As a business owner, selling your company will undoubtedly be one of the most important and pivotal points in your life. It is the culmination of your talent, vision and hard work, and a realization of the value you were able to build for yourself and others.

Your goal is likely to maximize that value by achieving the highest possible valuation for your company, and thus the highest possible sale price. Chances are, you can find additional opportunities to raise your company’s valuation by focusing on the buyers’ perspective, due diligence process and valuation methodologies. However, you will also likely need some time to execute on these opportunities, meaning you should evaluate them as soon as possible once you decide a sale is in your future.

Based on our experience working with business-owner clients, as well as the investment banks and other advisors that serve them, here are some common areas you may need to focus on as you seek the best price for your company.

Empowering your management team

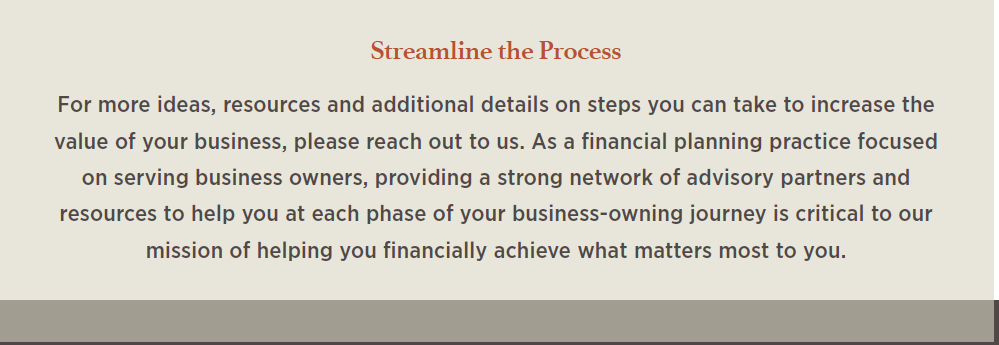

The importance of having a high-performing management team that can function without your guidance cannot be overstated. To understand where you may need to reorganize or invest time in mentoring and training team members to whom you can delegate high-level responsibilities, ask yourself the following:

If the answer to any of these questions is yes, you have some work to do. Giving up control can be difficult, but know that interested buyers will also ask these questions as they seek to assess the company’s future value when you are not in charge.

Further investing in your operating systems

While their impact on valuation differs considerably across industries, operating systems are a common source of gain, or pain, in the valuation process. These include not only the actual systems used to operate services and transactions of services, but also the logistical processes, efficiency and scalability of such systems.

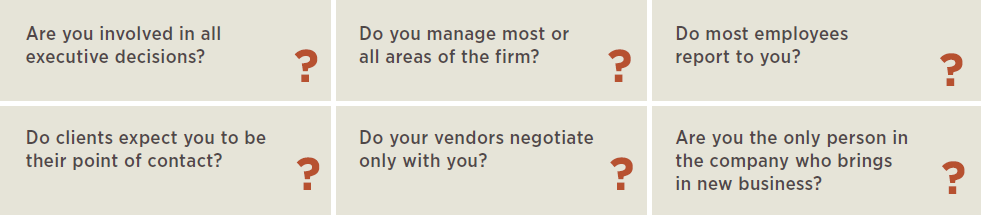

When looking at your company’s operating systems, most buyers will focus on scalability, among other factors. Can your business handle an increase in demand without breaking down or negatively affecting service quality and profit margins? This simple question can be the litmus test for the strength of your operating systems.

Other questions to ask yourself include:

Considering these challenges and identifying potential areas where operations may break down can help you decide where additional investments, system integrations and training are needed prior to the due diligence period of a sale.

Optimizing recurring revenue and customer concentration

Two value drivers that are often overlooked by business owners — but never by the buyers — are the amount of recurring revenue and customer concentration. The simplest way of looking at these two variables is: the largest recurring revenue and the lowest customer concentration your business can have, the higher the eventual valuation of your company will be.

Customer concentration depends on the specific industry and business model you’re using, but a good rule of thumb is that if any single customer accounts for more than 10% of your revenue, or the top five customers account for more than 25% of your revenue, you might have a customer concentration issue.

Addressing weakness in these areas may require additional hires, training or even reorganization within your sales team. It will also take some time so should be tackled as soon as possible.

Strengthening cash flow and the controls around it

In the business world, what gets measured gets results. Of course you should seek to have a strong, accelerating cash flow when preparing your business for a sale, but it can be a difficult goal to achieve and sustain.

The first step is to measure your cash flow and understand what adjustments are within your control that could increase your company’s value from the buyers’ perspective. Examples of analyses that can help you to accomplish this include:

• Seller’s discretionary earnings (SDE): SDE is a cash-flow-based measure of earnings that includes profit before tax and interest before the owner’s benefits, non-cash expenses, extraordinary onetime investments, and other unrelated business income and expenses.

• Net cash flows to equity and net cash flows to invested capital: These measures seek to parse out which cash flows remain for shareholders and creditors after paying all expenses, including taxes and investments in working capital and fixed assets

Focusing on what is valued or measured by buyers will guide you to set the right controls. For example, as part of the SDE analysis, buyers will consider what owners’ perks and salaries are included in the regular cash flows of the company. From cell phone bills to car leases and insurance, paying attention to these often-overlooked line items can help you slowly but surely increase the value of your business.

Participating in a valuation “practice round”

A good starting point for understanding if and where you have opportunities to boost your company’s business is to conduct an estimated valuation before the sale process begins. This could include seeking a full certified business valuation — one that adheres to the Uniform Standards of Professional Appraisal Practice (USPAP) guidelines — but it doesn’t necessarily have to. There is plenty of information to glean from a less formal (and less expensive) trial run.

For example, we have a partnership with BizEquity, a patented, online business valuation service offering a solution to business owners that is between full-blown certified appraisals and back-of-the-envelope calculations. Its methodology allows you to uncover some of the opportunities discussed above, particularly as they relate to strengthening earnings and cash flow.