Chart of the Month

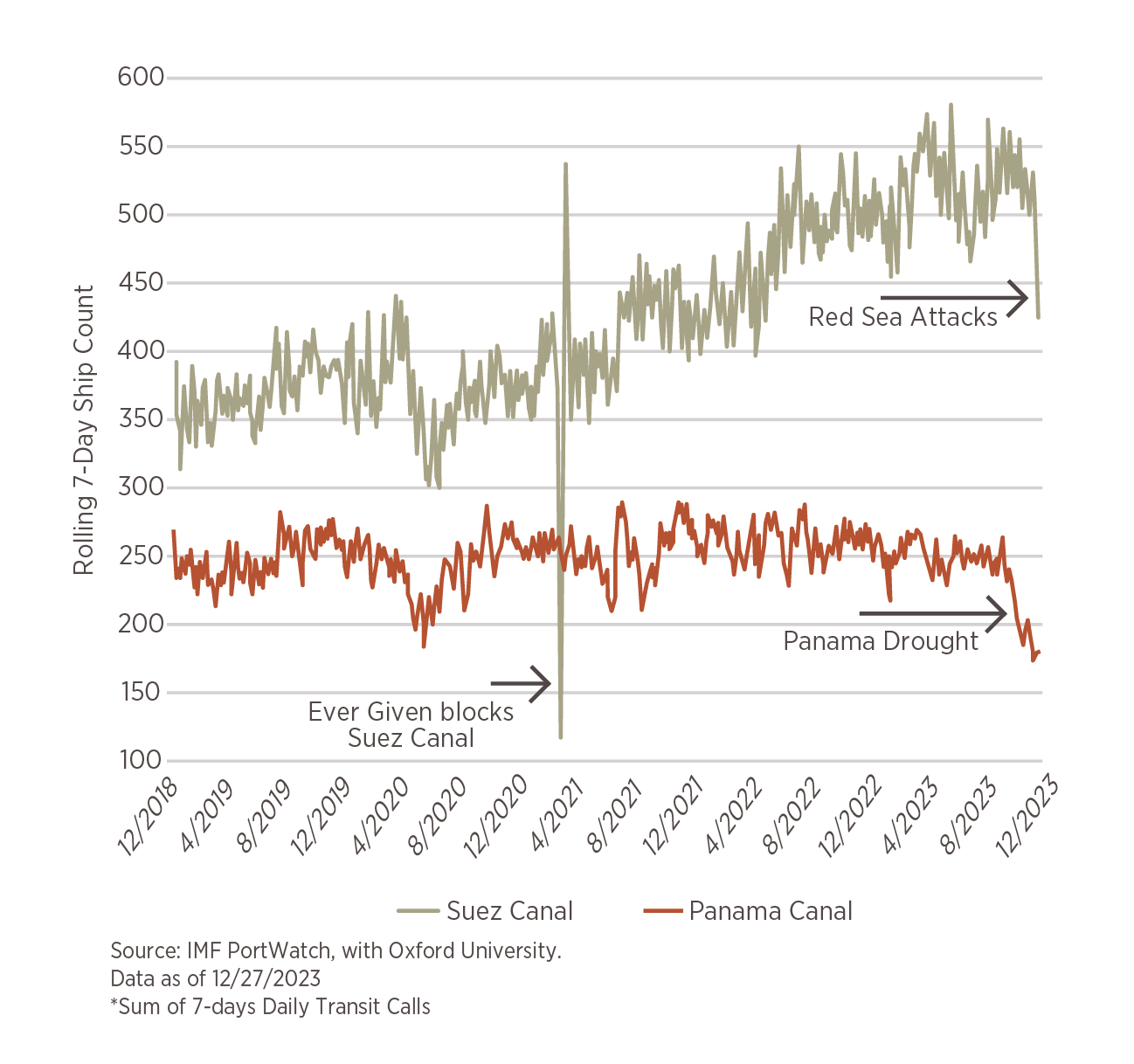

Air, Land, and Sea – the three modes of transportation – the “Sea” has recently entered a state of uncertainty and for more than one reason. Per the IMF PortWatch (in partnership with Oxford University), there are 13 chokepoints for global seaborne trade and 3 of them have come under stress: the (1) Panama Canal, (2) Suez Canal, and (3) Bab el-Mandeb Strait. The Panama Canal accounts for an estimated 5% of global sea trade while the Suez Canal and Bab el-Mandeb Strait, which bookend the Red Sea, account for an estimated 12%.

This month’s chart illustrates the drastic reduction in ships moving through these channels. For readability, we have only included the Panama and Suez Canal, but the chart for the Bab el-Mandeb Strait is nearly identical to Suez because ships must go through both to transport from Asia to Europe (or vice versa). The drop-off in the Panama Canal is a result of drought conditions, causing them to operate at only 55% of normal capacity (Capital Economics). For the Suez Canal, the recent drop is a result of spillover from the tense situation in the Middle East. A number of ships have been attacked in the Red Sea (Suez Canal sits at the northern end), causing the shipping companies to change course and take a much longer alternative route around Africa’s southern tip.

While the implications for inflation may not reverberate through the data points immediately, it is worth keeping an eye on as the recent events certainly put more pressure on supply chains as it will take longer for goods to get from point A to point B. The most recent example comes from nearly 3 years ago when the Ever Given containership got stuck sideways in the Suez, blocking all traffic for nearly a week.

As changes in your life occur, are you adjusting your financial plan accordingly? We’ve put together this 10-point checklist of key areas of your financial life. Take a look and see if you are ready for the year ahead.

- Life Changes (e.g., retirement, new family members, change of residence, etc.)

– Do you expect changes in your personal life that will significantly impact your financial plan ( switching jobs, changing your marital status, moving to another residence, etc.)?

– Are there significant events occurring that will impact your family members, such as children going to college or getting married, parental needs, etc?

- Overall Financial Plan Updates

– Do you have a documented financial plan that has been reviewed within the past six months?

– Do you expect significant changes to your income and expenses in the upcoming year?

– Does your budget reflect your values and priorities?

– Have you taken into account long-term compensation (e.g., stock options, restricted shares, etc.) and long-term savings (e.g., retirement plans?

- Emergency Fund Updates

– Do you have an emergency fund that would cover three to six months of expenses?

– Is your emergency fund able to be accessed easily i f necessary?

- Insurance Policies and Coverage

– Homeowners/renters: is it sufficient to cover your home and property against disasters?

– Life insurance: will it replace your income for your dependents?

– Disability insurance: do you have income support if you are injured or disabled?

– Healthcare insurance: do you have suitable healthcare insurance?

- Is It Time to Refinance?

– Are your current loans or credit cards at higher-than-market rates? Should you consider refinancing or consolidating these loans?

– If you have outstanding loans or credit, do you have a plan for paying back what you owe in a timely manner?

- Gifting to Heirs or Charities

– Have you considered making gifts to heirs while you are living to reduce the size of your estate?

– Do you have a charitable giving strategy? Have you considered bunching charitable donations for potential tax benefits?

- Estate Plans and Associated Legal Documents

– Do you have an estate plan in place that accurately reflects your intentions?

– Do you have a living will, healthcare directive, healthcare proxy, and durable power of attorney?

– Have any changes occurred that might require updates to these documents?

- Tax Changes That May Impact You

– Did any tax law or IRS rule changes occur that will impact your financial planning? These could include the following?

– Changes in tax rates or deductions

– Changes in contribution limits to retirement accounts

– Changes to required mandatory distributions from retirement plans

- Eligibility for Benefits and Retirement Planning Opportunities

– If eligible, should you take advantage of catch-up contributions to your retirement accounts or HSA?

– Are you hitting one of the key dates for eligibility for a government benefit or incentive this year ( e. g., 50 for catch-up retirement account contributions, 62 for Social Security, 65 for Medicare or 70 1 /2 for qualified charitable distributions)?

- Retirement Income Plan (if retired or semi-retired)

– Have you reviewed the status of your income sources ( Social Security, pension payments, annuities, etc.)?

– Have you reviewed your retirement expenses?

– Do your required minimum distributions ( RMDs) cover the balance of these expenses?

– Is your retirement plan able to weather the key retirement risks (e.g., longevity, healthcare, inflation, and poor market returns)?

– Have you made adequate accommodations for healthcare needs, including appropriate Medicare options?

Have questions? Our advisors are here to assist you. Contact us here.