One of the most important things a young adult can do to set themselves up for financial success is to establish credit. By establishing a healthy credit history at a young age, they will likely have an easier time getting approved for a mortgage or car loan in the future. However, with varying interest rates, eligibility requirements, and rewards, it can be hard to discern which card is the right choice. This guide details what a young adult should know about credit cards.

How to Open a Credit Card

Most major credit card issuers have stopped allowing parents to co-sign on a credit card. When a person does not have an existing credit history or a co-signer, it can be challenging to get approved for a credit card, but it’s not impossible. Credit card issuers such as Discover, Chase, and Capital One offer credit cards geared toward college students.

These types of cards require applicants to be 18 years or older and enrolled in a college or university. Students can apply through the card issuer’s website by providing their Social Security number, date of birth, and proof of income. It is important to note that proof of income can include pay slips from a part-time job, deposits from family members, or leftover financial aid.

Another option that young adults have is to ask their parents to add them as authorized users of one of their credit cards accounts. By becoming an authorized user, first-time credit card holders don’t have to worry about going through the application process and potentially being denied. They can receive their own card in their name and begin building credit accordingly.

Choosing the Right Card

There are many considerations when reviewing the various credit cards available to consumers, but there are two points that should be the most scrutinized: interest rates and fees.

Interest Rates: In an era of inflation and higher interest rates, first-time credit card holders must do their due diligence in understanding how much interest will accrue if they fall behind on payments. An Annual Percentage Rate (APR), is an interest rate that a credit card company charges account holders yearly. As of February 2024, the average APR is 27.92%, though consumers may receive a lower APR if they have a high credit score or are added as an authorized user to an existing account. Nevertheless, it is a factor that must be acknowledged before signing up for a card.

Fees: There are many fees written in the fine print that may be glossed over when applying for a credit card that can significantly increase the account’s monthly balance. In addition to monthly interest, lenders can charge cardholders an annual fee just for having a card with them. These fees typically stay at the same rate each year. Additionally, if you are late making payments, the lender will issue a late payment fee.

Extended periods of non-payment can lead to a lower credit score or an account holder being sent to collections.

Credit Scores and Debt

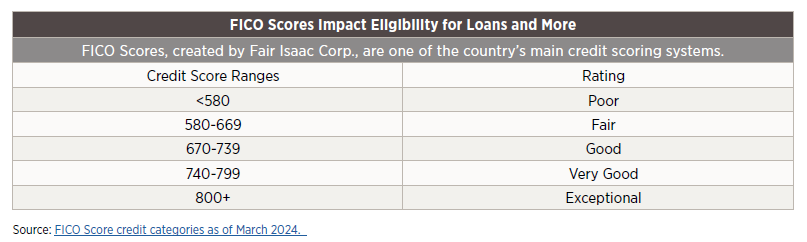

Eligibility to be approved for a loan or housing or even attaining lower interest rates on credit cards is heavily dependent on one’s credit score. Credit scores are three-digit numbers that indicate credit risk or ability to make payments to the lender.

Borrowers looking to create and maintain good financial health should aim to have higher credit scores.

Credit evolves over time. Borrowers can increase or decrease their score based on the decisions they make. Making payments on time, having a variety of accounts open (e.g. student loans or credit cards), and keeping monthly credit utilization at a low percentage, will gradually boost scores.

Poor financial decisions that can lower scores include opening too many new lines of credit in a short period, increasing the amount of debt owed, or missing payments. Missed or late payments can also cause the account to be sent to debt collection, a move that shows up on your credit report, so it’s essential to keep track of balances and payments.

Making Your Card Work for You

Credit cards can offer benefits that extend beyond building credit history and credit scores. They often offer rewards as an incentive for spending, such as receiving cash back for every purchase or earning airline miles or points. Choosing the card that will deliver the most beneficial rewards depends on one’s lifestyle and spending priorities. For some people that’s everyday items like gas and groceries and for others it’s travel.

A first credit card is a step in the right direction in terms of investing in one’s financial future. After opening a card and establishing positive financial habits, increasing credit scores will unlock opportunities for purchasing big-ticket items like cars and homes down the road.

Please reach out to your advisor who can help provide additional information about attaining credit.