The skyrocketing cost of college education has become a growing concern for students and families across the U.S. ― even for those with relatively high income and asset levels. In 2023–24, average annual total costs (i.e., for tuition and fees; room and board; and allowances for books and supplies, transportation and other personal expenses) for full-time undergraduate students were:1

- $19,860 for two-year students at public schools

- $28,840 for four-year students at in-state public schools

- $46,730 for four-year students at out-of-state public schools

- $60,420 for four-year students at private nonprofit schools

As tuition continues to rise, it is crucial to adopt a proactive approach to prepare for this major expenditure. Here are some of the main planning options you may want to consider:

529 Plans

Ideally, you want to begin saving for a child’s education costs as early as possible. One of the best ways to do so is through a 529 education savings plan. Currently, 49 states and the District of Columbia offer one.

These plans offer tax-free investing and distributions for qualified college education expenses, as well as distributions up to $10,000 per child per year for K–12 expenses and cost of apprenticeship programs, and up to $10,000 for qualified student loan repayments (lifetime limit). Individuals are not limited to their residency state’s plan and can contribute to any 529 plan. If your residency state’s plan does not offer a meaningful tax deduction or tax credit for 529 plan contributions, consider a plan that boasts low fees and a broad range of investment options.2

Also, with the passing of the Setting Every Community Up for Retirement Enhancement (SECURE) Act 2.0, beneficiaries of 529 college savings accounts can now roll over up to $35,000 over the course of their lifetime from any 529 account in their name to their Roth IRA. This helps alleviate concerns that money allocated to 529 accounts will be “trapped” if ultimately unused, encouraging greater savings for both education and retirement. Please note that these rollovers are subject to Roth IRA annual contribution limits and that the 529 account must have been open for more than 15 years.

UGMAs and UTMAs

Custodial accounts, also known as UGMA (Uniform Gifts to Minors Act) or UTMA (Uniform Transfers to Minors Act) accounts, are another way to save for a child’s college education. Adults typically establish these accounts on behalf of a minor. While the funds must be used for the child’s benefit, they are not necessarily earmarked for expenses related to college education, and the child assumes full control at the age of majority, typically 18 or 21, depending on the state. This lack of control may concern some. It is also important to note that custodial accounts are considered assets of the student when applying for financial aid. This can affect the amount of needs-based aid the student receives, so it is important to weigh the potential impact in situations where financial aid is a possibility.

Gifts and Direct Payments

For grandparents or other relatives or loved ones who want to help fund a student’s college education, the federal gift tax exclusion allows them to give a single beneficiary $18,000 ($36,000 per married couple) per year (based on 2024 amounts) without incurring any gift tax. This money could be used by the beneficiary to cover college expenses, although, of course, could also be used for other purposes. Or perhaps better yet, these gifts could be made directly to the beneficiary’s 529 plan or custodial account, taking advantage of two types of tax savings ― the annual gift tax exclusion and tax-free growth of the gift once invested in the beneficiary’s account.

Direct tuition payments are also exempt from gift tax. This is true for elementary, secondary, post-secondary and other qualifying schools but does not extend to books, room and board, or other expenses.

Roth IRAs

Although Roth IRAs are most frequently used to save for retirement, they can also be used to pay for qualified educational expenses. No additional penalty is assessed on these withdrawals, but you will incur an income tax liability if you have had the Roth IRA for less than five years and you withdraw not just the principal amount contributed but also earnings. Any excess funds that aren’t ultimately used for college can remain invested within the account for retirement, so you can use a Roth IRA to save for both goals simultaneously.

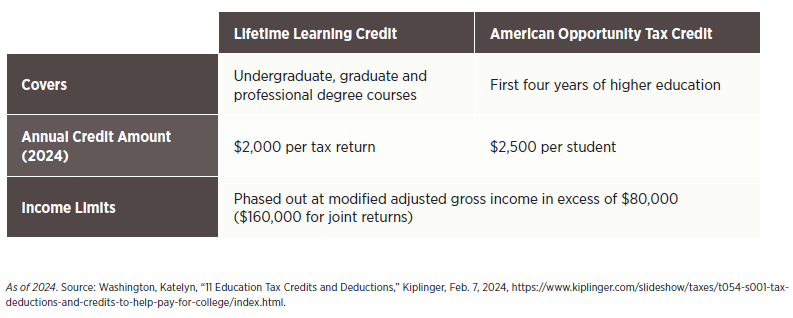

Tax Credits

There are also two federal education income tax credits that allow parents, or students if they are not claimed by their parent as a dependent, to lower their tax liability. However, both are subject to income limitations as detailed below:

Scholarships and Grants

Scholarships and grants are an excellent way to offset the rising cost of a college education. However, while every parent would love to see their child receive a four-year academic or sports scholarship to the college or university of their dreams, that is simply not realistic for most. In fact, recent data indicates that only about 1.5% of students are awarded full scholarships each year.3 However, many families are able to take advantage of some type of scholarship, from private scholarships to federal Pell Grants.

Students should invest time in researching and applying for scholarships well before their senior year of high school. Many organizations, institutions and businesses offer scholarships based on academic achievement, leadership skills, extracurricular involvement or specific fields of study. Additionally, students should explore grants offered by federal and state governments, as well as private foundations.

Reach Out to Us

The rising cost of college education may seem daunting, but with careful tax-aware planning and strategic actions, students and families can navigate this financial challenge. We are here to help. Please reach out to us early and often for help finding the right ways to save for and fund your families’ education.

1 College Board, “Trends in College Pricing and Student Aid 2023,” November 2023.

2 Fiducient Advisors’ “2023 Financial Planning Guide,” January 30, 2023. These materials were authored by Fiducient Advisors and are being used with their permission.

3 ThinkImpact, https://www.thinkimpact.com/scholarship-statistics/. Accessed July 31, 2023.