According to a study by AARP, almost half of Americans do not feel prepared for retirement.1 Based on our experience, this may even underestimate the issue, as just about everyone with whom we first meet, even those with considerable wealth, express concerns about not having enough assets to retire the way they would like.

To help you or anyone you know alleviate this mental burden and instead focus on maximizing what you can accomplish in retirement, here are some best practices that we help guide clients through:

01 Focus on what you can control

It is important to recognize that both controllable and noncontrollable variables impact financial outcomes in retirement, and act accordingly.

Unfortunately, in our experience, people tend to disproportionately allocate their time to factors they can’t control, when they should instead focus predominantly on the first, and to some degree, second, type of variables below:

- Full ability to control

- Current lifestyle spending

- Savings

- Identifying retirement goals, including lifestyle spending, and estimating their costs

- Asset allocation and location — investing optimally both in terms of assets (e.g., stocks, bonds, alternative investments) as well as the type of account in which they are held (i.e., taxable versus tax-deferred retirement accounts)

- Some ability to control

- Duration of employment and earnings

- Longevity — lifestyle choices

- Surplus spending — expenses outside of lifestyle spending

- Unable to control

- Market returns and inflation

- Tax policy and other laws

- Health care costs

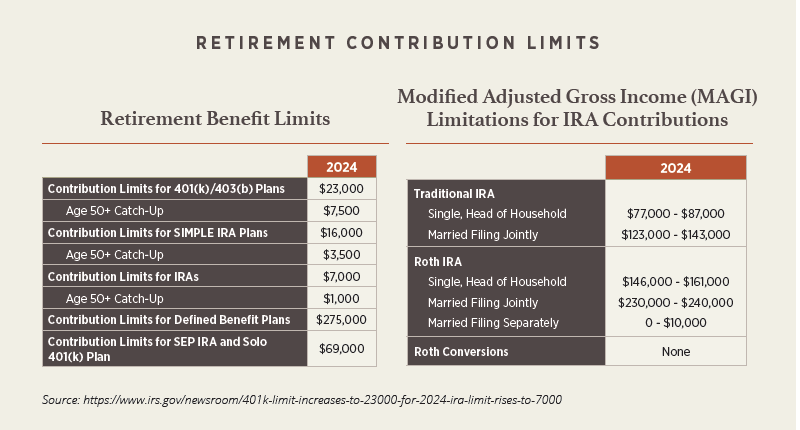

02 Maximize retirement savings beyond your 401(k)

Saving beyond 401(k)/403(b) plans is essential for most pre-retirees. In addition to maximizing your contributions to your workplace retirement account you should:

- Maximize your after-tax assets by:

- Maximizing contributions to after-tax accounts

- Considering backdoor Roth IRA contributions (if allowable)

- Considering a Roth IRA conversion

- Establish a spousal IRA, if relevant

- If self-employed, contribute to a Solo 401(k), SEP-IRA or Defined Benefit Plan

03 Plan for a long retirement

The average life expectancy for a 65-year-old is 83 years of age.2 But that is just an average; there is a 49% chance that at least one member of an age-65 couple will live to age 90, which goes up to 72% if both are non-smokers in excellent health.3

This means you may need to plan for a 30-plus-year retirement, especially if warranted by family history, during which, as a general rule of thumb, you will likely need to replace about 75%-80% of your pre-retirement annual income. And this does not factor in certain discretionary purchases you may wish to make — for example, second homes or support for your children as they begin their adult lives (e.g., weddings, first car and home purchases, etc.).

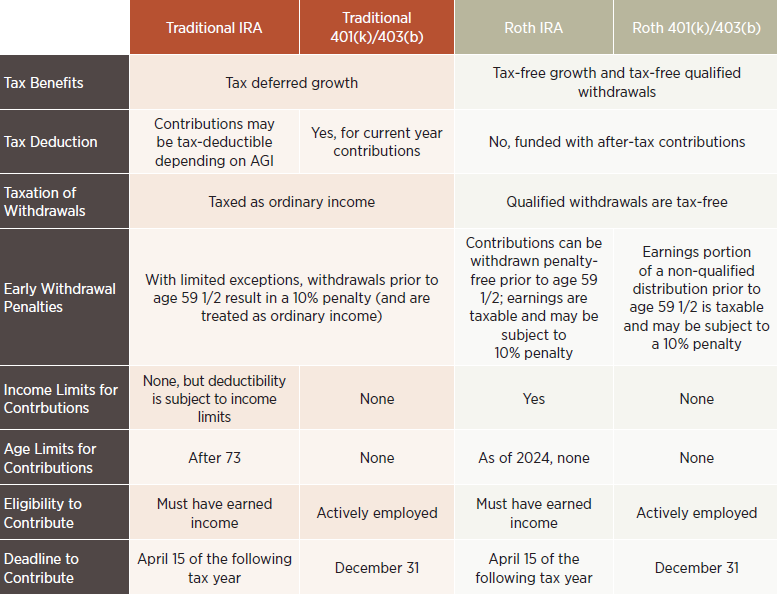

04 Identify the right retirement vehicle for your contributions

Evaluate your financial goals and marginal income tax bracket to decide whether to contribute to a traditional or Roth retirement account, or a combination of both.

The main reason you might decide to contribute to a Roth account instead of a traditional account is if you expect your taxable income to be higher in retirement than it is now. If that is the case, taking the tax hit now (rather than when you make withdrawals in retirement) while at a lower tax rate could make sense.

Another reason you may prefer a Roth account is if you expect to transfer your retirement assets to your heirs rather than spend them. In most cases, beneficiaries of Roth IRAs can make tax-free withdrawals during a 10-year period.

Traditional vs. ROTH – Side-by-side Comparison

Source: https://smartasset.com/retirement/ira-contribution-deadline

There may be other reasons for establishing or converting to a Roth IRA, including if you expect income taxes more generally to rise in future years. In any case, your financial advisor and accountant can help you determine if you are a good candidate.

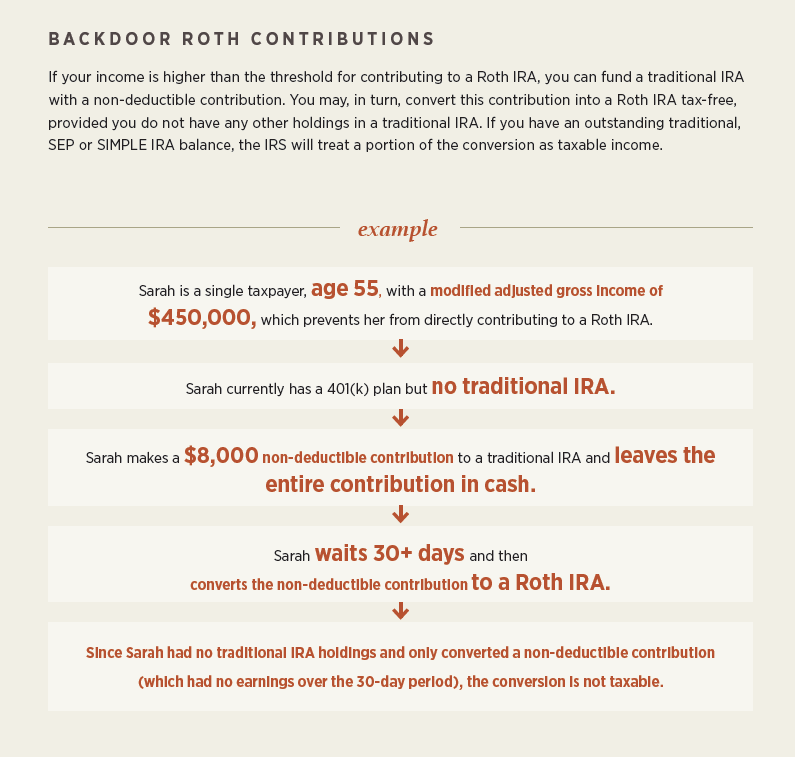

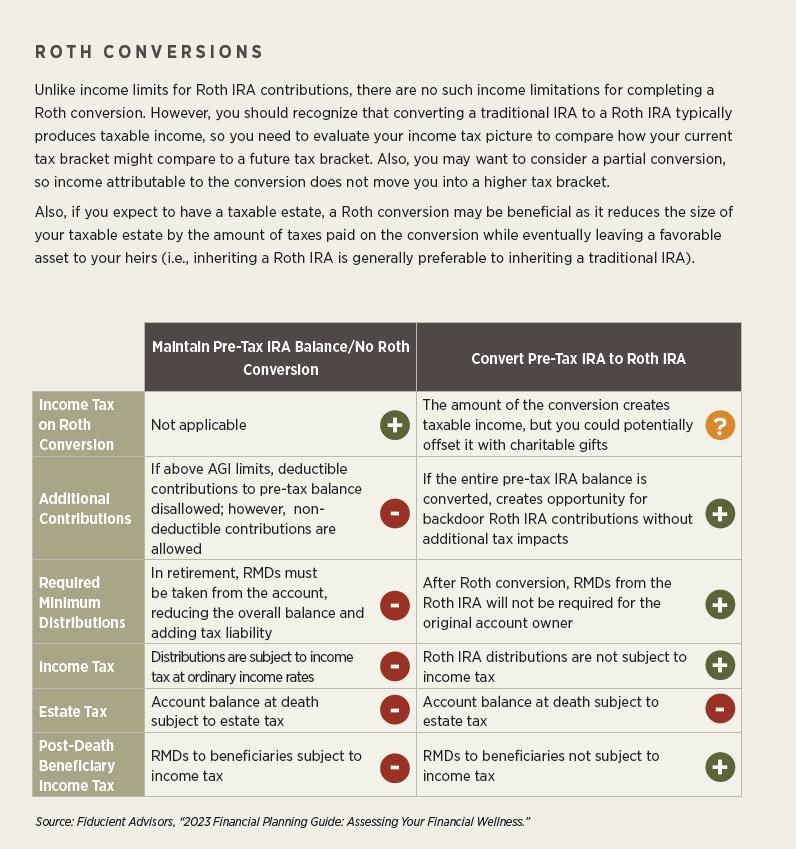

05 Consider other Roth strategies

Roth accounts can be especially attractive to high earners. Investment growth and future withdrawals are tax-free after age 59 1/2, and minimum distributions aren’t required at age 73 like they are with traditional retirement accounts.

However, current tax laws prohibit taxpayers with modified adjusted gross income of at least $161,000 ($240,000 if married, filing jointly) from contributing to a Roth IRA. But the following strategies can help those with income above those thresholds still take advantage of these vehicles:

Mega Backdoor Conversions

You can also check if your 401(k)/403(b) plan allows for “in-plan Roth conversions.” Known as a “mega backdoor Roth,” this strategy involves making after-tax contributions and subsequently converting those to a Roth account. However, note that time may be of the essence: This planning strategy has been targeted by lawmakers and could be addressed in future tax legislation.

06 Relocate wisely

If you’re considering relocating to a different state during retirement, make sure you assess the all-in cost of living in the new location, qualitative factors that are important to you, and residency requirements — especially if you will split time between multiple residences. Below are some variables to consider:

- Lifestyle: Do you like the culture and climate? Can friends and family visit you affordably and with relative ease?

- Access to health care: Will you have day-to-day access to top-tier health care professionals and facilities in your new primary location?

- Weather: Understand the risk of natural disasters and the cost of insurance in your prospective new state.

- All-in tax impact: The reality is that no state is “tax free.” Especially if your move is at least partly tax- motivated, be sure to evaluate the full spectrum of state taxes, including estate, property and sales tax. Also, understand how other unique sources of income, such as deferred compensation, stock option income and trust income, will be taxed at the state level. The rules vary, but it’s possible that your current state — rather than destination state — will tax this income.

07 Delay collecting Social Security if possible

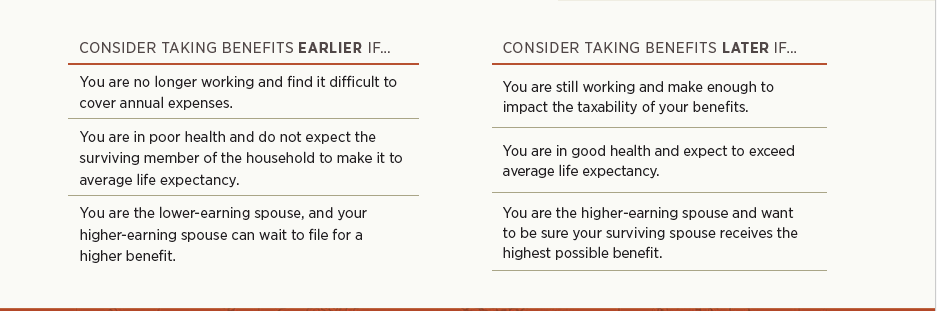

With the very real possibility that you could collect Social Security for more than 30 years, it is important to make an informed decision about when to begin collecting it, even if you don’t plan on using it as a major source of retirement income.

While you can begin receiving Social Security as early as age 62, full retirement age (FRA) varies from age 65 to 67 depending on your birth year. If you begin to collect before FRA, your monthly benefits will be permanently reduced. Conversely, if you start after FRA, your monthly benefits will be increased. Therefore, you may want to consider waiting until as long as age 70 to begin collecting in order to maximize your monthly benefit.

SOCIAL SECURITY EARNINGS LIMIT as of 2024

Prior to FRA, you can earn income of up to $22,320 before benefits are reduced.

In the year of FRA, you can earn up to $59,520 before benefits are reduced.

After FRA, you are not subject to any earnings limit.

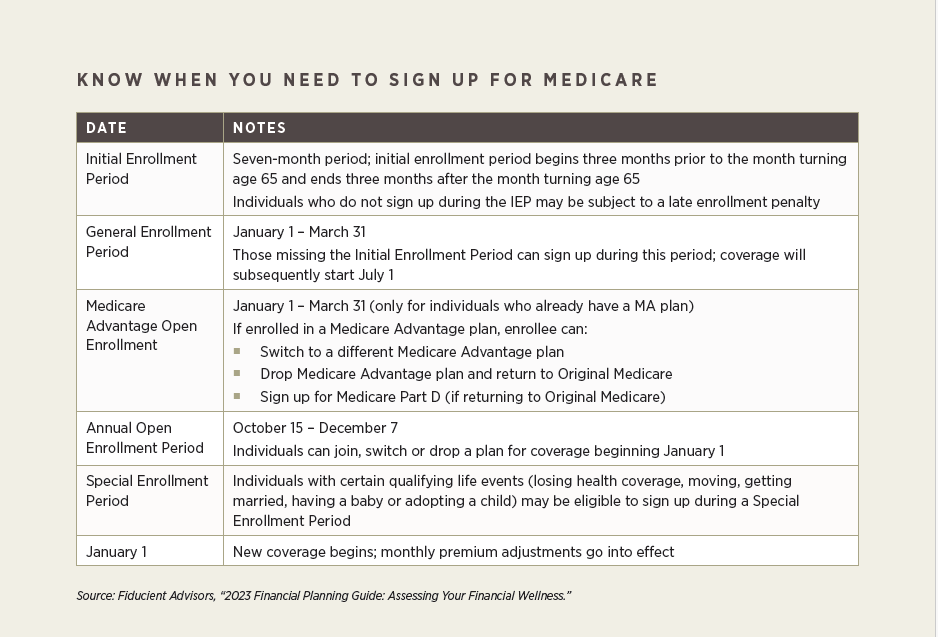

08 Prepare for Medicare and additional health care expenses

Well before you reach age 65, the age of eligibility to enroll in Medicare, you should begin to educate yourself on your options so that you can more accurately factor health care cost estimates into your retirement plan. This includes:

Understanding the different parts of Medicare. See below for a high-level summary:

A. Part A (Hospital Insurance)

- Free for people age 65 and older who paid payroll tax for 40+ quarters (about 10 years)

- Helps cover in-patient hospital care, skilled nursing facility care, hospice care and home health care

B. Part B (Medical Insurance)

- Anyone eligible for Part A is eligible to enroll in Part B and pay a monthly premium

- Helps cover physician services, outpatient care, home health care, therapy services, ambulance services, preventive services and durable medical equipment

C. Part C (Medicare Advantage)

- The private health insurance alternative to “Original Medicare” (i.e., Parts A and B), which might also include Part D coverage

- If enrolling in Medicare Advantage, must still enroll in Parts A and B and pay the Part B premium; also need to sign up and pay for the chosen Medicare Advantage plan

D. Part D (Prescription Drug Coverage)

- Run by private insurance companies that follow rules set by Medicare

- Helps cover the cost of prescription drugs

- Once total drug costs (between what you and the plan have spent) reach $4,660 (2023 limit), you pay no more than 25% of the drug price (this is often referred to as the “donut hole” of Part D coverage)

Factor In Out-Of-Pocket Expenses

Part of knowing if you have saved enough for retirement is being able to estimate your health care expenses, which are inherently uncertain. However, here are variables to consider based on research from T. Rowe Price that can help you and your advisor arrive at appropriate estimates:4

- The median annual costs for individuals paying for Medicare range from about $3,600 to $6,400 depending on your elections (e.g., traditional Medicare vs. Medicare Advantage, etc.). More conservatively, these costs at the 90th percentile range from about $8,700 to $10,900.

- The probability of experiencing a $2,000–$5,000 health care shock (an increase in out-of-pocket expenses during a two-year period) is about 11%; the probability of a shock of $25,000 or more is about 2%.

- Health care shocks increase with age, with the probability of an expense of $25,000 or more at age 90 or older increasing to more than 9%.

- The average health care shock is about $8,000 over 2 years.

- Total out-of-pocket health care expenses during the last two years of life increase with age, ranging for those ages 65 through 69 from $3,800 to $116,400 at the 50th percentile, and for those age 90 or older from $5,200 at the 50th percentile to $169,800 at the 95th percentile.

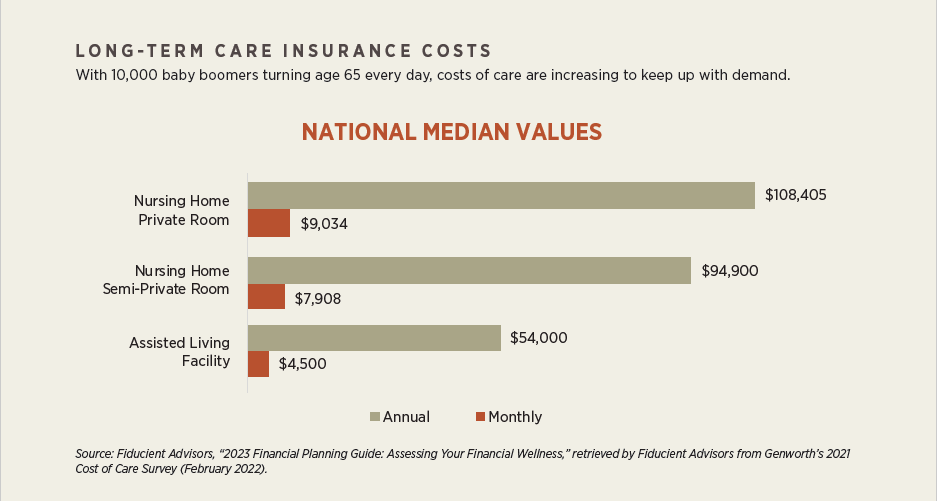

- Nursing home and long-term care drive high total out-of-pocket expenses; consider long-term care insurance.

Taking Advantage Of Triple-tax HSA Savings

You can use a health savings account (HSA) not only to cover healthcare costs while you work but also as a tax- efficient savings vehicle to cover costs during your retirement. HSAs offer triple-tax savings: You contribute pre-tax dollars, pay no taxes on earnings and pay no taxes when you make withdrawals for qualified medical expenses.

Unlike flexible spending accounts (FSAs), you can keep money you don’t use in your HSA account from year-to-year. You can also invest it, and after age 65, use the money to pay for nonmedical expenses without incurring penalties. However, if not used for qualified medical expenses, withdrawals are taxed at ordinary income rates, just as they would be from traditional IRAs or 401(k)s.

09 Review your plan with your advisor at least once a year

As you encounter both expected and unexpected life changes, your retirement plan doesn’t necessarily update automatically to reflect those changes. For this reason, meeting with your financial advisor at least once annually, not only for a regular update on your investments but also to perform a more holistic review of your financial plan, can help you avoid planning mistakes and uncover new opportunities to accomplish more with your savings.

Here is a Checklist of Common Items That Need Regular Review:

- Tax law changes

- Retirement goals

- Health condition an longevity expectations

- Current level of savings in light of retirement goals

- Portfolio asset allocation and asset location

- Estate planning documents

- If nearing retirement, your claiming age strategy for Social Security benefits

- Medicare options

- Beneficiary designations

- Medical directives

- Financial power of attorney

- Account titling

10 Evaluate wealth transfer and asset protection strategies

Depending on the size and complexity of your assets, and what you’d like to accomplish with them, you may want to consider advanced estate and tax planning strategies well in advance of your retirement. This is particularly the case now, given the impending expiration of provisions from the Tax Cuts and Jobs Act (TCJA) of 2017, including the roughly doubling of estate tax exemptions.

Examples of strategies to consider with your advisors include:

- Grantor retained annuity trusts

- Charitable remainder trusts and/or donor-advised funds

- Irrevocable life insurance trusts

- Qualified personal residence trusts

- Intrafamily loans

- And more; talk to your advisor

Lean On Us

No two retirement plans should look the same. Our assets, life journeys and goals are simply too unique to fit into a boilerplate framework. That is why working with a financial advisor who knows and appreciates you, while also benefiting from the experience of helping hundreds of other individuals and families, can pay dividends in retirement and beyond.

We look forward to hearing from you soon and helping you with one of the most rewarding experiences we have as advisors: empowering fulfilling retirements.