Following 2016 and 2020, it would have been difficult to predict a more controversial, quickly evolving presidential cycle, but it appears 2024 is shaping up to do just that. With the velocity of information, news outlets are quick to project, pushing the line with partisan narratives and looking to stir division among American voters. Headlines over the past few months have not lacked in significance, and have looked like the following:

As investors, our goal is to put emotion to the side and focus on opportunities, investing for five plus years rather than five weeks. The 2024 U.S. presidential election may come across as one of the most consequential of our lifetime, but is not out of the ordinary when compared to history. To name a few:

- The 2000 Presidential Election5:

The first election since 1888 in which the winning candidate lost the popular vote. Al Gore collected 500,000 (or 0.5%) more votes than George W. Bush. Bush won Florida by such a small margin (~500 votes) that state law required a recount of the votes, and without Florida, no candidate reached the necessary 270 electoral votes to claim victory. For five weeks, it was unclear who won the election, until the U.S. Supreme Court intervened with a 5-4 vote ending the recount and awarding the presidency to Bush.

- The 1948 Presidential Election5:

A distaste for Democratic candidate Harry Truman led southern Democrats to break away from the party and establish their own, known as the “Dixiecrats”. The 1946 midterms saw the House and Senate turn Republican for the first time in 20 years, and only 33% of Americans approved of Truman. In one of the greatest election upsets in U.S. presidential history, Truman won the election without a majority of the popular vote. An early press time (and poor prediction) led numerous copies of the Chicago Tribune to be printed, stating “Dewey Defeats Truman”.

- The 1912 Presidential Election5:

Theodore Roosevelt returned to running for Oval Office in 1912 following a two-term presidency from 1901-1909. Roosevelt challenged his predecessor, William Taft, in the Republican primary, losing the nomination and dividing much of the party. While on the campaign trail in Wisconsin, Roosevelt was shot in the chest but was able to finish the speech. Roosevelt and Taft split the Republican vote, leading Woodrow Wilson to victory. Eugene Debs, the socialist party candidate, won 6% of the popular vote, the best results for a socialist candidate in any U.S. presidential election ever.

Volatility May Occur, But Markets Move Forward

Joe Biden dropping out of the presidential election was uncommon, but it is not the first time this has occurred. Excluding Biden, five other U.S. presidents have chosen to not seek re-election, with two dropping out within a year of their term ending: Lyndon B. Johnson and Harry Truman.

Uncertain times in politics seem to weigh heavily on sentiment, but financial markets continue to move forward.

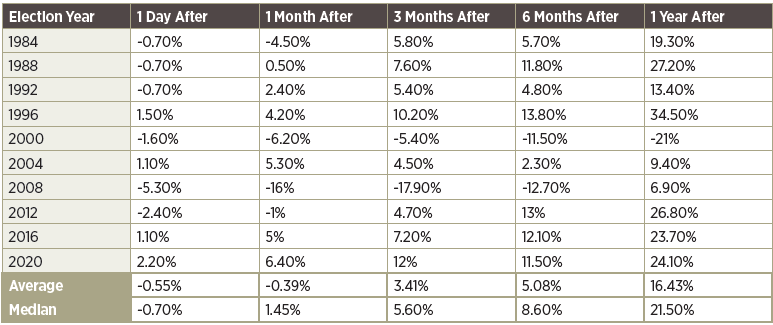

Going back to 1984, outside of the 2000 tech bubble, markets have been higher the year after every U.S. presidential election, with a median return of 21.5%.6 Staying invested through elections provides an opportunity for outsized gains.

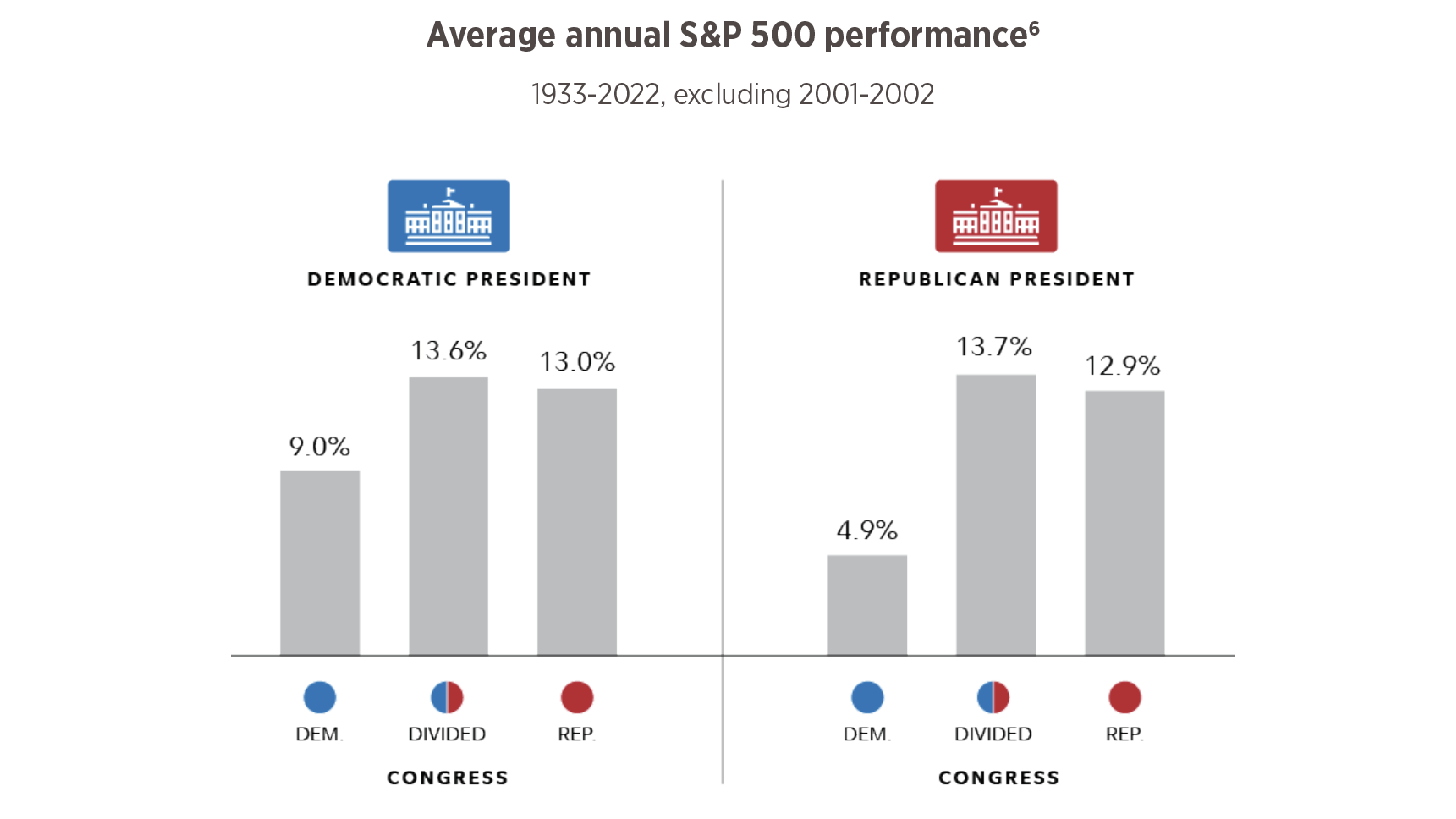

As we discussed in our first election piece, titled “The Winning Strategy: Staying Invested Through Election Years”, markets do not favor a specific party. Stocks rise in the long run, regardless of the president of the United States. Since 1933, stocks have risen, on average, in every party combination of president and congress, with a divided congress most beneficial for markets. A divided congress creates a gridlock, making it difficult for new laws and regulations to pass. With this, investors have a clearer picture of the path forward with less uncertainty.

Markets Tend to Outsmart Individual Logic

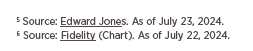

In election years, the best decision is to maintain a well-diversified portfolio across asset classes and remain true to your long-term plan. Analyzing different policies under two administrations may lead you to believe a given sector should outperform in a four-year presidential cycle, but more factors impact financial markets than just politics.

From 1990 to 2023, all eleven sectors experienced higher average returns under a Democratic administration. But this does not tell the full story, just as republicans cannot be blamed for the 2008 financial crisis, Democrats cannot be credited for performance that resulted in the tech bubble. Basing investment rationale on past performance is not indicative of future results, especially as it relates to presidential cycles.

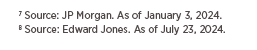

Deciding to invest in certain industries should not be entirely determined by the incumbent presidential party. Common thought would have been for traditional energy to perform better under Trump, as Trump is more in favor of fracking, drilling, and oil exploration in the U.S. But in fact, the opposite took place. Clean energy outperformed traditional energy during Trump’s administration, and traditional energy outperformed clean energy during Biden’s administration.9 Removing politics from investment decisions and staying true to a diversified portfolio provides the greatest probability for success in the long run.

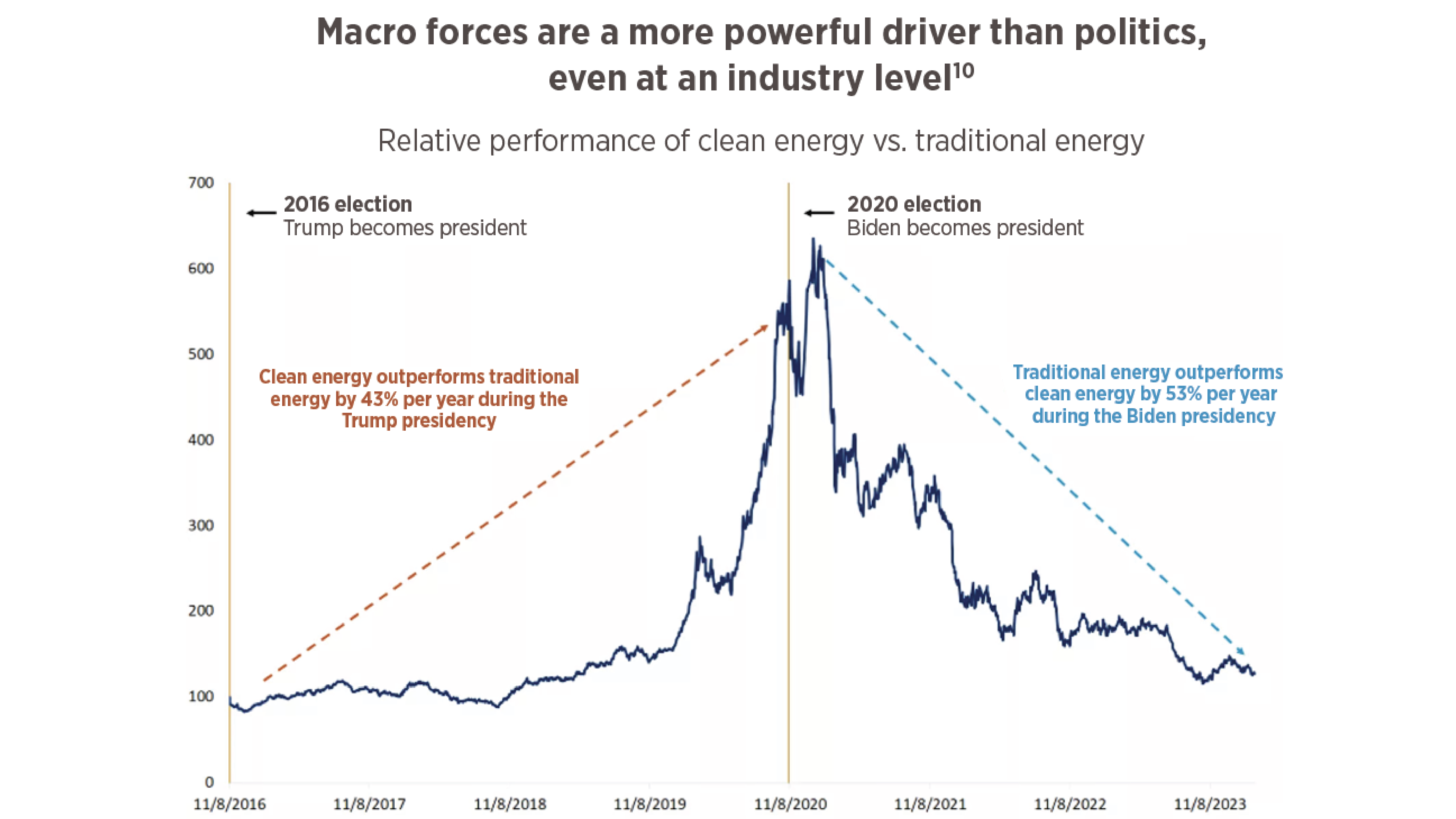

Markets Have a Longer Time Horizon Than Investors

Timing the market is an even more difficult, and costly, task. Data shows that when missing just the ten best days in the market during a given year, the average annualized return falls from 8% to 5.26%, over a 30% difference.11 And the best days do not come during good times, 50% of the best days in the market come during a bear market,12 and it is important to stay invested during these difficult times.

In the long run, the U.S. stock market averages an 8% return. Focusing on your time horizon and avoiding irrational short-term decisions provides a pathway to obtaining this long-run average return.

Concluding Thoughts

Markets may act irrationally in the short term. But on a long enough time horizon, market returns revert to long-run averages. Especially in election years with heightened tension, investors may want to alter portfolio positioning, weighting, or even fully move to cash. Maintaining well-diversified portfolios and staying the course provides an opportunity for success.