Having dedicated your career to healing others, you have certainly earned your compensation and then some. Your chosen vocation, however, often comes with a unique set of financial challenges, including student loans and delayed earnings, despite the high income that often accompanies it. And these challenges can be felt long-term. Weatherby Healthcare reports that nearly two-thirds of actively practicing physicians (65%) still carry debt from medical school.1

While immediate concerns related to simply paying your bills may alleviate over time, financial challenges don’t necessarily end as your career progresses and your assets accumulate. With greater wealth comes greater complexity, and the consequences of inefficient choices can grow and become more opaque.

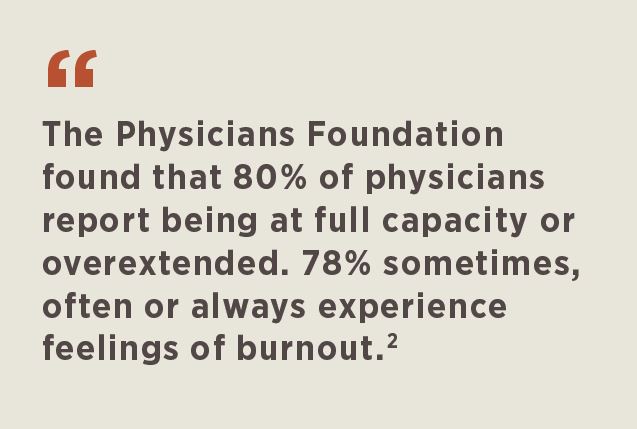

While many medical professionals recognize the importance of addressing their financial health, even after obtaining financial freedom, they often can’t afford to give it the attention it deserves due to the demands of their work, as well as the complexity of the process itself.

To help you streamline your path toward financial health as you concentrate on serving your patients, here are some common mistakes we have seen other physicians make, and suggestions for avoiding them.

Common Financial Mistakes Physicians Make

01 | Not working with a professional

The American Medical Association (AMA) likens physicians handling their own money to performing surgery on themselves.3 Yet, many attempt to do it on their own — often simply because they don’t think they have time to devote to the financial planning process.

But over the long run, a financial advisor can provide a sizeable return on your time investment by helping you streamline decisions, coordinate with your other advisors (e.g., accountant, estate planning attorney, etc.) and, ultimately, achieve more with your wealth.

When selecting a financial advisor, consider looking for someone designated as a fiduciary. For financial advisors, this means being legally and ethically bound to act in clients’ best interests. In practice, this means providing advice to you that is unencumbered by potential conflicts of interest, such as recommending investment or insurance products tied to that advisor’s compensation.

Just because someone is not a fiduciary does not mean that they are not a good advisor. However, your relationship with a financial advisor is based on trust. A fiduciary standard strengthens trust, because you don’t need to question the motive behind the recommendations you receive.

02 | Waiting too long to work with a professional

Physicians are champions of advising patients to schedule proactive checkups to manage their health. Financial advisors advocate for the same approach.

How do you know it’s time to meet with a financial advisor? Stephanie Nanney, CFP® CPFA, a partner at Private Vista, a wealth planning firm that specializes in advising physicians as part of its practice, recommends scheduling a consultation at the following points in time — which usually occur relatively early in your career:

• Upon completing your residency

• Before signing an employment contract

• When purchasing your first home/property

• When you’ve accumulated excess cash

• As you begin to pay off debt

• If you’ve been approached with an investment opportunity

Nanney explains, “Just as medical professionals seek to provide their patients with healthy habits, our goal is to provide clients with financial health from the get-go. We want to work with your team of professionals to put together a comprehensive plan that exceeds your short- and long-term goals.”

03 | Failing to take a holistic approach to financial wellness

Financial health, much like physical health, requires a lifetime commitment. It also requires staying healthy across multiple areas, including investments, tax management, estate planning, insurance and more.

But taking a comprehensive approach doesn’t need to be overly time-consuming or cumbersome. That’s where your financial advisor should come in — serving as a concierge-level general practitioner who efficiently engages your entire team of professionals, including accountant and estate planning attorney, in regular meetings and as needed at various milestones on your financial journey.

04 | Forgetting to include your spouse

Spouses commonly divide and conquer certain responsibilities, including in the financial realm. Perhaps one spouse takes the lead on investments and the other acts as the household “controller,” paying bills, transferring money between accounts, etc.

But as your wealth grows, a lack of communication and shared planning decisions can increasingly lead to suboptimal financial outcomes, short-term liquidity issues or even marital conflict. To avoid these issues, create shared objectives with your spouse around which you can build a financial plan capable of funding your lifestyle spending and long-term goals (e.g., a vacation home you hope to build or paying for your children’s undergraduate and graduate education). And, again, lean on your financial advisor to facilitate collaboration: The right individual will have experience and a process designed to help couples align financially.

05 | Selecting investments based solely on personal recommendations

Because physicians are high earners, friends and family, usually with good intentions, tend to pitch investment opportunities to them. But these opportunities have not always been properly vetted and may not align with what you seek to accomplish over the long run. If these situations arise, talk to your financial advisor, who can help you both evaluate the opportunity and propose a prudent allocation if you decide to move forward.

06 | Locating and withdrawing assets inefficiently

Building up sufficient funds to cover your lifestyle and retirement is only half the battle. You also need to consider the most efficient way to allocate and withdraw funds across the types of assets you own (e.g., bonds vs. stocks), and across your taxable and tax-deferred accounts (e.g., 401K), or risk paying significantly more in taxes. Your financial advisor, in collaboration with your accountant, has the experience and tools needed to help you make these decisions.

A Treatment Plan for Your Financial Health

Consider your own field for a moment: Can you imagine operating outside of your discipline? Developing a well-devised wealth plan is a complex, time-intensive process that requires significant attention and continuous review. But by working with the right financial advisor, who takes a holistic approach to your plan with your other specialists, you can streamline the experience and save significant time and money over the long run. And you can take comfort in knowing that your financial future is in just as capable hands as your patients are.

1 Saley, C. “Weatherby Healthcare Medical School Debt Report 2019.” August 2019. Retrieved March 9, 2022, from https://weatherbyhealthcare.com/blog/medical-school-debt-report-2019.

2 The Physicians Foundation. “2018 Survey of America’s Physicians: Practice Patterns and Perspectives.” September 2018. Retrieved March 9, 2022, from https://physiciansfoundation.org/physician-and-patient-surveys/the-physicians-foundation-2018-physician-survey/.

3 Farouk, A. “6 top financial planning mistakes physicians make.” American Medical Association. February 2016. Retrieved March 9, 2022, from https://www. assn.org/practice-management/career-development/6-top-financial-planning-mistakes-physicians-make/.