Workplace retirement plans have become increasingly complex over the last few decades— but with that complexity also comes more opportunities for companies of any size to offer this valuable benefit to employees.

In the past, any employer that wished to sponsor a defined contribution plan, like a 401(k), adopted its own individual plan, with fairly limited choices. However, now there are multiple options, which is a good thing, but it can also become extremely confusing for small and mid-sized business owners.

Some business owners may think a 401(k) savings plan for themselves, and their employees isn’t right for your business. Regardless, both you and your employees must prepare for eventual retirement, and a qualified retirement plan is a tax-advantaged way to help get you there.

We understand just how time-consuming running a business is, so we’ve put together a guide to help you decide which plan is best for you and your employees.

Did you know?

According to a 2023 report from the U.S. Bureau of Labor Statistics, only 56% of the adult population participates in a workplace retirement plan.1

One Bad Apple Rule

If a sponsor is not complying with even just one of the regulatory and operational requirements of the plan, your business could be subjected to negative tax ramifications.

What is the right plan for you?

If you own a small to mid-sized company, looking into the Pooled Employer Plan (PEP) could be extremely beneficial. PEPs were established through the SECURE Act. Overall, the goal of this part of the SECURE Act is to simplify offering a retirement plan by removing some of the administrative requirements for the individual employer.

Businesses should strive to be competitive with their benefits to attract and retain talent. The ability to offer a retirement plan option helps your small business stand out amongst other employers, proving your dedication to the financial wellness of your employees.

There are other benefits, as well. The largest takeaway, as noted in the chart above, is the possibility of additional tax credits. Those include:

- Tax credits for establishing new retirement plans

- Tax credits for establishing automatic enrollment plans

For tax years beginning after December 31, 2022, eligible small businesses with 50 people or less can take advantage of a 100% small employer tax credit for qualified start-up costs for new plans. Before the SECURE 2.0 Act was enacted, only employers with less than 100 employees were eligible for a three-year start-up credit of up to 50% of administrative costs.

Navigating the retirement plan landscape as a business owner is difficult. To help you focus on growing your business, we would like to take some of the burden off of you. If you’d like to discuss more about these options, please reach out to one of our advisors.

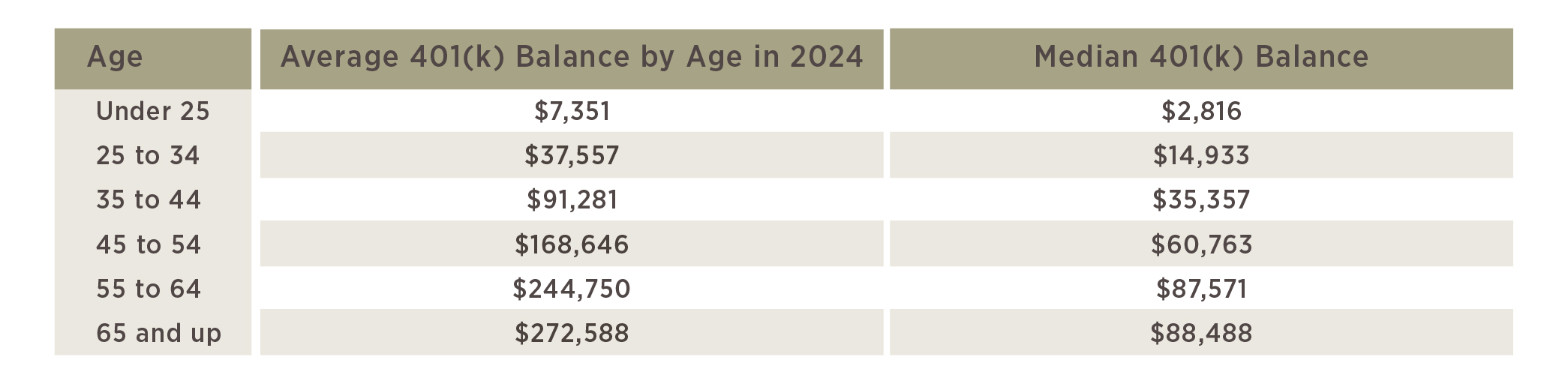

Facts to Know about Employee Retirement Savings2

Important Things to Know About Secure Act 2.0

The SECURE Act became law on December 20, 2019, and went into effect on January 1, 2021, while the SECURE 2.0 was signed into law on December 29, 2022, and went into effect on January 1, 2023. Under the act:

- Certain plans will be required to include an auto-enrollment feature.

- It is easier for small business owners to set up “safe harbor” retirement plans that are less expensive and easier to administer.

- Many part-time workers will be eligible to participate in an employer retirement plan.

- Non-spouses inheriting IRAs must take distributions that end up emptying the account within 10 years.

- 401(k) plans are allowed to offer annuities.

- Businesses with up to 100 people who sponsor a new plan can receive a tax credit for employer matching or profit-sharing contributions for the first five years of the plan. Employers can treat participating employees’ student loan payments as elective contributions to a 401(k), 403(b), or SIMPLE IRA for purposes of their employer match. This is for plan years beginning in 2024.

- 73 percent of civilian workers had access to retirement benefits in 2023: The Economics Daily: U.S. Bureau of Labor Statistics. (2023, September 29). Bureau of Labor Statistics. https://www.bls.gov/opub/ted/2023/73-percent-of-civilian-workers-had-access-to-retirement-benefits-in-2023.htm

- Campbell, T. (2024, September 25). Average 401(k) balance by age in 2024: How do you compare? Business Insider. https://www.businessinsider.com/personal-finance/investing/average-401k-balance