Global equity markets are selling off this morning, with most European indexes down between 2% and 4% and the S&P 500 opening nearly 2% lower than yesterday’s close. Here are some of the potential drivers of this move:

- This week, all 5 of the largest companies in the S&P – Apple, Microsoft, Amazon, Alphabet, and Facebook – report earnings from the third quarter. These five stocks have been responsible for a significant portion of the market’s upward move since March. Microsoft reported results last night (10/27) that were good, but the stock still traded down, suggesting that the bar is very high for these stocks and the broader tech complex in terms of what is already reflected in the price.

- With the election one week away, there is nearly zero chance of additional fiscal stimulus being passed before then, and a low chance of a bill being passed before the inauguration in January. With enhanced unemployment, direct stimulus payments, and the PPP for businesses largely having run their course, this will likely drag on consumption and investment. In addition, the potential for no clear election result to emerge by the end of Tuesday night is likely to cause additional volatility over the course of the week.

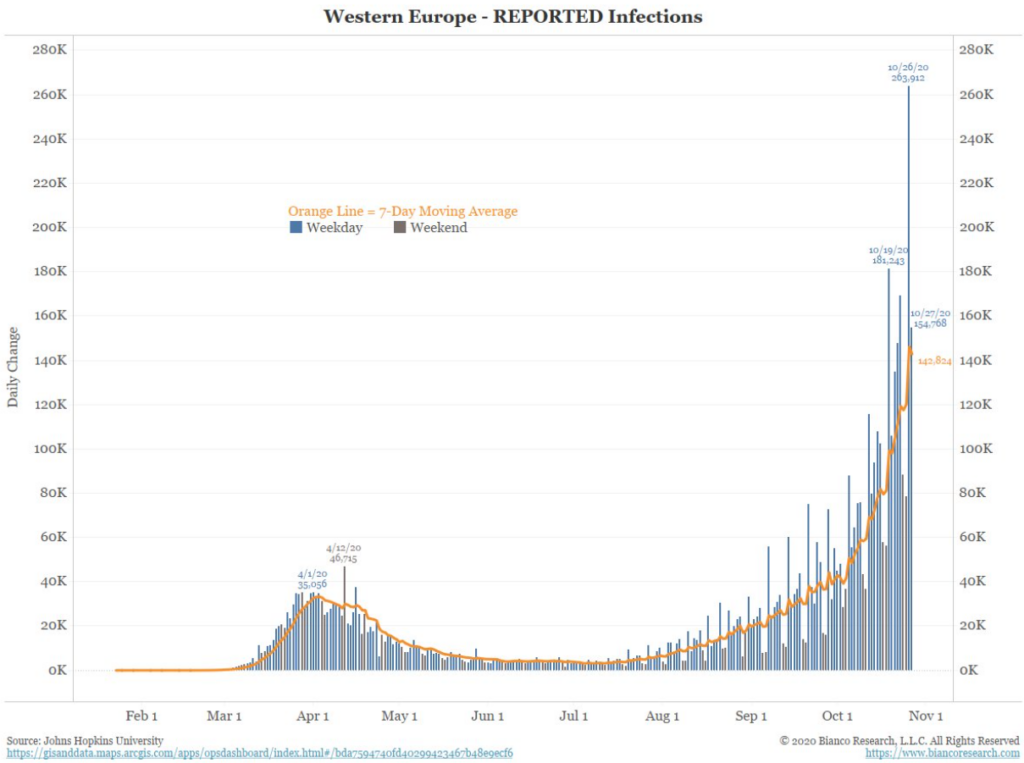

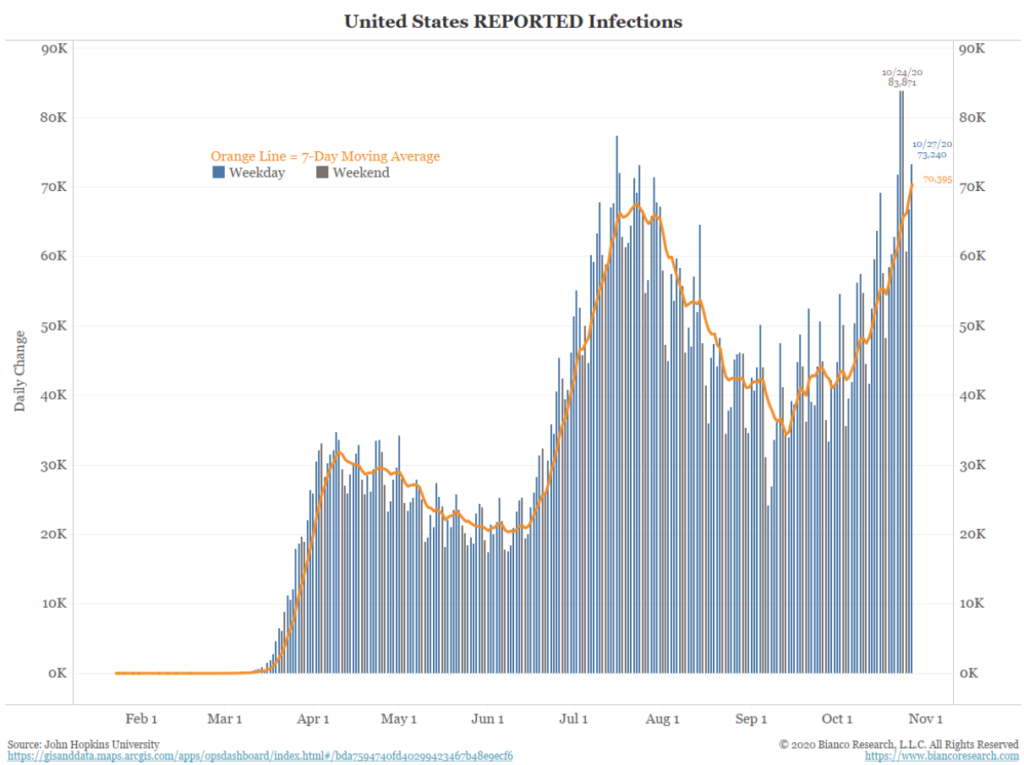

- The recent spike in COVID cases is particularly alarming and may be the main cause of today’s selloff. Some European countries have begun revisiting restrictions on bars, restaurants, and other businesses to reduce social contact. If this becomes necessary in the US as well, it would be a clear negative for economic activity. In either case, containment of the virus is a necessary precursor to any sustained economic recovery.

In our opinion, the market was already very optimistically priced based on underlying fundamentals. A majority of the companies that have already reported third quarter earnings have done at least as well as expectations, but this has not been sufficient to drive the market higher. After today’s selloff, European stocks as measured by the Stoxx 600 index have retraced to their June lows. As a reminder, the low point in June occurred when initial concerns about spiking virus case numbers in the southern US as well as Brazil and India halted the rally in global stocks. For the S&P 500 to fall to an equivalent level would imply a price of 3000, or about 10% additional downside from its current level. To be clear, this is not a base case of what we expect to happen, but one of several potential downside scenarios.