More than 53 million Americans administer care to their loved ones, with 61% of those caregivers being women.1 But, caregiving as a woman has greater costs compared to male caregivers. Caregivers are often unpaid for their labor, therefore, for female caregivers, this exacerbates the already existing gender pay gap and makes it harder for women to achieve their financial goals. Next, we detail the various factors that can impact the financial wellbeing of women when they care for their loved ones and how we at 6 Meridian can help women find balance in caregiving and financial planning.

The Sandwich Generation

The sandwich generation refers to individuals who find themselves balancing the responsibilities of caring for both aging parents and their own children. Notably, 48% of those in this demographic are women.2 Members of the sandwich generation often experience significant strain as they juggle their children’s needs—such as transporting them to school and extracurricular activities, assisting with homework, and providing overall guidance—while also supporting their elderly loved ones. This geriatric support can include arranging doctor’s appointments, preparing meals, and managing finances.

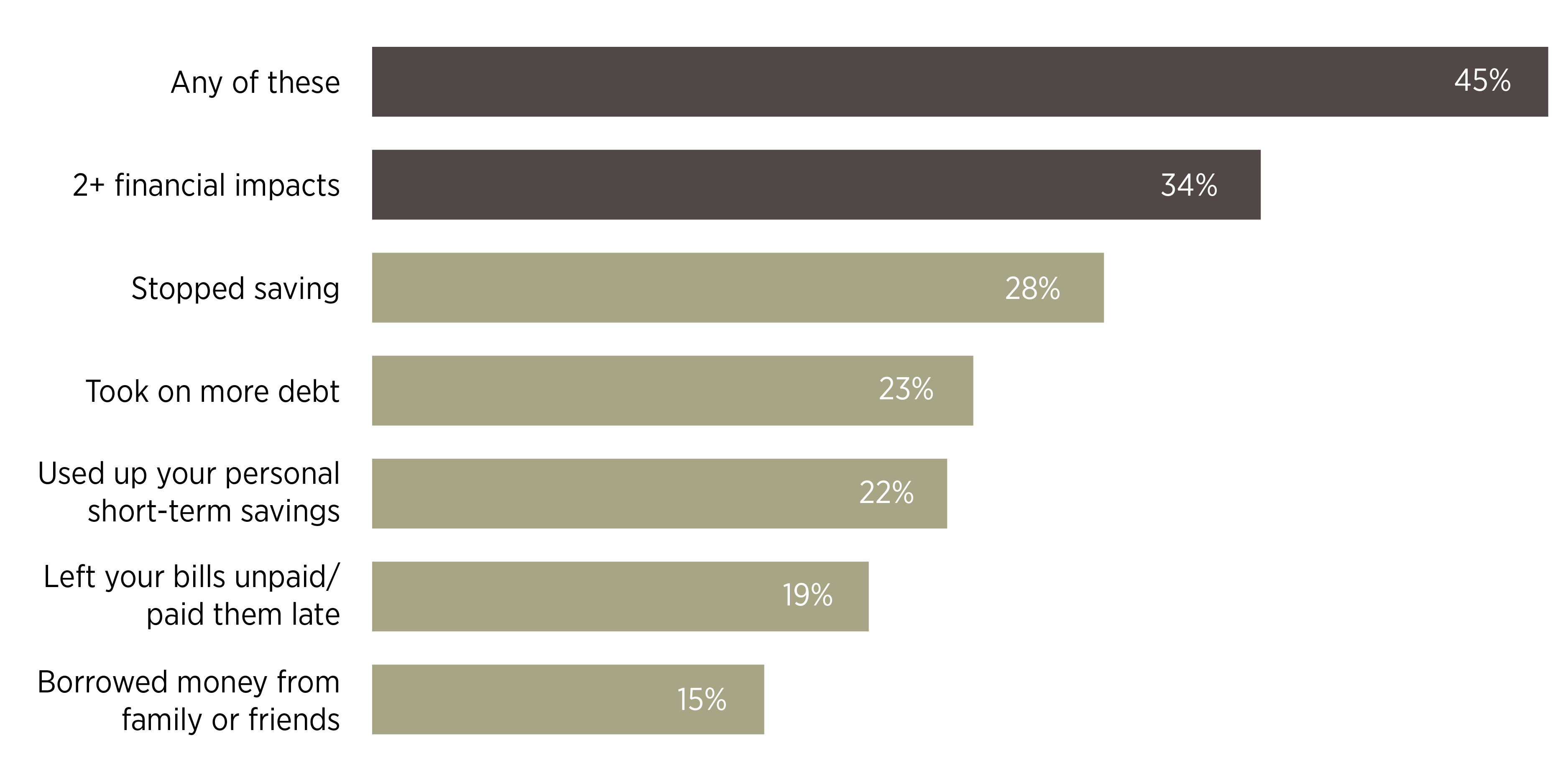

In addition to the emotional and physical demands, many in this generation face substantial financial burdens. They may find themselves halting their savings, accumulating debt, or depleting their hard-earned savings to cover long-term care costs and educational expenses for their children.

Impact on Career Trajectory

According to a study conducted by Edward Jones, nearly two-thirds of women in the sandwich generation reported that their caregiving responsibilities have adversely affected their ability to save for financial goals. This is largely because many caregivers need to reduce their work hours, leave the workforce entirely, or even retire early to meet the demands of their loved ones. The pandemic highlighted this issue, as many women faced the difficult choice of stepping away from their jobs to care for children when daycares and schools abruptly closed due to lockdowns.3 Unfortunately, taking a temporary or permanent leave of absence can create a ripple effect on their finances. The loss of employment leads to dwindling earnings and savings, and over time, it can also diminish their Social Security benefits. Additionally, returning to the workforce is increasingly challenging for these women, as they often face disadvantages in tenure compared to their male counterparts, which exacerbates the gender pay gap-Caucasian women earn an average of 82 cents for every dollar earned by men, while Black and Latina women earn 62 cents and 54 cents, respectively.4

Becoming a Care Recipient

The Office of the Assistant Secretary for Planning and Evaluation estimates that 75% of women over the age of 65 will develop severe long-term care needs before they die, compared to 64% of men. Given that women typically live longer than men, they and their families face significant challenges in financing long-term care. Ideally, elderly care recipients would rely on Social Security for income and have their medical expenses covered by Medicare. However, lapses in workforce participation can reduce the benefits women receive, and many long-term care services are not covered by Medicare. This situation can create a generational domino effect: women who once served as caregivers may find themselves in need of care, becoming dependent on their daughters and granddaughters for healthcare assistance and financial support.

Conclusion

Being a caregiver can significantly take a toll on the physical, mental, and financial wellbeing of women. To maintain a good quality of life, it’s essential for them to strike a balance between the demands of their careers and their responsibilities at home. Our advisors are dedicated to helping women achieve this balance. Whether you aim to boost your savings, invest for the future, fund your child’s education, or secure long-term care insurance for your elderly loved ones, we can create a tailored plan to help you reach your goals. Don’t hesitate to reach out to discover how we can support you on this journey.

1 Cothran, F. A., Heinz, P. A., & National Alliance for Caregiving. (n.d.). The economic effects of family caregiving on women (By

National Alliance for Caregiving). https://www.tiaa.org/content/dam/tiaa/institute/pdf/insights-report/2022-07/tiaa-institute-nacthe-

economic-effects-of-family-caregiving-on-women-wvoee-cothran-july-2022-0.pdf

2 Edward Jones. (2024, September 16). Women’s Responsibilities Impact Financial Goals. Edward Jones. https://www.edwardjones.

com/us-en/why-edward-jones/news-media/press-releases/women-responsibilities-impact-financial-goals

3 Women and the Workplace — What We Learned from COVID. (n.d.). https://www.americanbar.org/groups/crsj/publications/

human_rights_magazine_home/labor-and-employment-rights/women-and-the-workplace/

4 LeaMond, N. A. (2024, February 20). Give some, lose some: Why women caregivers face more financial instability. Blogs. https://

blog.aarp.org/fighting-for-you/why-women-caregivers-face-more-financial-instability

5 What is the lifetime risk of needing and receiving Long-Term services and supports? (2019, April 3). ASPE. https://aspe.hhs.gov/

reports/what-lifetime-risk-needing-receiving-long-term-services-supports-0