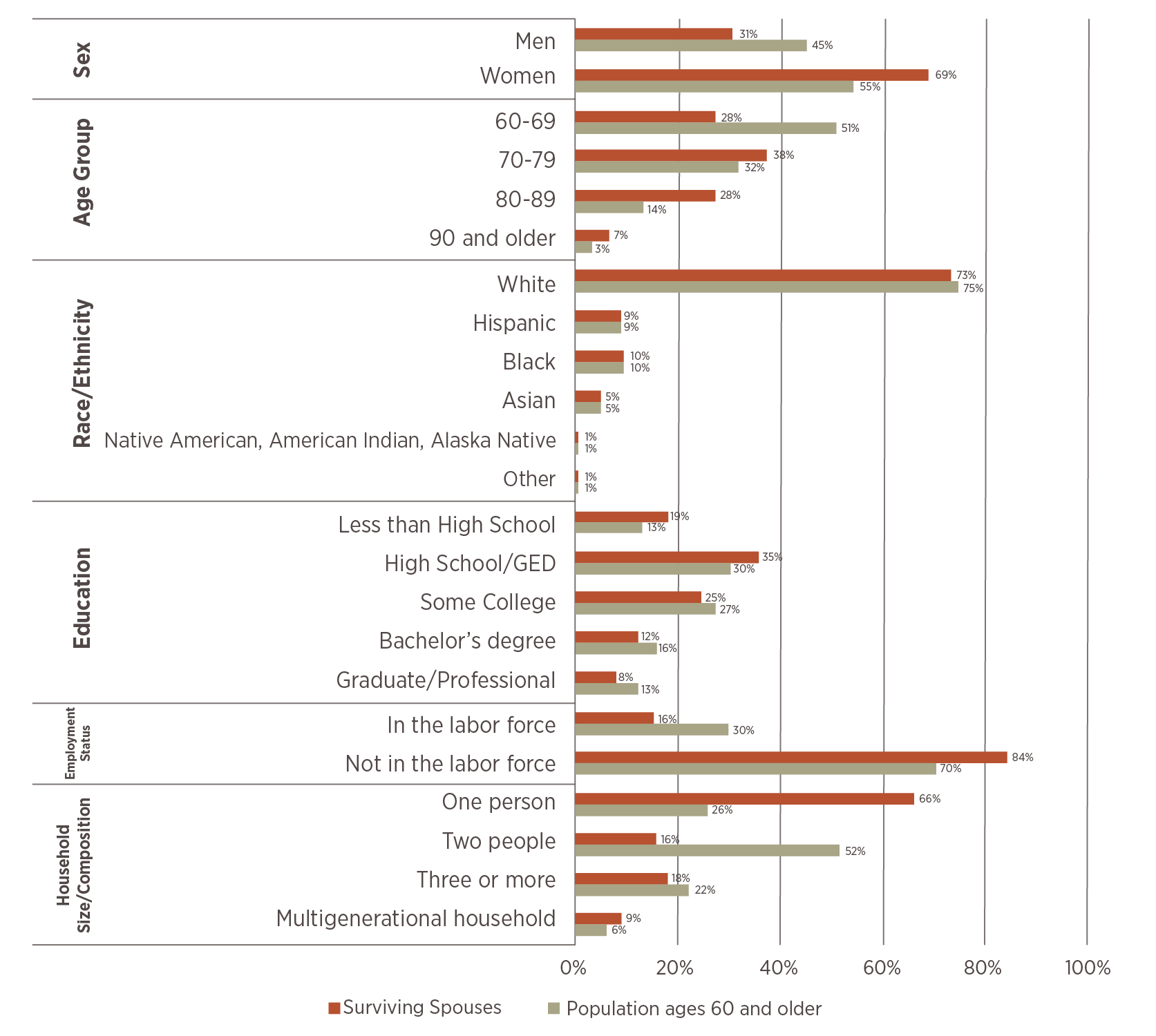

Given that women’s life expectancy in the U.S. is five years longer than men, they are highly likely to outlive their male spouses.1 In fact, U.S. Census data shows that 69% of women who are 65 or older have experienced the death of a spouse.2

While some women decide to remarry, many remain single, taking on the full responsibility of managing household finances that were once supported by two incomes. This significant life change can be mentally and emotionally overwhelming, as women are navigating grief while also facing new financial questions.

During this transitional period, it’s crucial for women to find a financial advisor who understands their situation and is equipped to help them rebuild financial stability.

Here are four key topics to discuss with an advisor after the loss of a spouse:

01| Financial Assessment

Loss in income due to the death of a spouse is inevitable. On average, individual annual income falls by $5,500 (11%) after the death of a spouse and remains at that level for the following two years. With that in mind, widows should work with their financial advisors and write out their current finances, including any assets, savings, anticipated income, debts, and expenses.3 This exercise can help them, and their advisor, visualize and uncover whether there are any gaps between income and expenses. From there, an advisor can help to establish a budget that matches the widow’s current financial situation.

Gathering documents such as wills, investment account documents, deeds, life insurance policies, retirement policies, Social Security and Medicare information, and any other relevant financial records is another important step. Advisors will be able to review these and see what percentage of funds their client is entitled to as a beneficiary. They also may determine whether the widow is entitled to apply for survivor benefits from their spouse’s Social Security that they paid into before their death. These benefits can be crucial in offsetting lost income.

Talk with your advisor to see how you can best maximize survivor benefits along with the individual Social Security that you have paid into over the years.

02| Taxes

When a spouse passes away, an individual’s tax filing status with the IRS changes, too, which can lead to a higher tax bracket, a reduced standard deduction, and the loss of certain tax benefits. This situation is particularly common among women and has been referred to as the “widow’s penalty.” The surviving spouse can still file as married filing jointly for the year of their spouse’s death, provided they do not remarry within that tax year.

After that year, the widow will need to file as single unless they qualify for the Qualifying Surviving Spouse status. This status can be claimed for up to two years following a spouse’s death. To qualify, specific criteria must be met, including:4

- Entitled to file a joint return with a spouse for the year the spouse died.

- Had a spouse who died in either of the two prior years and do not remarry before the end of the current tax year.

- Have a child, stepchild, or adopted child who qualifies as a dependent for the year or would qualify as a dependent except that the child does not meet the gross income test, or does not meet the joint return test, or except that the surviving spouse may be claimed as a dependent of another taxpayer. The widow also must live with this child in their home all year, except for temporary absences.

Anyone who doesn’t meet that criteria will have to file single in the second year after a spouse’s death.

Talk with your advisor to see how you can optimize your taxes in the year you file jointly so that you don’t become subjected to a higher tax bill.

03| Estate Planning and Assets

During the probate process of a spouse’s estate, it’s essential to collaborate with an advisor to update estate plans and ensure a smooth transfer of property ownership. Many married couples designate their spouse as the beneficiary or executor of their estate. However, after the loss of a spouse, it’s crucial to revise the beneficiary designations on life insurance policies and retirement accounts.

Consider granting an adult child or another trusted individual authority over healthcare decisions by appointing them healthcare proxy and signing a HIPAA release form. This will allow them access to medical information about the woman when necessary. Additionally, it’s wise to designate someone as your Power of Attorney to manage business, legal, and financial affairs in the event that the surviving spouse becomes incapacitated.

04| Estate Planning and Assets

Even after death, we leave behind a digital footprint that can unfortunately be exploited by scammers. Unscrupulous individuals often scour obituaries, social media, and stolen death certificate records to identify deceased individuals with significant assets, aiming to steal their identities. This troubling phenomenon, known as “ghosting,” typically occurs before the death is reported to banks, credit reporting agencies, or government organizations like the Social Security Administration and the IRS.5

To protect against this, it’s advisable to limit personal information in obituaries, as they are public records. Additionally, promptly notifying government agencies, including the state’s Department of Motor Vehicles, about the deceased is crucial. Contact major credit reporting bureaus to place a “deceased alert” on the individual’s credit reports and monitor for any unusual activity.

While managing the responsibilities that arise after a loved one’s passing is important, prioritizing mental health is essential. This is a significant life change and no one should be rushed into making major financial decisions.

At 6 Meridian, our approach is rooted in empathy and we are here to provide informed advice. Please don’t hesitate to reach out with any question or if you simply want to talk.

1 Dattani, S., Rodés-Guirao, L., & Roser, M. (2024, March 19). Why do women live longer than men? Our World in Data. https://ourworldindata.org/why-do-women-live-longer-than-men

2 U.S. Census Bureau. (2024, April 10). Marriage, divorce, widowhood remain prevalent among older populations. Census.gov. https://www.census.gov/library/stories/2021/04/love-and-loss-among-older-adults.html

3 Financial life after the death of a spouse – Federal Reserve Bank of Chicago. (n.d.). Retrieved November 13, 2024, from https://www.chicagofed.org/publications/chicago-fed-letter/2020/438

4 Understanding taxes -Filing status. (n.d.). https://apps.irs.gov/app/understandingTaxes/hows/tax_tutorials/mod05/tt_mod05_07.jsp

5 Navigation WMG, Fort Lauderdale FL. (n.d.). Navigation WMG. Retrieved November 8, 2024, from https://fa.wellsfargoadvisors.com/NavigationWMG/After-the-Loss-of-a-Loved-One,-Watch-Out-for-Scams.c10258.htm