What are QCDs?

If you have investments in pretax retirement accounts (i.e., IRAs, 401(k)s, etc.), the IRS requires you to take taxable required minimum distributions (RMDs) from these accounts on an annual basis once you reach age 73.1 These RMDs begin as a relatively small percentage of your retirement assets but increase over time as you age, potentially creating a high tax burden and possibly even pushing you into a higher income tax bracket or phasing you out from other tax deductions.

Qualified charitable distributions (QCDs) provide the opportunity for those who are charitably inclined, and don’t need the RMDs for cash flow, to mitigate this tax burden. They are a special provision in the tax code that allows IRA owners to make tax-free gifts of up to $100,000 (indexed for inflation) to eligible charities.

In addition to reducing your taxable income by up to $100,000, QCDs enable you to potentially make a larger charitable impact, as they don’t count toward the maximum amount deducted if you itemize your taxes.

What are the Potential Benefits?

Examples

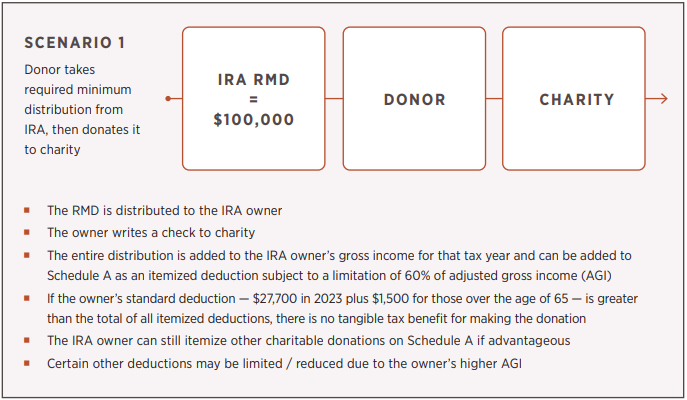

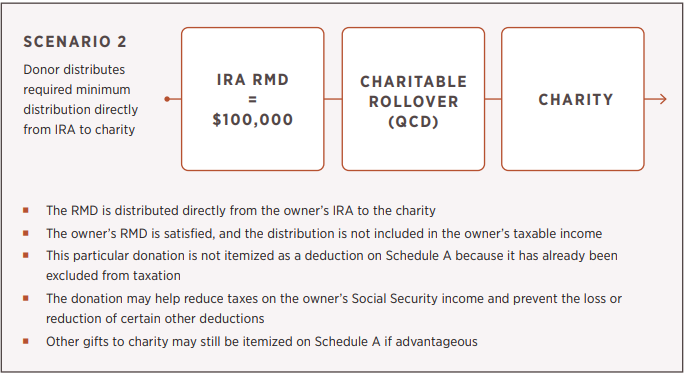

To better understand how they work and their potential benefits, consider the following two scenarios. In both cases, the IRA owner is required to take a Required Minimum Distribution of $100,000 from their IRA and wants to give that entire amount to a qualified charity.

One-Time Additional $50,000 QCD

It’s important to also note that, beginning in 2023, retirement account owners who are 70 ½ and older may also make an additional one-time $50,000 distribution directly from their retirement account to a charitable gift annuity, charitable remainder unitrust (CRUT) or charitable remainder annuity trust (CRAT), which they can treat as a QCD made directly to a charity for tax purposes. And this amount counts toward the owner’s RMD, if applicable.

A charitable gift annuity is a contract you can enter with certain nonprofits, whereby you (the donor) make a large gift to the nonprofit and in return can take a tax deduction and receive a fixed stream of income from the charity for the remainder of your life.

CRUTs and CRATs are gifts you (the donor) can make to a trust that can provide you income for a set number of years, or for the rest of your life, after which a named charity receives the trust’s remaining assets.

For more information about any of these charitable giving structures, talk to your financial advisor.

Who Might Benefit from a QCD?

- Retirees who have pretax accounts and are charitably inclined

- Retirees who potentially stand to lose certain deductions due to the increase in their adjusted gross income caused by their RMD

- Retirees who don’t itemize their deductions because their combined itemized deductions, including charitable donations, are less than the standard deduction

Additional QCD Considerations

Please note that the above applies to federal income tax only. You should also carefully consider state taxes with your financial and tax advisors.

Also, it’s important to keep the following limitations and restrictions related to QCDs in mind:

- As previously mentioned, the distribution must be made directly from your retirement account to the qualified charity.

- You cannot transfer the distribution to donor advised funds or private foundations.

- Other than the one-time additional $50,000 QCD discussed above, QCD distributions cannot be made in exchange for a charitable gift annuity or into a charitable remainder trust.

- Also, beginning in 2020, the original SECURE Act permitted deductible IRA contributions for workers over 70 ½, but any such contributions reduce your eligible QCD amount. The above examples assume no deductible IRA contributions were made during the same tax year.

- Again, QCDs cannot be deducted as charitable contributions on Schedule A.

QCDs can be a very effective charitable giving strategy, but they require skilled consideration. Please reach out to us, and we can coordinate with your other advisors, including your accountant and tax attorney, to determine if making a QCD is the right strategy for you.

Recently increased from 72 with the passing of the SECURE Act 2.0 in late 2022.