The COVID-19 pandemic and the resulting economic decline have changed the way many business owners operate. Challenges such as inflation, high interest rates, decreased consumer spending on nonessential items, and rising bankruptcies have had a significant impact. According to data from the International Business Brokers Association (IBBA) as of 2024, there is an oversupply of potential small business buyers and an undersupply of high-quality businesses for sale.1

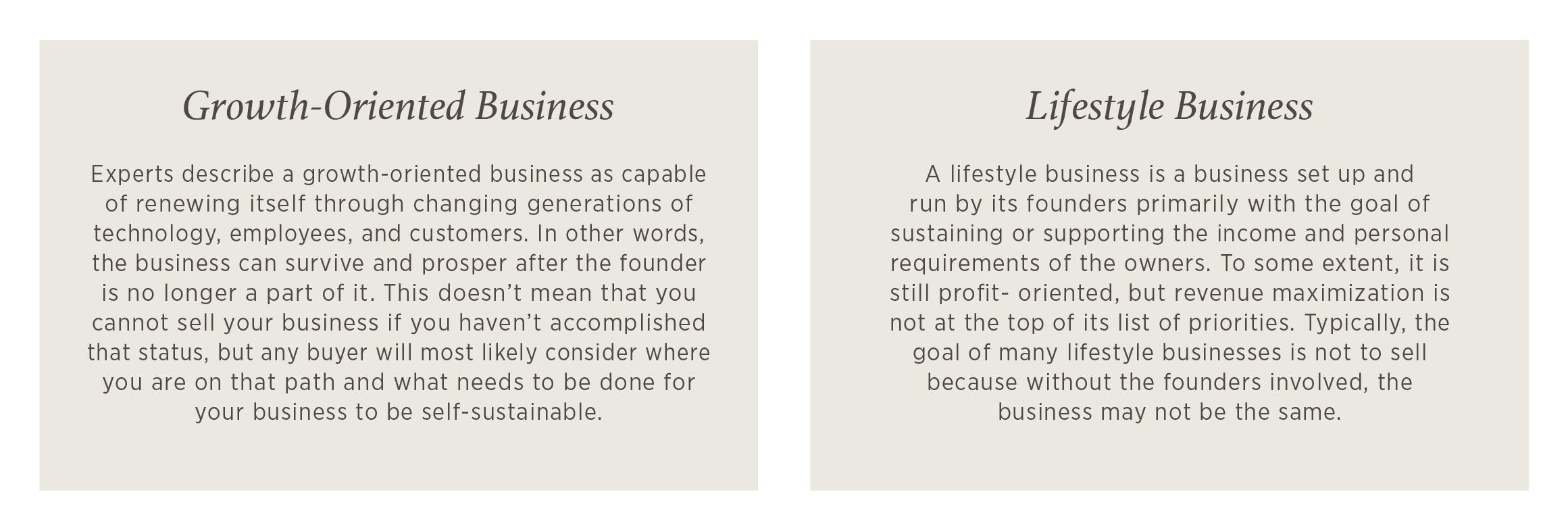

With this in mind, it is imperative for businesses to have fundamental value drivers that make their business attractive to potential buyers. This is why the first step before considering selling your business is acknowledging what type of business you own: a lifestyle or a growth-oriented business. Knowing which category your business falls into will help shape your expectations and determine the next steps to take.

Lifestyle vs. Growth-Oriented

It is common to confuse a lifestyle business with a growth-oriented business, but not knowing this distinction before you start planning to sell your business can prove to be a costly mistake. According to a 2023 study from MassMutual, 84 of business owners believe they could sell their business at a premium or for market value. However, only 54% of those surveyed stated that they would only be able to afford their lifestyle for more than 10 years after they sell.2 As those who have gone through the process of selling their business would tell you, identifying what type of business they want to run versus the type of business they need to run to fulfill that goal helped them more easily prioritize and execute their strategy.

Another way to think about whether your business falls into the lifestyle or growth-oriented business category is to ask yourself: What would it take to align my expectations when selling my business with the work I am willing to put into my business to appeal to more buyers? This decision is one that only you (and not the competition, economic environment, employees, or customers) can make. More concisely, if you are the value of your business, a buyer is less likely to pay for it without you. If that is the case, are you willing to put in the work it takes to create a valuable business without “you” as the driver of value?

What Drives Your Business Value?

Every entrepreneur who is considering selling their business should look closely at the aspects that can increase the purchase price and make that business more appealing in the marketplace. These characteristics are commonly known as “value drivers” and are primarily under your control. Below are five of the most relevant value drivers that you can start improving or assessing today.

01| High-Performing Management Team

The importance of having a high-performing management team under your direction cannot be emphasized enough. As most business leaders and acquisition literature states, this value driver will be the most impactful in the buyer’s eyes. Answer questions such as:

- Are you involved in all executive decisions?

- Do clients expect you to be their point of contact?

- Do clients expect you to be their point of contact?

- Do you manage most or all areas of the firm?

- How about vendors; do they only negotiate with you?

- Do most employees report to you?

- Are you the rainmaker?

If the answer to these questions is yes, you need to start developing a management team that can ultimately function without you. Having that mentality as you grow, mentor, and promote will help align your entire company with your exit strategy. What does a well-functioning management team look like? That will be defined mostly by the ability of the team to continue the growth and operation of the company without your involvement.

Just as important as the ability to run the firm, the culture your management team lives by can be impactful to the future value of the firm. Alignment with your values, vision, and approach to decision-making is key for the sustainability of the firm. When setting up your teams while gearing up to sell your business, think about how they fit with your company culture, and if they can continue down a growth path based on the solid foundation built.

02| Operating Systems

The second value driver that business owners need to focus on when preparing their companies for a sale is their operating systems. Not only does this include the actual systems used to operate services and transactions of services, but also the logistical processes, efficiency, and scalability of such systems.

The impact of this value driver could dramatically change depending on the industry. Understanding how important your operating systems can be for your company’s growth will determine the amount of time and money you will need to spend developing or refining them in preparation for your business to be sold.

When looking at your company’s operating systems, one factor that will be in most buyers’ minds is scalability. Can your business handle an increase in demand without breaking down or negatively affecting service quality and profit margins? This simple question can be the litmus test for the status of your operating systems. Other questions to ask yourself include:

- Can your company take on 10% more clients next week? Next month?

- Can it handle a 50% increase with the current setup and systems?

- Does everyone in your company know what to do if demand increases?

Thinking about this challenge when preparing your company to sell helps you improve and evolve as a firm and can shine a light on the importance of operating systems within your business model.

03| Recurring Revenue And Customer Concentration

Two often-overlooked value drivers by business owners — but never by the buyers — are the amount of recurring revenue and customer concentration. The simplest way of looking at these two variables is, the largest recurrent revenue and the lowest customer concentration your business can have, the higher the eventual valuation of your company will be.

Customer concentration depends on the specific industry and business model you’re using, but a good rule of thumb is that if any single customer accounts for more than 10% of your revenue, or the top five customers account for more than 25% of your revenue, you might have a customer concentration issue. Having the right contracts in place, documentation, and sometimes even a plan “B” can help mitigate valuation pains later on.

A healthy exercise that you and your firm can do no matter the type of business you have is to go through an outside valuation. “Going through a valuation is the equivalent of getting a physical and having a record of your vitals,” explains CEO of Lexington Wealth Management Michael Tucci. “We looked at it as a way to clearly identify drivers for productive and sustainable growth and helped us focus on what mattered to not just us, but also to the outside world.”

04| Cash Flow and Financial Controls

As is commonly known in the business world, what gets measured gets results, and this mantra couldn’t be more crucial when it comes to the financial goals of your business. Having a good and improving cash flow sounds like a given when thinking of preparing your business for a sale, but it can be a really difficult goal to accomplish in a sustainable way. The first step to achieving this goal is to measure it and have the right financial controls in place.

As most sellers would share, this exercise can be the most difficult one to go through, because it requires a constant look into how the business spends money and sets up controls and accountability locks along the way — not just focusing on the growth of new sales. To better understand the importance of these two synergies, BizEquity, a business valuation company, incorporates two analyses commonly understood by business owners as the north stars for their valuations: the seller’s discretionary earnings (S.D.E.) analysis and net cash flows to invested capital and discounted cash flow analysis.

Focusing on what is valued or measured by buyers will guide you to set the right financial controls. For example, as part of the S.D.E. analysis, buyers will consider what owner’s perks and salaries are included in the regular cash flows of the company. From cell phone bills to car leases and insurance, paying attention to these often-overlooked line items can help you slowly but surely increase the value of your business.

05| The Right Legal Entity

The last value driver to pay attention to before considering selling your business is to make sure you have the “right” legal entity in place. This particular value driver needs to be thought through with more advice and preparation time than others. The consequences of having the right entity in place will affect the tax structure of the sale, your personal tax bill when the transaction occurs, and ultimately the impact that such will have on your personal financial planning.

As many financial advisors with business owners as clients might point out, the legal structure at the selling point will most likely affect the timing of taxes paid and either shorten or extend your expected retirement plans.

“Either you are investing in the business, or you are investing in yourself,” Robert Warren, a partner at Twickenham Advisors shared. “Facing paying taxes, versus increasing the long-term value of your firm, will be determined by the expectation of the business and the legal structure of it.” In other words, alongside the determination of realizing if you have a lifestyle business or a growth-oriented one, the way the business is incorporated will drive a significant part of the value for you after selling.

If you are getting prepared to sell your business and are seeking a second look from professionals, don’t hesitate to reach out to set up an introductory meeting.

1. IBISWorld – industry market research, reports, and statistics. (n.d.). https://www.ibisworld.com/united-states/market-research-reports/business-brokers-industry/#IndustryStatisticsAndTrends

2. The importance of mitigating risk. (2023). In MassMutual. Massachusetts Mutual Life Insurance Company (MassMutual®). Retrieved August 13, 2024, from https://fieldnet.massmutual.com/public/bizmarket/pdfs/sb1163.pdf