Chart of the Month

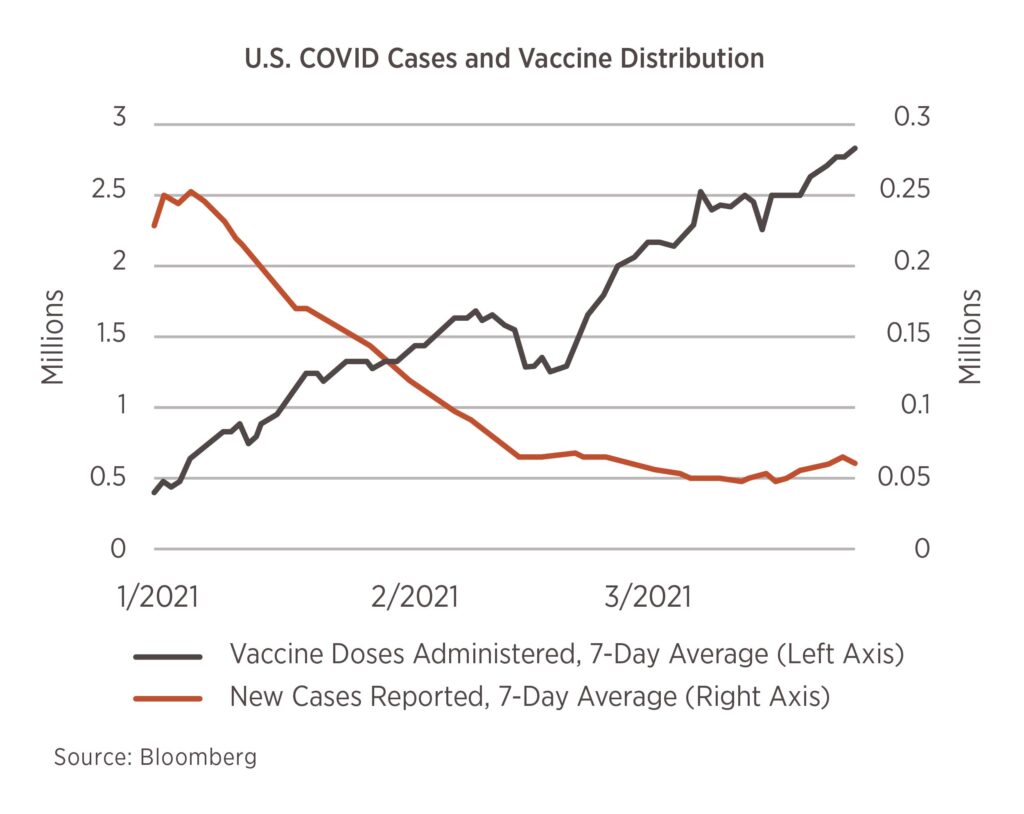

Looking back over the past year, financial markets have gone on an incredible run. The S&P 500 index of large cap US stocks rose by 54%, while the Russell 2000 index of small cap stocks rose by 93%. The yield on the 10-year treasury note has risen from 0.58% to 1.74%. A low starting point from the depths of March 2020, monetary support from the Fed, and fiscal support from congress have all played a role. However, the core of the market’s recovery has been the anticipation of a strong economic recovery as the pandemic subsides. As this month’s chart shows, that moment may be moving closer. Distribution of vaccines has reached a pace approaching 3 million doses a day in the US. Reported new COVID cases are down significantly from the beginning of the year. Given this pace of improvement, we may well see the economy catching up to the market’s expectations in the near future.

Advantages and Disadvantages of a Roth IRA Conversion

Thanks to a couple of factors, some investors are thinking about this move. However, it is crucial to understand the benefits and consequences of a Roth IRA conversion.

Do Roth IRAs seem even more attractive these days? Perhaps. You can cite two factors: current tax rates and the passage of the Setting Every Community Up for Retirement Enhancement (SECURE) Act.

Roth IRAs differ from traditional IRAs. Typically, distributions from traditional IRAs must start once you reach age 72, and the money distributed is taxed as ordinary income. When distributions are taken before age 59½, they may be subject to a 10% federal income tax penalty (although, the CARES Act does allow for some exceptions to those penalties for the 2020 tax year).1

On the other hand, if you are the original owner of a Roth IRA, you do not have to start taking distributions at age 72. And if you are least 59½ years old and have owned the Roth IRA for at least five years, any distributions you take may be exempt from federal taxes.2

Converting a Traditional IRA to a Roth IRA is a taxable event. You pay ordinary income tax on the converted amount. And federal tax rates are now near historic lows, thanks to the Tax Cuts and Jobs Act, and they are scheduled to stay there through 2025.3

A Roth conversion may be appealing purely from an income tax perspective. Taxable incomes have declined for many households due to recent economic slowdown, resulting from the COVID-19 pandemic in 2020, and it might put some traditional IRA owners in lower tax brackets this year. Add in the fact that federal income tax rates are low, to begin with, and 2020 could be a good time to go Roth.3

Why Roth IRA conversions not be advantageous. While the idea of no required minimum distributions and tax free withdrawals may sound appealing, it does not mean Roth conversions are the best strategy for every situation. Here are a couple reasons why a Roth conversion may not be the answer:

You don’t have enough outside funds to pay the conversion tax. This is by far the largest consideration for a Roth conversion. If you have to use your IRA to pay the conversion taxes, you are eroding the future earnings power of that account. And because amounts converted to a Roth IRA are subject to income taxes, a large conversion may be enough to push you into a higher tax bracket.

You are near retirement or will be in a lower tax bracket in the future. As discussed above, converted amounts will be subject to state and federal income taxes. If you are still working, you are likely in a higher tax bracket than you will be once you retire. Roth conversions are most beneficial for investors who will find themselves in a much higher tax bracket in later years when they would be taking IRA withdrawals.

Remember, this article is for informational purposes only. It does not replace real-life financial or tax advice. Be sure to consult a tax or financial professional before making any decisions regarding your traditional IRA or Roth IRA.

Written by Jordan Swisher, CPA, CFP® & Marketing Pro

Citations.

1. TheStreet, May 13, 2020

2. NerdWallet, July 31, 2020

3. Bankrate, July 21, 2020