Your questions are our top concern. Over the past few weeks, we have collected the most frequently asked questions about the market and financial planning. We will be sharing our responses and research here. Check back often as we will be continuously adding content. Upcoming topics include interest rates, recession fears, the bond market and the consumer sentiment index.

This week’s question:

What is the outlook for corporate profitability?

Posted on July 25, 2022

Transcript:

H! I’m Andrew Mies, Chief Investment Officer, for 6 Meridian. Thanks for joining us for another segment of Your Questions Answered.

Today the question we’re going to tackle is, what’s the outlook for corporate profitability?

When you look at the stock market there are two drivers for its valuation: the price-to-earnings ratio (PE ratio) and corporate profitability or corporate earnings. In our previous segments, we talked about the decline of the PE ratio for the S&P 500 has experienced this year due to the increase in interest rates and so today we’re going to take the other side of that equation. What’s our outlook for earnings?

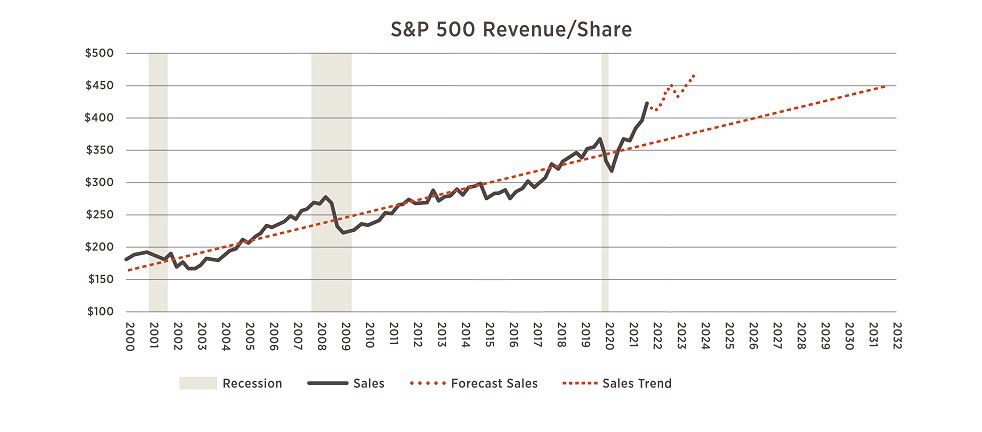

The graph you see on your screen shows you the actual revenue per share for the S&P 500 going back to year 2000, and what you see is that it has ebbs and flows and the shaded areas on the graph represent times of recession. During a recession, typically you see revenues decline. We lay in a red straight line dotted straight line and that shows you the trend for corporate revenue going back over this period of time and this is useful because we can extend that line out and it shows us what is the trend expect for corporate revenues over the next several years.

When you look at this data, you see that the current revenue per share is as far above trend as we’ve ever been. That’s driven by two factors; primarily number one, the fiscal stimulus that we saw from Washington, D.C. post COVID and number two, the very easy financial conditions provided by the federal reserve.

Both of those are in retreat. The fiscal stimulus payments have ended, and the federal reserve is tightening financial conditions. The reason that the fiscal stimulus is so important is because the way the economy works when Washington, D.C. sends money out to individuals and to small businesses. Over time, almost all that stimulus ends up on the income statements of the largest companies. That’s just how the US economy works.

So going back to our question, which is, what is the outlook, when you look at the data and you look at what’s changed, we think that it’s likely that corporate revenues are going to trend back over time towards the trend line but that’s not what Wall Street is currently forecasting. We’ve added in now the dotted line showing the forecast for the next couple of years for corporate revenue and you see it’s a continuation of the very strong growth.

We think that’s optimistic, and we think that it’s likely that over the next several years, corporate revenues will revert back towards the trend line. That can happen a couple of ways. We could have a couple of years or several years a very modest revenue growth or we could have a recession which would be induced by what the federal reserve is doing right now by raising interest rates and tightening financial conditions. Either way, we think that the outlook that Wall Street’s presenting is too optimistic.

Thank you for your time please reach out to your advisor if you have any further questions. Have a great day.

-Andrew Mies, CIO, 6 Meridian

–Recorded on July 15, 2022

Previous week’s question:

What is the story behind the rise in interest rates?

Posted July 12, 2022

Transcript:

Hi, I’m Andrew Mies, Chief Investment Officer for 6 Meridian. Thanks for joining us on another segment of Your Questions Answered. Today, we’re going to talk about what is the story behind higher interest rates.

If you recall in our last video, we looked at the decline in the stock market year-to-date and when we decompose that decline, it was clear that rising interest rates were a big driver of that decline. So today we’re going to look at what’s happened over the previous year that’s caused rates to move so much higher.

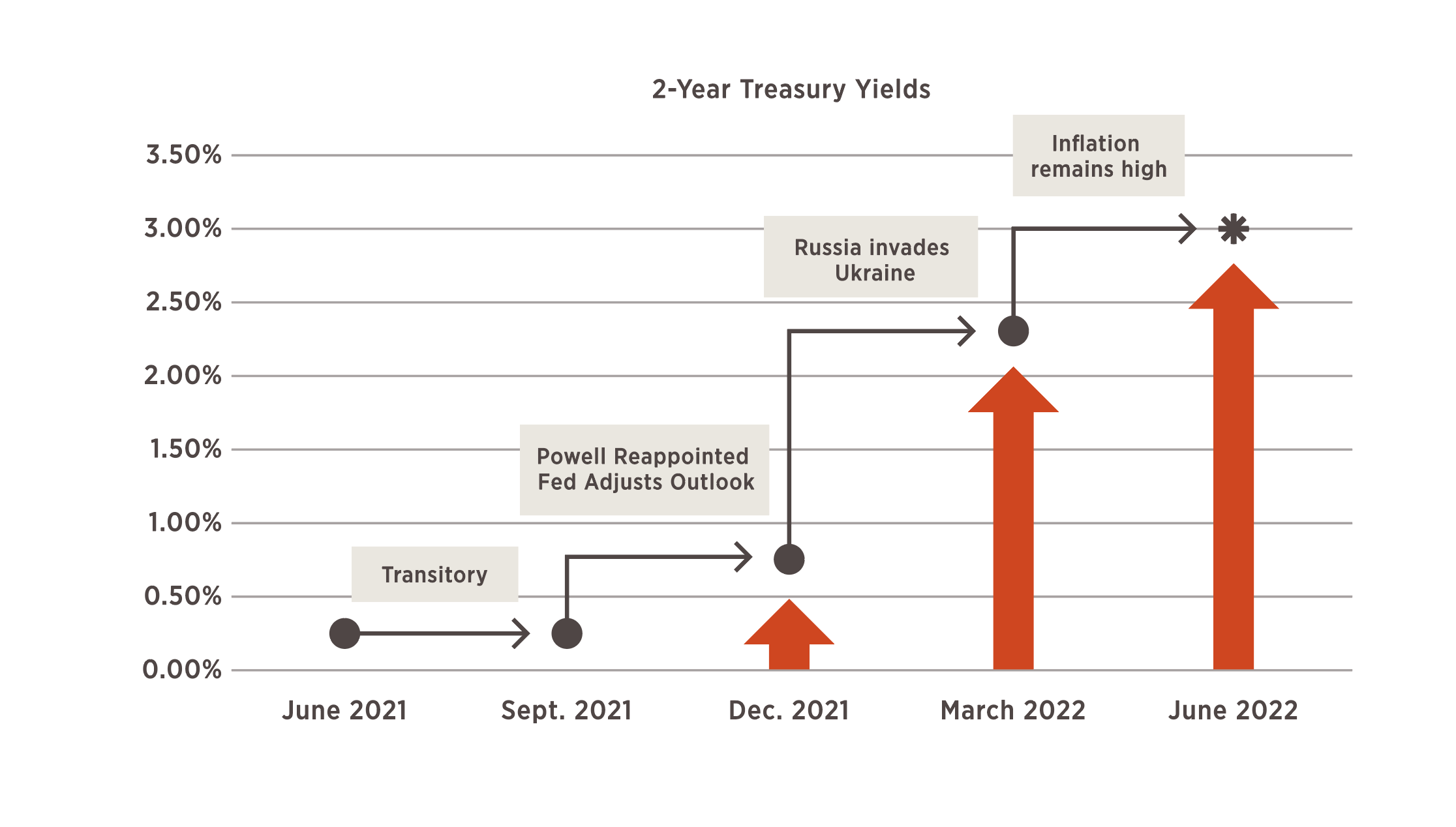

June of last year, June 2021, the 2-year Treasury was yielding 25 basis points, 0.25%. Today the 2-year treasury is yielding 3%. The reason that the 2-year is so important because it incorporates investors’ best guess of what the Federal Reserve is likely to do going forward. So, when we look over the last year, the primary driver of the increase in rates is changed expectations by investors for what the Fed is likely to do. So, what’s changed in the Fed’s thinking? If we go back to the third quarter of last year, Jerome Powell, the chairman of the Fed, and most Fed Governors, as well as a lot of leading economists, were talking about the inflation that the economy was experiencing as being ‘transitory’.

And that simply means that the inflation we were experiencing was due to supply chain constraints, shipping issues and other things going on in the economy, that were a result of the Covid crisis when we went into the fourth quarter. Jerome Powell was renominated for a second term as chairman of the Federal Reserve, and he started to talk about the entrenched nature of inflation and the strong economy and the need for the Fed to probably tighten financial conditions starting in ‘22.

So as a result, the 2-year treasury started to trade higher. It ended the fourth quarter at roughly 1%. When we came into 2022, the expectation was the Fed would have modest hikes and they would gently reduce the size of the balance sheet. But then Russia invaded Ukraine in February and that caused commodities to spike significantly. The market then interpreted this as being further reason for the Fed to become more restrictive and tighten financial conditions further. And at the end of the first quarter the 2-year treasury had a yield of 2.5%. In the second quarter, which just ended, brought more information to observers with regards to the components of inflation and most of that information led observers to believe that we had a more entrenched problem. The Fed was going to have to be more aggressive. The Fed confirmed those beliefs from testimony that Jerome Powell gave to the Senate and speeches that he gave regarding his intention to stamp out inflation, even if it caused a recession.

We believe that the Fed is behind the curve and that the Fed probably was too late to tighten financial conditions. Part of this could be due to the third quarter of last year and the fourth quarter of last year, when it was unclear Jerome Powell was going to be renominated to head the Fed, and as a result, he was probably a little slow in starting the tightening process.

Thanks for joining us today. If you have any questions, please reach out directly or contact your 6 Meridian advisor. Have a great day.

-Andrew Mies, CIO, 6 Meridian

-Recorded on July 8, 2022

Previous week’s question:

What is driving the equity market sell-off?

Posted June 28, 2022

Transcript:

Andrew Mies: Welcome to Your Questions Answered where we address a variety of topics that are related to what’s going on in the financial markets. Today, we’re going to talk about the equity risk premium. The equity risk premium is what you get paid as an investor for owning risky stocks instead of owning risk-free bonds.

This is a premium that can be measured in the market at various different times. It’s never fixed. It’s never exactly set but what it does is it gives you some sense of what type of return you should expect to earn over time.

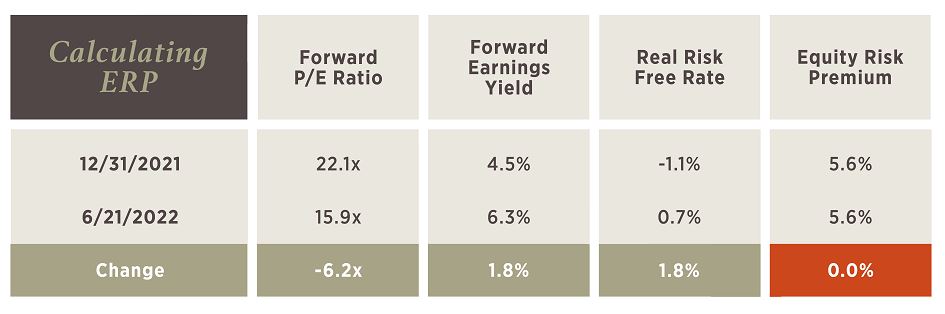

How is the equity risk premium calculated? There are two components to the calculation that we can observe in the financial markets and then we apply math. The starting point is the forward PE ratio.

For the S&P 500, we take the inverse or just one divided by the PE ratio, and that gives us the forward earnings yield. From there we look at the real free interest rate, which is the 10-year treasury yield less expected inflation that gives you a real interest rate. And once we have those two components, we take the forward earnings yield, we subtract out the real risk-free rate, meaning what is it that we can earn without taking any risk and that delivers the equity risk premium. The equity risk premium is just the spread that you earn for taking on the risk of being a stock investor.

When we look at what’s happened in the market so far this year, we’ve seen a pretty significant drawdown in the value of the stock market and what we did is we broke it down into the components of that drawdown.

If you go back to December 31st of last year the S&P 500 was trading at 22.1. If we take the inverse of that or just take one divided by the forward PE that gives us what the forward earnings yield is for the S&P 500 and at that time it was 4.5%.

At the same time, we look at the real risk-free rate, which is what is the 10-year treasury yields after you subtract out future expected inflation, and that’s -1.1% and that gives you an equity risk premium of 5.6%. Now let’s fast forward to June of this year and the markets obviously sold off. The current forward PE ratio is 15.9 times and if we take the inverse of that that gives us a forward earnings yield of 6.3%.

We then look at what’s happened in interest rates. And this has been the big move that’s taken place. The real risk-free rate has moved up to 0.7%. When we do the math and we subtract the real risk-free rate from the forward earnings yield, we end up with an equity risk premium of that is exactly the same; 5.6%.

So what does this mean as an investor? It means that the entire drawdown in the equity markets is primarily attributable to the change in interest rates. It hasn’t incorporated concerns about future recession or concerns about what’s going on in Ukraine or concerns about China lockdowns. And so the expected spread or the expected Equity risk premium that you’re earning is exactly the same as it was at the end of last year.

If you have any more questions, please feel free to reach out to your 6 Meridian advisor or check out our content on our website. Thank you.

-Andrew Mies, CIO, 6 Meridian

-Recorded on June 24, 2022