For many years, it was generally accepted that the divorce rate was steady around 50% — that is, half of all marriages failed for one reason or another. That statistic actually originated in the 1980’s; however, for the past several decades, the divorce rate has been declining1 for a variety of reasons.

Couples are choosing to delay marriage until they are more financially secure; couples are cohabitating instead of exchanging vows…there many contributing factors. One fact remains steady, however: divorce can be extraordinarily taxing and expensive in terms of both mental and monetary resources.

Very few people make the decision to divorce lightly; there are often children involved, shared assets, shared liabilities — all the pieces that make up a life built together. And there are always emotions involved, even in the most amiable separations.

It’s very important, when making such a life-altering decision — a decision that will have implications on you, your spouse, your children, your friends — that you have support in place. You’ll need a friendly shoulder to cry on, who can help you think of the future when it might seem far away. You’ll likely need support for your children, and/or yourself, from a therapist or counselor, to help sort through hurt feelings and questions. Many people find comfort in talking with a pastor or another religious figure — even if, perhaps, religion had not been important in the past. Many people also utilize a life coach to help them move forward and visualize their future.

You will also need the professional support of those who know the system and how to navigate properly. While some couples are successful working through a mediator, which can be cost-effective (and often more time-efficient), most couples end up working with attorneys, through the court system. And that can become expensive. A last resort is to end up letting a judge decide the ultimate outcome of your divorce.

“I wanted to turn my divorce into a positive. What if I didn’t blame the other person for anything, and held myself 100 percent accountable? What if I checked my own s— at the door and put my children first? And reminded myself about the things about my ex-husband that I love, and fostered the friendship?” – Gwyneth Paltrow

“I kept wishing I could fast forward and get to the end. I knew it was a good decision,

the right decision, but the steps along the way were so exhausting and emotional.

I just wanted to wake up with it all finished—like Sleeping Beauty!” – Author Unattributed

“Imagine spreading everything you care about on a blanket and then tossing the whole thing up in the air. The process of divorce is about loading that blanket, throwing it up, watching it all spin, and worrying what stuff will break when it lands.” – Amy Poehler

Expert Support: Who You Need

The average cost of a divorce in the US is approximately $15,000 per party2 — including items such as attorney fees, court costs, and any experts such as accountants or child custody specialists. But those costs can skyrocket quickly; celebrities aren’t the only ones who suffer through divorces that can cost between $100,000-$200,000… in fact, it might surprise you how often dollar figures like that come up. Factors that increase fees include child custody issues, hourly rates of lawyers, and even how long the whole process takes.3 And if there are high-net-worth assets involved, from shared property to limited partnerships, it can be far more complex. For more information on mistakes to avoid in a high-net-worth divorce, see our paper “High Net Worth Divorce: Five Mistakes to Avoid”.

It might surprise you to know that only about 5% of divorces actually go to trial4 (those tend to be most hotly contested and, extremely expensive). The average length of time to complete a divorce is around eleven months (it increases to eighteen months if it goes to trial); in many states, a divorce can be completed as quickly as 30 days.5 What factors influence how long your divorce will take, and how expensive it will be?

Child custody issues are often the most complicated discussions that lawyers and court professionals are involved with, as details are worked out for vacations, living arrangements and support. These are also the most emotionally charged. Further complicating matters: it can be difficult to impossible to reverse any decisions once finalized. That’s one of the main reasons that many attorneys work to settle out of court; otherwise, a judge is making life-changing decisions for children he or she has only met via court documents. Lawyers are also hesitant to become involved in complex custody decisions for the same reason and may suggest a “guardian ad litem” to represent the children’s interests and give them a voice in court — especially if the situation is contentious.

The other factor that can make divorces stretch on and on (with the costs escalating) are arguments about financial issues and splitting assets. Here, again, is an opportunity to bring in a financial professional to help supplement a lawyer’s skill set.

Many settlements are structured according to formulas set up by the court system. Thus, there is very little to be gained (and a great deal to be lost, in attorney fees) in going back and forth to try to “take revenge”, or otherwise get a greater share of the settlement than a court might feel is justified. How do you reach a result quickly, that is fair to both parties?

“You can come at it very aggressively and blame and blame and blame. Or you can put yourself in the garage, so to speak. Take yourself apart and clean off the bits. Reassemble.” – Chris Martin

Financial Advisors: Short- and Long-Term Benefits

Add a financial advisor to your team of consultants. There are a number of benefits; for a flat fee (often $5,000 or less), an advisor can sit with both parties, and their attorneys, and detail a fair and equitable plan to split assets. Working with an advisor at a pre-negotiated flat rate does two things: (1) it allows you to work out the emotions of your divorce with someone who is not charging you hourly (2) it allows you to thoroughly vet ideas versus feel a time crunch of the clock ticking, ringing up additional charges. Take your time and make smart financial decisions. A financial advisor can bring an informed perspective to the table and help both you and your ex-spouse reach an agreement that allows you to retain more of your assets (rather than paying them out in attorney’s fees). In fact, some advisors who work with divorced clients are so adept at putting together reasonable plans that they eventually end up taking on both parties as clients, as they plan for a financial future post-divorce.

Friends or family members who have been through a divorce can often help you find a good financial advisor to handle these types of discussions. If you don’t have those resources available, you can always search for a Certified Divorce Financial Advisor here. You can also start by talking to an advisor, who may also be a great source of advice for an attorney, who specializes in your situation. Most lawyers would be willing to bring in an advisor (for a fee, most likely); financial planning is not their expertise. Many are so focused on other details that they may split assets according to state law and move on, without running numbers and projections. Like custody decisions, it can be very difficult (or impossible) to make changes to financial asset splits, post-settlement. Oftentimes, one spouse makes an emotionally charged financial decision like keeping the family home, which may not be in their best long-term interest; an advisor can be pivotal in helping navigate the pros and cons of making these decisions.

“Perhaps sometimes reminding ourselves that we do have a choice makes it easier to pick the harder one. – Eva Melusine Thieme

What You Need to Know and Do

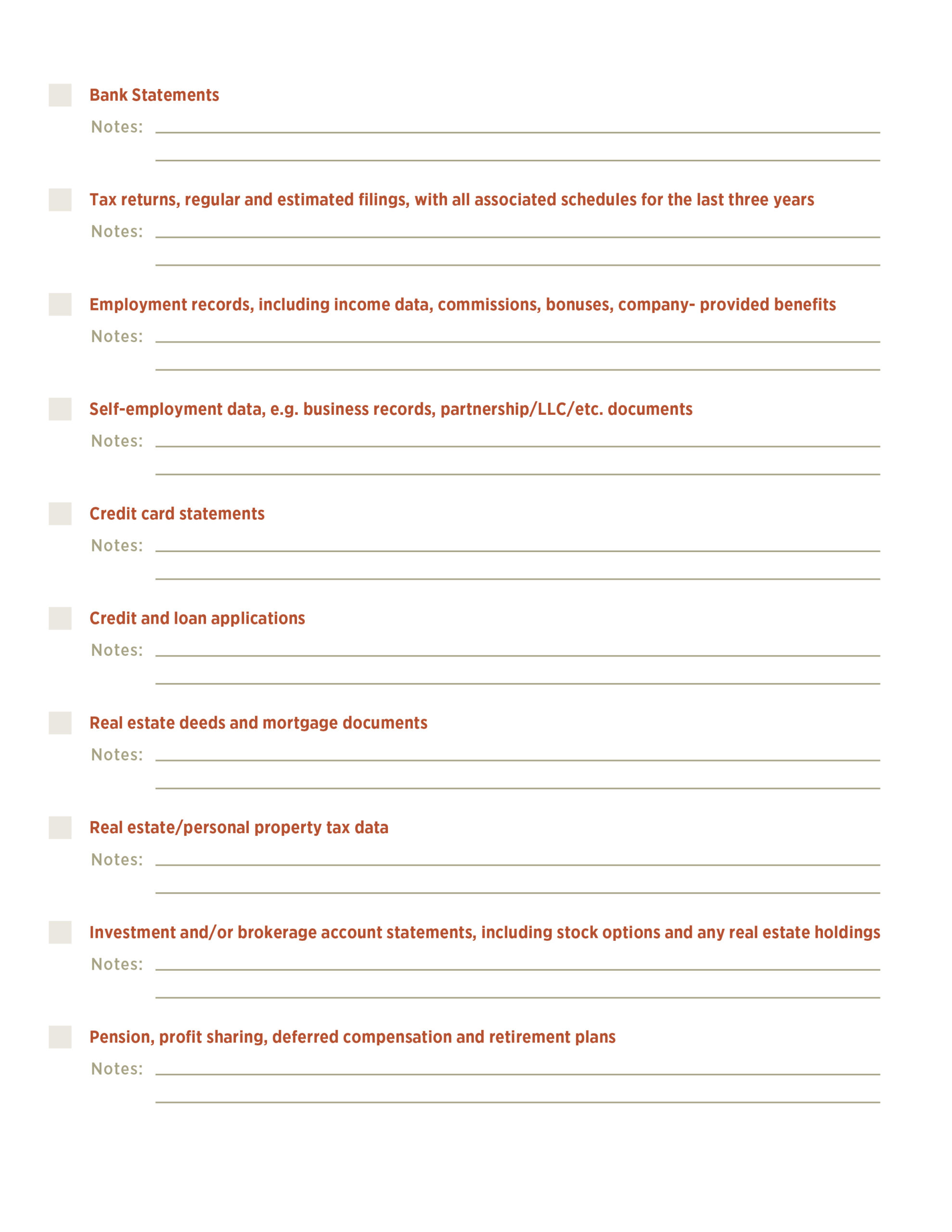

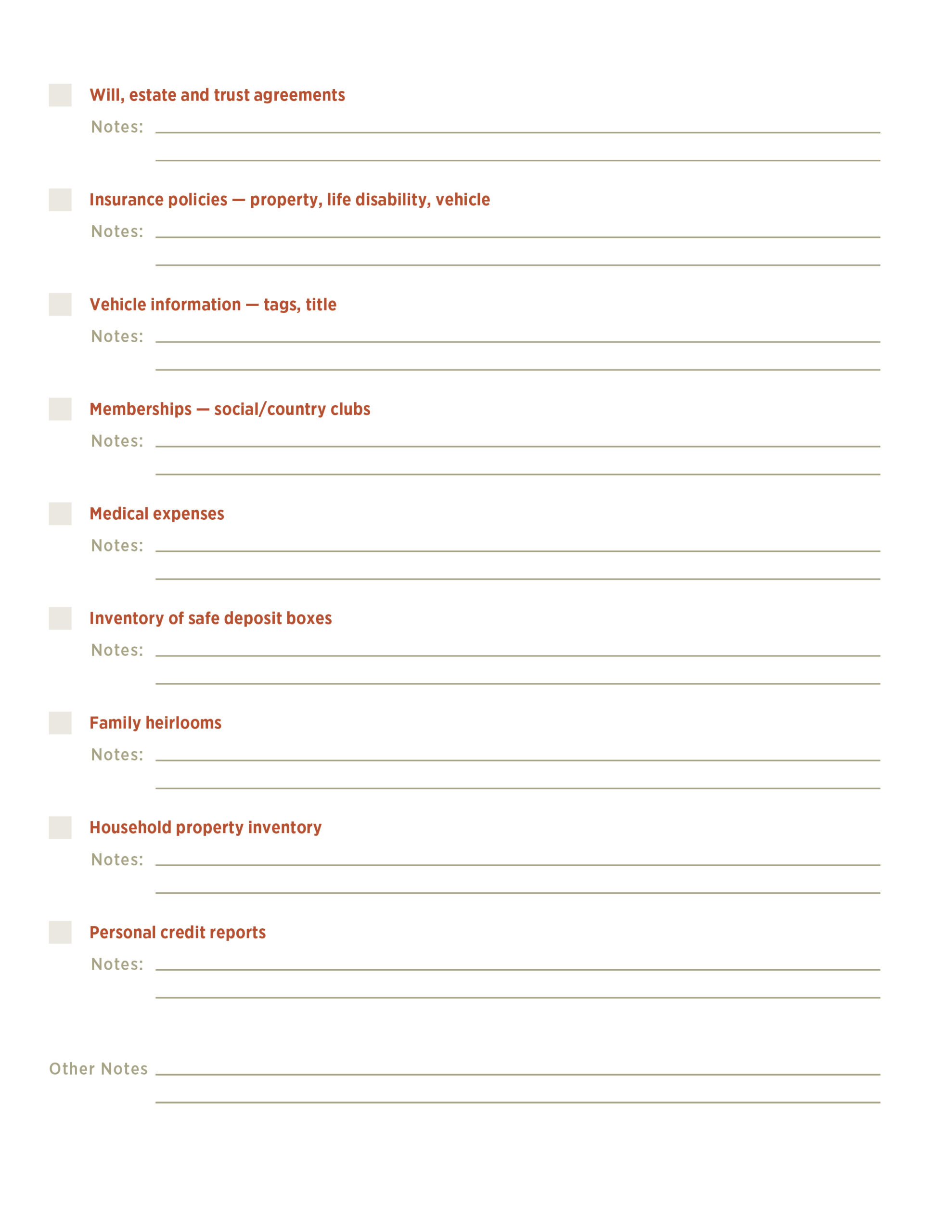

Prior to meeting with an advisor — or even a lawyer — gather important financial information in one place. There is a checklist included in this guide, to help you prepare. You may want to save everything securely to one folder on your computer, for easy access as you are asked for documentation during the process. A financial advisor can help as well with access to a secure document vault and to help get you organized.

There are a lot of moving pieces and a lot of competing priorities. Several things that are important to take care of at the beginning:

- Open individual checking and savings accounts for yourself and freeze any joint accounts so neither party can access them without permission until agreements are in place. Be sure things like direct deposits or automatic payments are routed properly.

- Request a credit report to ensure all joint accounts are closed. You may also wish to contact credit card companies to freeze accounts, open individual accounts, and end responsibility for any future charges on shared cards.

- Change the passwords and PINs on your accounts.

- Confirm your health insurance status, and that of your children; you typically can remain on a spouse’s policy until the end of the month and then may have an option to COBRA, or enroll through your own company even in an “off” time of year through a “change of circumstance” exception. If you don’t have coverage through one of these options, you are going to have to find an independent plan. Make sure you take these healthcare costs into consideration as it can be very expensive.

- Update emergency contacts and medical records, assigning a person to be notified in an emergency and removing your former spouse.

- Consider what you post on social media; anything sour may come back to haunt you in a settlement discussion. You may wish to block your ex-spouse or simply stay off social media until settlements are made.

Next Steps, with Professional Support:

- Update the beneficiaries on all your brokerage accounts, retirement accounts, life insurance policies, and Transfer on Death (TOD) accounts

- Revoke and update any existing Power of Attorney, Health Care Proxy, and Living Will

- Retitle assets into your name

- Determine what to do with any insurance policies

- Establish a QDRO process to split retirement accounts per agreement; this is something that you will likely need an attorney or a financial advisor to assist with.

During a transformation as complex as divorce, it’s challenging to know exactly what you need to do to protect yourself and move forward. The sooner you get a clear snapshot of your current circumstances and clarity around your next steps, the sooner you can start moving forward. There will be ups and downs but making sure you have emotional and professional support can give you the chance to take a breath when it all seems too much.

Though it might seem overwhelming to tackle financial tasks now, it’s one step in a process; you need to protect yourself from unexpected tax consequences or expensive financial surprises that may be lurking after your divorce.

“I’ve interviewed and portrayed people who’ve withstood some of the ugliest things life can throw at you, but the one quality all of them seem to share is an ability to maintain

hope for a brighter morning — even during our darkest nights.” – Oprah Winfrey

We are here to give you that help in the here-and-now and for the future you are working to build.

1 https://time.com/5434949/divorce-rate-children-marriage-benefits/

2 www.businessinsider.com/average-cost-divorce-getting-divorced-us-2019-7

3 Ibid

4 www.cbsnews.com/news/the-divorce-process/

5 www.nolo.com/legal-encyclopedia/ctp/cost-of-divorce.html

Divorce Document Checklist