As loved ones age, family dynamics often shift, with former caregivers transitioning into care recipients. A recent CNBC article highlighted as “baby boomers begin turning 80 in 2025, there will be a growing wave of people who may need more support and services, and the burden will be heaviest for their children.”1 This means many decisions with immense financial, physical and emotional implications will fall on the next generation. Perhaps the most difficult decisions relate to whether it’s time for a loved one to move into a long-term care facility and if so, how to execute on that reality.

Hightower’s own Chairman and CEO Bob Oros understands the challenges firsthand. During the pandemic, it became apparent that his mother’s health was declining and she was no longer suited to independent living. “We thought we did all of the right things,” Oros says, recounting his experience, “but when the time came and we needed to take action, it was a different ball game.” With a perspective steeped in a deep knowledge of the financial industry, Oros shares what he did right, oversights and advice for those embarking on this journey.

Tips to Ease the Transition

“Moving a parent,” Oros points out, “is not like threading a needle; lining up their exit and entry is not easy and comes with a heavy emotional aspect.” The process is highly personalized with multiple factors to consider. Here are some tips to help guide you along the way:

- Have the hard conversations early. Engage your loved ones in a candid conversation before their faculties become diminished. As Oros says, “It’s not a surprise that a person’s health will ultimately decline. The key is to have the important talks in advance of that progression.”

- Schedule meetings with your advisors. Gather your team of professionals to guide the process. As fiduciaries, your financial advisors and estate attorneys can help schedule one-on-one meetings with appropriate parties to ensure your parent’s whishes, for everything from legacy planning, the dispersal of personal belongings, funeral arrangements and more, are properly communicated for legal and other planning purposes.

- Prepare for the expected.

- Consider purchasing long-term care insurance. Oros’ parents reaped the benefits of their long-term care insurance, which he notes “is always best bought when in great health,” cautioning, “but not every policy offers equal benefits, so be sure to comparison shop.”

- Regularly update important documents. Appoint a power of attorney, transfer titles and assets as appropriate, and ensure trust and estate plans are up-to-date. Consult a financial advisor to ensure all of the boxes are checked.

- Think of the logistics. A surprise factor for Oros was the difficulty involved in moving a senior, “particularly out of state, and especially during a pandemic.” The takeaway? Identify specialty moving companies in advance of a major move.

- Scenario Planning. A rule of thumb in business, scenario planning exercises can help highlight potential gaps in any plan. Oros recommends conducting them in tandem with your financial advisor. He explains, “The right support and a strong playbook are key. Really playing out all of the scenarios in advance of executing your plan is invaluable. It’s exponentially more difficult to make decisions in real-time when emotions come into play.” Some questions that will arise include, “How can I tap into my long-term care benefits?” and “How can I become more liquid to pay for moving expenses and down payment on senior living facilities?”

Finding the Right Residence

Taking the first steps in the search for the right residence can be the hardest part. Narrow the options down by determining what type of community fits your needs. According to the AARP, the three main housing options for seniors who require assistance on a daily basis are as follows:

- Assisted living residences. Housing for those who can’t live independently, but don’t need skilled nursing care. The level of assistance varies and may include help with bathing, dressing, meals and housekeeping. Costs vary.

- Nursing homes. Offering skilled nursing care and substantial long-term assistance, these homes provide meals as well as medical and personal care. Bedrooms and baths may be private or shared. Medicare and Medicaid may provide some coverage.

- Continuing care retirement communities. Designed to meet the changing needs of older people, these facilities provide a variety of housing options and services on the same campus. A resident might start out living independently and transition to an assisted-living environment or stay in the nursing unit when ongoing skilled nursing care is required. This is a more expensive housing option; expect a sizable entrance fee and monthly charges.

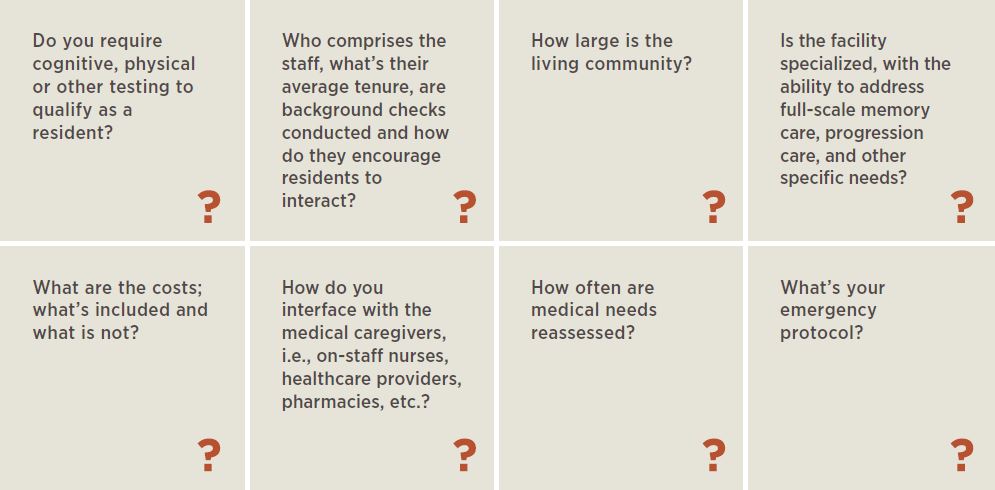

Ask the questions

“When conducting your search,” Oros says, “you are meeting with a team of commission-based salespeople. Each facility has its own bells and whistles, but what some consider perks are completely unnecessary for others. Prepare a comprehensive set of questions to find the right place for your unique circumstances.”

Some examples:

Developing a plan to ensure that your loved ones get the care they need requires a multifaceted approach. Tap into your local community including your network of advisors for recommendations and guidance through this period of transition and difficult decisions.