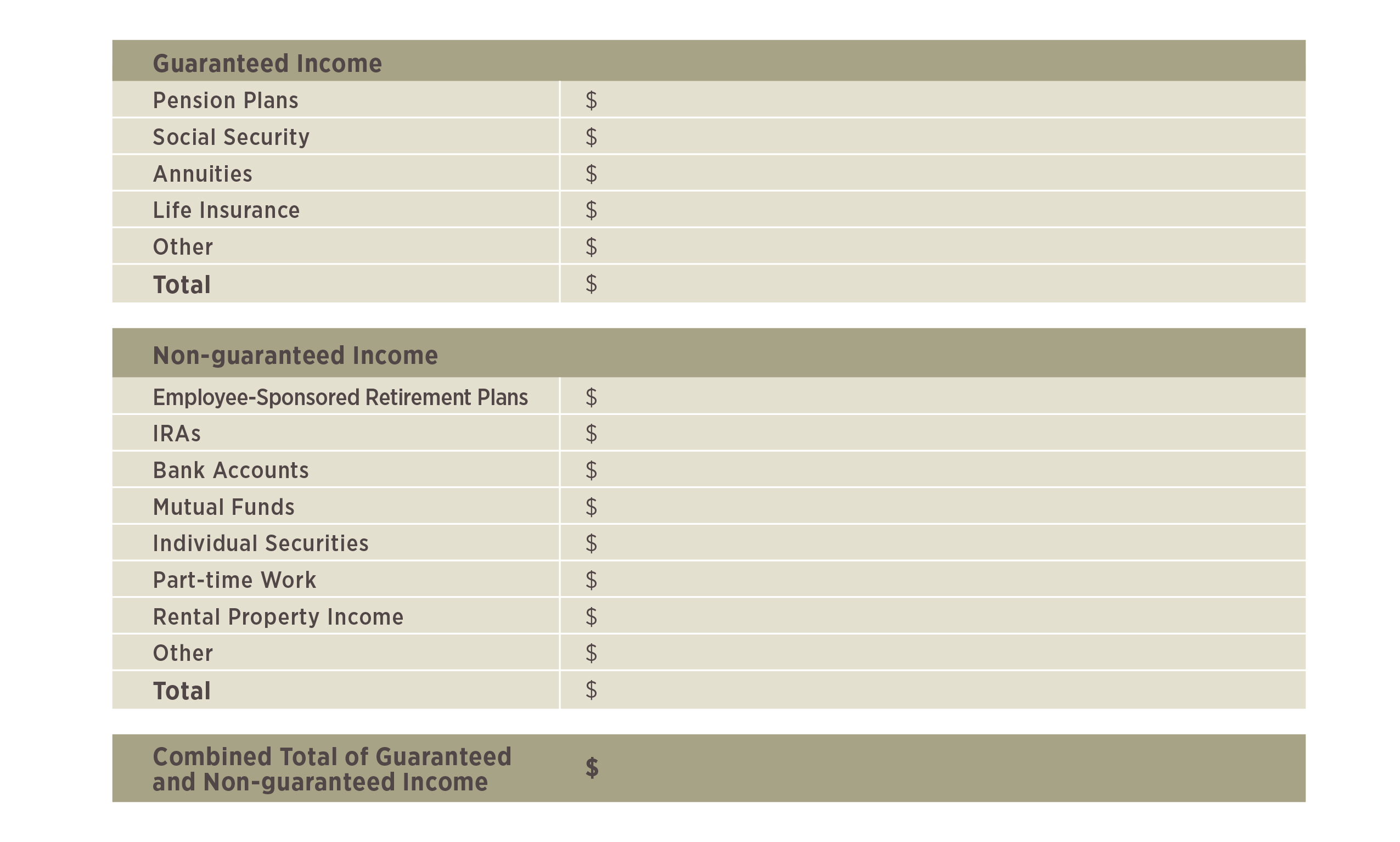

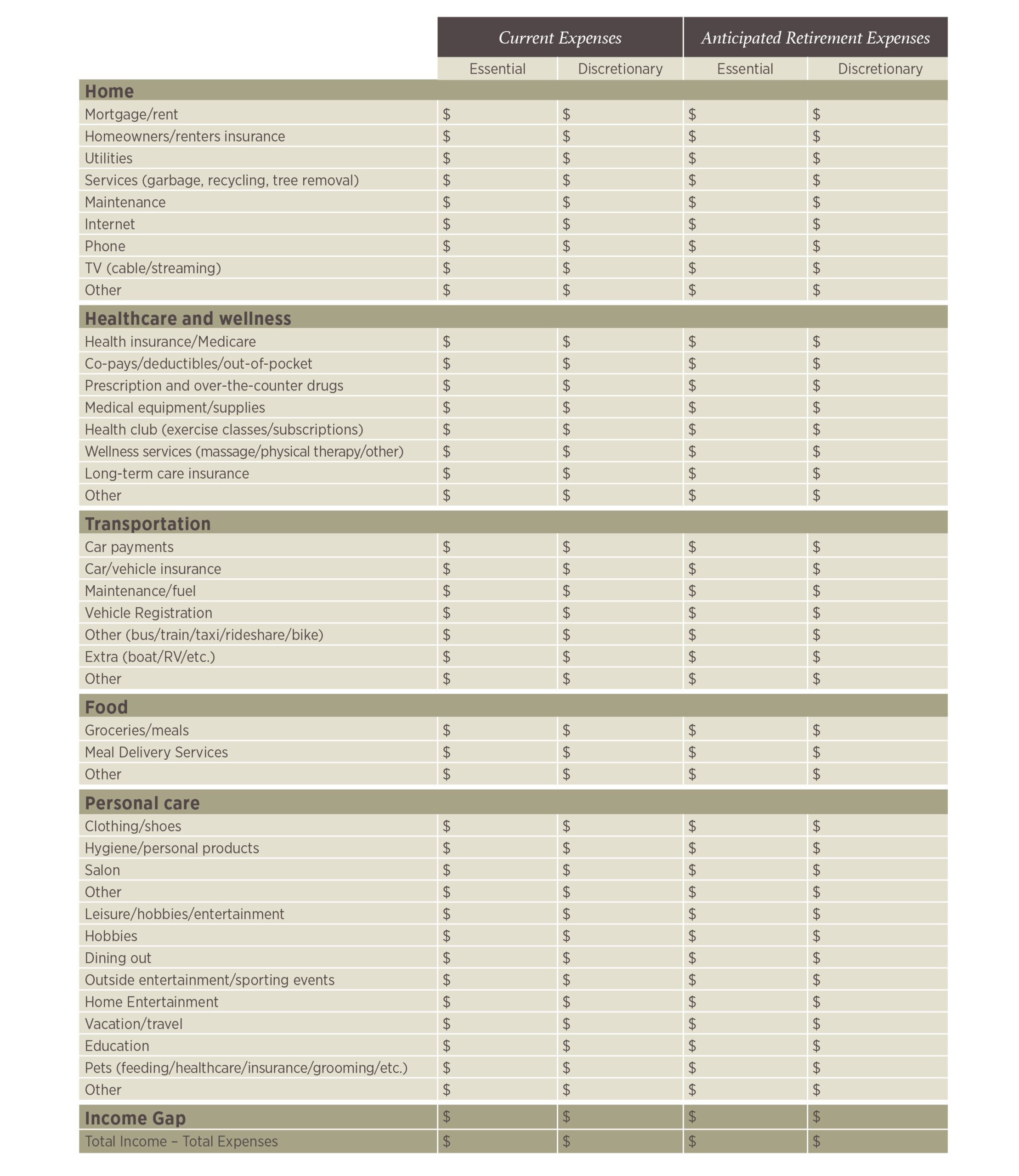

This retirement planning worksheet will help you visualize your retirement life, including where you want to live, the activities you want to pursue, and how you want to leave a legacy. The second section will then guide you through creating a budget that outlines your fixed and discretionary expenses, as well as your guaranteed and non-guaranteed income.

Self-Evaluation Questions

Residency

- Where is your ideal place to retire? (Waterfront, rural area, city, mountains)

- Do you want to stay in the same home?

- Would you like to upsize or downsize?

- How far do you want to be from your friends and family?

Activities and Hobbies

- What types of sports, clubs, or associations are you a part of now?

- What would you like to join in the future?

- Do you have to travel to carry out these activities?

- How important is being social to you?

Philanthropy

- Are you considering charitable giving as part of your legacy?

- What initiatives would you be interested in giving to?

- How can my skills and experiences support the causes I care about?

Legacy

- What do you think your life’s legacy will be?

- How do you want your legacy to live on?

- How do you want to include your family in your legacy planning?

Retirement income