The best time to begin planning is often well before you think to do it.

It was more than 200 years ago that Benjamin Franklin decried: “In this world nothing can be said to be certain, except death and taxes.” Despite this inevitability, those who avoid planning for end-of-life care are in the majority. In fact, according to a 2021 study in the Journal of Psychosocial Nursing and Mental Health Services, while 90% of people think it’s important to talk about end-of-life wishes with their loved ones, only 27% have actually done so.1 And without proper preparation, these decisions can impose immense financial, physical and emotional burdens on the next generation.

On the other hand, early communication and a proactive plan can provide an invaluable gift to families: precious remaining time can be spent with loved ones instead of making difficult financial and medical decisions. Here are some steps families can take to that end:

01 | Communicate with all of the stakeholders earlier than you think is necessary.

Schedule a meeting and involve family members and others, such as friends, caregivers and clergy, to minimize any potential conflicts. Prepare a comprehensive set of questions to guide the conversation. Some examples include:

- How do you envision the last phase of your life?

- In what scenarios would you opt to receive life-sustaining treatment? Do you want to be resuscitated if you stop breathing or your heart stops beating?

- Where do you prefer to spend your last days — at home or in a hospital or hospice facility?

- Do you have outstanding financial affairs to resolve?

- Are your important documents (birth certificate, will, power of attorney, lists of assets and investment accounts, etc.) up-to-date and, if so, how can they be accessed?

- Who should be involved in your care and in making decisions on your behalf? Is there anyone who should not be involved?

How would you like the details of your death (funeral, speakers, customs, etc.) to be arranged?

02 | Plan for a long life.

Perhaps the most challenging aspect of end-of-life planning is that the timeline is unknown. Factors including average life expectancy, health and family history can serve as general guidelines, but it’s best to plan for a very long life so that you minimize the risk of outliving your assets. Ask your advisors — estate attorney, financial advisor and accountant — to collaborate to help you conduct planning exercises around various scenarios. Some questions that may arise include, “How can I tap into my long-term care benefits?” and “How can I become more liquid to pay for moving expenses and down payments on senior living facilities?” Additionally, make sure you have adopted (or plan to) best practices for preparing for a long period of retirement in which your expenses may exceed your income, including:

- Maximizing retirement savings by making catch-up contributions to 401(k)s and IRAs. This benefit, which enables contributions beyond the typical limits, only applies to individuals age 50 or older. It’s also typically prudent to try to avoid making withdrawals for as long as possible until you are required to (for traditional IRAs, the year in which you turn age 72, or 70 1/2 if you reached 70 1/2 before January 1, 2020; 73 if you reach age 72 after December 31, 2022) in order to benefit from the tax-deferred growth of your assets for as long as possible.

- Optimizing your Social Security payments by delaying claiming them until, at a minimum, you reach your full retirement age,2 and ideally, until age 70, when your benefit peaks.

- Consider purchasing long-term care insurance (LTC). According to LongTermCare.gov, long-term care is “a range of services and supports you may need to meet your personal care needs. Most long-term care is not medical care, but rather assistance with the basic personal tasks of everyday life, sometimes called Activities of Daily Living (ADLs), such as bathing, dressing, using the toilet, transferring (to or from bed or chair), caring for incontinence and eating.”3 Though LTC insurance is often costly and confusing, it can be instrumental in protecting your family and legacy.

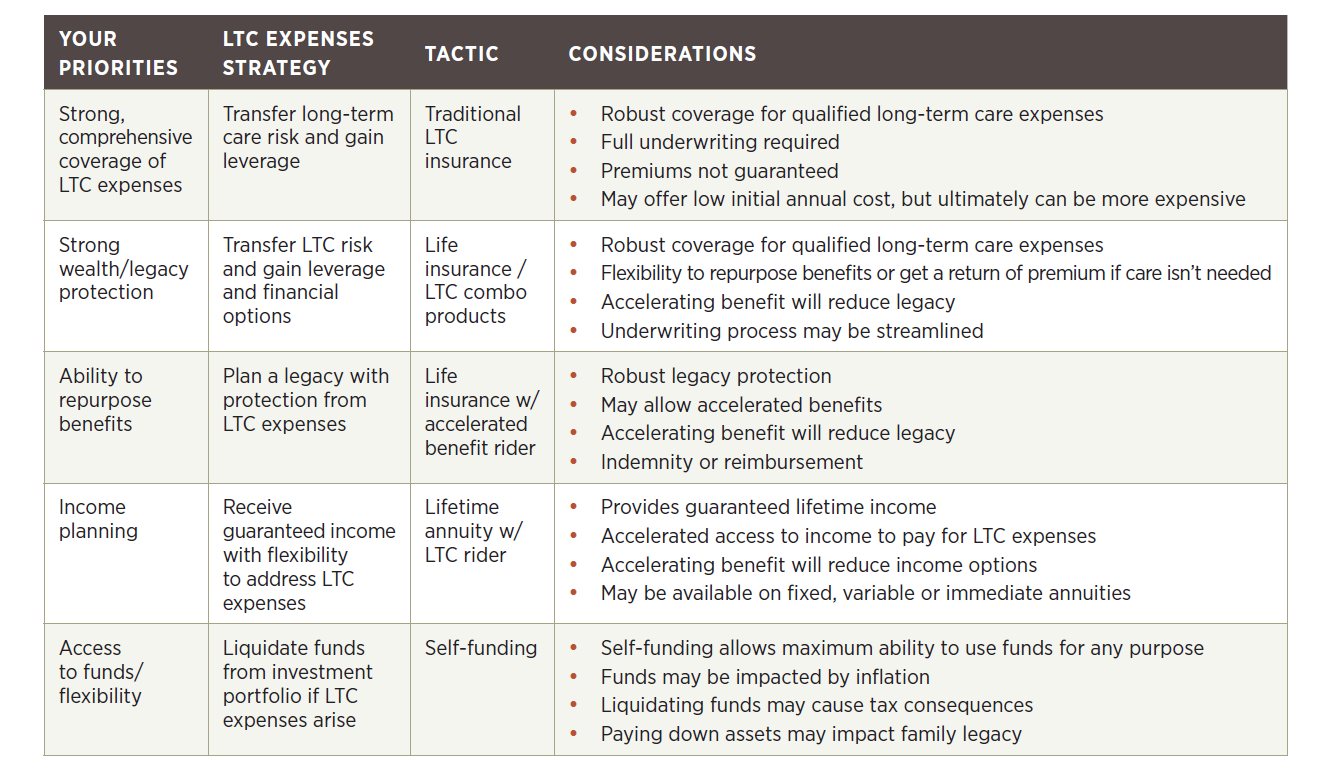

Each policy offers different benefits and strategies, so be sure to comparison shop. This cheat sheet may help:

03 | Regularly updating important documents and assigning roles.

Appoint a power of attorney, transfer titles and assets, if necessary, and ensure trust and estate plans are up-to-date. Store these documents in addition to birth certificates, property deeds and wills in a centralized location that can be accessed by the appropriate stakeholders.

Consider the following:

- Assign a power of attorney. This role is assigned through a legal document, designating another party with the power to make financial decisions on an individual’s behalf should they become unable to make sound decisions. This role can be fulfilled by a family member, friend, accountant, attorney or trust company officer, but it’s essential that this position is appointed while your loved one is still healthy.

- Prepare advance medical directives to clearly communicate wishes regarding end-of-life medical care. These documents may vary from state-to-state. The most important medical directive is a durable power of attorney for health care, which indicates whom you would like to make decisions for you if you are unable to. Other directives include DNR (do not resuscitate), DNI (do not intubate) and non-hospital DNRs. And to support any of the directives you provide, consider completing a HIPAA authorization form. It ensures that everyone understands your wishes about who has access to your medical records and can communicate with your providers.

- File a joint account. Discuss adding a trusted family member or friend to aging loved ones’ bank accounts. This precaution can help ensure that funds are accessible if your loved one becomes unable to manage their own finances. In this scenario, don’t forget to have associated credit cards, PayPal, Venmo and other lines of credit canceled. As an alternative, some states allow a “convenience account,” which enables a second person to make transactions solely benefiting the account owner.

- Prepare estate planning documents. Beyond creating a will, proper estate planning ensures a seamless transition of all assets including funds, valuable items, brokerage accounts, insurance policies and more. Equally important, however, is that the intentions you set forth in your will, trusts and other documents are communicated and discussed with beneficiaries and other stakeholders while you are still alive and well.

As advisors focused on holistic financial planning, we have witnessed time and time again both the hardship that clients face when end-of-life planning is put off, and the peaceful fulfillment achieved through proper planning and communication. We are here to help you and your loved ones navigate these suggested steps. Please reach out to us to start the conversation.

1 Sorrell, Jeanne M., “End-of-Life Conversations,” Journal of Psychosocial Nursing and Mental Health Services, “End-of-Life Conversations, Jan. 1, 2018.

2 https://www.ssa.gov/benefits/retirement/planner/agereduction.html

3 LongTermCare.gov, U.S. Department of Health and Human Services. “What Is Long-term Care?” Last modified February 21, 2017. https://longtermcare.acl.gov/the-basics/what-is-long-term-care.html.