There is no single indicator that can tell us how best to invest. However, we find it is vital to keep pace with economic and market data that show what current and potential future trends are taking shape. To do this, we look at signals from equity and fixed income markets as well as from the real economy.

Here are some of the indicators we use to map out where the economy and markets may be headed.

Economy

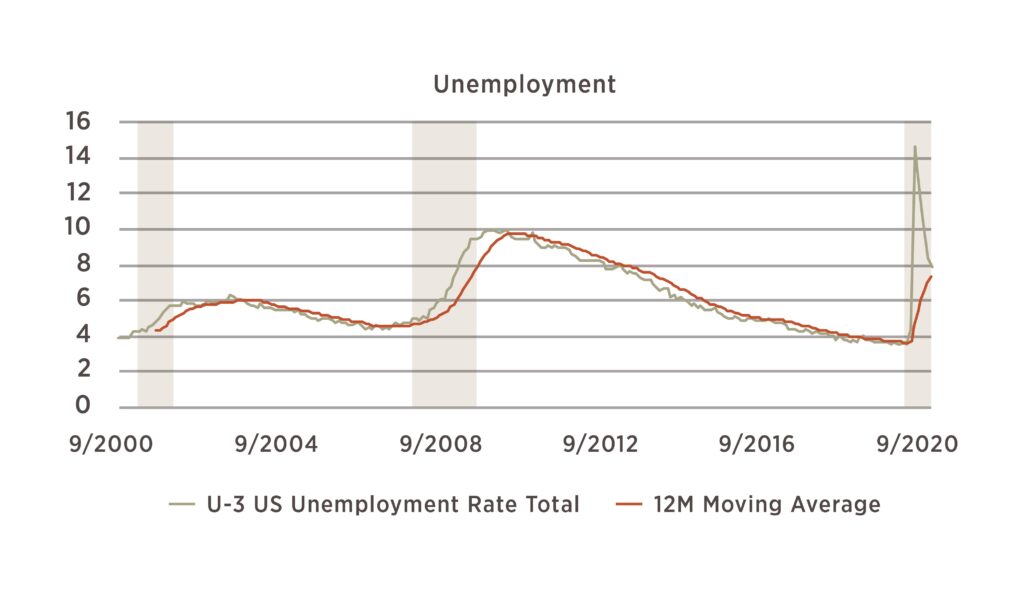

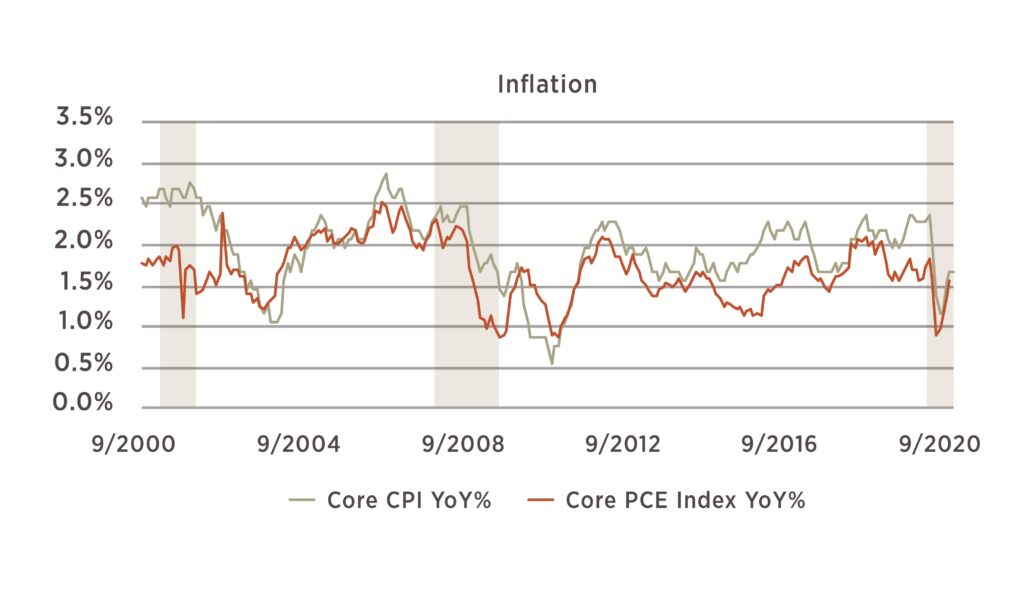

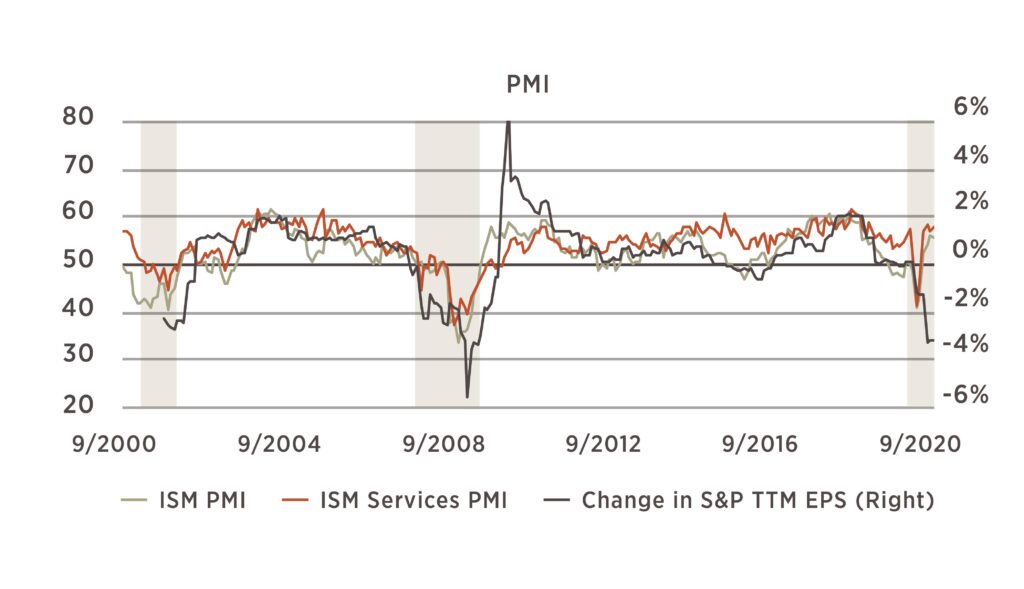

In September, current indicators continued to show improvement in the economy. Unemployment continued to decline, reaching 7.9%, although much of the change was driven by workers exiting the labor force. Inflation was steady with the core CPI coming in at 1.7%, while retail sales continued to climb. The manufacturing Purchasing Managers’ Index (ISM PMI) has historically provided a good guide to the direction of travel for S&P 500 earnings, however, given the magnitude and speed of shocks to the economy this year, it is reasonable that a recovery in earnings would lag by a few quarters. That index was at 55.4 for September while its counterpart measuring services industries rose to 57.8, where levels above 50 indicate expansion in activity.

Source for all graphs: Bloomberg 2020, Analysis by 6 Meridian

Forward Indicators

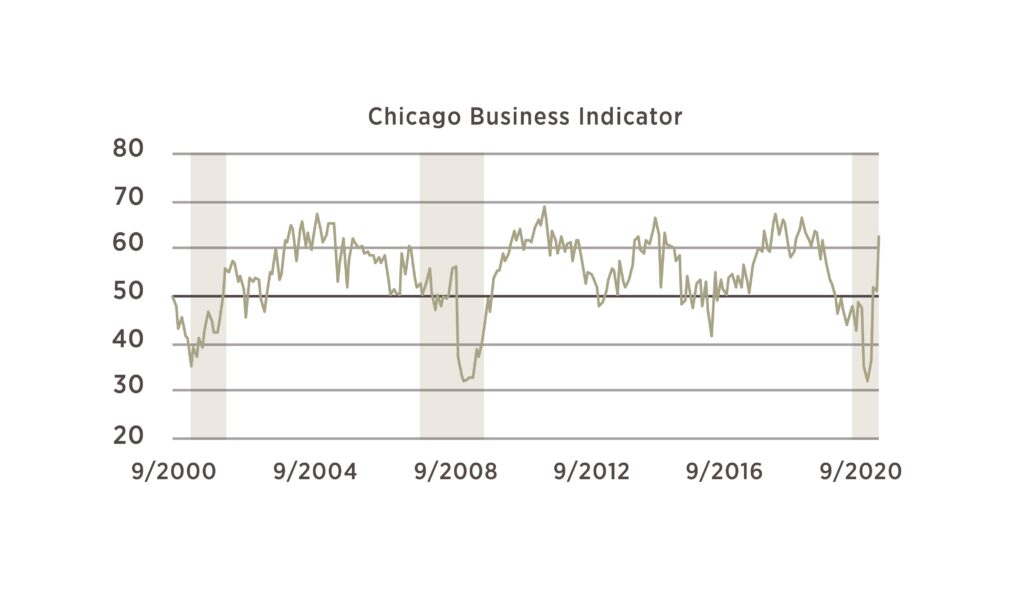

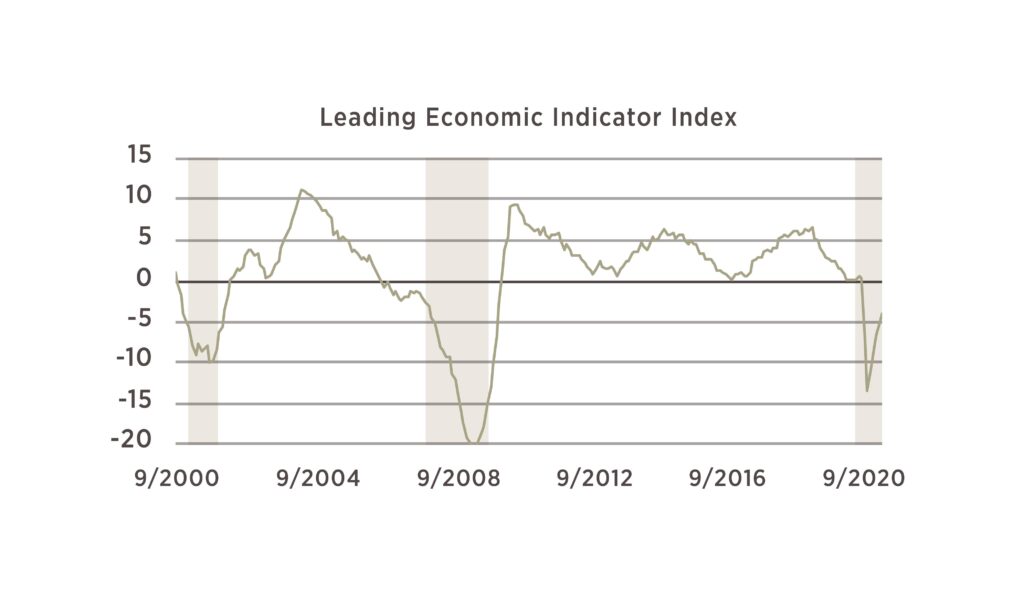

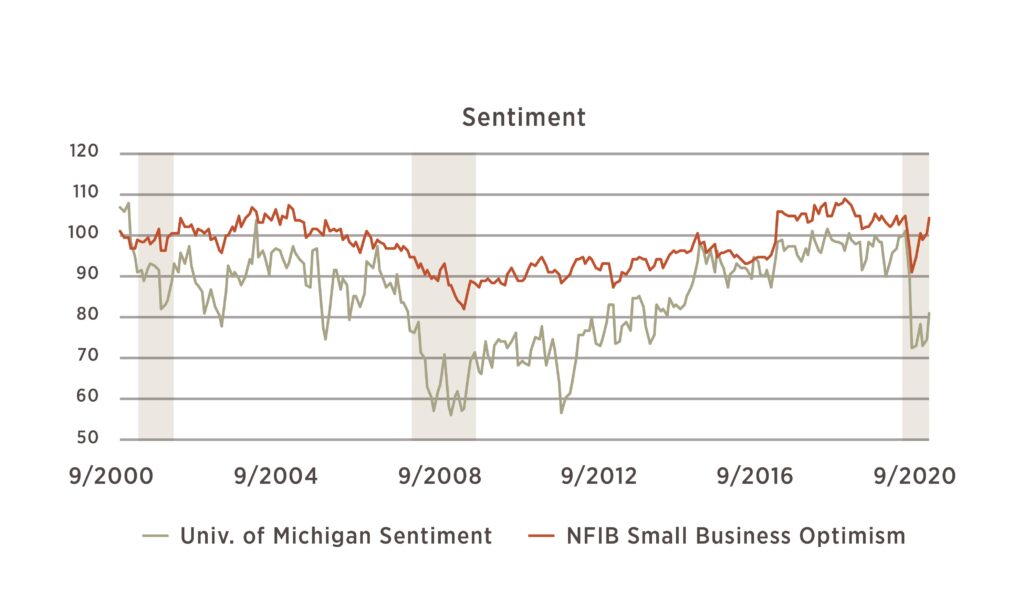

Leading indicators, which we use to gauge expectations of future economic activity, are beginning to show improvement as well. The Chicago Business Indicator, which gauges business activity and investment intentions, jumped to 62.4 this month (readings above 50 indicate expansion). The index of leading indicators, while still negative, continued to improve month-over-month. Small business sentiment has improved fully to pre-pandemic levels. Consumer sentiment remains depressed but appears to be improving from the low levels seen this spring.

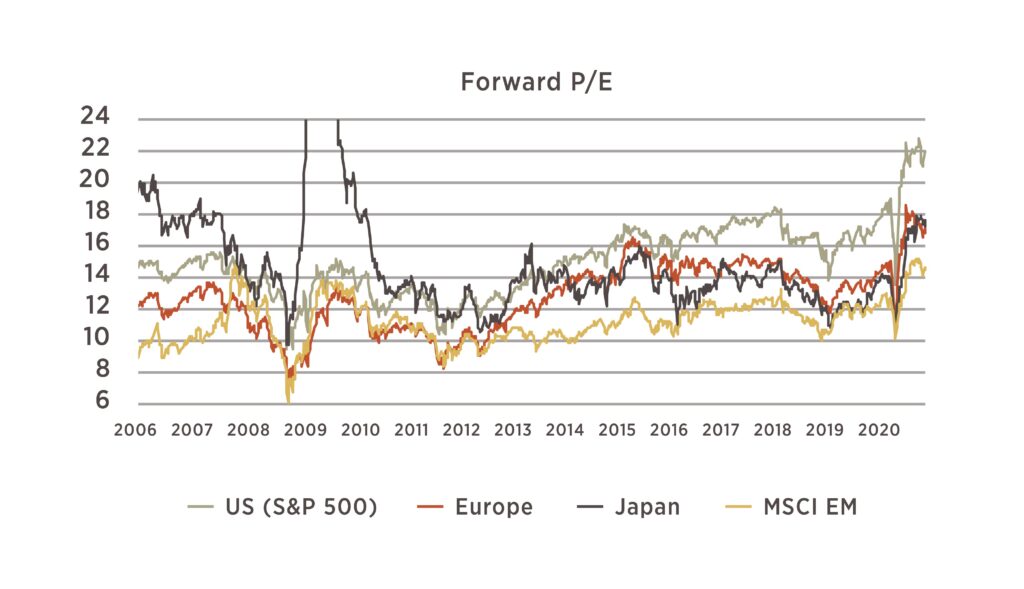

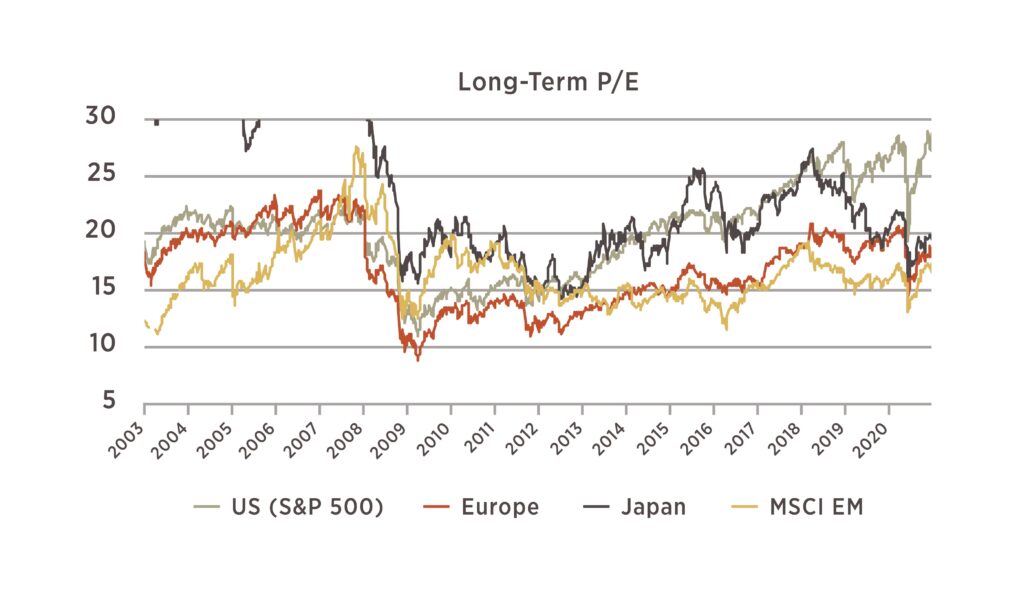

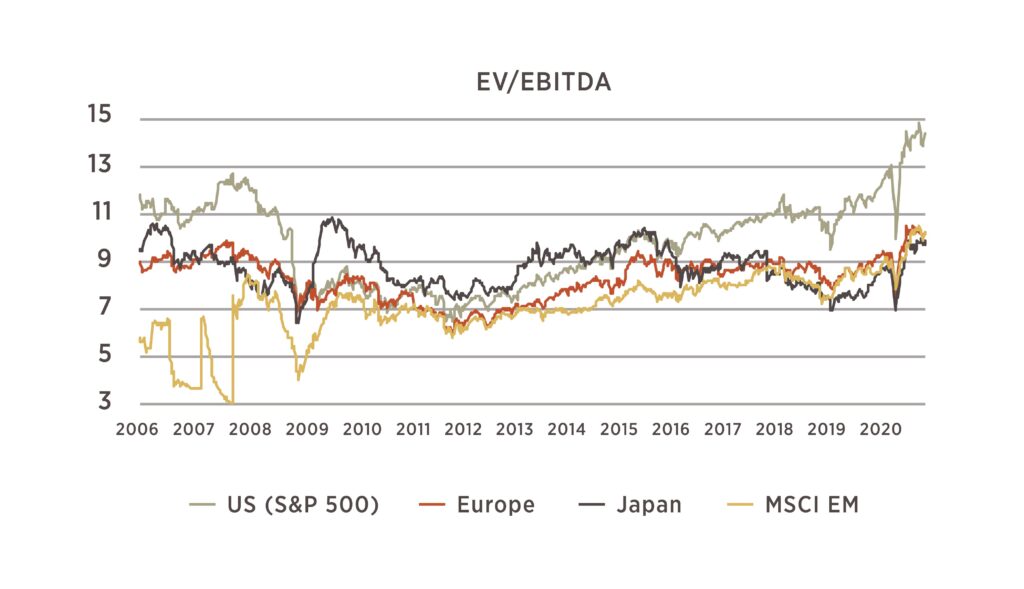

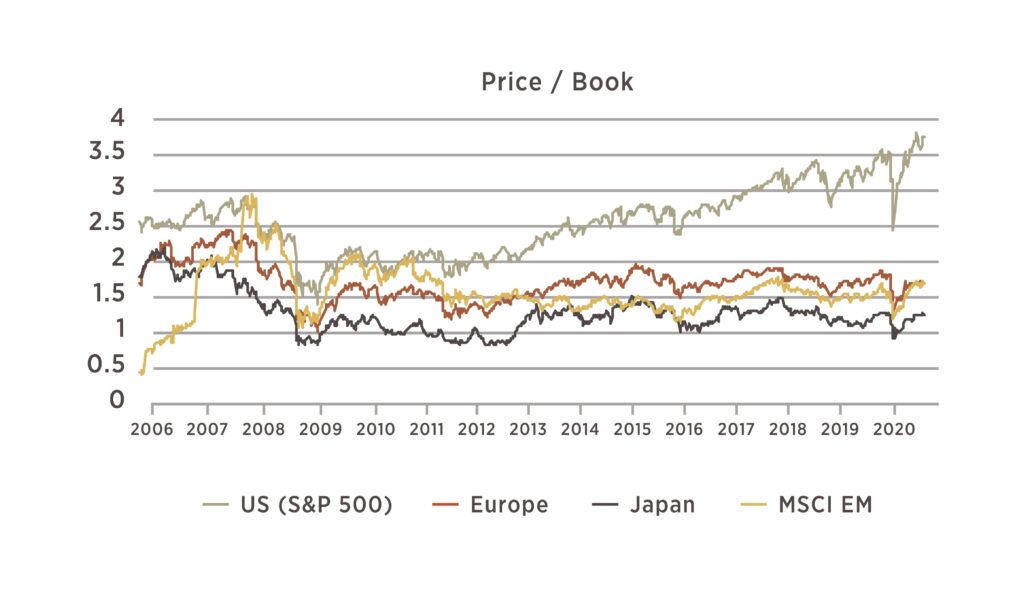

Equity Market Valuations

We include several measures of valuation for stock markets to get a more thorough picture than any one measure would provide. Currently, these measures are all telling the same story – US stocks look very expensive relative to their history and relative to non-US markets, especially after the recent upward move in prices. While these ratios may not revert fully back to historically normal levels, it is unlikely that they will continue to expand indefinitely.

Fixed Income

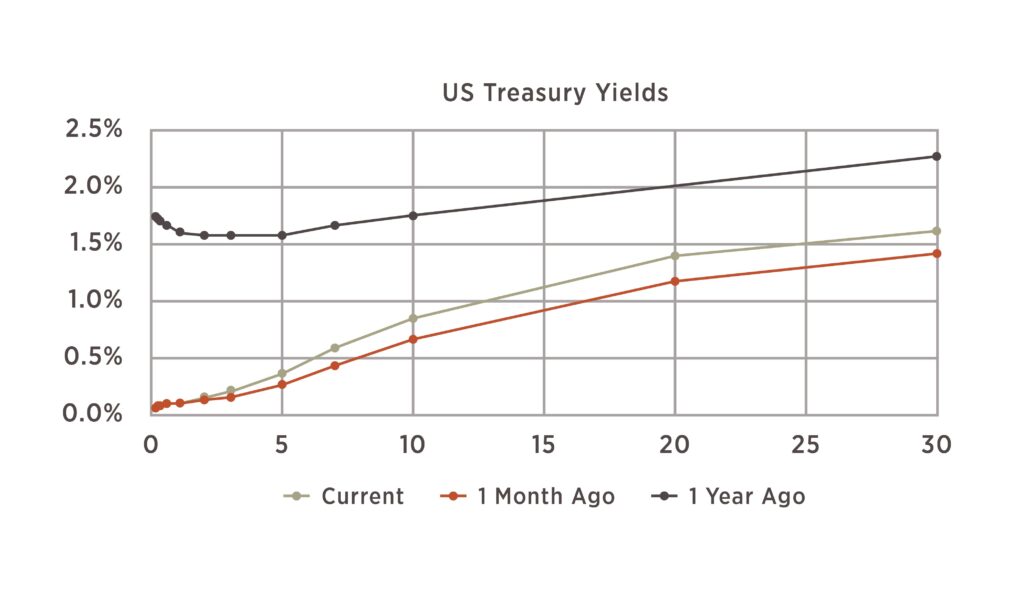

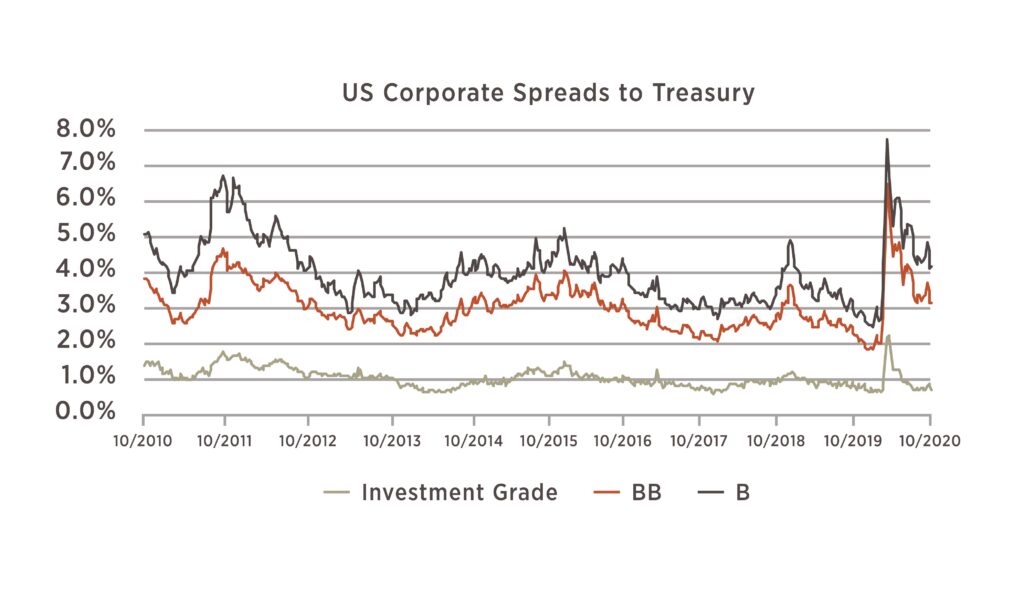

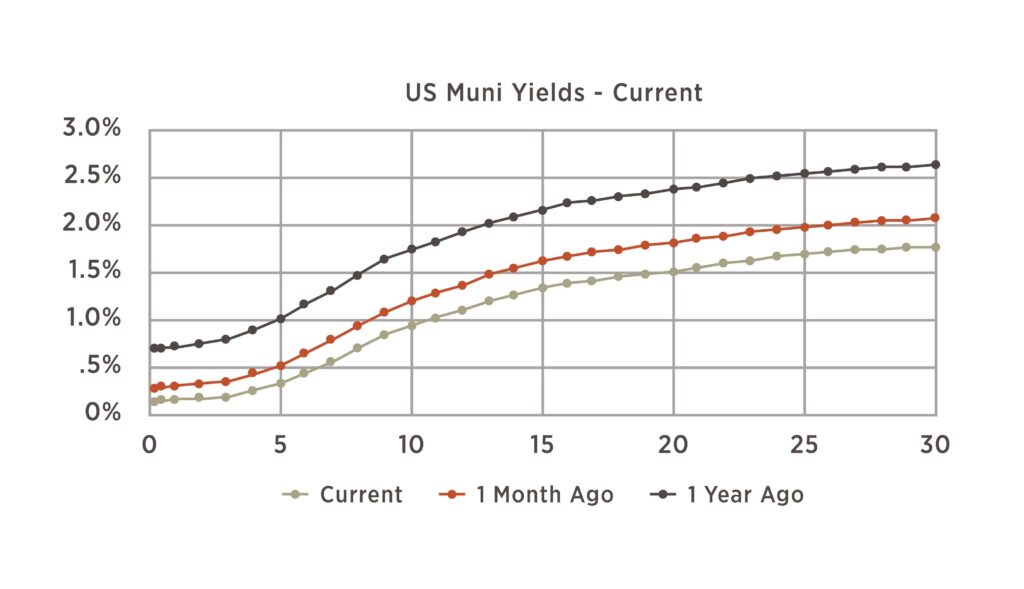

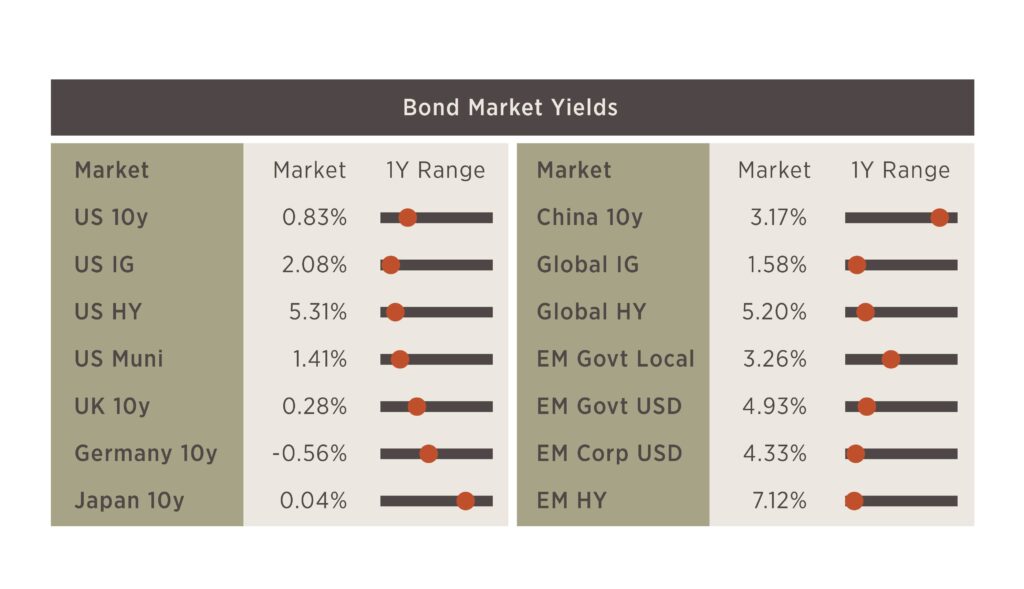

Looking at fixed income markets, the US Treasury yield curve has steepened, as longer dated yields rose throughout the month. The 10-year yield now sits at 0.83%, which is still low in historical terms but notably higher than the levels reached earlier this year. Corporate spreads, representing the additional yield offered to take on corporate credit risk, spiked earlier this year as would be expected in a downturn. More surprising is the speed at which they have come back down to historically low levels. Spreads on investment grade bonds are back to where they were in 2019. High yield spreads – including the BB and B rated bonds on this chart – remain wider, but this also reflects a high level of uncertainty around potential defaults and bankruptcies from high yield issuers.